Payment reconciliation has long been one of the most time-consuming and error-prone tasks in finance. For many organizations, finance teams spend hours or even days manually matching bank statements, invoices, and customer payments across multiple systems. The result? Delays in the financial close, frustrated teams, and higher risks of reporting errors.

And this isn’t just perception. A PwC Global Finance Survey found that finance professionals spend 30–40% of their time on transactional activities like reconciliation, leaving little room for strategic decision-making. Another study by Deloitte highlighted that more than 70% of finance leaders see manual reconciliations as a leading cause of inefficiency in the month-end close.

With rising transaction volumes and the pressure for real-time cash visibility, traditional reconciliation methods can’t keep up. Relying on spreadsheets and siloed systems risks inefficiency, errors, and compliance issues. Automated, AI-driven payment reconciliation reduces manual effort, improves accuracy, and accelerates the close process, all while giving finance teams better control. In this blog, we’ll discuss why payment reconciliation is critical, the common challenges teams face, and how automation helps achieve faster, more accurate, and confident financial closes.

Payment reconciliation is the process of verifying that the payments received or made by a business match the corresponding invoices, bank statements, and accounting records to ensure that every transaction is accounted for accurately, helping organizations maintain financial integrity, reduce errors, and avoid discrepancies.

Unlike general bank reconciliation, which focuses solely on matching bank statements with the cash ledger, payment reconciliation tracks each payment against invoices or orders, identifies exceptions like partial payments or chargebacks, and resolves mismatches proactively. It is a critical part of the month-end close process and forms the foundation for accurate reporting, audit readiness, and cash flow visibility.

Can You Reconcile Every Transaction Without a Miss?

Download the Reconciliation Template to spot mismatches instantly and simplify your reconciliation and month-end close.

Payment reconciliation processes vary depending on transaction types and business operations. Each type serves a specific purpose and requires a tailored approach to ensure all financial activities are accurately recorded in the company’s accounting books. The most common forms of reconciliation include:

| Payment Reconciliation | Bank Reconciliation | Accounts Receivable (AR) / Accounts Payable (AP) Reconciliation | General Ledger (GL) Reconciliation |

| Match customer payments with invoices or orders | Verify that internal records match bank statements | Ensure AR and AP ledgers match actual transactions | Validate the integrity of the overall financial accounts |

| Compare received payments to invoices, identify partial or duplicate payments | Compare bank statements with ledger entries, identify discrepancies | Match invoices, payments, and vendor/customer records | Compare subsidiary ledgers with the GL, review journal entries |

| Ensures accurate cash posting and reduces errors in financial records | Provides an accurate cash balance and helps detect fraud or errors | Improves the accuracy of payables and receivables, and prevents late payments or missed collections | Ensures financial statements are accurate and audit-ready |

Payment reconciliation is a crucial process that ensures every payment matches invoices, bank statements, and accounting records. Inefficient reconciliation can delay the financial close, reduce cash flow visibility, and increase errors. Here’s why effective payment reconciliation is essential for modern finance teams:

Accurate payment reconciliation prevents discrepancies in accounting records and financial statements. It helps avoid reporting errors that can impact decision-making and compliance.

Manual reconciliation is prone to mistakes and consumes significant time. Automating the reconciliation process minimizes human errors and accelerates the financial close.

Reconciliation provides real-time insight into cash positions and outstanding payments. Enhanced visibility supports better liquidity management and strategic financial planning.

A clear reconciliation trail ensures organizations meet regulatory requirements and are prepared for audits. Automated reconciliation tools make it easier to maintain accurate records.

By reducing manual reconciliation tasks, finance teams can focus on trend analysis, working capital optimization, and improving overall business performance.

Reliable payment reconciliation reduces disputes with customers and vendors, increasing confidence in financial reporting for management, investors, and auditors.

Payment reconciliation is often a complex and time-consuming R2R process. Finance teams face multiple challenges that can slow down the month-end close, increase errors, and affect cash flow visibility. Here are the most common obstacles businesses encounter:

Relying on spreadsheets and manual reconciliation increases the risk of mistakes. Even small errors in matching invoices to payments can delay the financial close and create reporting inaccuracies.

Organizations processing hundreds or thousands of payments daily face reconciliation challenges. Manual tracking becomes inefficient, increasing the likelihood of unmatched or misposted transactions.

Payment data spread across multiple ERPs, banks, and payment gateways slows down reconciliation. Lack of centralized information hinders accuracy and reduces cash flow visibility.

Customers may make payments in installments or at unexpected times. Resolving these exceptions manually consumes time and can affect the overall accuracy of the reconciliation process.

Finance teams often struggle to get real-time insights into payments and cash positions. Poor visibility makes it harder to manage liquidity, plan working capital, and meet strategic goals.

Incomplete or inaccurate payment reconciliation increases regulatory and audit risks. Without automated tracking, maintaining an audit-ready trail is time-consuming and error-prone.

Manual payment reconciliation is one of the biggest bottlenecks in finance, slowing down the financial close and increasing the risk of errors. By adopting AI-driven and automated reconciliation solutions, organizations can transform this critical process, reducing manual effort, improving accuracy, and gaining real-time cash flow visibility. Here’s how automation makes a difference:

AI-driven tools automatically match payments to invoices, orders, or bank statements. This eliminates the need for tedious manual reconciliation and speeds up the month-end close.

Automation identifies unmatched or partial payments and flags exceptions instantly. Finance teams can resolve issues quickly without spending hours manually investigating discrepancies.

By reducing manual reconciliation tasks, organizations can close books faster and with higher accuracy. Automation minimizes errors and ensures reliable reporting.

