Imagine wrapping up a thrilling mystery novel where every clue fits perfectly into place; that’s what a well-executed month-end close process feels like for finance professionals. It’s not just about crunching numbers; it’s about ensuring every financial detail is accurate and up-to-date.

The month-end close process is essential for maintaining accurate financial records and making informed business decisions. This guide will provide a month-end close checklist, break down the steps for effective financial closing, and share best practices to streamline your month-end close. Whether you’re a seasoned accountant or a business owner, this resource will help you navigate the process with ease.

The month-end close process is a crucial accounting task conducted at the end of each month to ensure accurate and timely financial reporting. It involves several steps, such as reconciling accounts, reviewing transactions, making adjusting entries, preparing financial statements, and analyzing performance.

Specifically, the month-end close process includes reviewing the company’s balance sheet, intercompany trades, month-end journal entries, and other documents (like bank statements, income, and expenses) and reconciling them.

This process is a mandatory fiscal reporting requirement for public companies, ensuring compliance with financial regulations and standards. Additionally, it plays a vital role in helping businesses maintain accurate and reliable records throughout the year, which is essential for making informed financial decisions and facilitating smooth operations. The month-end close process helps in tax filing, preventing accounting errors, and getting an overall picture of the company’s cash flow scenario.

AI in Finance: Why 82% Fall Short—and How to Get It Right

From data issues to cultural pushback, learn what’s holding teams back and how to move forward.

The month-end close is a critical accounting process that finalizes and wraps up all financial activities for the previous month. This involves systematically reviewing, documenting, and reconciling every financial transaction that occurred during that period, ensuring that the financial records are accurate and complete.

Businesses that wait until the end of the year to prepare their financial reports often find the task tedious and daunting. To ease the process, most businesses prepare monthly financial statements. This provides an ongoing view of their financial KPIs and makes the year-end process smoother.

The month-end close process ensures accurate financial reporting by reconciling transactions and preparing key statements. Automating the month-end close process boosts efficiency, reduces manual errors, and enables timely, compliant reporting.

Businesses can drastically reduce manual efforts and increase accuracy by standardizing month-end closing procedures and adopting AI-driven solutions. This modern accounting approach to monthly closing helps identify anomalies early, ensures seamless data flow, and delivers a faster accounting monthly close process, freeing teams to focus on high-value analysis rather than repetitive reconciliation tasks.

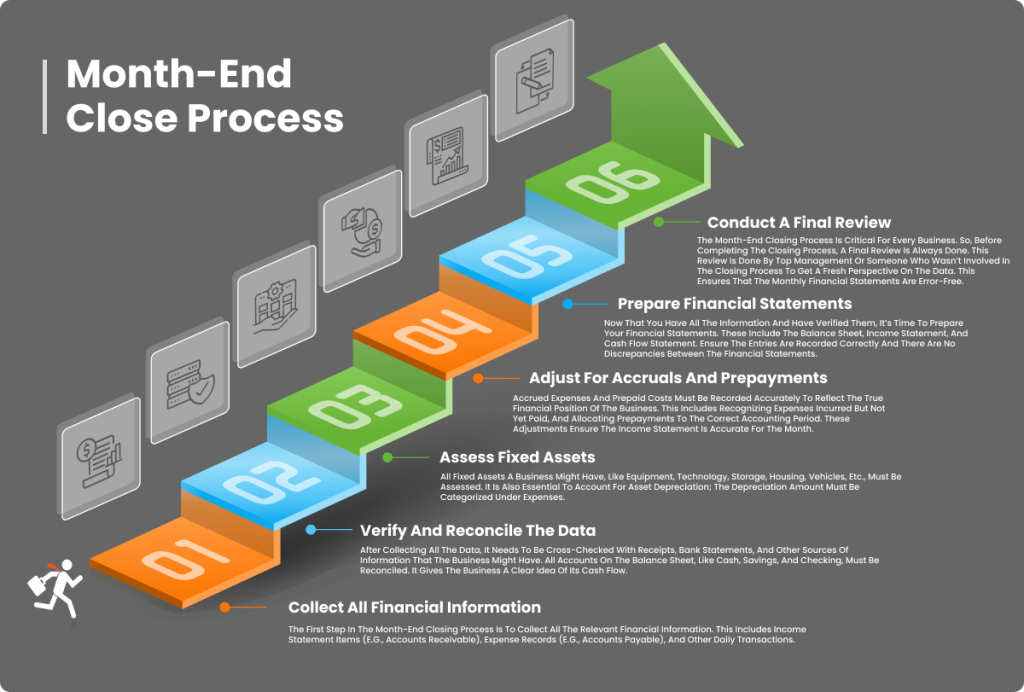

There are six key steps to the month-end close process. These steps give a general overview of how most businesses review and reconcile their books at the end of every month:

The first step in the month-end closing process is to collect all the relevant financial information. This includes income statement items (e.g., accounts receivable), expense records (e.g., accounts payable), and other daily transactions.

