Transparency is paramount in the world of finance. Without standardized accounting practices, businesses could manipulate financial data, leading to irregular success overviews and hindering fair comparisons.

Generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) are the bedrock of financial reporting worldwide. By adhering to these guidelines, companies ensure accurate reporting, empower stakeholders to make informed investment decisions, and foster trust in financial markets. In this blog, we will discuss the differences between GAAP and IFRS and explore their impact on the accounting landscape.

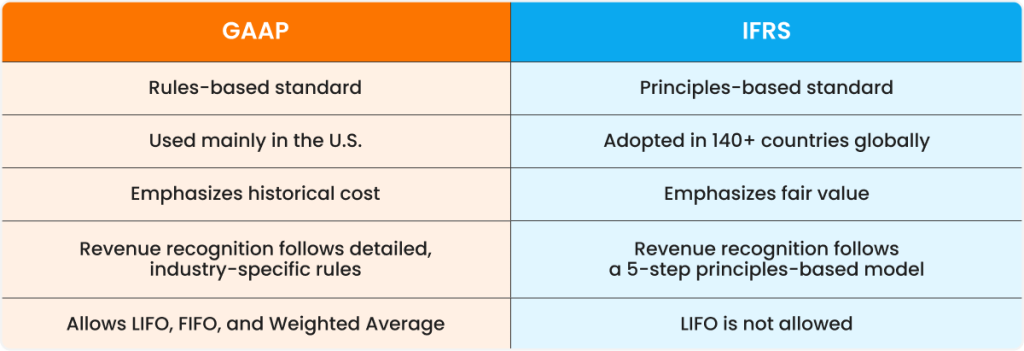

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are two major global accounting frameworks used for preparing and presenting financial statements. GAAP is primarily used in the United States and is rules-based, providing detailed guidance for specific scenarios.

IFRS, used in over 140 countries including the EU, UK, Canada, and Australia, is principles-based, offering broader guidelines that allow for more interpretation and professional judgment. While both aim to ensure transparency, consistency, and accuracy in financial reporting, they differ in methodology, terminology, and specific accounting treatments, such as inventory valuation, revenue recognition, and asset revaluation.

Your 2025 Roadmap to Smarter Financial Reporting

Learn what top CFOs consider when choosing a consolidation and reporting solution.

GAAP, crafted by the Financial Accounting Standards Board (FASB) for the Securities and Exchange Commission (SEC) in the US, forms the bedrock of financial reporting for domestic and Canadian publicly traded firms. As a rule-based system, GAAP ensures consistency and transparency in financial statements, aiding investors in assessing data and facilitating informed decision-making.

Pro tip: The rules-based GAAP accounting system ensures regularity, consistency, sincerity, permanence, prudence, continuity, proper timing of entries, full disclosure, and transaction honesty.

International Financial Reporting Standards (IFRS) are a global framework for public company financial statements that aims for consistency, transparency, and comparability. Administered by the International Accounting Standards Board (IASB), IFRS is applied in 167 jurisdictions, including the European Union.

Often confused with International Accounting Standards (IAS), which they replaced in 2001, IFRS streamlines accounting practices and statements, enabling informed financial assessments and decisions by businesses and investors worldwide.

Pro Tip: IFRS, with its principles-based approach, grants leeway and promotes discretion, fostering professional judgment among accountants and financial practitioners.

Both GAAP and IFRS standards aim to ensure transparency, consistency, and comparability in financial statements, but they differ in their approach. GAAP is more rules-based, whereas IFRS relies on principles. Below are the key principles that define each framework:

Key principles of GAAP

Key principles of IFRS

Although GAAP and IFRS differ in their approach—rules-based vs. principles-based—they share several foundational goals that promote reliable and consistent financial reporting across organizations. These similarities make it easier for global companies to align financial data and support potential convergence between the standards. Here are some of the key similarities between US GAAP and IFRS:

GAAP and IFRS, while similar in some aspects, diverge significantly. GAAP, mandatory for US public firms, is rule-based, while IFRS, globally recognized but not legally enforceable, operates on principles. Their differing enforcement and scope underscore their contrasting approaches to financial governance.

The difference in enforcement leads to varied interpretations and disclosures. Additionally, GAAP is US-centric, whereas IFRS is globally accepted and regulated by the IASB. Despite global influence, the US remains an exception, mandating GAAP for domestic firms. These distinctions underscore the nuanced differences between the two accounting standards.

