Expand your Workday capabilities with AI-powered AP automation solution – specifically designed to process complex invoices

Just complete the form below

Automate invoice matching and approvals to cut cycle times by 2X. Achieve 100% autocoding of non-PO invoices and eliminate manual entry with auto-mapped fields in Workday.

Extract PO and non-PO invoice data with 95% accuracy. Bi-directional Workday AP integration ensures vendor, PO, invoice, and payment updates remain consistent across systems - reducing reconciliation gaps and ensuring audit-ready precision.

Standardized, real-time updates through Workday AP integration deliver full financial transparency. Sync schedules - hourly, daily, or on-demand - align with business cycles, reducing silos and strengthening decision-making at scale.

The Agent connects to Workday in real time to validate vendor, company code, and GL data - preventing mismatches and errors.

Immediately after approval, invoices and attachments post into Workday via secure APIs, ensuring instant ERP visibility.

For large volumes, the Agent compiles invoices into encrypted batches and sends via API or SFTP.

Failed postings appear in a worklist; AP processors correct data and retry with one click - preserving audit trails.

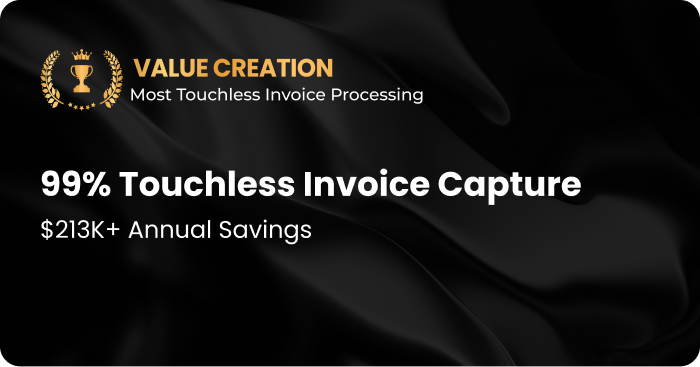

With HighRadius' Agentic AI-powered AP automation software, invoice processing cycle time is 2X faster, and overall productivity improves by 40%.

Book a Discovery Call

Yes, Workday offers accounts payable automation features, but most enterprises enhance them by integrating with specialized AP automation software like HighRadius. This combination streamlines invoice capture, approvals, and payments directly within Workday. As a result, finance teams gain greater efficiency, compliance, and visibility across the AP process.

Workday AP automation digitizes invoices, validates them against purchase orders, and routes them for approval within the system. Integrated solutions like HighRadius enhance this by adding AI-powered invoice capture, automated matching, and real-time exception handling. This reduces manual work while ensuring accurate and faster payments.

HighRadius integrates with Workday using secure API connections and industry-standard authentication protocols such as OAuth 2.0. This ensures encrypted data exchange and compliance with enterprise security policies. As a result, AP teams can trust the integration without compromising sensitive financial information.

Key elements synced include vendor master data, purchase orders, invoices, general ledger codes, and payment status. This two-way synchronization ensures AP automation software stays aligned with Workday ERP in real time. It eliminates duplicate entries and maintains accurate financial records.

Implementation timelines typically range from a few weeks to a few months, depending on the complexity of the AP workflows and enterprise requirements. Standard integrations can be deployed faster, while customized configurations may take longer. With HighRadius, most Workday integrations are designed for rapid, low-disruption rollouts.

When selecting AP software for Workday, consider scalability, AI-powered automation features, compliance support, and ease of integration. Ensure the software syncs seamlessly with Workday elements like invoices, POs, and vendor data. Also, evaluate security standards and ROI potential to future-proof your AP operations.