Financial close management (FCM) is a recurring process where accounting teams check and adjust account balances at period-end. The team's goal is to create financial reports that show the company's true financial position. Accounting teams finalize financial records monthly, quarterly, or yearly to keep stakeholders informed. These stakeholders include management, investors, lenders, and regulatory agencies.

The process starts when teams record transactions as journal entries and ends with financial statement preparation. Teams consolidate transactions from multiple accounts and reconcile information to validate it. They also look for irregularities that need adjustments. Large businesses, particularly those with investor backing, must follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Finance teams without automation spend 80% of their time cleaning data!

While AI slashes them 95% accuracy, accelerating close cycles by 30%.

Download EbookCompanies run their financial close process every month. This complex process takes multiple days and needs significant resources. Most businesses spend about six days on monthly closes. Quarterly closes need more time, while year-end closing can stretch to 18 days. Top companies have cut this down to just a few days.

Finance teams track the process timeline using "T-minus" and "T-plus" days. The actual close date is "T". Teams work on specific tasks before month-end during T-minus days. These tasks include closing subledgers, settling accounts, and collecting data. Teams create their first trial balance and draft financial statements on the close date. After closing, they analyze results, create reports, and fix any problems they found during the process.

The close process starts when teams record transactions as journal entries. Financial report preparation marks the end. Accountants combine transactions from different accounts during this cycle. They check information to make sure it's valid and spot any issues that need fixing. A balanced trial balance is the end goal, where all debits match all credits.

The real value of managing closes well comes from giving stakeholders accurate financial information quickly. This helps them make better decisions and improve business results.

Financial close management's main goal is to accomplish four key objectives that affect an organization's financial health and operational efficiency.

Accurate financial reporting is the life-blood of financial close management that builds trust between companies and their stakeholders. This objective needs strict data validation, reconciliation, and review procedures to spot and fix errors or discrepancies. Companies that use resilient validation systems can detect inconsistencies early in the close process and make timely corrections for greater reporting precision. On top of that, this accuracy helps comply with accounting standards like GAAP and IFRS.

Financial close management works to find and remove inefficiencies, redundancies, and manual tasks throughout the accounting cycle. Companies create consistent workflows across departments and business units by standardizing procedures and documenting policies. Automation of repetitive tasks like data entry, reconciliation, and report generation creates immediate effects and frees up employee time for value-adding activities. This standardization helps prevent bottlenecks and reduces last-minute problem-solving during close periods.

Financial close management verifies compliance with accounting standards, regulatory requirements, and company policies through resilient internal controls and compliance checks. Good controls reduce financial risks, prevent fraud, and maintain data integrity. Companies can strengthen their risk management culture when they implement segregation of duties, where different people handle initiating, approving, and recording transactions. This well-laid-out approach helps companies guide through changing regulatory landscapes while avoiding penalties and damage to their reputation.

Current and accurate financial information leads to better strategic decisions. Financial close management speeds up reporting cycles and gives management fresh insights instead of old data. The close process turns historical accounting information into applicable information for forecasting and planning. Finance teams can focus on detailed analysis of financial trends when processes work better. This enables proactive adjustments that improve an organization's financial position.