For inventory valuation:

Inventory valuation determines the worth of inventory using accounting methods: FIFO, LIFO, and weighted average.

For cash flow statements:

The cash flow statement depicts cash movement in and out of a business during a reporting period.

For the balance sheet:

A balance sheet summarizes a company’s financial position at a specific time.

For asset revaluation:

Asset revaluation is vital for reflecting accurate asset values over time.

GAAP and IFRS play a critical role in ensuring financial statements’ accuracy, transparency, and comparability of financial statements across companies and industries. They provide a standardized financial reporting framework for recording and reporting financial data, enabling investors, regulators, and stakeholders to make informed decisions confidently. By promoting consistency and integrity in financial reporting, both frameworks help reduce the risk of misrepresentation, support global investment, and enhance trust in the financial markets. Here are some of the key reasons why GAAP and IFRS are important:

GAAP and IFRS significantly influence how businesses report financial performance and how investors interpret that information. These accounting standards shape financial statements’ credibility, comparability, and transparency, directly impacting decision-making for internal and external stakeholders. Here are some of the key impacts on businesses and investors:

Determining which accounting standard, IFRS or GAAP, is better is subjective and depends on various factors. IFRS in accounting is principles-based, providing flexibility and encouraging professional judgment, while GAAP is rules-based, offering clear guidelines but less room for interpretation. Some may prefer the principles-based approach for its adaptability and accurate representation of transactions.

However, given the global adoption of IFRS, transitioning to this standard could streamline financial reporting for multinational corporations and facilitate international investment. Ultimately, the choice between IFRS and GAAP depends on each entity’s specific needs and circumstances.

HighRadius’ AI-powered Record-to-Report solution is built to streamline and modernize your financial reporting and consolidation processes, ensuring full compliance with both GAAP and IFRS standards. From automated journal entries to real-time anomaly detection, the solution enables a day-zero month-end close and delivers up to 90% reconciliation accuracy, with built-in audit trails and real-time validations.

With HighRadius Financial Consolidation Software, organizations can achieve a 60% boost in consolidation efficiency, an 85% reduction in manual adjustments, and 50% faster multi-currency consolidation. This not only accelerates the financial close process but also ensures 100% compliance and audit readiness across global entities.

The Financial Reporting Software complements this by enabling 95% reduction in report preparation time, 80% faster financial reporting, and 100% error-free output, giving finance teams the agility to deliver accurate insights quickly and consistently.

Whether you’re reporting under GAAP, IFRS, or both, HighRadius provides the automation, intelligence, and control needed to simplify reconciliations, ensure consistency across entities, and deliver accurate, timely reports. By eliminating manual effort and reducing audit risk, your finance team can stay audit-ready and focus on high-value strategic activities, rather than drowning in spreadsheets.

The USA has not embraced the International Financial Reporting Standards (IFRS) due to its adherence to the distinct Generally Accepted Accounting Principles (GAAP), rooted in long-standing accounting traditions different from IFRS practices.

IFRS operates on principles, while GAAP follows the rules. GAAP’s stringent framework provides specific procedures, leaving minimal interpretation, unlike the principles-based approach of IFRS. This fundamental difference underscores the contrasting methodologies between the two accounting standards.

IFRS mandates inventory valuation at a lower cost or net realizable value, while GAAP uses lower cost or market value. Unlike GAAP, IFRS permits inventory reversal write-downs. This disparity reflects differing approaches to inventory valuation and write-down allowances between the two standards.

IFRS follows the principle of recognizing revenue upon value delivery, while GAAP offers industry-specific rules. However, both standards require revenue recognition upon goods delivery or service rendering, emphasizing the importance of completing transactions before income recognition.

The U.S. uses GAAP, while over 140 countries use IFRS, including the UK, Canada, Australia, and EU nations. Major economies like India and China have adopted IFRS with local modifications, aligning global reporting practices for consistency and comparability. This global shift supports cross-border investment and transparency.

IFRS isn’t necessarily better than GAAP; it depends on the context. IFRS is more flexible and principles-based, making it easier to achieve global consistency. GAAP, being rules-based, offers more detailed guidance. Each has strengths based on regulatory needs and market environments. Many advocate for a combination of both.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center