Options Available for Check Payment Processing

This e-book will walk you through the options for processing checks on the parameters of processing cost, check float reduction and resource requirement.

Options Available for Check Payment Processing

For processing checks, SMBs are largely dependent either on internal manual processing or expensive lockbox services offered by the banks. All of these options, either drain internal resources or money. The options available for check payment processing are:

- Traditional In-house Processing

- Remote Deposit Capture (RDC) Solutions

- Bank Lockbox Services

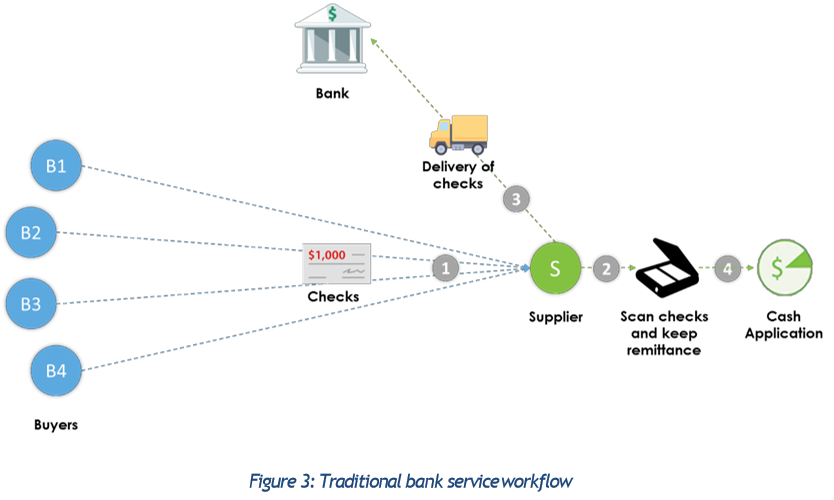

Traditional In-house Processing

- Checks are directly sent to the supplier

- Resources individually scan checks and key-in remittances information for cash reconciliation

- Checks are physically deposited to the bank

- Cash application is done manually by the A/R team

Cost

It lies somewhere between cost-intensive and cost-effective. Even though this process mitigates high lockbox fees, high resource allocation for the labor-intensive work greatly reduces the cost benefits.

Speed

It is a time-intensive process since manual intervention is needed at every step of the way, right from making scanned copies, depositing checks in the banks and manual reconciliation. As it is, checks come with a float of 3 days. On top of that, time lag due to the above processes is directly reflected in the processing time. The extra days get added to the company?s DSO and impact working capital.

Resource Requirement

Plenty of low-value manual work is associated with processing checks by the conventional method. These could be isolated as physical delivery of checks to banks on a daily basis, scanning check payments and remittance reconciliation. All these are time-taking activities, especially when a company receives hundreds of checks daily. Apart from that, manual cash application requires a high employee count to account for variability in incoming payment volumes. Analysts manually link the checks and open invoices together and feed the data into a spreadsheet. Once that gets done, they typically have to process a high volume of cash posting exceptions. Only after all this, the cash is posted to the ERP system.

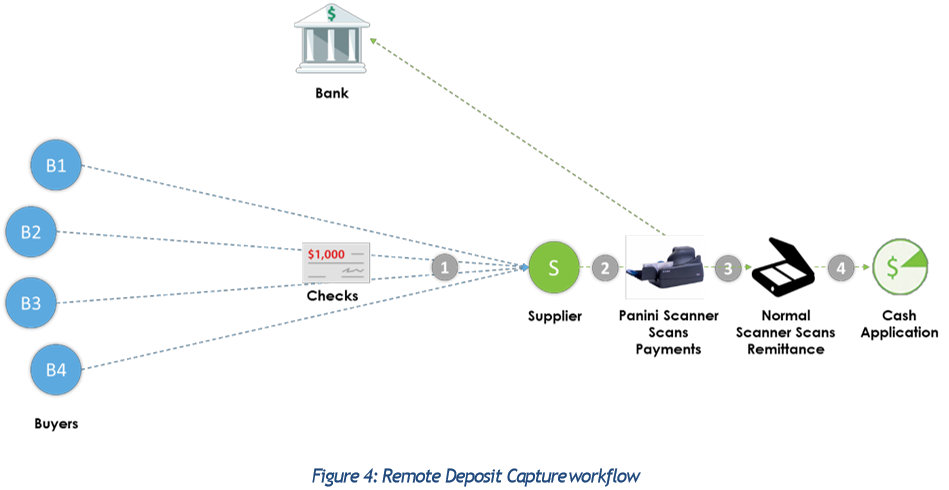

Remote Deposit Capture

In 2004, Panini launched the MyVision X check scanner and gave birth to the concept of Remote Deposit Capture. This scanner had the capability to scan large batches of check payments and transmit an image directly to the bank for processing. The workflow of RDC is highlighted in the following sequence of events:

