How Did Robots Win Over Amazon in the Dispute Resolution Challenge?

- Find out about the specific challenges posed by manual processing of disputes, and how automation solves them.

- Learn more about POD aggregation & auto-coding, and how automation uses them to efficiently navigate through the Amazon Vendor Central.

- Know more about how AI-based automation systems provide C-level Executives with visibility on cash flow and working capital metrics such as deductions day outstanding, write-offs and more.

The Most Common Challenges Faced By A/R Teams While Managing Disputes

To meet the CFO’s objectives of safeguarding the cash flow, A/R leaders from the consumer packaged goods (CPG) industry are keen on working with their teams to ensure faster resolution of disputes. But the teams usually must deal with either or all of the following challenges in the process:

- Communicating back and forth across multiple internal teams such as sales, credit to collect relevant information.

- Aggregating documents such as claims, POD, and BOL from various sources.

- Disputing on time with proper denial correspondence.

Further complications arise when teams receive a high volume of claims from a major customer, such as Amazon. Analysts have to make an extra effort to resolve these queries, such as logging into a specific web portal like Vendor Central (VC) to dispute these claims manually. A/R leaders need to ensure their teams can handle customer portals seamlessly and reallocate their bandwidth to more strategic decision-making tasks.

This blog tries to address the issues above by presenting a use case of Amazon Vendor Central.

Teams handling customer claims on their web portals can relate with either of the following scenarios:

- Raising disputes from portals becomes a laborious exercise – It involves navigating through claims in the VC, identifying the dispute, attaching the proper backup documentation, and updating them in their ERP. This makes it a highly time-consuming and manual process.

- Vendors are penalized for no fault of their own< – Invalid deductions pop up frequently where vendors are disputed without a valid reason and are charged for it. Teams then have to identify the validity of such disputes, which restricts their bandwidth.

- Lack of access to the relevant backup data – Analysts must deal with aggregating backup data across different teams to perform root-cause analysis. Most of the time, there is minimal relevant data available for them to make accurate decisions.

The biggest question on every A/R leader’s mind is whether a technology solution can eliminate the manual steps associated with dispute resolution in Vendor Central, and provide options to counter against invalid claims?

Handling Amazon Vendor Central: Every Analyst’s Nightmare

The A/R collections team handles many tasks, from managing all outstanding invoices, resolving customer payment problems, and reducing the volume of aging receivables.

Often, a simple miss-step in one of these processes can result in delinquent client engagement and lead to invoice disputes. An invoice dispute occurs when a client decides they shouldn’t pay an invoice. This can have a serious impact on a company’s cash flow regardless of the reason for the dispute

In some cases, up to 5% of invoices are written off due to invoice disputes. Things get more complicated when you must adopt a complex workflow just for handling deductions from only one customer like Amazon. Although it has ties with several vendors, the Amazon Vendor Central is challenging for deductions analysts because of its cumbersome processes for resolving disputes.

Let’s find how technology can automate dispute resolution on customer portals such as Amazon Vendor Central.

How Difficult Is It To Raise a Claim On Vendor Central?

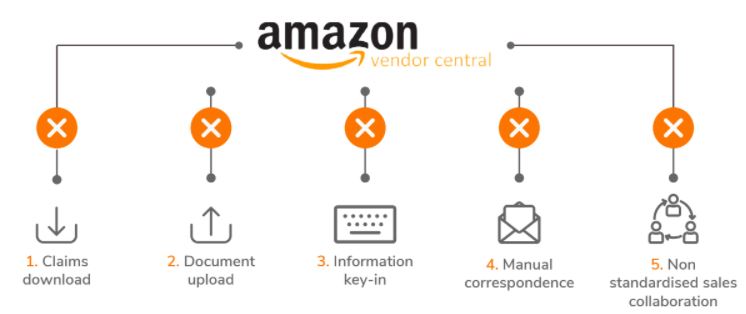

Highly Manual processes for disputing in Vendor Central

a. Claims download: This process involves dispute analysts manually downloading each claim one by one from the portal as it cannot be fetched in bulk.

b. Document upload: Information related to each dispute has to be painstakingly keyed into the portal, which could delay raising disputes significantly.

c. Information key-in: Whenever there is an invalid dispute, analysts must manually type and send the denial correspondence with relevant documents attached, such as claims, POD, BOL, to Amazon.

d. Manual correspondence: Analysts must manually send correspondences related to every dispute when they’re doing their research. This time-consuming to-and-fro process unnecessarily delays the dispute resolution.

e. Non-standardized cross-team collaboration: Resolving disputes involves teams collecting relevant information from multiple departments, including cash application, collections, logistics, sales, and supply chain. Analysts often waste their bandwidth due to the poor collaboration between internal teams.

As a result, the dispute resolution process:

How Would Robots Fare Against Vendor Central?