AI-powered reconciliation provides a live view of incoming and outgoing payments. CFOs and finance teams can make better decisions about liquidity and working capital.

Automated reconciliation creates a transparent audit trail, helping organizations maintain regulatory compliance and simplifying audits.

AI can handle large volumes of payments effortlessly, enabling businesses to scale without adding additional resources or manual effort.

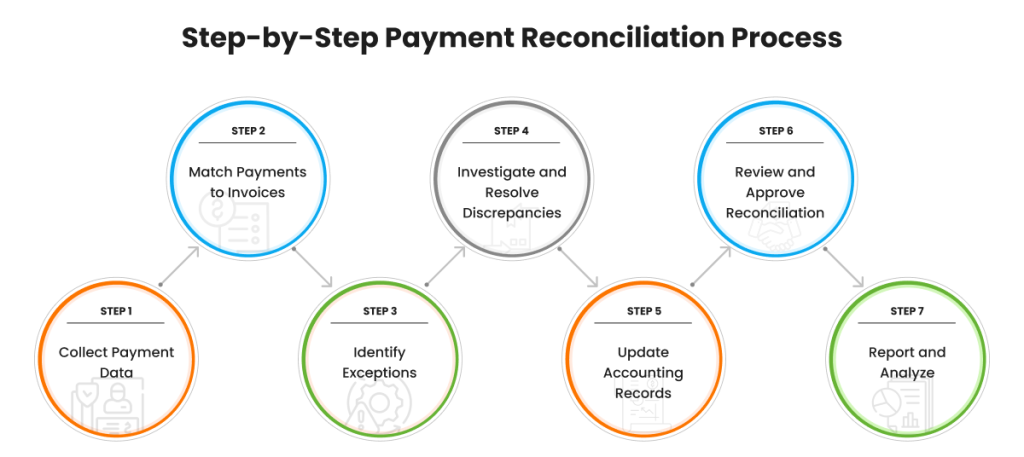

An efficient payment reconciliation process is critical to maintaining financial accuracy and cash flow visibility. Whether done manually or through automation, following a structured approach ensures that all transactions are accounted for and exceptions are resolved promptly. Here’s a step-by-step guide to effective payment reconciliation:

Gather all payment information from bank statements, ERP systems, and payment gateways. Centralizing data ensures that every transaction is captured for reconciliation.

Compare received payments against corresponding invoices or orders. Automated reconciliation tools can perform this step instantly, reducing manual effort and errors.

Flag unmatched or partial payments, duplicate transactions, or discrepancies. Early identification helps prevent delays in the financial close.

Work with relevant teams to resolve exceptions by verifying customer payments, correcting data entry errors, or adjusting records as needed.

Once discrepancies are resolved, update the general ledger and ERP systems to reflect accurate payment and invoice status.

Finance managers should review reconciled transactions for accuracy and approve them before finalizing the financial close.

Generate reports to track reconciliation metrics, cash flow trends, and exception patterns. Insights from these reports can drive process improvements and optimize working capital.

Effective payment reconciliation requires a combination of structured processes, automation, and regular monitoring. By following best practices, finance teams can minimize errors, accelerate the financial close, and maintain accurate cash flow visibility. Here are some key best practices:

Traditional payment reconciliation is often a manual, error-prone process that slows down financial operations. HighRadius Payment Reconciliation Software revolutionizes this by leveraging Agentic AI and automation to achieve up to 80% reconciliation automation, 30% faster close cycles, and 100% reporting accuracy. Integrated seamlessly with your ERP, it ensures real-time transaction matching, proactive exception management, and audit-ready compliance, empowering finance teams to close faster and make more informed decisions.

Payment reconciliation in accounting is the process of matching incoming payments with issued invoices. It ensures accurate cash posting, helps detect duplicate or missing entries, prevents revenue leakage, improves transparency, supports audits, and keeps financial reporting complete, timely, and fully compliant.

Payment reconciliation focuses on matching customer payments with invoices to ensure cash is applied correctly, while bank reconciliation compares company records with bank statements. Both processes keep books accurate, highlight discrepancies, and help businesses prevent costly errors and potential fraud.

AI helps payment reconciliation by automating transaction matching, spotting anomalies, and learning from payment patterns. It minimizes manual effort, speeds up processing, improves accuracy, provides real-time cash visibility, supports compliance, and enables finance teams to close books faster and with greater confidence.

Payments should ideally be reconciled daily in high-volume businesses and at least monthly for smaller ones. Regular reconciliation minimizes errors, detects fraud early, prevents duplicate entries, keeps financial data reliable, ensures cash visibility, and gives finance teams greater control and confidence in reporting.

Yes, payment reconciliation can detect fraud or duplicate payments by flagging mismatches, irregular transactions, and unusual payment patterns. Beyond accuracy, it helps safeguard company cash flow, prevent revenue leakage, strengthen compliance, support audits, and reduce overall financial risks for businesses of every size.

If payment reconciliation is not done properly, it can lead to inaccurate books, missed or duplicate payments, delayed closes, compliance risks, and even fraud going undetected. Poor reconciliation reduces cash visibility, weakens audits, and undermines stakeholder trust in financial reporting.

Tools for payment reconciliation include spreadsheets, ERP systems, accounting software, and advanced AI-driven payment reconciliation software. Modern tools like HighRadius automate matching, flag anomalies, centralize data, ensure audit readiness, and provide real-time cash and working capital visibility.

Automated payment reconciliation is faster, more accurate, and scalable than manual methods. It eliminates human errors, reduces close cycles, and ensures compliance. AI-driven tools like HighRadius provide real-time cash visibility, proactive exception handling, and audit-ready records for finance teams.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center