After collecting all the data, it needs to be cross-checked with receipts, bank statements, and other sources of information that the business might have. All accounts on the balance sheet, like cash, savings, and checking, must be reconciled. It gives the business a clear idea of its cash flow.

All fixed assets a business might have, like equipment, technology, storage, housing, vehicles, etc., must be assessed. It is also essential to account for asset depreciation; the depreciation amount must be categorized under expenses.

Accrued expenses and prepaid costs must be recorded accurately to reflect the true financial position of the business. This includes recognizing expenses incurred but not yet paid, and allocating prepayments to the correct accounting period. These adjustments ensure the income statement is accurate for the month.

Now that you have all the information and have verified them, it’s time to prepare your financial statements. These include the balance sheet, income statement, and cash flow statement. Ensure the entries are recorded correctly and there are no discrepancies between the financial statements.

The month-end closing process is critical for every business. So, before completing the closing process, a final review is always done. This review is done by top management or someone who wasn’t involved in the closing process to get a fresh perspective on the data. This ensures that the monthly financial statements are error-free.

Month-end close is a crucial activity for every business, spearheaded by the finance department, which requires the books to be closed quickly and accurately. Accurately forecasting cash flow predictions, making strategic business decisions, and financial planning all depend on a successful financial closure.

The month-end close process is important to businesses and provides the following benefits:

Having precise and trustworthy financial data allows businesses to make informed and strategic decisions, ensuring long-term success and stability.

Clear insights into financial status help identify strengths and weaknesses, as well as proactively identify errors, enabling proactive management and planning to maintain financial health.

Reliable financial records serve as a foundation for forecasting and strategic planning, aiding in setting realistic goals and allocating resources efficiently.

Proper financial closure helps track and manage cash flow effectively, ensuring the business has sufficient liquidity to meet its obligations and invest in opportunities.

An accurate financial reporting framework builds trust and confidence among investors, creditors, and other stakeholders, supporting better business relationships and investment opportunities.

A thorough month-end close process helps identify and correct errors promptly, reducing the risk of inaccuracies in financial statements and maintaining compliance.

Organized and accurate financial records streamline the tax filing process, making it easier to comply with regulations and avoid penalties.

A well-structured month-end close process ensures complete and accurate records, making audits less stressful and more efficient. With organized documentation and timely reconciliations, finance teams can confidently support audit requirements and reduce the risk of compliance issues.

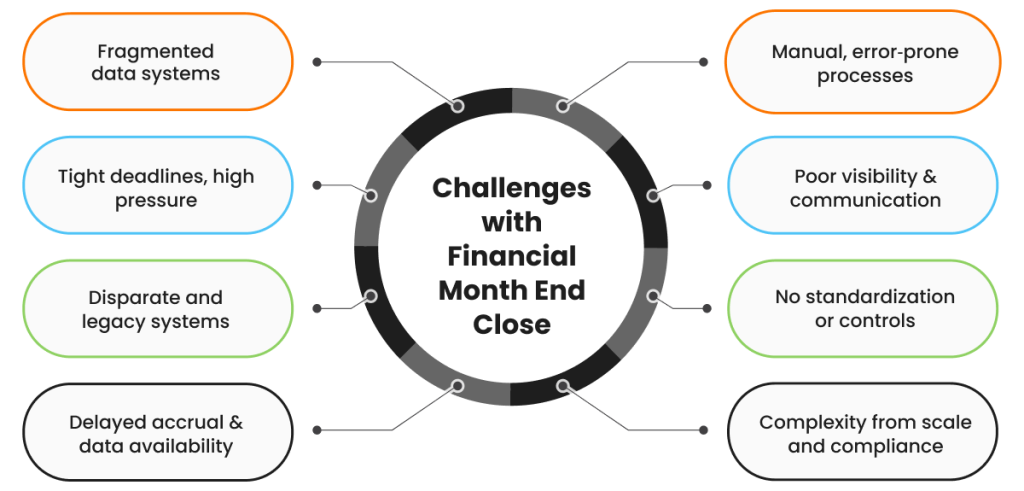

Every business routinely conducts the month-end closing process. Before discussing its best practices, it is essential to identify the challenges. Let’s examine some common roadblocks businesses face during the month-end close and their solutions.