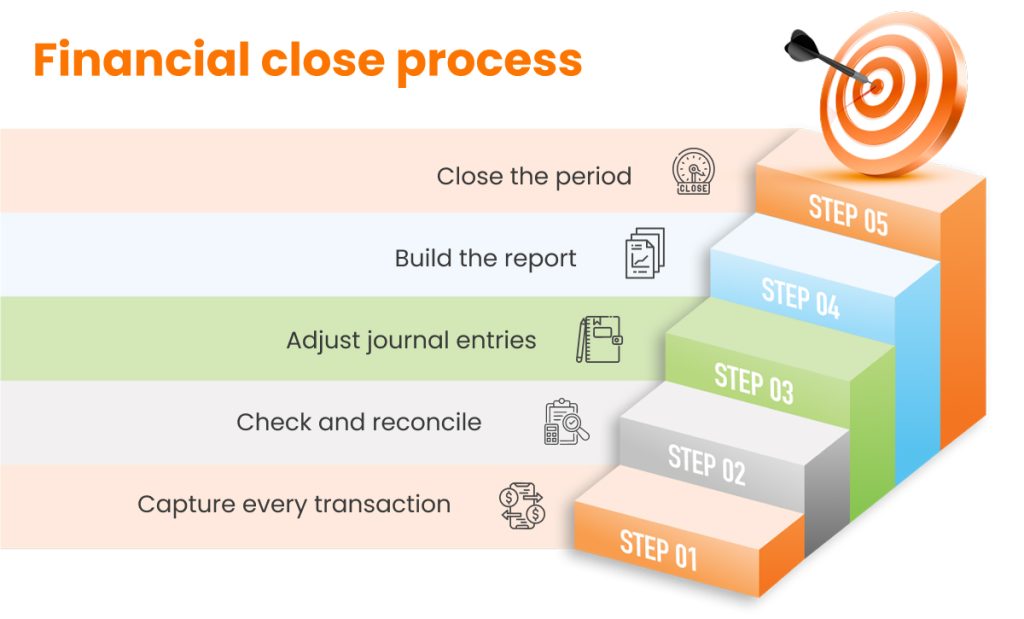

The financial close process needs systematic execution through several vital steps that will give accurate financial reporting. Organizations can maintain data integrity throughout the closing cycle with this well-laid-out approach.

A successful financial close needs solid groundwork. The team creates a detailed close calendar that outlines specific tasks, deadlines, and responsible parties. The controller or senior accounting manager must verify that all stakeholders know their roles. They also need to confirm available resources, including staff and appropriate accounting software. Good planning prevents bottlenecks and makes the process run smoothly.

The accounting teams gather and verify financial data based on the schedule. This step covers data collection from sales invoices, accounts payable subledgers, and business units. Teams validate data by settling records to verify that all transactions are factored in without discrepancies between different sources. This significant stage creates the foundations for all future analysis.

Each general ledger account needs comparison with corresponding independent statements to spot and investigate differences. This process matches transactions and balances to ensure accurate accounting records. The team then makes adjustments to keep accounting data current, accurate, and complete. These adjustments often include accruing unprocessed expenses, eliminating intercompany transactions, and settling prior-period adjustments.

The accounting team drafts financial statements after reconciling and adjusting the data. They prepare the balance sheet, income statement, cash flow statement, and other required reports with footnotes where needed. Companies with business units of all sizes must also consolidate information from various entities into final reports.

The review process verifies compliance with relevant standards and requirements. It includes an internal controls review to check effectiveness and find weaknesses. The team also ensures financial statements meet appropriate requirements like GAAP or IFRS. This detailed examination confirms that financial information stays reliable and compliant.

The focus shifts to improving the financial close process after completion. The accounting team evaluates performance, identifies challenges, and suggests improvements. This evaluation often leads to policy updates, automation investments, or additional team training. Complete documentation and archiving of working papers and supporting evidence create a clear audit trail for future reference.

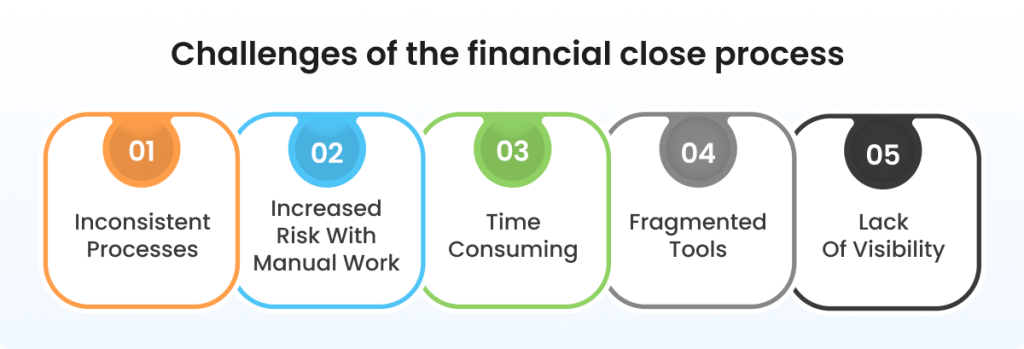

Organizations face many roadblocks when closing their financial books. Many finance teams don't deal very well with systemic problems that affect timely and accurate reporting.

