How to gain end-to-end visibility with real-time cash flow forecasting systems?

Implementing an appropriate technology to empower treasury can be a game-changer. Learn how embracing automation is the first step toward providing treasurers with real-time cash visibility.

Significance of real-time cash flow visibility for managing treasury

Only 33% of companies are able to enhance their cash flow visibility. Real-time cash flow visibility is critical for sustaining steady corporate operations. Businesses should modify their business continuity plan to recognize and adapt to any vulnerabilities in times of crisis. Unfortunately, most companies do not have 360-degree visibility into their cash flows due to process limitations.

What are the hurdles for gaining real-time cash flow visibility?

Many companies find it challenging to get strategic cash flow insights. This might be due to:

- Inflexible/outdated system for real-time cash flow forecasting

- Data spread in silos

- Lack of tools to dig down to transactional data levels

Cash visibility issues might result in higher financial risks, such as:

- Inadequate cash return

- Missed opportunities and a loss of confidence in decision-making

- Higher costs of borrowing, bank charges, and penalties

- Ineffective investments

- Flawed hedging decisions as a result of insufficient data on FX fluctuations

Cash management tackles a wide range of issues. Whether treasurers aim to reduce external borrowing or maximize return on investments, either way, the first step is to understand how much cash is available. So, treasurers need a real-time cash forecasting system to assist them in estimating future flows. This helps to keep the suitable individuals informed and accountable.

Gaining complete cash visibility gets more complex when an organization’s structure becomes more sophisticated and dispersed. The following are the most prevalent issues that arise due to low cash visibility:

- Non-standardized forms and transaction codes

- Less promptness of information (real-time versus previous day balances)

- Inaccessibility of SWIFT reporting in banks

- Developing credible projections

- Managing business risks

- Making sound investment and borrowing decisions

The influence of end-to-end visibility on treasury

Continuous end-to-end visibility into the financial and operational performance is critical for decision-making. Real-time visibility reveals the procedures that underpin such decisions. For example, financial analysts and HR departments can see precisely where problems are occurring instead of analyzing historical data. This allows them to intervene and implement performance improvements.

End-to-end visibility delivers financial insights that assist companies in:

- Determining risk factors

- Improving and enriching business processes

- Determining if an organization’s investments get directed toward the most suitable areas

Cloud-based business models outperform manual solutions (spreadsheets) in today’s finance world. During rapid market change, cloud-based technology helps firms become future-proof with real-time cash forecasting. It improves cash flow management and helps prevent impending risks.

How to gain cash flow visibility with a real-time cash flow forecasting system?

Implement an effective cash flow management system

Cloud-based or real-time cash flow forecasting system helps businesses to:

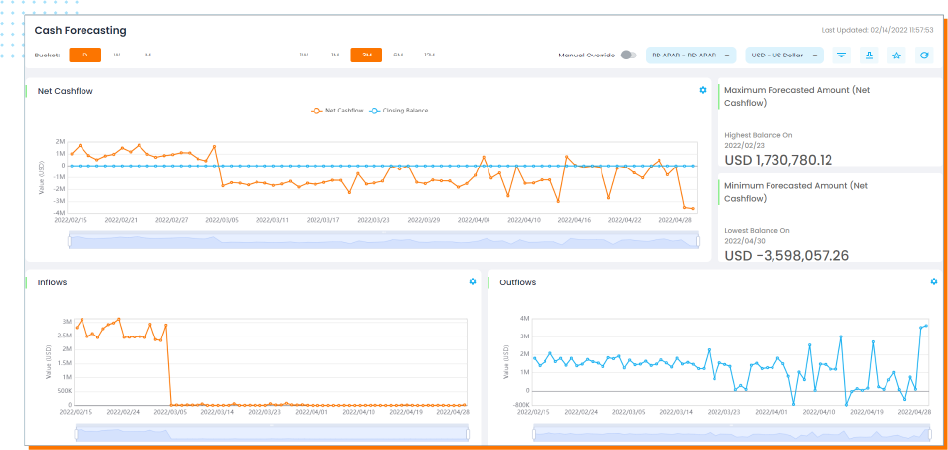

- Enable real-time visibility through dashboards and reports

- Understand trends based on past information

- Reduce the complexity of operational processes by reducing manual and time-taking tasks

- Provide automated data upload and consolidation and allow drilling down to line items for detailed analysis

Cloud solutions are safe and accessible at any time and from any location. Even when team members work remotely, business owners and managers can easily collaborate and continue business operations smoothly. This facilitates better organizational planning and allows organizations to pivot more quickly.

Refine scenario planning and forecasting during uncertainty

Businesses often face a complicated chain of dependent uncertain events and consequences. Proactively estimating the effect of scenarios helps discover course correction options and make objective decisions.

With a system for real-time cash flow forecasting, companies can identify various scenarios and their impact on liquidity. This enhances better dealing with unforeseen events.

