Key Takeaways

- The choice between on-premise and cloud-based Treasury Management Systems (TMS) is a crucial decision for optimizing financial operations.

- Cloud-based TMS offers flexibility, scalability, cost-effectiveness, and automated functionalities compared to the upfront costs and maintenance of on-premise solutions.

- AI-powered treasury management uses advanced analytics to optimize investments and make smarter liquidity decisions amid market uncertainties.

Introduction

In the ever-evolving landscape of enterprise treasury management, one question reigns supreme: What’s the best solution for your organization? Choosing between an on-premise or Cloud-Based Treasury Management System (TMS) can feel like navigating a maze of options, each promising to revolutionize your financial operations. To effectively assess liquidity, funding, financial risk management, and corporate governance amid unpredictable market shifts and volatility, CFOs must establish appropriate KPIs. The treasury KPIs are essential for optimizing decision-making and ensuring the organization’s financial stability.

In this blog, we embark on a journey to demystify this age-old debate and uncover the ultimate answer. Time to explore the world of TMS solutions like never before!

What is On-Premise TMS?

An on-premise Treasury Management System (TMS) is a software solution installed and operated directly on a company’s own servers and infrastructure, typically within the organization’s physical premises or data centers. With an on-premise TMS, the company is responsible for purchasing, installing, configuring, and maintaining the hardware and software required to run the system. This approach gives the organization complete control over the TMS and its data, but it also requires significant upfront investment in hardware, software licenses, and IT resources for ongoing maintenance and support.

What are its drawbacks?

The typical use of a TMS involves:

- The need for back-end server hardware

- The hiring of programmers or IT employees

- The large amounts of money are paid for software licenses.

What is Cloud-Based TMS?

Cloud-Based Treasury Management Systems (TMS) are the latest financial technology for managing an enterprise’s treasury operations in the digital age. Unlike traditional on-premise solutions, a cloud-based TMS is hosted on the vendor’s servers and accessed via any internet-connected device as the application. This provides a flexible, scalable, cost-effective alternative for managing an organization’s cash, investments, and financial transactions. Keep reading to understand how cloud treasury software aids a company’s growth.

The global treasury management system size is expected to reach USD 16.10 billion by 2032.

8 Benefits of Cloud Treasury Solutions

In today’s fast-paced and digitally-driven business world, treasury departments are adopting cloud-based solutions to transform their financial operations. The cloud offers flexibility, scalability, and accessibility, allowing organizations to streamline their treasury management processes and achieve greater efficiency, agility, and innovation.

The following are the advantages of cloud-based treasury solutions for large companies:

