Key Takeaways

- Choosing the right model, whether GBS, BPO, or SSC, is crucial for aligning business operations with specific goals.

- A hybrid approach, combining GBS, BPO, and SSC, offers flexibility and balances in-house control with outsourcing efficiency.

- AI and data analytics are key in transforming GBS, enhancing decision-making and operational efficiency.

Introduction

Choosing the most suitable strategy for your O2C (Order to Cash) process is crucial, especially when faced with a range of options such as global business services, shared services, and outsourcing. But which one should you choose?

The answer to this question isn’t straightforward. There are numerous factors to consider. Nevertheless, this guide will assist you in dissecting the complexities of each strategy. It aims to uncover their respective advantages, limitations, and the ideal scenarios for their application.

By the end, you’ll be equipped with the insights necessary to navigate these choices and effectively optimize your O2C process. So, let’s dive in.

What is Global Business Services (GBS)?

Global business services (GBS) is a unified framework that integrates an organization’s back and front office operations into a single, cohesive unit. This integration aims to streamline processes, foster collaboration, and support strategic business goals on a global scale.

GBS differs from older models by offering a comprehensive approach to managing business services. It’s not just about consolidating tasks or reducing costs. Instead, GBS focuses on enhancing service quality, improving decision-making, and fostering innovation. By centralizing services and using advanced technologies, GBS helps companies become more efficient and agile.

Examples of global business services

Global business services (GBS) include a range of integrated services like finance and accounting, human resources, IT support, procurement, and customer service. These services are streamlined and managed centrally, supporting various business functions across an organization’s global operations.

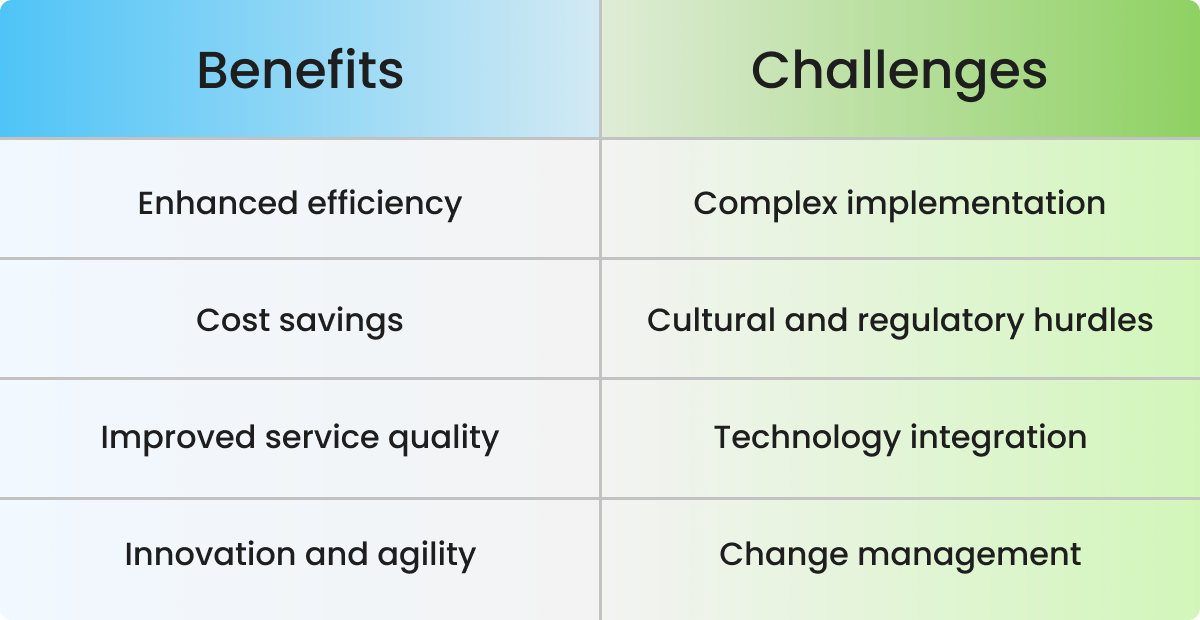

Benefits and Challenges of the GBS Model

While GBS offers significant benefits, it’s not without its hurdles. The model requires a careful balance of global standardization and local adaptation, and its success hinges on strategic implementation and continuous improvement. Below, we outline the main benefits and challenges associated with implementing and managing a GBS framework.