In 2004, Panini launched the MyVision X check scanner and gave birth to the concept of Remote Deposit Capture. This scanner had the capability to scan large batches of check payments and transmit an image directly to the bank for processing. The workflow of RDC is highlighted in the following sequence of events:

- Multiple buyers send checks and remittances to the supplier

- RDC scans the checks and directly sends it to the bank

- A separate scanner is used to scan the remittances for usage in reconciliation or archival

- The A/R team applies cash to their ERP system

Cost

The Panini Scanner is not a hefty investment and RDC cuts down on the costs associated with manual handling and transportation. However, cash application is still manual and the company needs to bear resource costs.

Speed

RDC reduces the processing time of checks by remotely delivering checks to the banks. Since RDC could potentially process the checks the moment it arrives at the supplier, it gains 1-2 days in processing time over other methods.

Resource Requirement

RDC still requires a human to operate and scan the checks (for transmission to the bank) and remittance (for cash application) separately. Also, since the subsequent cash application process is still manual, resources need to be allocated.

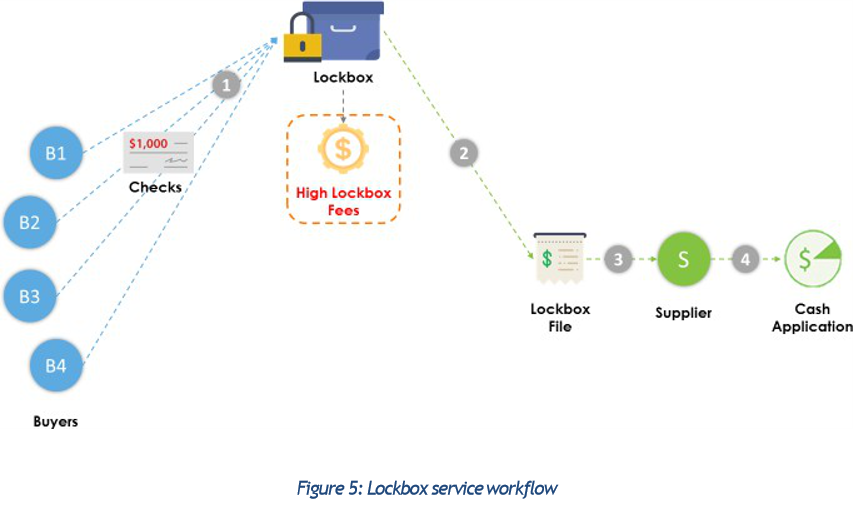

Lockbox Service

With rising volumes of check payments, banks stepped in to ease the processing of high volumes of checks with their lockbox processing services. As illustrated in the above diagram, lockbox operates in the following manner:

With rising volumes of check payments, banks stepped in to ease the processing of high volumes of checks with their lockbox processing services. As illustrated in the above diagram, lockbox operates in the following manner:

- All check payments sent to the company from various buyers get directed to the lockbox

- Bank collects checks and remittances received at regular intervals from the lockbox and keys-in the relevant payment and remittance information into an electronic lockbox file

