RDC 2.0: How North American SMBs Could Save More than $1.3 Billion in Lockbox Fees

This e-book will walk you through the options for processing checks on the parameters of processing cost, check float reduction and resource requirement.

Executive Summary

The most powerful trend in B2B payments is the rampant adoption of e-payments. Buyers are spoilt for choice when it comes to choosing a form of e-payment between ACH, credit cards and Wire payments.

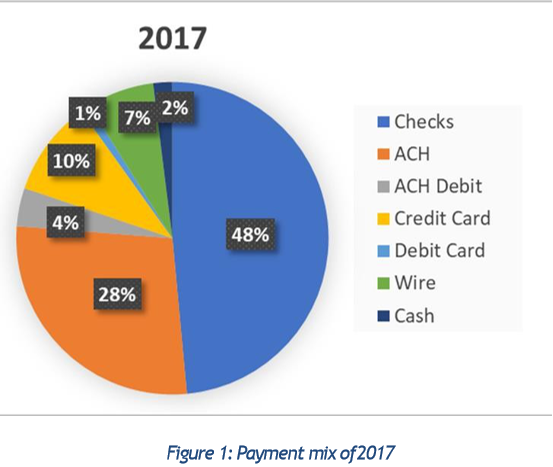

What is difficult to digest is that paper checks continue to dominate the payments landscape (48% of volume) and this dominance is larger for payments coming in from small and mid-sized businesses.

Many studies indicate that for A/R teams at small and mid-sized businesses, the volume of incoming paper checks amounts to a whopping 75%!

This leaves SMBs in a dilemma since they only have three choices – either do everything manually, use Remote Deposit Capture (RDC) solutions, or pay for expensive lockbox services

This e-book walks through a close examination of all these options and also evaluates RDC 2.0 – a next-gen RDC which is capable of enabling check deposit to the bank as well as straight-through reconciliation of payments.

Key Challenges in Check Processing

Despite checks being the Achilles’ heel for A/R departments, suppliers have no choice but to comply with the preferences of their buyers.

The challenges with processing checks could be classified as follows:

Speed of Payment Processing

The major disadvantage for suppliers is that checks come with a float of approximately 3 days. This is also one of the reasons why check payment is favored by buyers.

But then there are several external factors that come into play and further delay processing. The reason for slow processing could be attributed to scanning checks and remittances separately, depositing payments in banks and manually keying-in data for reconciliation. Together, this delays payment reconciliation by 3-5 days.

This is the reason suppliers are reluctant to accept checks – payments hit the bank much later than the actual payment date and suppliers end up having to support longer credit terms than intended.

Processing Costs

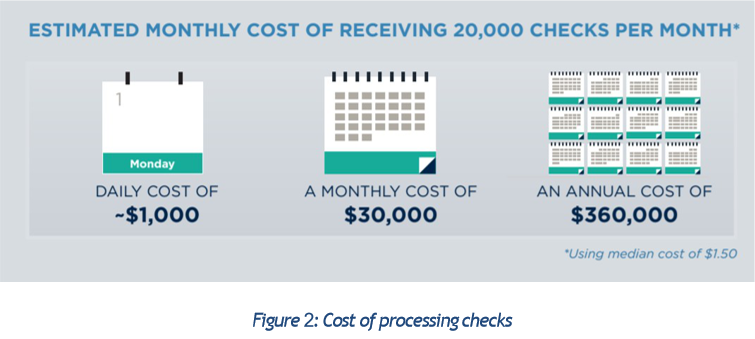

As per a survey by the Association for Financial Professionals, a company could end up spending as much as $30,000 for processing 20,000 checks a month.

According to the survey, receiving a paper check is 5 times as expensive as ACH

For small and medium-sized businesses with low dollar value transactions, the cost of processing checks directly eats into the profit margin.

Resources Requirement from Credit and Collection Effort

Processing checks are low-value manual work and do not add value to credit and collections. Being a highly manual process, it is also prone to errors.

It is a double-whammy since check processing requires resources to be moved from credit and collections, without adding any value towards lowering DSO or working capital.

Options Available for Check Payment Processing

For processing checks, SMBs are largely dependent either on internal manual processing or expensive lockbox services offered by the banks. All of these options, either drain internal resources or money.

