Raising money is crucial for businesses looking to start, expand, or maintain operations. One effective way in which companies can raise funds is through contributed capital. Contributed capital is the money that shareholders invest in a company in exchange for ownership shares. This method often serves as the primary source of funding, especially for growing businesses, and showcases the trust and confidence that investors have.

Unlike loans, which need to be repaid, contributed capital represents a long-term investment by shareholders. In 2022 alone, companies worldwide raised over $3 trillion through various funding methods, highlighting the importance of capital contributions in the business world

Understanding the fundamentals of contributed capital is essential to grasping the basics of business finance as well as devising effective financial strategies for companies to grow and thrive. This guide will walk you through everything you need to know about contributed capital, from contributed capital definition, key components to formulas and examples, and how automated cash forecasting software unlocks precision and smart decision-making.

82% of business failures stem from poor cash flow oversight.

Don’t let outdated workflows put your shareholder capital at risk.

Download AI GuideContributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. It’s a crucial part of a company’s equity and represents the funds raised directly from shareholders rather than from the company’s operations.

Other than earning from their core business operations, organizations can raise funds in the following ways:

It’s crucial to note that capital contributions, which inject cash into a company, can come in various forms beyond selling equity shares. For instance, an owner might secure a loan and contribute the proceeds as capital. Companies may also receive non-cash assets like buildings and equipment as capital contributions. These increase owners’ equity, but “contributed capital” specifically refers to funds received from issuing shares, not other types of contributions.

Understanding contributed capital is essential for analyzing a company’s financial health and investment appeal. It shows how much the direct shareholder contribution is, which can indicate their confidence in the company’s future. Let’s dive deep into the components of contributed capital to better understand its nuances.

Contributed capital consists of two primary components: common stocks and additional paid-In capital. Understanding these components helps clarify how companies raise money from shareholders.

Common stocks represent ownership in a company. When a company issues common stocks, it’s essentially selling a piece of itself to investors. Think of common stocks as slices of a pizza. When you buy a slice, you own a part of the whole pizza (the company). The more slices you have, the bigger your ownership.

Shareholders with common stock get certain rights, such as voting rights on company matters and receiving a portion of the company’s profit as dividends.

Think of common stocks as slices of a pizza. When you buy a slice, you own a part of the whole pizza (the company). The more slices you have, the bigger your ownership.

Shareholders with common stocks can vote on important company decisions and may receive a portion of the profits, known as dividends.

Additional paid-in capital is the amount investors pay over the nominal or par value of the stock. This component reflects the extra money shareholders are willing to invest in the company beyond the basic share price. Imagine you’re buying a limited- edition toy that costs $1, but because it’s popular, you pay $10. The extra $9 you paid over the base price is like additional paid-in capital.

This extra payment shows the confidence investors have in the company’s potential to succeed and grow.

Understanding the components of contributed capital is essential for grasping how companies raise funds and grow. By breaking it down into common stocks and additional paid-in capital, we can see the different ways investors contribute to a company’s financial foundation. This also helps in gauging the trust and expectations investors have in the company’s potential and future success.

Imagine a new company, ABSZ Inc., is looking to raise funds to develop to scale their software product category. t. They decide to issue 1,000 shares of common stock with a par value of $1 per share.

Par Value Contribution: If investors buy these shares at their par value, ABSZ Inc.. will raise $1,000 (1,000 shares x $1 par value). This amount is recorded as common stock.

Above Par Contribution: Suppose the demand for ABSZ Inc. shares is high, and investors are willing to pay $10 per share. For each share, the additional $9 over the par value is considered additional paid-in capital.

So, if all 1,000 shares are sold at $10 each, the total raised would be $10,000.

Here’s the breakdown:

Common Stock:

$1,000 (1,000 shares x $1 par value)

Additional Paid-In Capital:

$9,000 [(1,000 shares x $10) – (1,000 shares x $1 par value)]

Calculating contributed capital is straightforward once you understand its components. The formula combines the values of common stock and additional paid-in capital.

Formula for contributed capital calculation:

Contributed Capital = Common Stock + Additional Paid-In Capital

Calculation of contributed capital:

Let’s revisit our example with ABSZInc. to see how this formula works in practice.

Using the formula:

Contributed Capital=$1,000+$9,000=$10,000

So, ABSZInc.’s total contributed capital is $10,000.

This formula helps companies and investors understand the total amount of direct investment made by shareholders. It’s a key indicator of the confidence investors have in the company.

Understanding the pros and cons of contributed capital helps companies and investors make informed decisions about financing and investment strategies.

While contributed capital offers significant advantages like improving financial stability and attracting long-term investors, it also has potential drawbacks such as ownership dilution and dividend obligations. Companies must weigh these factors carefully to determine the best financing strategy for their growth and sustainability while keeping in mind the equity contribution made to all the shareholders.

