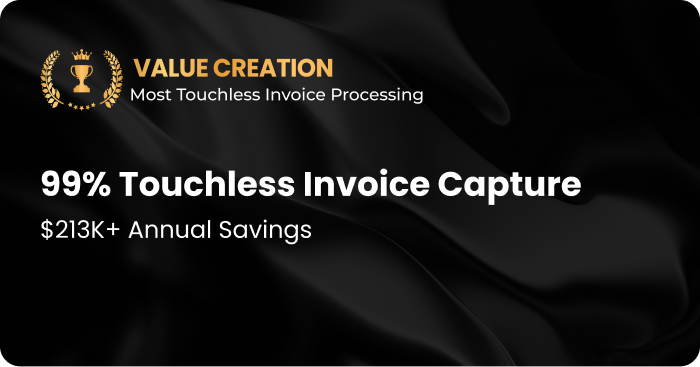

95% Invoice Capture Rate

Turn supplier emails into ready-to-process invoices

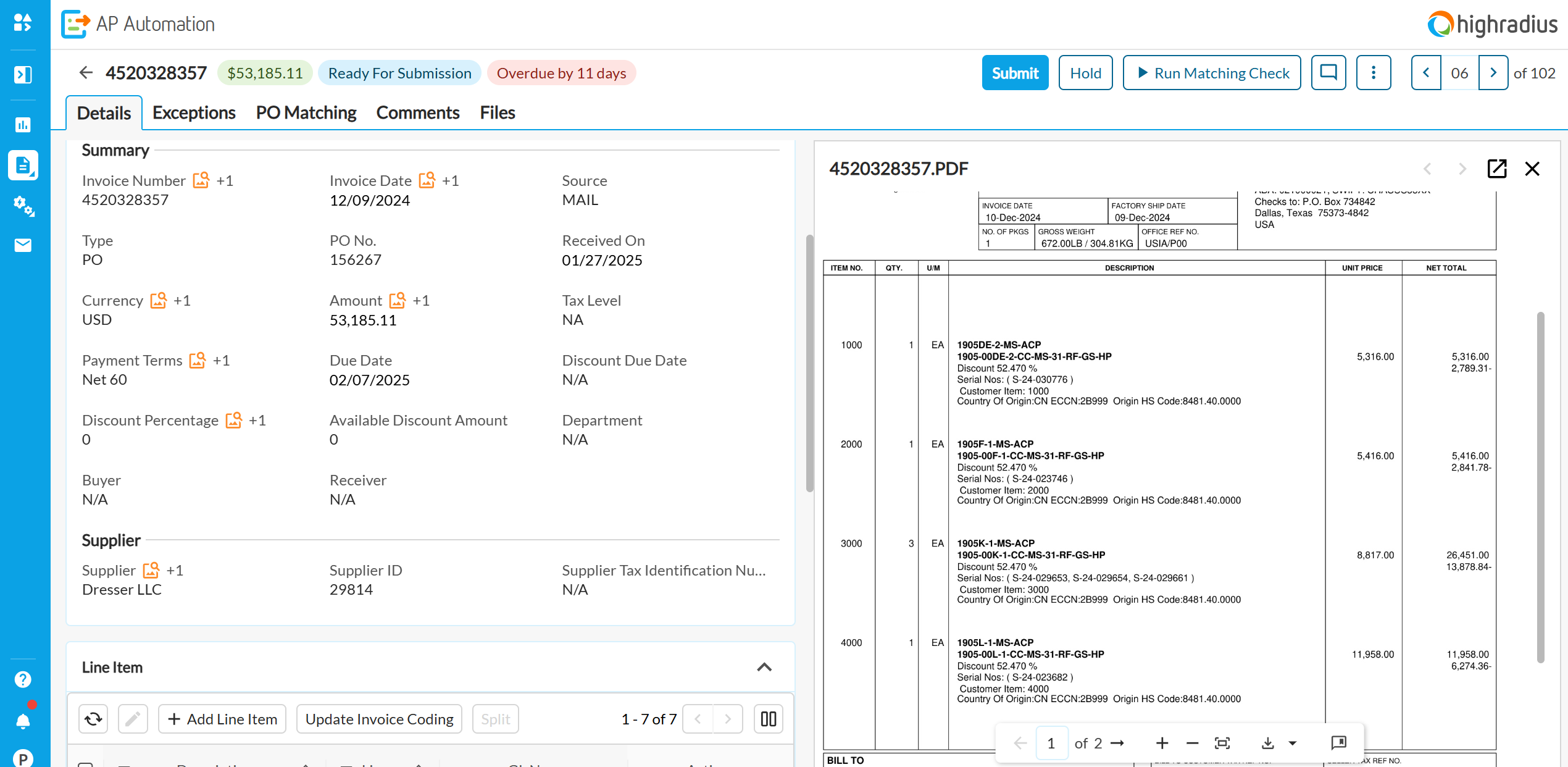

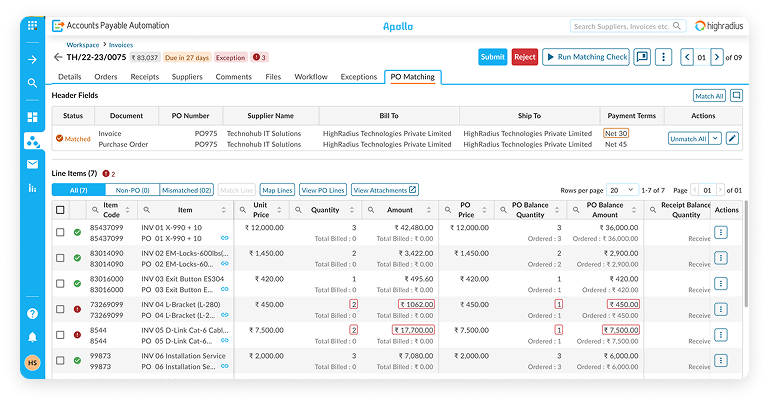

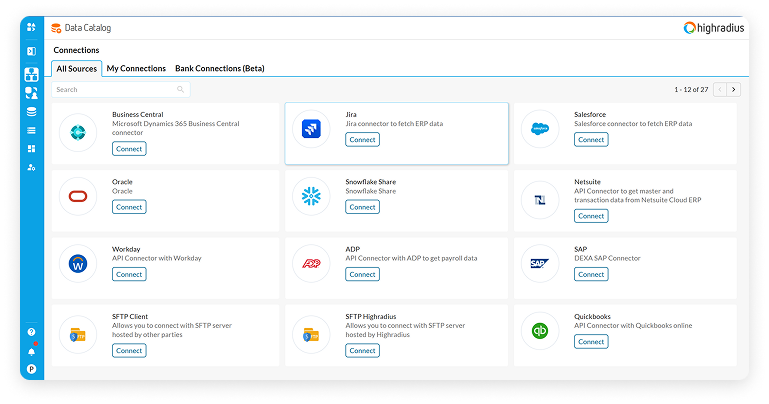

HighRadius uses AI and machine learning to extract, validate, and upload invoice

data directly into your ERP. Invoices are processed the moment they arrive, eliminating