Benefits:

- Enhanced efficiency: GBS streamlines various business processes, leading to increased operational efficiency across global operations.

- Cost savings: By integrating services, GBS helps reduce overhead costs and achieve economies of scale.

- Improved service quality: Standardized processes under GBS lead to consistent and higher quality services across different regions.

- Innovation and agility: The model fosters innovation by freeing up resources and enables companies to respond swiftly to market changes.

Challenges:

- Complex implementation: Setting up a GBS framework is intricate and requires meticulous planning and execution.

- Cultural and regulatory hurdles: Managing services across various cultures and regulatory environments can be challenging.

- Technology integration: Establishing a technology infrastructure that supports GBS can be costly and complex.

- Change management: Transitioning to a GBS model involves significant organizational change, requiring effective leadership and communication.

With these points in mind, it’s important to compare GBS with other service delivery models like business process outsourcing (BPO) and shared service centers (SSCs). The next section will delve into this comparison, offering insights into how each model aligns with different business needs. But before that let’s understand the other delivery models in brief.

What is the Business Process Outsourcing Model?

Business process outsourcing (BPO) means delegating your manual, time-consuming business tasks to another company. This organization will own, administer, and manage these tasks while making sure it meets the specific standards and KPIs you agreed upon.

The BPO model focuses on labor cost arbitrage. It involves you signing a contract with a third-party agency specializing in any work you need to get done. BPO offers organizations to reduce working capital and OpEx, increase cash flow, and resolve customer issues faster resulting in improved customer satisfaction.

Benefits:

- Cost reduction: BPO helps in cutting costs, especially for labor-intensive tasks.

- Focus on core business: Allows companies to focus on their core activities by outsourcing non-core functions.

- Expertise access: Access to global talent and specialized expertise not available in-house.

- Scalability: BPO provides flexibility to scale operations up or down as needed.

Challenges:

- Quality control: Maintaining consistent quality standards can be challenging.

- Communication barriers: Cultural and language differences may lead to misunderstandings.

- Security risks: Potential risk of data breach or loss of confidentiality.

- Dependence on suppliers: Over-reliance on outsourcing partners can be risky.

What Is the Shared Services Centers/Organizations (SSC/SSO) Model?

A shared service center (SSC) is a centralized unit within an organization that provides shared services to consolidate and streamline business functions (like finance, HR, IT, or customer service) to achieve greater efficiency, cost savings, and standardization.

A global shared services model helps companies in reducing complexity by centralizing mostly back-office functions but keeping them in-house. Shared service centers can be set up globally or locally. It’s done to save costs and allows better decision-making.

Business Process Outsourcing vs Shared Services Centers vs Global Business Services

Each model has its unique features, benefits, and challenges. Understanding these differences is key to choosing the right approach for your organization’s needs. Here, we’ll compare these models to provide a clearer picture of how they function and what they offer.

|

Feature |

Business Process Outsourcing (BPO) |

Shared Service Centers (SSC) |

Global Business Services (GBS) |

|

Services Offered |

Both back-office and customer-facing services (e.g., payroll, accounting, social media, customer support). |

Primarily back-office or non-customer facing services (e.g., finance, HR). |

Both customer-facing and back-office services, often including complex processes (e.g., customer support, order processing, invoicing, logistics). |

|

Operational Focus |

Tied to specific business functions or units; focuses on operational efficiency and cost-effectiveness. |

Focuses on standardizing and optimizing internal processes for specific business units. |

Integrates services across multiple functions, focusing on efficiency, standardization, and strategic alignment. |

|

Ownership and Control |

External third-party providers; potential risks in data security and lesser control over processes. |

Remains within the organization, offering more control over operations and data security. |

Can be in-house or outsourced; provides a balance of control and flexibility, with options for tailored solutions. |

|

Customization and Flexibility |

Limited customization; services are often standardized across clients. |

Moderate customization based on internal needs of the organization. |

High level of customization; services are tailored based on specific client needs and strategic goals. |

|

Strategic Alignment |

Often operationally driven with less emphasis on strategic alignment. |

Internal alignment with business units but limited external strategic integration. |