The options available for check payment processing are:

- Traditional In-house Processing

- Remote Deposit Capture (RDC) Solutions

- Bank Lockbox Services

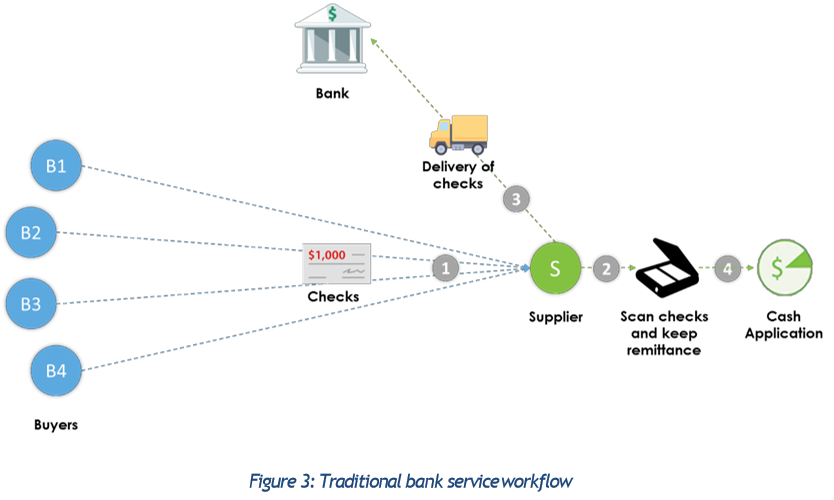

Traditional In-house Processing

- Checks are directly sent to the supplier

- Resources individually scan checks and key-in remittances information for cash reconciliation

- Checks are physically deposited to the bank

- Cash application is done manually by the A/R team

Cost

It lies somewhere between cost-intensive and cost-effective. Even though this process mitigates high lockbox fees, high resource allocation for the labor-intensive work greatly reduces the cost benefits.

Speed

It is a time-intensive process since manual intervention is needed at every step of the way, right from making scanned copies, depositing checks in the banks and manual reconciliation. As it is, checks come with a float of 3 days. On top of that, time lag due to the above processes is directly reflected in the processing time. The extra days get added to the company’s DSO and impact working capital.

Resource Requirement

Plenty of low-value manual work is associated with processing checks by the conventional method. These could be isolated as physical delivery of checks to banks on a daily basis, scanning check payments and remittance reconciliation. All these are time-taking activities, especially when a company receives hundreds of checks daily.

Apart from that, manual cash application requires a high employee count to account for variability in incoming payment volumes. Analysts manually link the checks and open invoices together and feed the data into a spreadsheet. Once that gets done, they typically have to process a high volume of cash posting exceptions. Only after all this, the cash is posted to the ERP system.

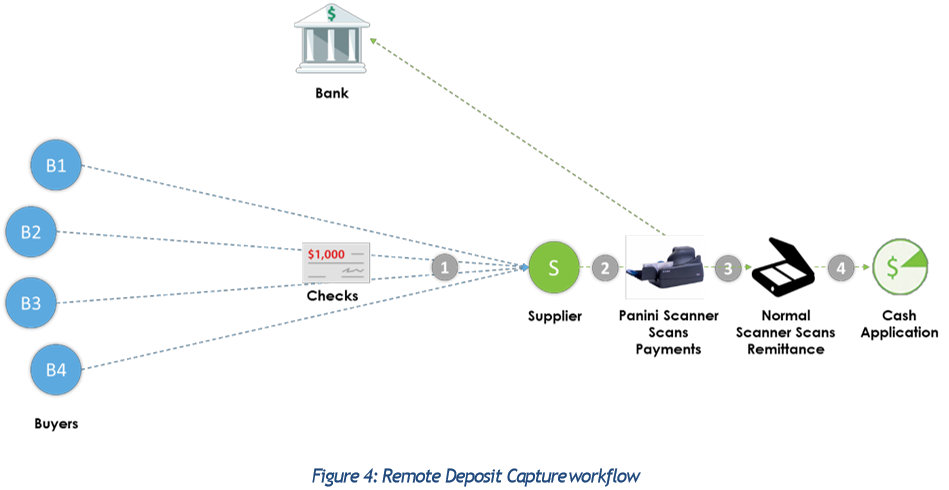

Remote Deposit Capture

In 2004, Panini launched the MyVision X check scanner and gave birth to the concept of Remote Deposit Capture. This scanner had the capability to scan large batches of check payments and transmit an image directly to the bank for processing. The workflow of RDC is highlighted in the following sequence of events:

