Evolution of Treasury Management System With Artificial Intelligence

Understand the evolution of the Treasury Management System in the age of AI and the true potential of AI-powered cash forecasting systems.

Executive Summary

We are in a digital revolution that is fundamentally changing the way businesses are done across the globe. From growing transparency, consumer engagement, and new patterns for consumer behavior to research, development, and distribution using digital platforms has improved the quality and efficiency at which value is delivered.

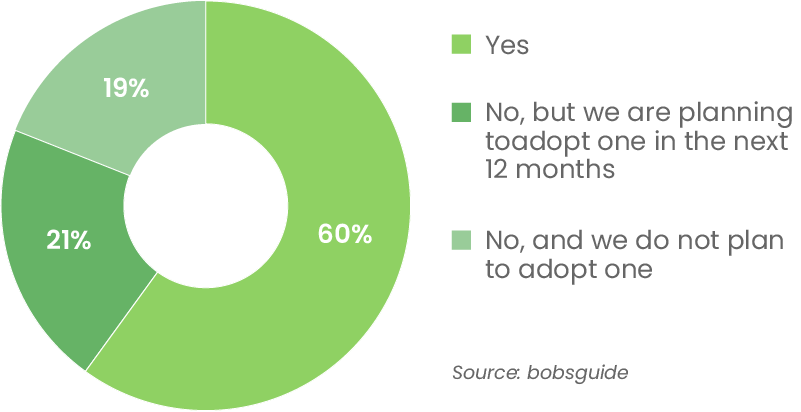

Increased complexity and volatility of modern business have made cash flow forecasting and liquidity management more crucial than before. A survey on treasury systems and trends indicates that 60% of organizations have increased their investments in Treasury Management Systems (TMS). The result indicates the trend of organizations’ increased investment in Treasury Management Systems.

Does your organization use a treasury management system?

According to a survey, of over 200 treasurers, 75% of respondents identified concerns around inadequate treasury systems infrastructure. One of the key findings of the survey was that the extent to which technology can be used to achieve scalability, reduce cost, and gain a competitive advantage is not yet fully appreciated.

Treasury software systems combined with the use of Artificial Intelligence (AI) and Machine Learning (ML) are transforming treasury yet many organizations with TMS continue to use spreadsheet-based solutions for cash flow forecasting. So the organization’s treasury technology investment is under-utilized, resulting in inefficient and error-prone processes.

This ebook provides detailed information on the state of TMS and its evolution in the age of AI and helps you understand the true value it delivers in corporate treasury departments.

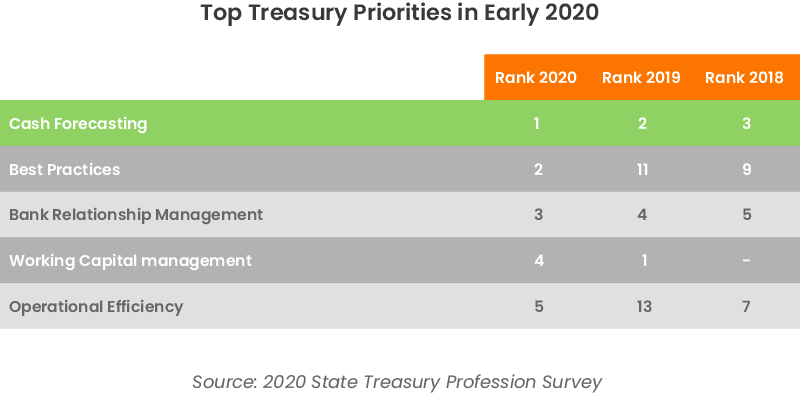

Treasures’ Top Priorities

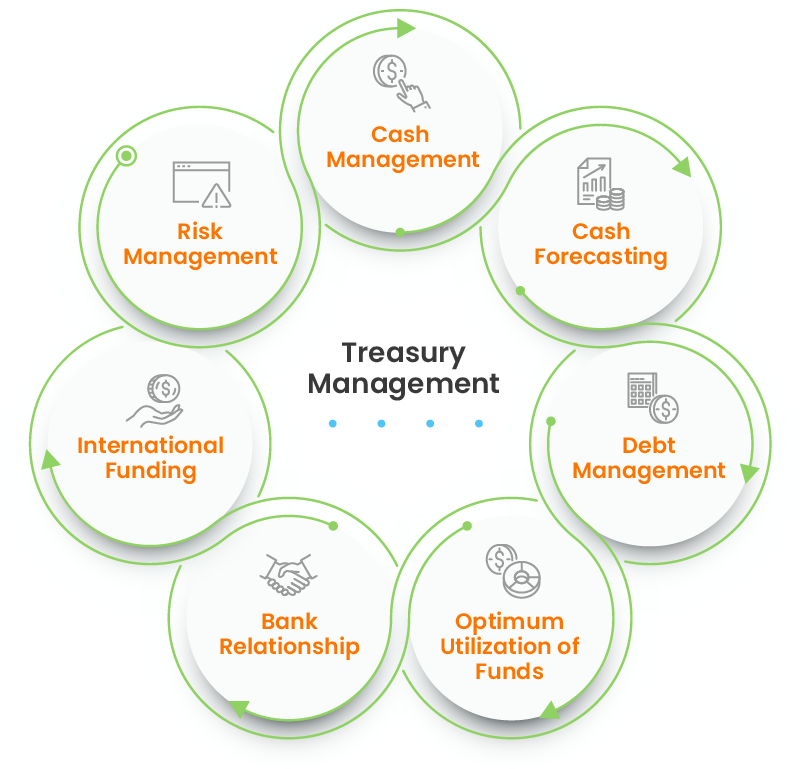

The treasury functions are seen as vital enablers in supporting an organization’s growth. Treasury has shifted its focus from transactional operations to assisting organizational strategies and increasing cash efficiency. The following are the prime responsibilities of a treasury function in an organization:

