Accounts Payable Approval Software: AI-Powered Approval Workflows To Reduce Processing Cycle Time

AI Agents Automate payment approvals using policy-based rules, intelligent routing, LLM-powered in-email approvals, and human-in-the-loop workflows.

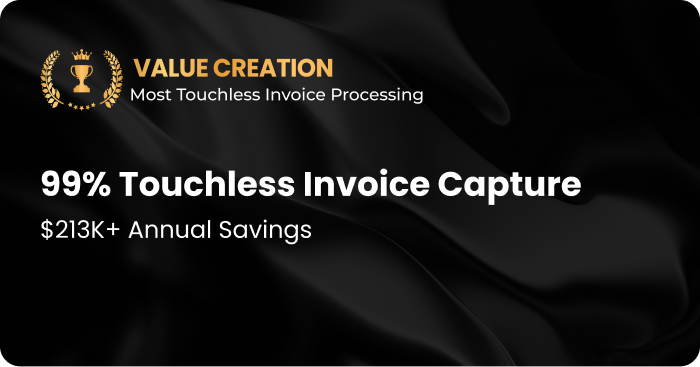

Reduce Invoice Processing Cycle Time by 85%!

Integrates With 50+ ERPs

See How Accounts Payable Approval Software Works

Just complete the form below