- Multiple buyers send checks and remittances to the supplier

- RDC scans the checks and directly sends it to the bank

- A separate scanner is used to scan the remittances for usage in reconciliation or archival

- The A/R team applies cash to their ERP system

Cost

The Panini Scanner is not a hefty investment and RDC cuts down on the costs associated with manual handling and transportation. However, cash application is still manual and the company needs to bear resource costs.

Speed

RDC reduces the processing time of checks by remotely delivering checks to the banks. Since RDC could potentially process the checks the moment it arrives at the supplier, it gains 1-2 days in processing time over other methods.

Resource Requirement

RDC still requires a human to operate and scan the checks (for transmission to the bank) and remittance (for cash application) separately. Also, since the subsequent cash application process is still manual, resources need to be allocated.

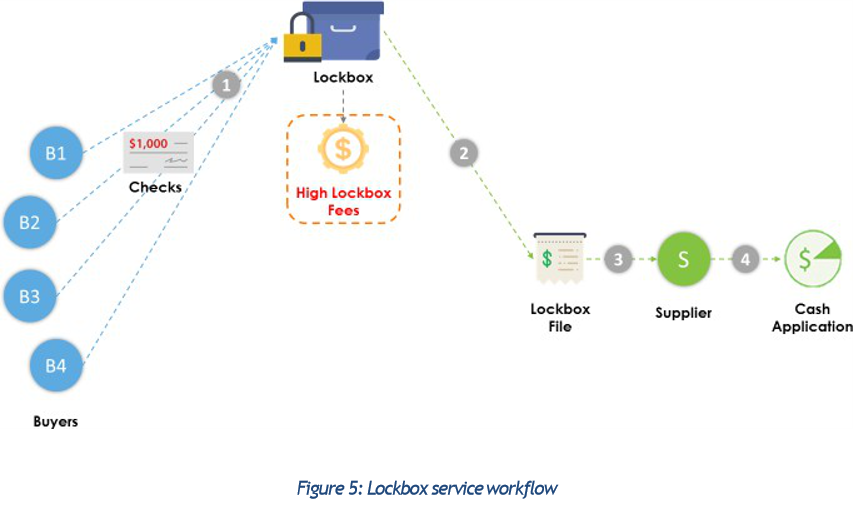

Lockbox Service

With rising volumes of check payments, banks stepped in to ease the processing of high volumes of checks with their lockbox processing services. As illustrated in the above diagram, lockbox operates in the following manner:

- All check payments sent to the company from various buyers get directed to the lockbox

- Bank collects checks and remittances received at regular intervals from the lockbox and keys-in the relevant payment and remittance information into an electronic lockbox file