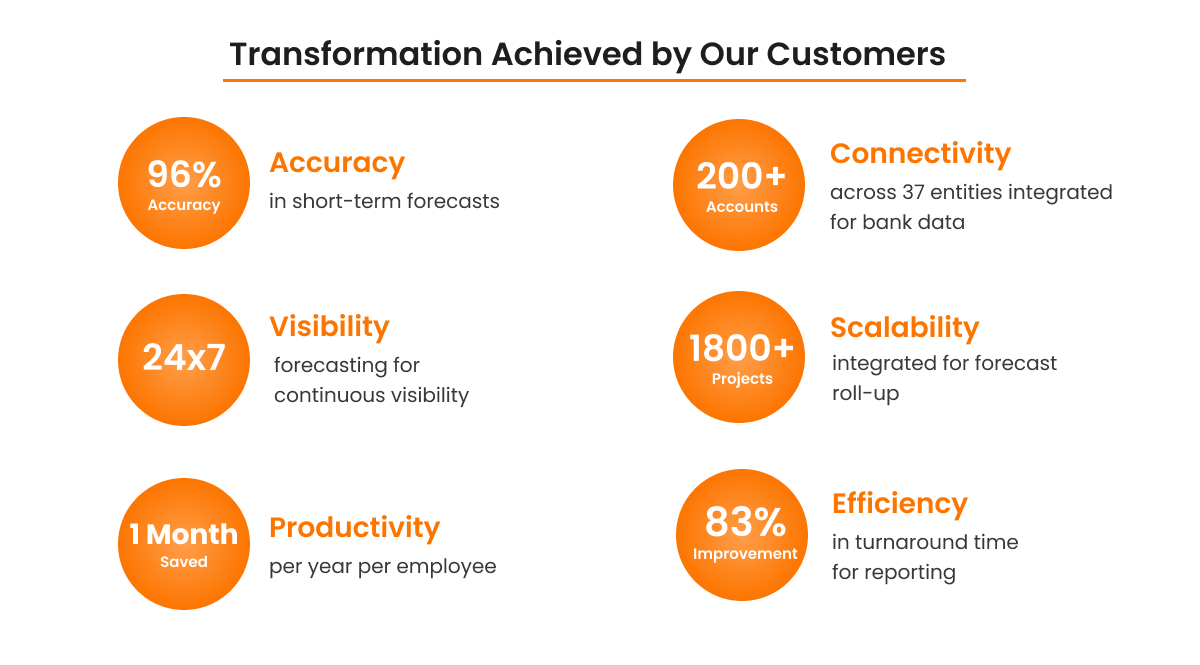

- Increased accuracy for short-term & long-term cash forecasts.

- Faster deployment and implementation of the treasury software.

- Bottom-up and accurate forecasting across different cash flow categories, regions, and currencies.

- Global cash visibility over cash position and cash flows across all subsidiaries.

- Seamless integration using API across banks, ERPs, and FP&A systems.

- Automated bank reconciliation and bank statement parsing to improve cash flow management.

- Capability to make data-driven decisions for growth activities like investment and M&A.

- Automated capturing of intercompany activities like:

- Tracking balances

- Recording interest across all mirrored

- Monitoring notional bank accounts

10 Key Features of Cloud Based TMS

At the heart of modern treasury operations lies the Treasury Management System (TMS), designed to streamline financial processes, optimize cash management, and mitigate risk. With a robust array of features and functionalities, TMS empowers treasury professionals to navigate the complexities of global finance with precision and efficiency. A good cloud treasury management software must contain the following features:

- Seamless integration with multiple systems (ERPs, bank portals, TMS, etc.)

- Cash transactions are automatically segmented (for instance, by A/R, A/P, taxes, and payroll).

- Financial transactions matching under predetermined rules one-to-one, one-to-many, and one-to-all

- Combining funds in many currencies

- Automated bank reconciliation

- Accurate and real-time cash positioning

- Dependable cross-bank connectivity

- Checking user and payment activity

- Fraud detection and prevention

- Reporting of daily and real-time statements from a single location

On-Premise TMS Vs. Cloud Solutions: Comparison

|

Parameters |

TMS |

Cloud solutions |

|

Cost |

Depending on the complexity of the solution, licensed TMS costs from $200K to $400K. Users also need to pay an extra annual maintenance fee. |

SaaS business cash flow software runs on an annual subscription basis. The price can range from $45,000 – $60,000, including a one-time setup fee. |

|

Ease of use |

A TMS doesn’t support all devices, and it requires training before use. Only high-end TMS vendors have an excellent round-the-clock customer support system. |

Cloud treasury management solutions have an easy-to-use interface. It is device-independent and has an excellent customer-support module. |

|

Updates and maintenance |

TMS requires frequent updates with the help of IT on a weekly or monthly basis. |

Updates and maintenance are the responsibility of the vendors, not the users. The updates are also customizable. |

|

Time-saving |

TMS can save up to 50% of the time spent performing repetitive tasks such as:

|

Cloud-based treasury systems can help recover as much as 80% of the hours wasted on manual tasks per year. |

|

Implementation |

Implementation takes 5 to 6 months. |

Implementation takes only 3 to 4 weeks. |

Why Are Cloud Treasury Solutions Better Than Others?