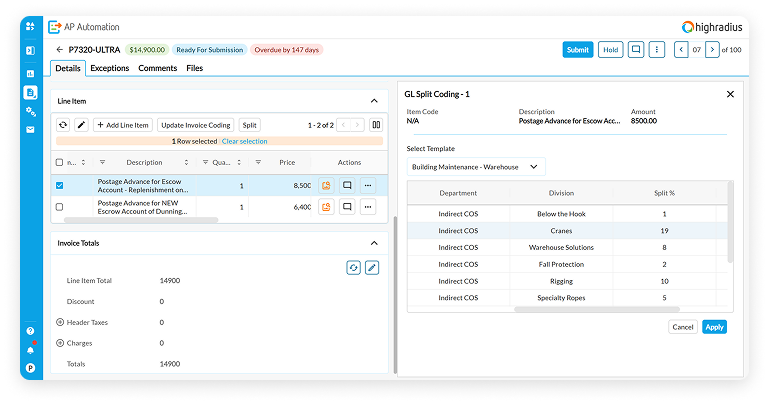

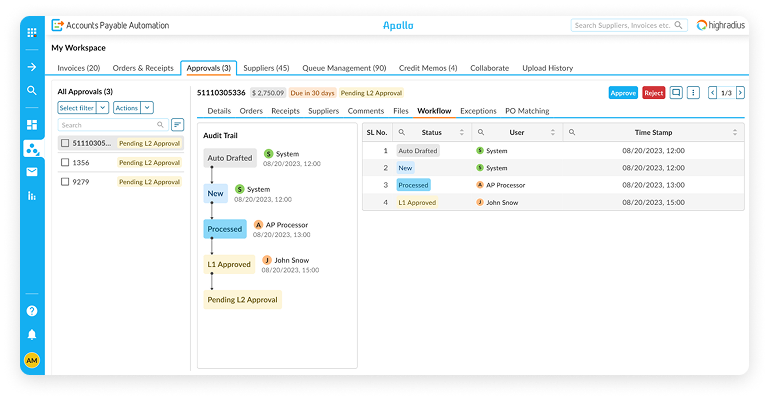

manual data entry and freeing your AP team to focus on exceptions, approvals, and cash

control.

- AI-powered OCR for scanned, PDF and Image Invoice Capture

- Auto-Extraction of header and Line-Item Data

- Automated split and merge for multi-invoice PDFs

Download Solution Brief