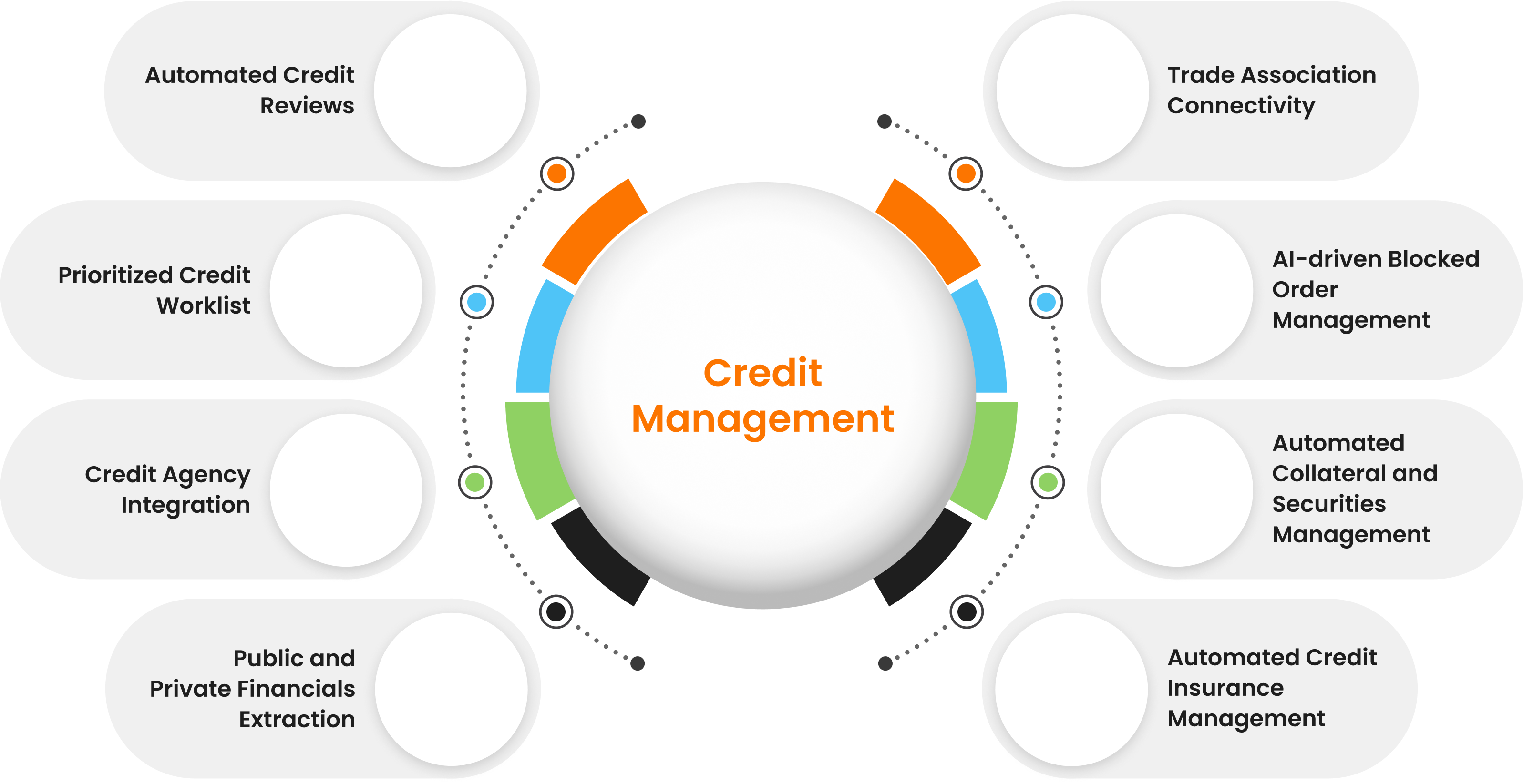

Credit Risk Management

AI-based Credit Worklist Prioritization

Enabling analysts to efficiently review prioritized Customer accounts daily, based on diverse credit evaluation criteria such as Credit Limit Exceeded, Blocked Orders, New Customer Applications, Bankruptcy Alerts, Expiring Collaterals, and Periodic Reviews