- Analysts then download the lockbox file from the bank portal

- Analysts review exceptions and post the cash into their ERP

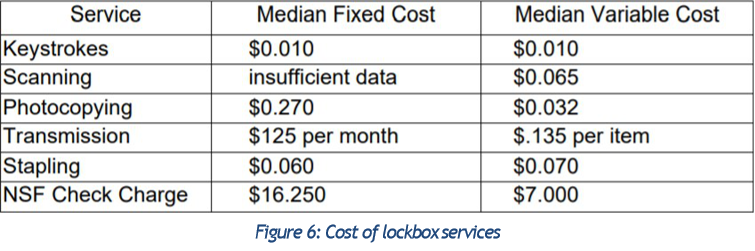

Cost

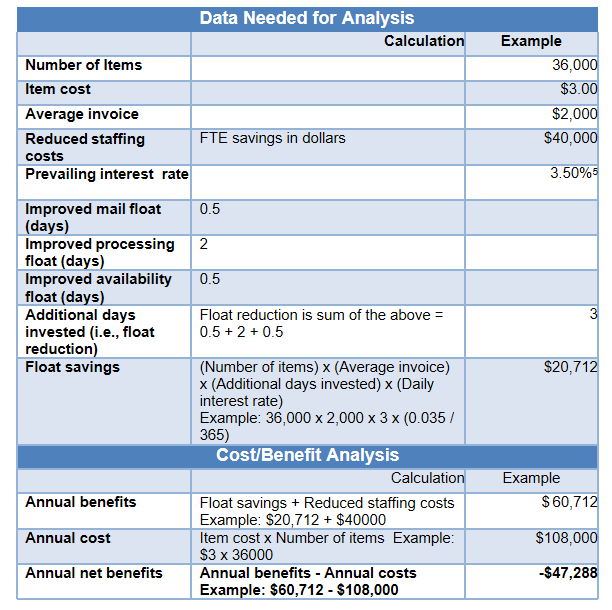

Lockbox services improve the efficiency of cash application and free up some resources from the A/R team. But then as the age-old cliché goes “there is no free lunch.” Companies end up paying a fortune for availing lockbox services. Banks charge exorbitantly for capture, keystrokes and transmission costs. As per a survey conducted by Credit Research Foundation, the lockbox services that banks charge their customers for are highlighted below:

Looking at the different components – the bank could end up charging $1 to $3 for a single check. A company receiving tens of thousands of checks a month could easily be looking at a five-digit lockbox fee for the whole year. This amount is direct leakage from the bottom line.

A cost analysis of lockbox fees for a typical SMB indicates that a company could end up spending almost fifty thousand dollars annually.

Speed

The lockbox service streamlined the check processing turmoil by expediting the workflow. It got rid of various low-value tasks such as:

- Physically delivering checks to banks

- Individually scanning checks and remittances

- Entering payment and remittance information into a spreadsheet

Resource Requirement

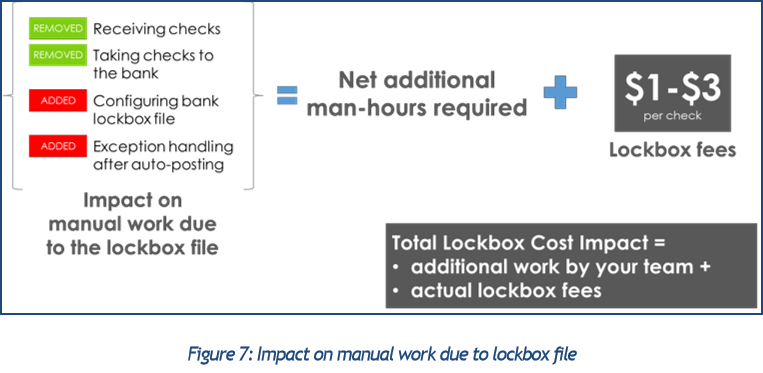

Even after paying a huge sum to the bank for their lockbox service, the payment processing is still not 100% straight-through. One issue is the format of the lockbox file – and it matters a lot. 80% of the time, the lockbox file has to be first re-configured before any value can be extracted from it. A lot of companies create macros and formulas to do this. However, this is a time taking and error-prone process; definitely not the rosy picture we looked at, to begin with.

Post this, the A/R team still has to handle exceptions. The data key-in by the bank captures only limited header level information, and it is often insufficient to successfully reconcile payments with open invoices. 38% of banks do not key more than Check Number, Check Amount and Invoice Number.

The bottom line, there is additional work involved that translates to the increased manual effort from your team that adds to the costs. Hence, the lockbox is an unpractical luxury for SMBs.

Remote Deposit Capture 2.0: Next Generation Remote Deposit Capture

To address the challenge of traditional Remote Deposit Capture, companies have started using traditional RDC in conjunction with Artificial Intelligence enabled cash application, in what has been termed as RDC 2.0. RDC 2.0 integrate remote check deposit with straight-through cash application.

RDC Integrated with Cash Application

Step 1. Scanning

Unlike traditional RDC scanners, RDC 2.0 is able to scan checks and remittances together in one batch. Each batch is capable of scanning up to 100 checks at one go. Once the checks get scanned, the solution captures data with high accuracy and precision with its inbuilt Magnetic strip based MICR capture and OCR based data capture.

