Ensuring Successful Implementation of Treasury Technology

What you’ll learn

- How to build a strong project team.

- Tips for creating a comprehensive technology implementation project plan.

- Techniques for navigating project implementation bottlenecks.

How to form a project team?

To determine who should be included in the project team, start by determining which processes and teams will be impacted by the implementation and developing a shared timeframe for various project stages. A project team can be formed by considering the following individuals:- Project manager: A project manager supervises the project from start to finish and oversees day-to-day operations to keep the project on track.

- Employees from reporting vendors: They can offer expert guidance and help with data collection and analysis issues.

- Subject matter experts: SMEs understand the requirements of the project. Thus they can guide through the project implementation.

- Technical personnel: An IT person is responsible for identifying if the system depends on any IT resources.

- System users: The system users can suggest if any extra data is needed for the system to function or if any representative from a specific department needs to be present. For example, A/P and A/R data are essential to developing a cash forecasting cloud. Hence A/P and A/R personnel must be included in the team.

Ways to navigate the implementation of technology

The planning phase involves documenting project plans, defining project deliverables and requirements, and putting together a timeframe. It entails developing a set of plans to assist the project team in navigating the project’s implementation stage.

These are the best practices to navigate the implementation process:

- Make a list of the resources needed to develop the system.

- Allocate the work among the team members after compiling a list of all the requirements.

- Specify blackout days when some or all team members will be unavailable.

- Pick a team, analyze the metrics, and allocate work before transferring the project to production.

- Check whether the project is heading on the right path.

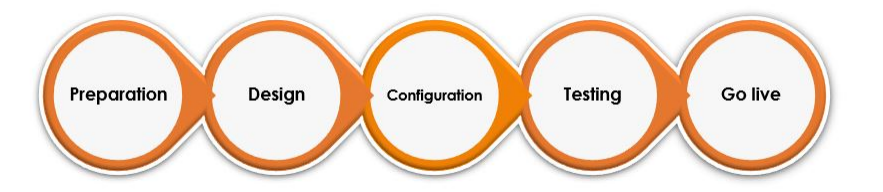

5 phase implementation methodology

The project implementation follows the 5 phase methodology that includes:

1. Preparation phase: The vendor initiates the project onboarding process after signing the contract.

2. Design phase: The vendor begins designing the deliverable after gathering information about requirements. This stage ensures that everyone is on the same page and that the project proceeds according to plan.

3. Configuration phase: The vendor refers to this step as the “build phase.” In this phase, coordination and project management takes place.

4. Testing: Firms utilize the testing phase to identify all of the system’s flaws and faults, fix those issues and verify if the product fits the needs of their clients.

5. Go live: The system is ready to use by the clients.

Digital transformation can be a complex project for most companies if not planned properly. The most difficult area is integrating a new system into existing treasury systems without disrupting team productivity. Here are a few pointers to streamline the implementation process:

- Provide the vendors with detailed documentation during the preparation phase for them to understand the requirements clearly.

- Ensure the software blueprint addresses all business requirements in the design phase.

There’s no time like the present

Get a Demo of Cash Forecasting Cloud for Your Business

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.