Contributed capital and earned capital sound similar and are often confused with one another. However, they have very clear distinctions. On one hand, contributed capital represents the funds shareholders invest directly into the company through the purchase of shares, signifying external financial support. Conversely, earned capital, or retained earnings, is generated internally from the company’s operational activities and reflects its profitability. Below is a comparative overview that highlights the fundamental differences between these two essential components of shareholders’ equity.

|

Attribute |

Contributed Capital |

Earned Capital |

|

Definition |

Capital received from shareholders when they purchase company shares. |

Profits earned from a company’s operations after covering expenses. |

|

Source |

Investment made by shareholders. |

Revenue generated from business activities. |

|

Impact on the Balance Sheet |

Increases shareholders’ equity without increasing debt. |

Increases retained earnings, part of shareholders’ equity. |

|

Accounting Treatment |

Recorded under shareholders’ equity as common stock and additional paid-in capital. |

Recorded under shareholders’ equity as retained earnings. |

|

Usage |

Used for business expansion, development, or as strategic capital. |

Typically used for reinvestment in business, paying dividends, or saving for future expenses. |

|

Investor Perspective |

Represents ownership and potential influence in company decisions. |

Reflects the company’s operational success and profitability. |

Traditional capital planning often relies on outdated spreadsheets and static assumptions, leaving finance teams blind to real-time liquidity shifts. That’s why modern businesses are turning to automated cash forecasting software to drive faster, more confident capital decisions with AI-powered precision and real-time visibility.

AI models deliver high-confidence cash projections, critical for funding, investment, and capital structure decisions.

Consolidated forecasting provides a unified capital overview—helpful for repatriation and cross-entity cash pooling strategies.

Scenario modeling enables treasury to simulate FX, rate impacts, and other capital assumptions—leading to smarter decision-making.

Automating data ingestion and forecast updates reduces errors, cuts manual time by ~30%, and frees teams to focus on capital planning.

Legacy forecasting systems often lack real-time data integration, rely heavily on manual inputs, and offer limited scenario planning. These gaps lead to delayed insights, increased risk of errors, and poor alignment between cash forecasts and capital allocation decisions. Without intelligent automation, finance teams spend hours chasing spreadsheets instead of analyzing cash positions. This hinders agility in funding decisions, equity planning, and managing shareholder expectations.

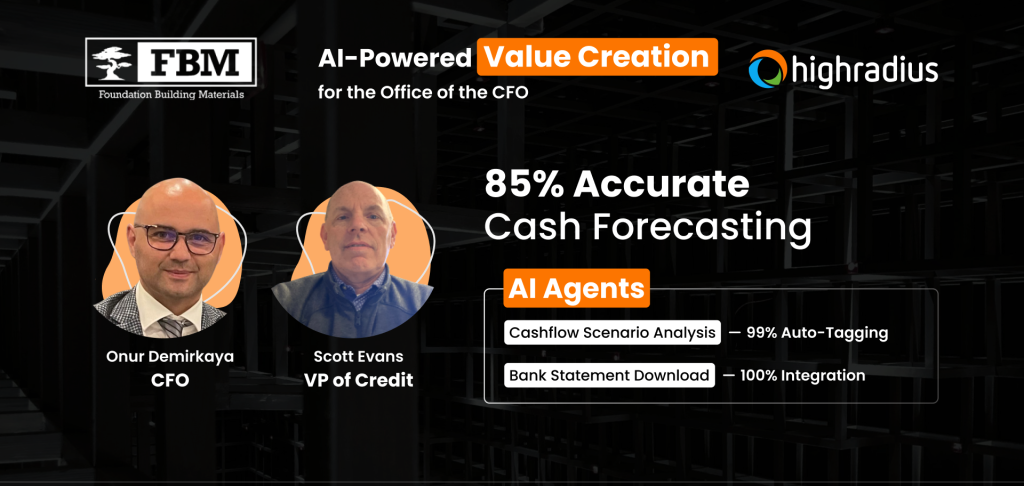

With this in mind, HighRadius’ Treasury Management System brings you automated Cash Forecasting Software, which not only helps unlock accurate and consistent cash forecasting but also chooses the best-fit, ready-to-use customizable forecasting template to align with the business requirements.

Our Cash Forecasting Software leverages advanced technologies such as artificial intelligence (AI) and machine learning (ML). It integrates with banks and ERPs to get AR/AP data, improve ML prediction rates, and enable treasurers to achieve accurate, real-time cash forecasting. The system also allows variance analysis by automatically flagging gaps between forecasts and actuals, identifying trends, course-correcting assumptions, and improving future model accuracy. Businesses can forecast cash into any category or entity daily, weekly, and monthly with up to 95% accuracy, perform what-if scenarios, and compare actuals vs. forecasted cash.

Additionally, HighRadius’ automated cash management software helps enterprises recover up to 50% of idle cash trapped across fragmented bank accounts, geographies, and entities. With centralized dashboards and automated cash positioning, treasurers can make faster, more informed liquidity decisions—freeing working capital that would otherwise sit untouched.

When an investor pays a company for shares, the journal entry involves debiting the cash account for the received amount and crediting the common stock account for the par value of issued shares. Any excess amount is credited to an additional paid-in capital account, reflecting the total capital contribution.

Contributed capital is the total investment made by shareholders through the purchase of a company’s stock, including common stock and additional paid-in capital. Earned capital, or retained earnings, is the profit a company generates from its operations and retains for reinvestment or to pay off debt.

Contributed capital is recorded as a credit. When shareholders invest in a company, the cash or asset account is debited, and the contributed capital accounts (common stock and additional paid-in capital) are credited, increasing the company’s equity.

Contributed capital is not an asset. It is recorded under shareholders’ equity on the balance sheet, representing the total funds shareholders have invested in exchange for ownership shares.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center