- Cash Flow Management- the process of tracking cash positions. It stabilizes its liquidity, helps in efficient utilization of cash and assets, and maximizes profitability.

- Cash Flow Forecasting- is a way to learn an organization’s financial position by keeping track of the finances and predicting where an organization is heading.

- Risk Management- the process of identifying, assessing and controlling threats to an organization’s capital and earnings.

- Payment-reconciliation- is the process that compares two sets of records to check that figures are correct and in agreement.

- Banking Relationship- Ensuring regular and timely payments with banks helps in strong banking relationships, resulting in better interest rates, loan structures and terms.

With the emergence of covid-19, companies realized that maintaining liquidity is essential to navigating through the crisis, Treasurers must provide the CFO with accurate and timely forecasts. According to a survey by Treasury Strategies 88% of treasury professionals consider cash flow forecasting as their top priority.

But also a recent survey with treasurers from Fortune 1000 companies revealed that nearly 90% of them rate their cash flow forecasting as ‘Unsatisfactory’ with almost all of them citing ‘Excel/spreadsheets’ as the major drawback followed by ‘Lack of Richer Data’ being the other.

Cash Flow Forecasting Challenges while using spreadsheets

- Data Gathering- Difficult to gather data from different sources is difficult. (ERP, Banks)

- Consolidation- Difficult to consolidate different departments data to a single global cash forecast.

- Low-value and Error-Prone- Manual processes have operational challenges and high chances of error.

- Inaccurate long term forecast- Lack of confidence in forecast beyond a one or two week duration.

- Variance Justification- Absence of regular variance analysis to analyze/improve upon the forecasting process.

- Reporting- No real-time reporting, causing difficulty in making timely decisions.

Evolution of Treasury Management System

Treasury management system (TMS) is a software that helps to automate, record, and control core treasury functions to improve process efficiency and gain relevant cash insights. It allows companies to streamline processes like communication with banking partners or pulling cash flow data in real time while ensuring that finance data is secure.

TMS have evolved significantly leading the treasures to achieve more accuracy in cash flow forecasting.

Gen 1 – Mainframes(1980s)

- Difficult to install because of their hardware components.

- Difficult to maintain them as they required additional IT support for regular updates.

- Difficult to manage large data as it would hang up.

Gen 2 On Premise Applications(2000s)

- Difficult to integrate with other tech solutions.

- Difficult to maintain as third-party support or highly competent IT specialists are required.

- Difficult to operate, as administration requires special training and expertise.

Gen 3 Cloud/SaaS (2010s)

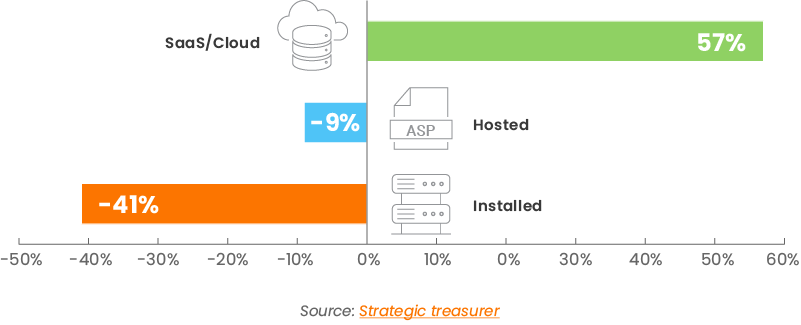

Saas/cloud technologies have been dominating the landscape for more than decade now. As a result, there is a 57% increase in Saas/cloud technology deployment and 41% decrease in installed solutions.

Dominance of cloud and software-as-a-service (SaaS) solution continues in adoption and are seen to increase in value as SaaS deployments offer many other number of benefits:

- Fast implementation and deployment

- Built-in provider security

- Availability of precise and real-time data

- Reduced errors in calculation and manual entry

- Activity tracking in detail

- Flexibility in banking and connectivity

- Risk minimization and regulatory compliance

According to a survey by Deloitte, 20% of crucial treasurer’s tasks such as cash flow forecasting and cash flow management are still managed by spreadsheets despite having a cloud base TMS resulting in errors and inaccurate forecasts. This is where the Gen4 AI-enabled solutions would help treasurers to become strategic partners and advisors to the business.