Step 2. Transmission of the enriched file

With the scanned data, the solution creates an enriched electronic file consisting of the payment details in a bank-compatible ICL (Image Cash Letter) format for transmission to banks. The solution also creates a processed electronic index file of the payments received for internal cash application. This omits the need to key-in payment data by the analysts into a spreadsheet.

Step 3. Real-time cash application

- The received electronic index file of the payments gets auto-matched with the scanned remittance information

- The open A/R invoice details get pulled from the supplier’s ERP system

- The payment details are individually linked with the line-items in the open A/R

- Cash gets auto-posted in the ERP

All of this happens entirely straight-through without the need for any manual intervention.

Benefits of RDC 2.0

- Straight-through process: The solution is capable of capturing checks payment and remittance accurately and handling exceptions. The solution achieves a posting hit rate of more than 95%.

- Cost-Effectiveness: RDC 2.0 is feasible for SMBs because of its high cost-savings. The areas where RDC cut costs are:

- An RDC scanner is a one-time investment and very cheap to procure. It can also be availed at monthly subscriptions instead of up-front payment.

- Expensive lockbox services. This could generate up to five-digit dollar savings.

- Costs required for resources just for keying-in data

- Transportation and manual handling costs

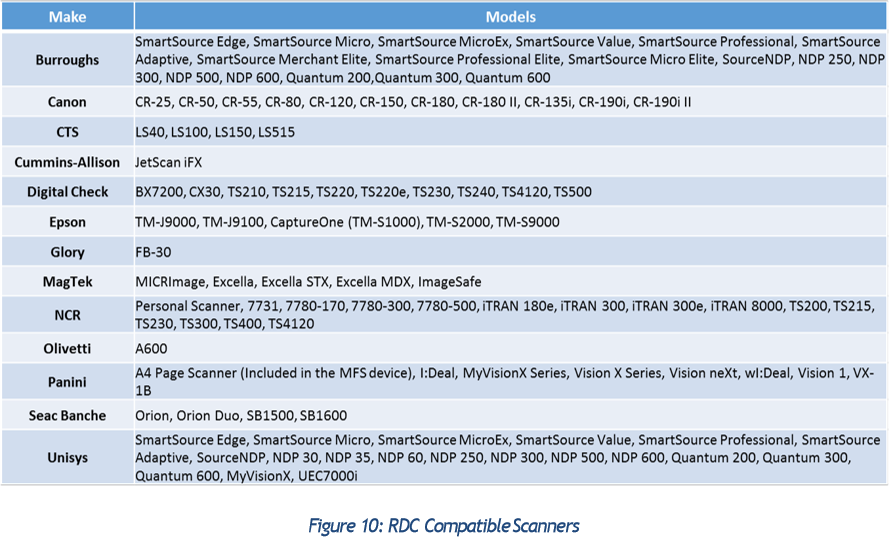

- Compatibility: Since RDC 2.0 solutions rely on the integration of regular RDC scanners with Artificial Intelligence-enabled cash application solutions, they are inherently compatible with most popular RDC scanners available on the market, including the one on your desk.

- Bank and ERP Agnostic: The solution is independent of the type of Bank or ERP the supplier uses. This enables business scaling in terms of operations and geographies.

- Real-time Cash Application: The moment the checks hit the company, they get scanned, processed and posted into the ERP