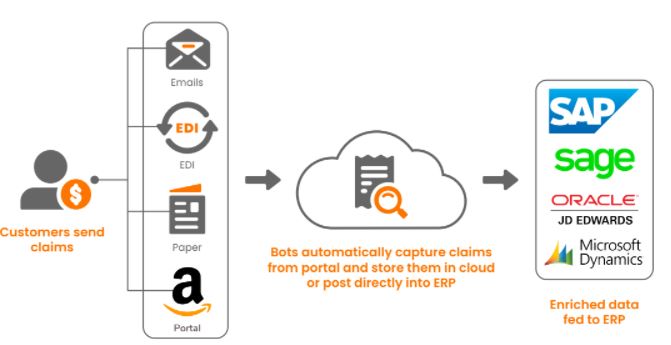

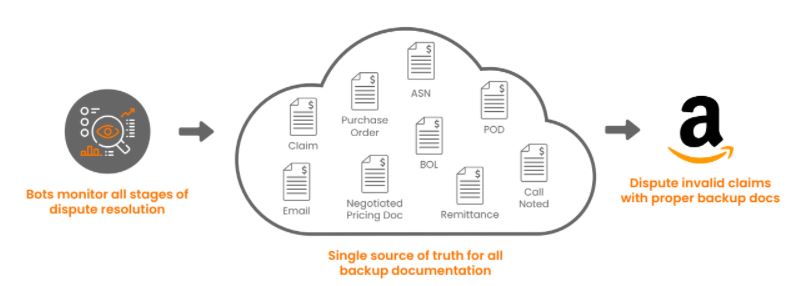

1. Claims and POD Aggregation

As a result, all the claims/disputes information is exported from Vendor Central in one single batch eliminating the need for manual download.

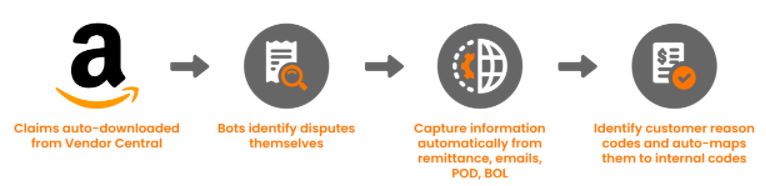

2. Auto-coding Deductions

Spent on dispute identification and coding is now saved, and deductions are assigned to analysts who can directly start working on them.

3. Web Push

The deduction is claimed on the same day for invalid claims when the denial package is uploaded to Vendor Portal attached with POL, BOD, ASN.

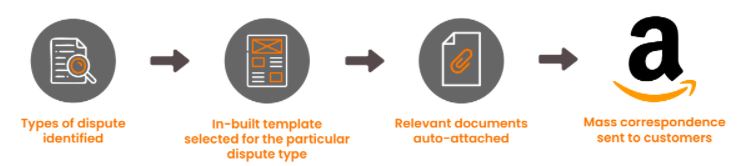

4. Dispute Correspondence

Analysts don’t have to write emails or attach documents for each customer separately.

5. Audit Trail

Disputing on time with proper backup documentation results in faster resolution.

Leveraging Automation to Resolve Real-World Amazon Dispute Cases

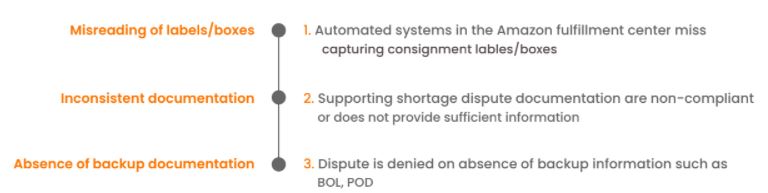

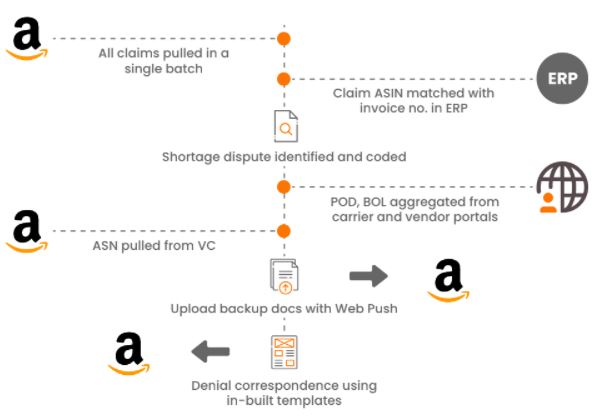

1. Shortage Deductions

How were they resolved before?:

- Analysts log in to VC and download each claim manually

- The ASIN number is manually matched with the invoice number in the ERP; this process is repeated for each claim

- Analysts go through claims individually and identify shortage disputes

- Analysts collect backup documents from carrier portals, emails, and paper

- Analysts open each dispute separately in VC and upload the relevant documents such as POD, BOL, and claim

- Analysts key in the relevant information in VC for each dispute

How does Automation save the resource’s bandwidth?