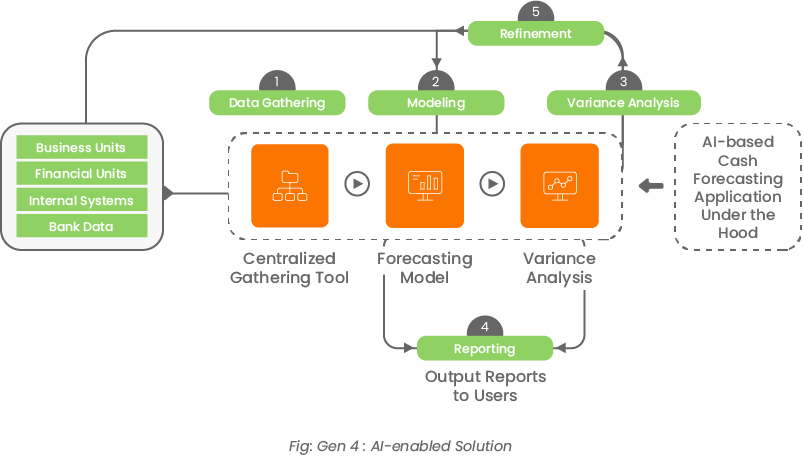

Gen-4: AI-enabled Solutions

Adopting AI-enabled treasury technology empowers teams to evolve from a purely operational role to a strategic role, spending less time on extracting data and more time on providing insightful, trusted foresight that enables the CFO to plan for what’s next.

AI and ML integration can shift cash flow forecasting from a historical data additive model to a future oriented predictive model which means the forecast process will involve advanced statistical modeling that can predict, rather than calculate, future cash flows.

This will help the treasury teams to leverage cash flow forecasting insights to make timely and confident decisions. AI automation streamlines the different steps of cash flow forecasting in the following ways:

- Data gathering

Cash forecasts rely upon a number of different sources, and with the help of Robotic Process Automation(RPA) and Application Programming Interfaces’(APIs) data gathering can be automated over multiple sources like ERPs, banks, etc. regionally or globally, providing real-time and rich data for accurate forecasting. - Modeling

The data gathered is then fed into cash flow forecasting models. Sophisticated AI models are used for complex categories like A/R and A/P and heuristic models for simple cash flow categories like tax, payrolls etc. - Variance analysis

This process can help identify shortcomings within the forecast by comparing forecasted cash flows for a given period to the actual cash flows and with AI, It can be performed at entity, region and cash flow category-level, for multiple durations, providing more accuracy to make confident decisions. - Reporting

The reports are generated following the forecast and variance analysis respectively, and they are utilized to specify short- and long-term goals as well as provide accurate data to higher treasury authorities for further action. - Refinement

To refine performance, a closed feedback loop allows the system to learn from past mistakes and understand variance drivers. The outputs of the AI model can be reused to train future versions of the model. It will make tweaks and adjustments in the models to forecast better in the future.

Addressing the underlying key issues:

These Gen 4 AI-enabled solutions also impact the key factors of cash flow forecasting by providing prominent benefits.

- Visibility

Since the data is scattered across several entities. It builts local forecasts from the bottom up at individual entity, company code, and currency levels, that ultimately roll up to the central treasury. This provides transaction-level granularity allowing treasurers to track daily cash movements and view cash forecasts at a granular level. - Accuracy

Accuracy is affected due to process inefficiencies and dynamic factors. Gen 4 AI- solutions utilize suitable models for each cash flow category like using heuristic models for payroll, taxes, etc, and using M/L algorithms/AI models for A/R and A/P. Also, track variance for multiple time horizons and adjusting the models leading to increase the forecasting accuracy, required to make confident decisions. - Frequency

Due to the high turnaround time for generating forecasts, the frequency of forecasting is not timely enough. Gen 4 AI-solutions Leverage technology such as RPA and API to gather data in real-time from banks, TMS, ERP, FP&A tools allowing treasurer to forecast in the required forecasting cadence to make timely decisions. The forecast frequency can be daily, weekly, monthly, quarterly, or yearly. - Collaboration

The manual nature of reporting or sharing the data within the teams takes a lot of time. Gen 4 AI-solutions provide a connected workspace where treasury teams can observe the data which is uploaded into the system and teams can immediately extract the forecast insights. This shared environment enables teams to send or receive the forecasts and business intelligence reports easily and quickly.

AI-powered cash flow forecasting is becoming increasingly crucial as today’s TMS should provide a holistic view of not just current day cash positions, but also deliver tools and insights to provide reliable forecasts. CFOs with the necessary information and intelligence will not only identify and predict market shifts but proactively manage this volatility through timely execution of an organization’s risk management.

Elevating Treasury's Mandate to Strategic Partner of the CFO

In current economic conditions, it is paramount for Treasurers and Cash Managers to have a clear view of their organizations’ liquidity position and cash flow forecasts. Technologies like AI, machine learning, and APIs help to make the treasury management process more seamless. With just one click, treasurers can now focus on strategic tasks rather than manual and redundant tasks.

Implementing new digital technologies will give them more insight into the business, and push them towards a more strategic role. Such an outcome can only be achieved in the context of an explicit technology strategy and this will evolve their role from managers and treasurers to strategic advisors of the CFO.