Danone?s Discovery on How to Choose the Right Technology for Automating A/R Processes in SSOs

An insightful summary of how these GPOs made their A/R future-ready while reducing costs, improving metrics and keeping their customers happy!

Danone?s Discovery on How to Choose the Right Technology for Automating A/R Processes in SSOs

Define the Automation that You Want

The credit and A/R team at Danone wanted to transform their A/R operations using technology. The first step they used was to define what they expect from automation based on their unique business requirements. Here is what they expected from automation: ? Single source of truth ? Easy to deploy and flexible ? Easy to train resources ? Future-ready ? Scalable Across Business Units

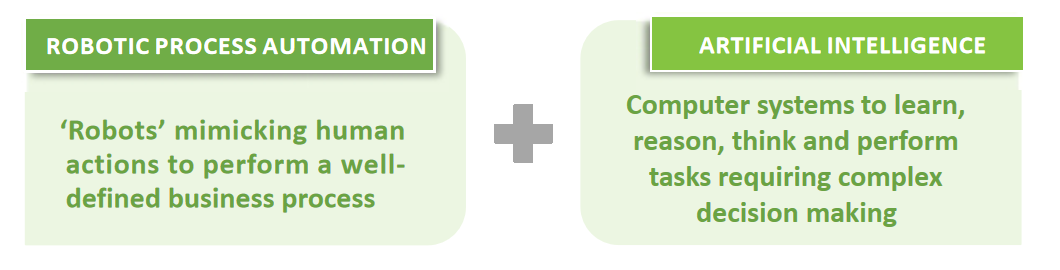

Identify the Technology that You Need

What To Look For In A Partner

In order to find the perfect vendor, Michael suggests you should check if the vendor: ? Asks the right questions o Has strong experience from past implementations o Collects mission-critical information in a timely manner ? Explains the impact of business decisions o Develops a deep understanding of our business o In-depth understanding of technology decisions o Helps see impact/consequence at each step ? Offers a tailor-made approach o Implementation suited to ensure no business disruption o Standardization for processes, but flexibility to accommodate local BUs

Best Practices on Technology and Vendor Selection

Best practices suggested by Michael Pettyjohn, Director, Customer Financial Services, Danone: ? Plan in detail – What features are required in the product application ? Plan for the future – Choose a solution which will scale as the business grows ? Internal stakeholder alignment – Ensure that all stakeholders are kept in the loop ? Frequent interaction with vendor – Onsite blueprinting and weekly project status meetings