Manual financial close processes waste time, invite errors, and drain resources. Companies that still rely on spreadsheets and manual data entry risk making mistakes. Automation provides a game-changing solution by handling reconciliations and entries quickly. AI-powered accounting software works around the clock and manages tasks like account reconciliation outside regular hours. This automation cuts down errors while boosting precision and data integrity.

Quality data forms the foundation of reliable financial reporting. Poor or wrong data can result in non-compliance and regulatory fines. A well-laid-out approach to financial data quality management helps improve accuracy and minimize errors. Teams should review and audit data regularly to maintain reliability and fix any issues quickly. Companies should set up procedures to update and correct information promptly to prevent errors from piling up.

Tight deadlines often push teams into rushed processes. Companies should set firm closing dates for posting transactions to solve this. A standard schedule that assigns specific duties to team members makes deadlines and responsibilities clear. Switching from monthly hard closes to soft monthly closes with quarterly hard closes can reduce the need for investigations.

A striking 88% of Finance and Shared Services leaders say their departments need better cross-functional work than ever. Yet 45% report their teams need to improve how they work across departments. Poor teamwork usually shows that businesses don't understand their processes well enough. Regular meetings that show performance metrics and updates on key projects help boost coordination. This team-based approach shows how different departments benefit from working together and helps focus everyone on strategic goals.

People often mix up financial close management and closing the books, but these represent two different concepts in accounting workflows.

Financial close includes all accounting processes for a period - the complete accounting cycle from recording transactions to generating financial statements. The process of closing the books serves as the final step in this broader workflow. Books closing has specific goals: zeroing out temporary accounts, locking previous period balances, and updating retained earnings based on operational results. The complete end-to-end process of financial close needs accurate data pulled from multiple systems.

Books closing happens right after account settlement and before stakeholder report distribution. The financial close process takes much longer than it did decades ago. Modern processes must handle terabytes of financial, operational, ESG, and tax data from different sources. Most organizations want to close their books within 3-5 days - typically 3 days for regular months and 5 days for quarter-end periods.

Financial close needs coordination between departments and stakeholders who handle various tasks. The accounting department handles most of the books closing operations. Companies need clear documentation and communication about everyone's roles and responsibilities to streamline the closing process.

Automation tools are changing how organizations handle traditional financial close processes. These tools reduce manual work and make results more accurate. Studies show that errors exist in 90% of spreadsheets, but automation can eliminate these mistakes.

Financial close management software automation brings all financial information together on a single platform. Organizations get a complete view of their finances. Teams no longer waste time with back-and-forth communications when everything sits in one place. Modern close and bank reconciliation solutions connect directly to ERPs, which creates uninterrupted data flow and removes risky manual exports. Data moves accurately between systems, and teams work from a single source of truth throughout the close process.

Predefined workflows standardize tasks and make sure activities happen in the right order. Team members receive automatic task assignments while the system tracks progress and alerts them about delays. Advanced systems take care of reconciliations by matching transactions and finding discrepancies that need review. Companies that use automation see their processes become simpler and faster.

Immediate dashboards show process status and highlight delays or blocked tasks right away. Managers can spot problems before they affect deadlines. The system records timestamps and creates audit trails that make both managers and auditors happy.

Automation platforms make teamwork easier for finance professionals, regardless of their location. Cloud solutions let multiple team members work on documents at the same time without conflicts. Built-in tools for comments and status updates replace endless emails and status meetings that teams once needed for coordination.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center