- Analysts then download the lockbox file from the bank portal

- Analysts review exceptions and post the cash into their ERP

Cost

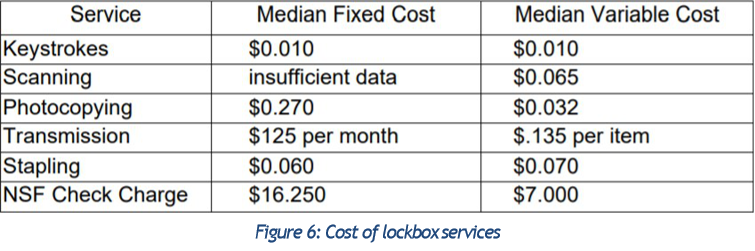

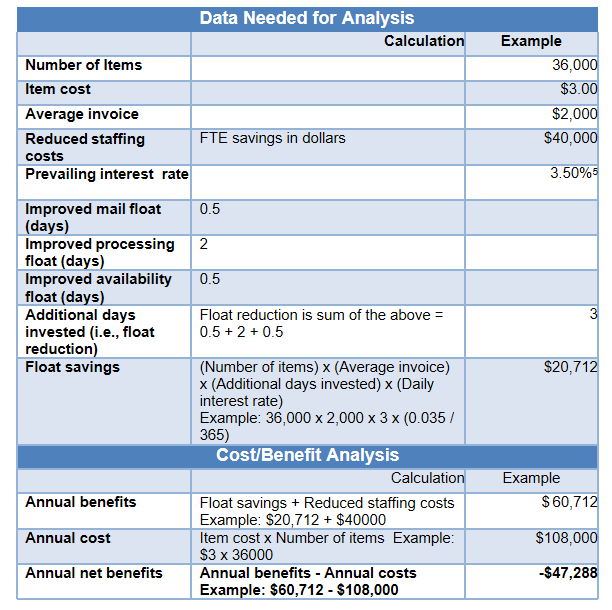

Lockbox services improve the efficiency of cash application and free up some resources from the A/R team. But then as the age-old clichÈ goes ?there is no free lunch.? Companies end up paying a fortune for availing lockbox services. Banks charge exorbitantly for capture, keystrokes and transmission costs. As per a survey conducted by Credit Research Foundation, the lockbox services that banks charge their customers for are highlighted below:  Looking at the different components ? the bank could end up charging $1 to $3 for a single check. A company receiving tens of thousands of checks a month could easily be looking at a five-digit lockbox fee for the whole year. This amount is direct leakage from the bottom line. A cost analysis of lockbox fees for a typical SMB indicates that a company could end up spending almost fifty thousand dollars annually.

Looking at the different components ? the bank could end up charging $1 to $3 for a single check. A company receiving tens of thousands of checks a month could easily be looking at a five-digit lockbox fee for the whole year. This amount is direct leakage from the bottom line. A cost analysis of lockbox fees for a typical SMB indicates that a company could end up spending almost fifty thousand dollars annually.

Speed

The lockbox service streamlined the check processing turmoil by expediting the workflow. It got rid of various low-value tasks such as:

- Physically delivering checks to banks

- Individually scanning checks and remittances

- Entering payment and remittance information into a spreadsheet

Resource Requirement

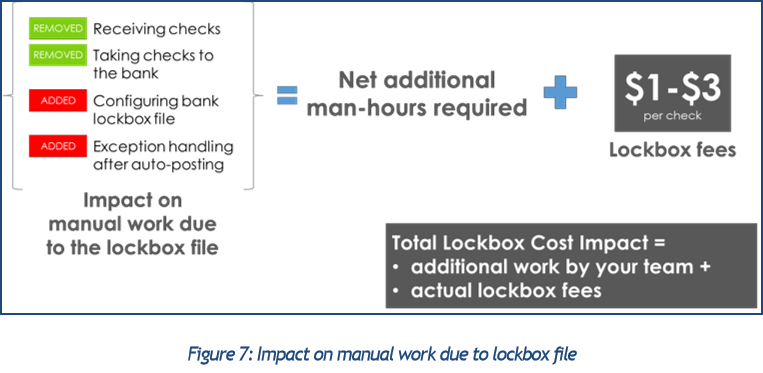

Even after paying a huge sum to the bank for their lockbox service, the payment processing is still not 100% straight-through. One issue is the format of the lockbox file ? and it matters a lot. 80% of the time, the lockbox file has to be first re-configured before any value can be extracted from it. A lot of companies create macros and formulas to do this. However, this is a time taking and error-prone process; definitely not the rosy picture we looked at, to begin with. Post this, the A/R team still has to handle exceptions. The data key-in by the bank captures only limited header level information, and it is often insufficient to successfully reconcile payments with open invoices. 38% of banks do not key more than Check Number, Check Amount and Invoice Number.  The bottom line, there is additional work involved that translates to the increased manual effort from your team that adds to the costs. Hence, the lockbox is an unpractical luxury for SMBs.

The bottom line, there is additional work involved that translates to the increased manual effort from your team that adds to the costs. Hence, the lockbox is an unpractical luxury for SMBs.