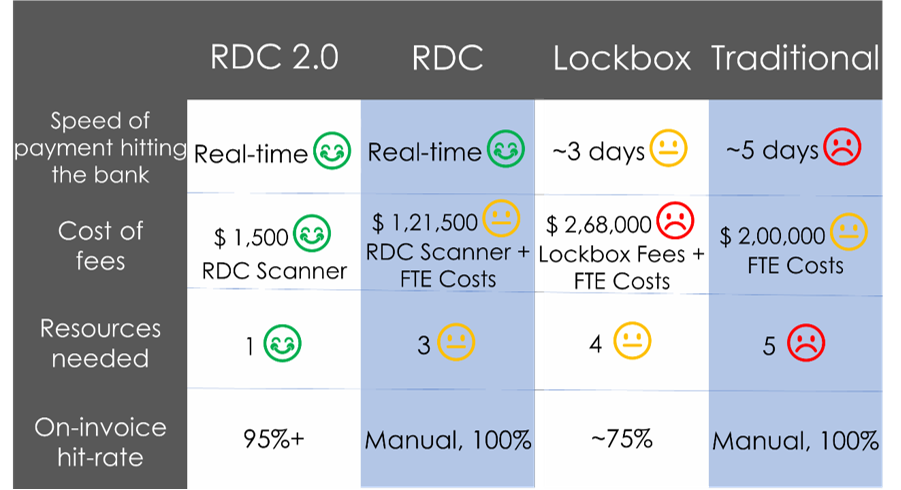

RDC 2.0 – Speed, Cost and Resource Requirement Analysis

Speed

Everything happens in real-time. As soon as the checks are scanned, they are deposited in the bank and processed for cash application and posting.

Cost

It eliminates the costs required for lockbox services, or for in-house data keying-in and manual reconciliation of payments and remittances, resulting in big savings.

Resource Requirement

It is a straight-through process, providing end-to-end automation, thereby enabling your team to focus on high-impact work across credit and collections.

RDC 2.0 vs. RDC vs. Lockbox vs. Traditional Processing

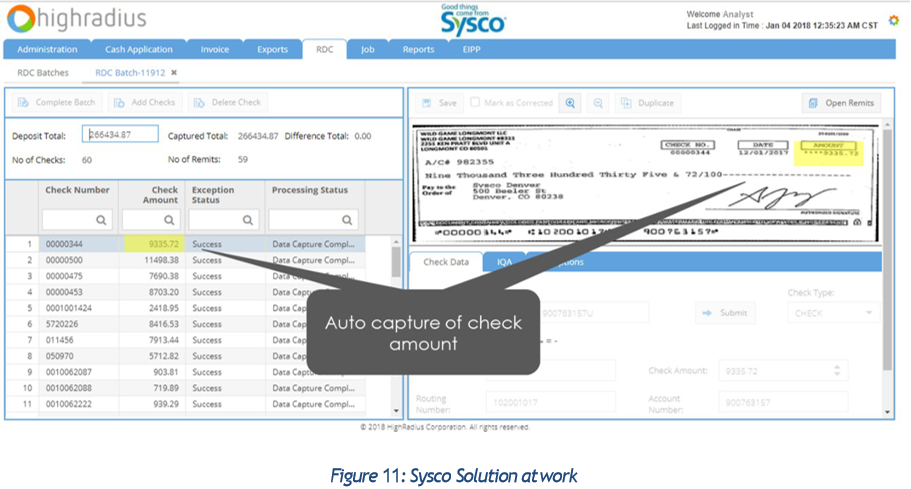

6. Case Study: The Sysco Story

The major roadblocks Sysco was facing were:

- 72 business units

- No centralized cash application

- Multiple deposit accounts

- In-house processing of all deposits

Sysco processed 3 million line-items every year. Remittance information was not used for cash application and they achieved a hit-rate of only of 30-40%. These bottlenecks did not allow them to apply cash the same day.

With HighRadius Remote Control Deposit 2.0 they achieved:

- Centralized cash application with decentralized scanning

- Effectively process remittances across all formats

- Allow one payment across 72 operating companies

- Process checks and remittances in one go

They achieved same day cash application along with 85%+ hit rate.

About HighRadius

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freeda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The RadiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit https://www.highradius.com/

HighRadius Integrated Receivables Platform

Integrated Receivables is a solution to optimize accounts receivable operations by integrating all receivable and payment modules to work as a unified business process. At the core of the Integrated Receivables platform are solutions for credit, collections, deductions, cash application, electronic billing and payment processing – covering the entire gamut from credit-to-cash. The HighRadius™ Integrated Receivables platform is a stand-out as it enables every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, faster dispute resolution and improved efficiency, accuracy for cash application, billing and payment processing.

HighRadius™ Integrated Receivables leverages Rivana™ Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively using machine learning for accurate decision making across credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOne™ network, closing the loop from the supplier A/R process to the buyer A/P process.