1. Fragmented data systems

Finance teams use multiple ERPs, spreadsheets, and point tools, creating data silos that delay consolidation and cause errors.

2. Manual, error‑prone processes

Heavy reliance on spreadsheets and manual journal entries adds time, inconsistency, and stress to your month end close accounting.

3. Tight deadlines, high pressure

Most organizations aim for a 5–10 day close, yet 25% take 10+ days—leading to rushed processes and burnout.

4. Poor visibility & communication

Lack of real-time tracking, unclear roles, and constant chasing across teams causes unpredictable delays.

5. Disparate and legacy systems

Outdated tools can’t handle multi‑entity, multi‑currency, or regulation complexities—forcing manual workarounds.

6. No standardization or controls

Without repeated procedures, checklists, or review workflows, inconsistencies multiply and audit readiness suffers.

7. Delayed accrual & data availability

Critical accrual data and financial entries often arrive late, pushing month‑end updates into crisis mode.

8. Complexity from scale and compliance

Multi‑entity, multi‑currency consolidations and evolving regulations make accuracy harder and slow down the close.

Your month-end close process should include recording incoming cash, checking your AR records, and reconciling all accounts, including petty cash. Tracking all business transactions is essential to ensure accurate records and mitigate fraud risks, guaranteeing your organization’s financial well-being.

Here are some best practices to follow during the month-end closing process:

Month-end closing is among the most critical accounting processes for every business. Rushing through it and making mistakes won’t help, especially if these statements will be referred to for your year-end close. Accurate monthly financial reports improve transparency and help track KPIs correctly.

A standardized approach to the month end closing procedures helps ensure consistency, accuracy, and accountability. Using checklists and templates streamlines the accounting monthly close process and minimizes missed steps during financial reporting.

Since month-end closing is a routine activity, you must note any roadblocks or problems you encounter to address them effectively. For example, if collecting data takes more time than planned, try to keep everything organized throughout the month.

Businesses should also consider investing in automation solutions that support data aggregation and segmentation. HighRadius’ Record to Report solution provides financial close automation, offering project templates, close task management, and accounting anomaly detection.

Even though you must not sacrifice quality for speed, you must also plan ahead to meet your month-end financial reporting deadlines. If you are required to complete the closing process within a week and know that the timeline is unrealistic, communicate this beforehand.

Sticking to a consistent schedule for releasing financial statements every month can help you better organize your team’s time and activities. Further, adopting automated accounting solutions can help you make a day-zero financial close through immediate and accurate decisions.

Automation is the key to reducing the time and effort required for the month-end closing process. From collecting data to reconciling accounts, automation can drastically speed up workflows. It also helps reduce errors and simplifies the sharing of financial statements.

Clear communication is essential throughout the month end close process. When accounting teams collaborate and share updates in real time, it reduces bottlenecks, ensures smoother monthly closing, and helps avoid last-minute surprises.

