Key Takeaways

- Gain valuable insights into the creation and utilization of credit memos.

- Explore the significant role credit memos play in business financial management.

- Unearth common errors to avoid when issuing credit memos and how to tackle them.

Introduction

Accounting documents form the backbone of a business’s financial health. One such critical document is the credit memo. This blog will explore this financial tool, its importance, how to create and track it, and much more.

Understanding Credit Memos

What is a Credit Memo?

A credit memo, or credit note, is a correctional document issued by a seller to a buyer, typically used to amend invoices by reducing amounts owed due to errors, price adjustments, or returns in sales transactions.

Why Do Businesses Use Credit Memos?

Businesses use credit memos to:

-

Manage Accounts Receivables: Crucial for finance teams as it directly impacts cash flow and revenue, adjusting the outstanding amounts customers owe.

-

Keep Financial Records Accurate: Helps adjust the value of sales and accounts receivables accurately, reflecting the business’s true financial health.

-

Handle Disputes: Offers an organized way to resolve pricing disagreements or errors in billing.

-

Foster Trust: Assures transparent communication about transaction adjustments, fostering trust.

How to Create a Credit Memo: A Step-by-Step Guide

Creating a credit memo is not a daunting task, provided you follow these key steps:

-

Gather Relevant Information: Obtain all necessary details, including the original invoice number, customer details, and reasons for issuing the credit memo (such as an incorrect item billed, price adjustment, etc.).

-

Formatting and Content: Prepare the credit memo format with details like date, credit memo number (sequential numbering or reference-based numbering), description of goods or services, the amount to be credited, etc.

-

Ensure Compliance: Ensure the memo aligns with accounting standards and internal company policies.

Examples of a Credit Memo

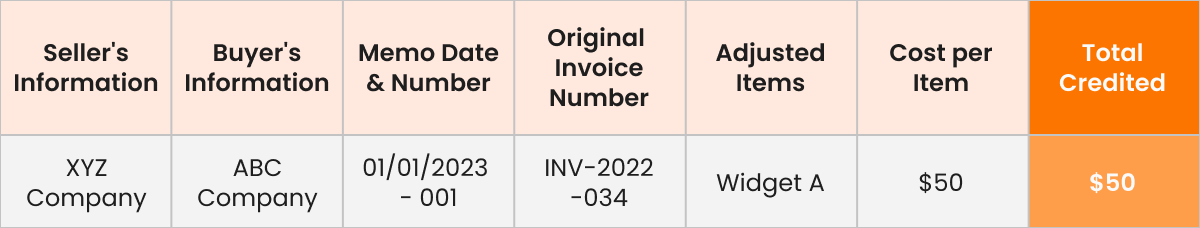

A well-drafted credit memo example would include sections for:

- Seller’s and buyer’s information

- Credit memo date and number

- Original invoice number

- An itemized list of goods or services

- Each item’s cost and the total amount credited

A well-formatted credit memo can be represented like the one below:

The credit memo above indicates that XYZ Company issued a credit memo to ABC Company on 1st January 2023, crediting $50 due to an issue with ‘Widget A’, as per the original invoice number INV-2022-034.

Free Credit Memo Template to Get You Started

To make the process simpler, here are 3 free credit memo templates. They are easy-to-use tools that ensure you don’t miss out on any crucial details.

Accounting for Credit Memos

Journal Entry for Credit Memo

A credit memo journal entry typically involves debiting your Sales Returns, and Allowances account and crediting your Accounts Receivable account. Here’s an example:

-

Debit: Sales Returns and Allowances ($X)

-

Credit: Accounts Receivable ($X)

This entry reflects the reduction in your receivables and your sales revenue.

How to Track Credit Memos

Here are some practical methods you can adopt to track credit memos efficiently:

-

Accounting Software: Utilize software solutions with built-in credit memo tracking, ensuring linked memos, accurate records, and easy auditing.

-

Detailed Log Maintenance: Manually maintain a log (digital or physical) detailing memo purpose, amount, associated invoice, and date of issuance.

Best Practices for Avoiding Credit Memo Errors

Here are some common pitfalls when issuing credit memos and their solutions:

-

Mismatch in Memo and Invoice Details: Ensure memo details match the original invoice. Always check the invoice number, customer details, and items or services.

-

Incorrect Calculations: Minor miscalculations can significantly impact your accounts. Especially verify complex adjustments like partial returns or discounts.

-

Lack of Standardization: Establish a consistent format across all memos to reduce confusion and streamline auditing.

-

Delays in Issuing Credit Memos: Prompt issuance of credit memos prevents financial reporting disruption and enhances customer satisfaction.

-

Overlooking Credit Memo Approvals: Avoid unauthorized adjustments by instituting a credit memo approval process, ensuring each issued memo is justified and verified.

Conclusion

When used effectively, credit memos can streamline your business’s financial management. We hope this guide helps you understand credit memos better and utilize them effectively in your business.

For more in-depth information on accounting documents and processes, keep an eye on our recommended resources or reach out to us directly on the live chat with our accounting experts. Happy accounting!