Strong focus on aligning services with overall organizational strategy and goals. |

|

Cost Implications |

Typically cost-effective due to economies of scale achieved by the provider. |

Potential for cost savings through internal efficiencies and standardization. |

Balances cost-effectiveness with strategic investment; can lead to long-term savings and value creation. |

Choosing The Right Global Service Delivery Model for Your Business

When it comes to deciding which model to choose and implement, there are multiple business factors to consider and the pros and cons of each model that you should be aware of. Here are the two top parameters for you to keep in mind while selecting the suitable service delivery model:

1. Business vision

Leaders should self-assess the following criteria while planning for and selecting any service delivery model. Below is a questionnaire for you to gather enough information to make a decision:

- What is your long-term cost goal?

- Are you more focused on aggressive cost reduction or interested in a long-term investment with a higher ROI?

- Are scalability and expansion a priority to you or a plan for later?

- Does your vision include long-term engagement with customers focused on service-delivery excellence?

2. Costs involved

One of the most important factors to consider is the cost involved and the ROI delivered from the service implemented. Hence below are two important questions you need to ask yourselves:

- Does the current budget allow us to put in the costs required for a particular service delivery model?

- By what timeframe would you be able to enjoy returns on your current investment? Does the ROI sound convincing to you?

The issue of “Outsourcing vs. Shared Services vs. GBS” is a never-ending debate and the right answer requires an objective look at the unique requirements of each situation.

When to choose a Business Processes Outsourcing model?

Outsourcing tends to make the most sense when an organization is looking for fundamental change, wants to move quickly in a short period, and views cost reduction as a top priority.

When to choose a Shared Services model?

For established businesses aiming beyond cost-cutting, global shared services offer greater control over key processes, reducing risk. This approach is vital for strategic activities and those with strict compliance demands, ensuring added value and secure operations.

When to choose the GBS model?

GBS is ideal for leaders aiming to elevate their functions into top-tier service providers, enhancing organizational agility. It suits organizations striving to lead their industry, offering the agility to swiftly respond to opportunities, threats, or key economic changes.

So, What's the Best Service Delivery Model for Your Business?

When it comes to optimizing business functions using GBS, Shared Services, or Outsourcing, there’s no one-size-fits-all solution. Many businesses benefit from a hybrid approach, combining elements of each model to best meet their needs. This flexibility allows organizations to manage different business functions in the most effective way, balancing in-house control with outsourced efficiency.

Take finance, for example. Critical and higher-risk activities like credit and collections might be best kept as in-house shared services, where direct oversight is crucial. Automation in these areas, particularly with advanced tools like those offered by HighRadius, can significantly enhance efficiency and accuracy. On the other hand, more transactional tasks such as accounting and cash application could be effectively outsourced, allowing for quick scalability and progress tracking while maintaining centralized control over other functions.

Conclusion

When deliberating between global business services (GBS), shared services, and outsourcing for your O2C process, it’s imperative to acknowledge the unique advantages each model offers.

Amid the choices of GBS, shared services, and outsourcing, the paradigm leans towards the strengths of GBS as an optimal choice. The integration of data analytics and AI is revolutionizing the GBS landscape. These technologies not only streamline operations but also provide deep insights for better decision-making and strategic planning. With the right tools, businesses can transform vast amounts of data into actionable intelligence, driving efficiency and innovation.

HighRadius’ cutting-edge solutions, powered by AI and advanced analytics, are tailored to empower GBS models. HighRadius provides tools that seamlessly integrate with your existing systems, enhancing your ability to manage finances, track progress, and scale operations effectively. By leveraging HighRadius’s technology, businesses can stay ahead in a rapidly evolving global market, ensuring they are not just keeping up but leading the way in efficiency and strategic growth.

Choosing between GBS, shared services, and outsourcing is not about selecting one over the others; it’s about finding the right balance that suits your organization’s unique needs. With the support of HighRadius’ innovative solutions, businesses can harness the power of data and AI to drive their GBS strategies forward, ensuring they remain competitive and agile in a dynamic business landscape.