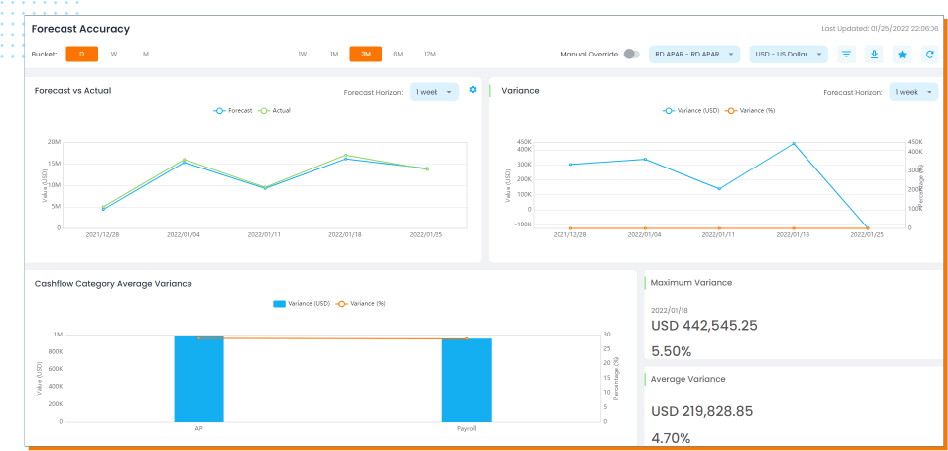

Leverage interactive reporting dashboards

A real-time customized cash flow dashboard is one of the most sophisticated tools for treasurers today. Financial operations can use interactive reporting dashboards to get real-time visibility into systems, processes, and business health.

Dashboards help treasurers to:

- Track cash movements

- Analyze trends and anomalies

- Visualize and understand cash flow deviations

Treasurers can easily access dashboards through the cloud systems without asking the IT staff or other teams to provide them with dashboards. Data in dashboards get displayed in various ways, including:

- Charts

- Graphs

- Scorecards

- Maps

The data is also shared among teams, departments, or the entire company by:

- Saving

- Printing

- Exporting to spreadsheets

- Uploading to a document management system for archiving purposes

Gather insights offered by financial analytics

Financial analytics provides a wealth of corporate knowledge and enterprise performance. Finance analytics are critical for helping businesses foresee and plan for the future. And they also entail sifting through masses of data to find trends and make predictions.

Finance analytics can track:

- When a customer might pay late

- Predict a spike or downturn in the market

- Price fluctuations in interest rates

Financial analytics provides information that helps to improve a company’s profitability, cash flow, income statements, and business operations. Hence, it helps corporate finance teams make better decisions and increase the company’s value.

Embrace automated data aggregation

Real-time data aggregation provides these three factors that increase visibility:

- Timeliness

Organizations can track transactions and balances at different intervals through automatic data capturing. This ensures better adjustments in cash forecasts to improve accuracy and timely reporting. - Granularity

With automation, transaction-level data is gathered seamlessly from numerous sources such as banks and ERP. It also enables an in-depth analysis of cash flows across many cash flow categories, regions, and currencies. This level of detail aids in the development of a more accurate cash forecast. - Quality

A system for real-time cash flow forecasting quickly eliminates redundancies and creates structured data. The ability to aggregate data by relevance ensures that the data available to build the forecast model is of the highest quality. This enables strategic financial planning.

How are the benefits of cash flow forecast profitable for treasurers?

Treasury departments require a centralized view of their worldwide cash situation to make informed financial decisions. Accurate and dependable cash forecasting, timely reporting, and effective working capital utilization will benefit from 360-degree, comprehensive cash visibility.

With a cash forecasting system, companies can:

- Better understand their real-time cash flow

- Make better decisions to manage liquidity risk

- Help their firm navigate through difficult times

Benefits with HighRadius real-time cash flow forecasting system:

Forecasting automation reduces human tasks and the risk of errors, allowing teams to focus on higher-value tasks.

Over the short and long term, consolidated predictions allow for better cash repatriation, pooling, and hedging.

Reports that provide extensive information on future trends offer investors and borrowers confidence in their selections.

Granular data access leads to more accurate forecasts. This leads to better liquidity and debt management.

Several users can access, update, edit, and share information using the cloud-based platform.

Customer success story with HighRadius:

A $37B global wholesale distributor with operations across Americas, EMEA and APAC faced these challenges:

- North America, EMEA and APAC each had different ERP instances and different cash processes, creating significant challenges in global forecasting and visibility

- Lack of bank connectivity and multiple legacy systems led to long turnaround time for generating forecasts

- Lack of continuous visibility across thousands of transactions created high forecast variances

- Extended user base across geographies provided inadequate decision-maker visibility

By using the HighRadius cash flow forecasting system, it achieved the following results:

- Continuously consolidate 28 regional forecasts with minimal manual effort

- Provide highly improved accuracy (upto 74%) vs. existing process

- Automatically highlight forecast variance at regional, account and transaction levels

- Enable continuous insight into current and forecasted global cash position