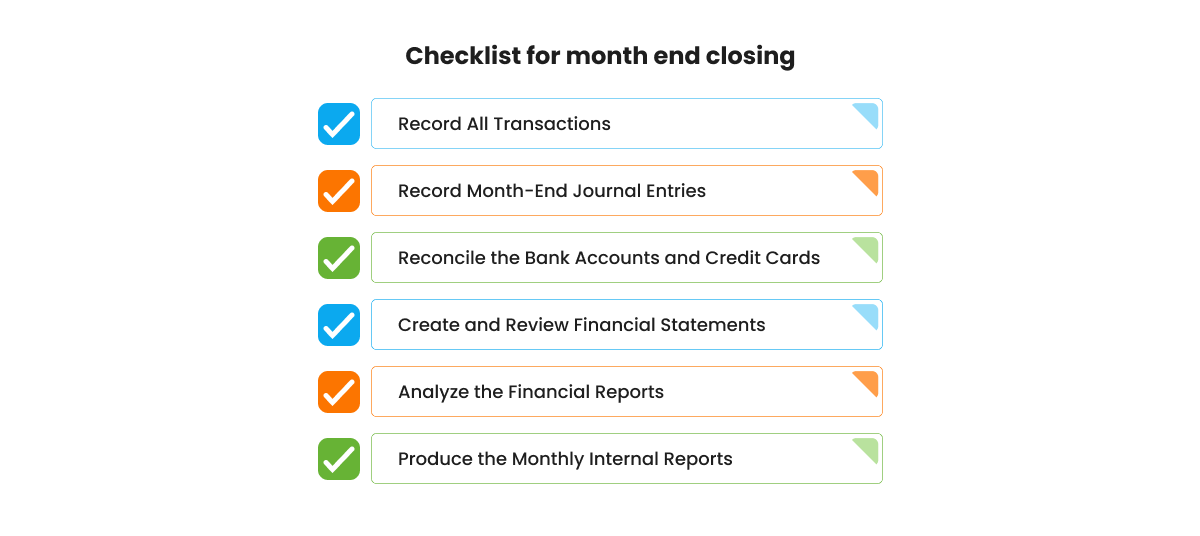

A month-end close checklist is a structured list of tasks finance teams must complete before finalizing the monthly financial books. It ensures that data from multiple sources is collected, reconciled, and reviewed to produce accurate financial statements. Having a checklist not only streamlines the process but also reduces errors and improves consistency in financial reporting.

Making a checklist of all the tasks you need to finish each month helps keep your month-end close organized and consistent. To make it more efficient, the checklist should follow the same sequence in which the tasks are actually carried out. For instance, recording bank transactions should appear before reconciling bank accounts. Here are some common activities typically included in a checklist for month-end closing :

Ensure all transactions related to bank accounts, accounts receivable, accounts payable, and credit cards are accurately recorded. This forms the foundation of a reliable month-end close.

Record necessary adjustments to account balances, such as prepaid expenses, accrued expenses, accrued payroll, depreciation, and other month-end adjustments.

Compare all bank and credit card transactions to their respective statements to identify and resolve discrepancies.

Maintain and reconcile workpapers that support key financial statement accounts, ensuring all balances align with the corresponding financial statements.

Examine reports including the Balance Sheet, Profit & Loss, Cash Flow, General Ledger, and Sales Summaries to verify completeness and accuracy.

Finalize internal reporting documents for management review, providing a clear and accurate picture of the company’s financial performance.

Implementing a month-end close process checklist ensures that all financial transactions are accurately recorded, reconciled, and reviewed. With structured month-end closing procedures, finance teams gain clarity, efficiency, and control over the close cycle.

A well-designed checklist supports your month-end close accounting, optimizes your accounting monthly close process, and transforms routine monthly closing into a scalable, strategic advantage.

One of the main challenges in month-end closing is the time it takes to complete the process. Most organizations take 5-10 working days to complete the month-end close, and businesses often find it difficult to reduce this time. HighRadius’ Record to Report Software helps your business make the month-end closing process faster, smoother, and error-free. Our AI-powered transaction detection system gives access to real-time data and helps spot errors. It also automates manual tasks like financial data collection and reconciliation.

HighRadius’ Account Reconciliation software ensures that all balances are accurate and consistent across your financial statements. By automating reconciliation, businesses can reduce errors and improve efficiency.

Transaction matching software enables rapid comparison of large volumes of transactions, significantly speeding up the reconciliation process and ensuring discrepancies are identified and addressed swiftly. Substantiation provides robust documentation to verify the accuracy of financial entries, enhancing compliance and reliability. Journal Entry Automation streamlines the creation, approval, and posting of journal entries, drastically reducing manual effort and potential errors.

Together, these tools from HighRadius transform your financial closing procedures, enabling a seamless, efficient, and accurate month-end close process. Businesses can achieve a zero-day financial close and reduce their month-end close time by up to 40%, ensuring timely and precise financial reporting.

Month-end reporting involves preparing and analyzing financial reports at the end of each month to summarize a company’s financial performance. It includes reviewing financial statements, such as income statements, balance sheets, and cash flow statements, and identifying key performance indicators.

It is the process of reviewing, reconciling, and verifying that all financial transactions and aspects of the company’s ledgers from the past fiscal year add up. This involves calculating the business expenses, income, revenue, assets, investments, equity, and more.

The month-end close process involves recording, reconciling, and reviewing all financial transactions to ensure accuracy. It includes steps like recording journal entries, reconciling accounts, reviewing transactions, generating financial statements, making adjusting entries, analyzing variances, ensuring compliance, and preparing reports.

You should review your month-end close process quarterly or biannually to ensure it stays efficient and aligned with evolving business needs. Regular updates to your accounting monthly close process help identify bottlenecks and optimize month-end regulatory accounting ethics.

A month-end close checklist helps keep financial tasks organized and accurate. It makes sure nothing is missed, speeds up the close, cuts down errors, and gives managers clear reports for better decisions.

A month-end close checklist lists the key tasks to wrap up your books each month. It usually includes:

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center