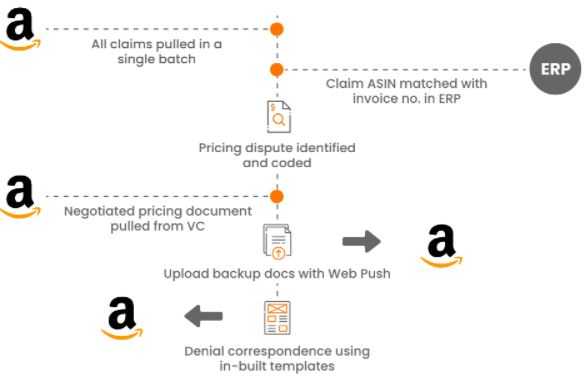

2. Pricing Deductions

Why do they happen?

How were they resolved before?

- Analysts log in to VC and download each claim manually

- The ASIN number in the claim is manually matched with the invoice number in the ERP

- Analysts go through claims individually and identify the pricing disputes

- Analysts log in to VC and download negotiated pricing documents

- Analysts upload the pricing documents relevant to that particular pricing dispute

- Analysts key in the relevant information in VC for each dispute

How does Automation help

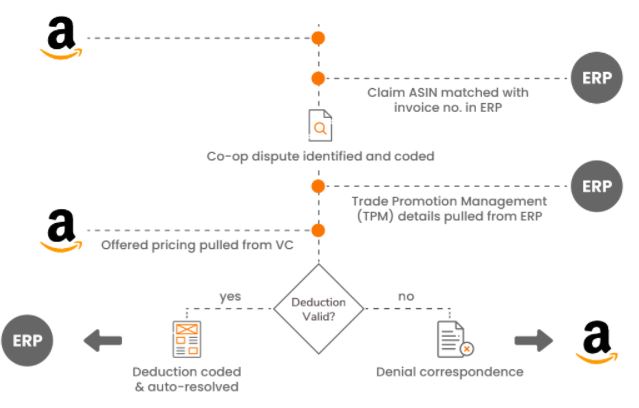

3. Co-Operational Deductions

Why do they happen?

How were they resolved before?

- Analysts log in to VC and download each claim manually

- The ASIN number in the claim is manually matched with the invoice number in the ERP

- Analysts go through the claims individually and identify the co-op disputes

- Analysts check product catalog and pricing agreements in VC

- Analysts go back and forth across Sales and Credit teams for deal sheets and trade documentation

- Analysts key in the relevant information in VC for each dispute

How does Automation help?

4. Vendor Chargebacks

Why do they happen?

- 2% cost of the product: if the ASNs submitted have less than 100% compliance but greater than 95% from the trailing six weeks

- 4% cost of the product: if the ASNs submitted have between 70% – 95% compliance from the prior six weeks

- 6% cost of the product: if the ASNs submitted have less than 70% compliance from the prior six weeks

How does Automation help?

1. Audit trail

Robots track all forms of communication with vendors and store all backup documents in one source for effortless disputing in case of invalid chargebacks.

2. Auto- compliance

- Attaches all relevant documents for disputing

- Eliminates errors due to manual keying in

- Disputes as soon as a claim is raised

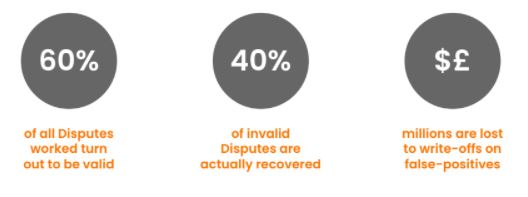

Why auto-resolve disputes?

What can Robots do?

3. Bonus: drill-down capability

Robots provide real-time out-of-the-box and custom reports for end-to-end managerial view. It allows drilling down on inefficient sub-processes and applying speedy corrective measures.

What can Robots do?

- Reports provide a view on the number of deductions and the type of deductions happening periodically for different locations, warehouses, vendors, and customers.

- Reports provide C-level Executives with visibility on cash flow and working capital metrics such as deductions day outstanding, write-offs, the volume of deductions, deduction values, and more.

- Reports allow managers to track the productivity of analysts and take instant corrective actions on identifying process inefficiencies.

Conclusion

Before adopting the auto resolving dispute system:

- Each claim was manually downloaded from VC for resolving resulting in delayed dispute resolution

- If not paid, vendors waited for 30 days for repayment and then raised a dispute

- No option to batch deductions

- All data elements need to be manually keyed in when disputing

- Piling up of unresolved disputes results in more write-offs

- Insufficient time dedicated to research and resolution of disputes

- High days deduction outstanding (DSO) and low invalid deduction recovery

After adopting automation tools to resolve the disputes:

- All claims are pulled from VC in a single batch, along with BOD, and POD

- The dispute is raised with proper backup documents as soon as an invalid claim is raised

- Deductions can be processed en-masse

- Data elements are automatically entered into the system with high accuracy

- Automated resolution results in lower write-offs

- With automation, analysts have additional bandwidth to research and resolve disputes

- Fewer days deduction outstanding (DDO) and high invalid deduction recovery