The use of cloud technology is more effective for digital transformation. It allows for better flexibility and agility across an enterprise. Cloud treasury solutions help enterprises scale faster in the following ways:

- Quicker and more returns on investment:

There are no update and upgrade costs for the new capabilities of SaaS software. The vendor handles updates and upgrades, achieving more significant ROI. Large companies can improve their ROI by using business cash flow software through: - Decreased interest expense

- Increased investment income

- Freed-up resource bandwidth

- Future-ready solution:

A cloud-based treasury management system is highly flexible and scalable. Many users can access the cloud at the same time. It adapts to the changes and requirements of an organization. For example, if a billion-dollar firm acquired a new company. A solution would be needed to store vast amounts of bank data. Cloud solutions also allow organizations to respond to different scenarios swiftly. - More bandwidth for strategic tasks:

A cloud-based TMS frees up the bandwidth of analysts. They can focus on liquidity planning instead of manual data gathering and modeling. With accurate and readily available data, treasurers can make confident investment/debt decisions.

HighRadius Treasury Management Solution

With businesses continuously evolving, the amount of data to be processed increases exponentially, making it even more complex to manage liquidity. By leveraging HighRadius Treasury Platform, you can make smart liquidity decisions in a timely manner.

HighRadius has developed an advanced analytics cash forecasting solution powered by patented ML and AI. The company has invested significantly in building a large infrastructure of data scientists to produce the best models and outcomes. Additionally, it offers automated daily cash positioning to optimize investments & borrowings by tracking financial instruments. Below mentioned are some of the key features of this treasury platform.

1. AI experience

HighRadius has been an early adopter and pioneer of AI in financial services and has completed 250+ transformational AI projects with high accuracy.

2. Enhanced bank balance visibility

Save hours with 100% bank balance visibility via centralized bank balance analysis across multiple accounts with custom views and data exploration.

3. Tailored models

HighRadius runs the data through 25 AI models to find the best-fit curve for each category and time horizon to deliver the highest accuracy. This improves the cash management productivity by 70%.

4. Timely updates

HighRadius releases new updates every month. They work with 250+ Fortune 1000 companies.

5. Customer success

HighRadius has a team of 3500+ members to provide best-in-class support for deployed solutions, including a dedicated team of data scientists.

6. Exceptional bank connectivity

Real-time bank data access with bank API supports and versatile formats to provide 100% Automated Bank Integration.

7. Automated cash forecasting

AI-based automated daily cash forecast for up to 12 months with up to 95% forecast accuracy. Make data-driven decisions based on accurate future cash predictions. This will also help reduce idle cash by 50%.

FAQs

1. What does TMS stand for in treasury?

TMS, short for Treasury Management System, is a comprehensive software suite designed to streamline financial operations, manage cash flow, mitigate risk, and optimize treasury functions within organizations, ensuring efficient and effective management of funds and financial assets.

2. What is TMS payment?

TMS payment encompasses the functionality within Treasury Management Systems that facilitate various payment processes, including electronic fund transfers, wire transfers, payment approvals, reconciliation, and reporting, providing organizations with a centralized and automated platform for managing their payment workflows and financial transactions.

3. How much does a TMS software cost?

The cost of cloud treasury software can vary significantly depending on factors such as the complexity of features, scalability, implementation requirements, vendor pricing models, and customization needs. Generally, TMS software costs can range from tens of thousands to millions of dollars, including upfront licenses, subscription fees, implementation costs, and ongoing maintenance expenses.

4. What is the difference between on-premise and cloud-based TMS?

The main difference between on-premise and cloud-based TMS is where the software is hosted and managed. On-premise TMS is installed on company servers, requiring in-house IT support, while cloud-based TMS is hosted and managed by the vendor, accessed via the internet, and typically has a subscription-based pricing model.