Risk Management Plan for Recession with Treasury Management Software

Read this eBook to identify the challenges faced by the CFOs in risk management due to recession 2022, and learn the five risk management plans to manage liquidity and prevent risk during volatile times.

How is treasury more prone to risks in recession 2022?

A possible recession is once again in the spotlight. With the recession looming over the United States, there have been fluctuations in interest rates. The recession can threaten businesses by disrupting revenues, and cash flow. So, CFOs must tread the path cautiously, balancing growth initiatives and costs with proper treasury risk management. This is easier said than done since most treasury teams have fewer human resources and outdated systems at their disposal to battle a recession, which makes risk management challenging and ineffective.

Risk management difficulties during the recession

Treasury is responsible for ensuring enough cash on hand and devising measures to offset any financial hazards. But treasuries worldwide face increasing pressure to meet this goal. As cyber frauds are increasing daily and the FX risks are escalating, treasuries need to take concrete steps to achieve their risk management goals. Here are the following difficulties CFOs are faced during risk management:

- Inability to monitor liquidity:

When there are numerous banks, ERPs, and payment systems in use, liquidity can be quite challenging to monitor. The use of non-standard treasury processes results in diverse technological environments and organizational complexity. Companies cannot emphasize liquidity monitoring because they are obtaining loans and drawing on credit lines to get extra liquidity. - Unable to detect market trends:

Many treasurers still find managing the complete spectrum of market risk difficult. As the global economy continues to deteriorate, businesses in many sectors face increasing operational, financial, and liquidity issues. It will be challenging for companies with an outdated market risk system to get real-time measurements and greater data availability. - Difficulty in working capital management:

Working capital management is a challenge for all types of businesses, whether due to risks associated with international trade or the need to compromise on payment terms to remain competitive.

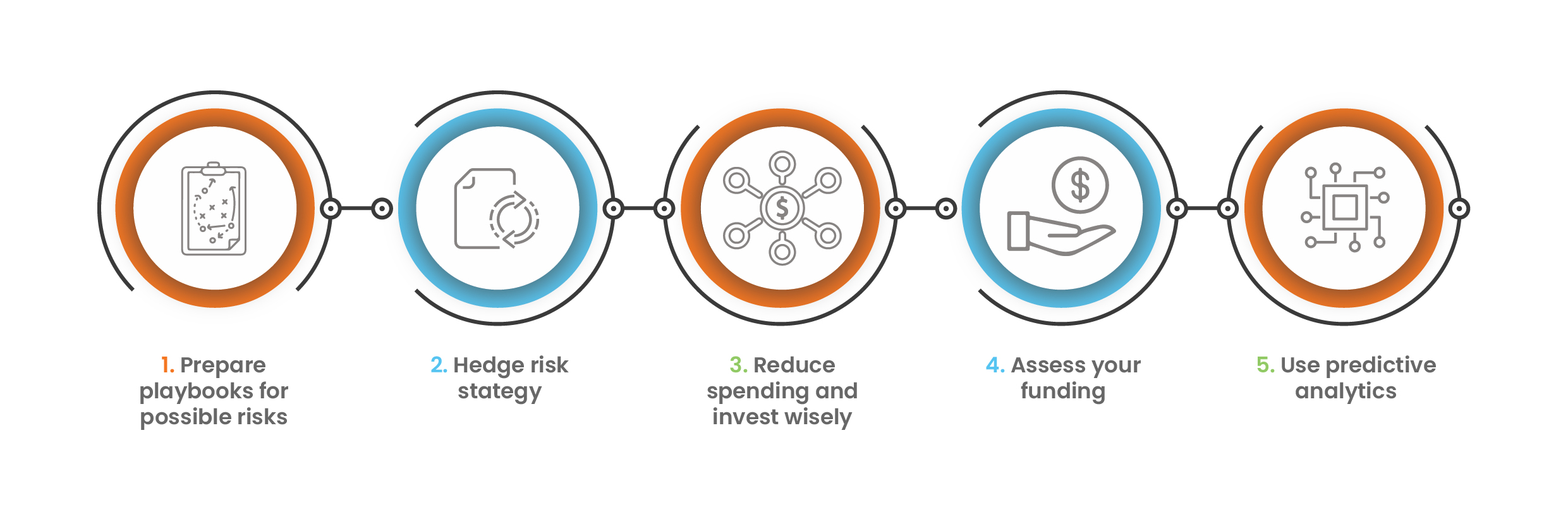

5 risk management plans for CFOs during the recession

-

Prepare playbooks for possible risks

The impact of several probable events will be lowered if CFOs are ready for them. If the past few years have taught us anything, finance teams need to be more imaginative when imagining the extent of risks their companies may face. This calls for a solid grasp of operations, potential repercussions, and mitigation plans for various scenarios.

-

Hedge risk strategy

Depending on the industry, many different hedging instruments are available. The risk you need to protect yourself against relies on that industry. The regions now experiencing a lot of activity revolve around commodities and interest rates. Many businesses are using tools to hedge against anticipated price rises in the future as the cost of energy, metals, and commodities continue to rise.

-

Reduce spending and invest wisely

Having enough cash flow becomes a top priority as businesses face increasing input costs due to disruptions everywhere. Optimizing costs is likely the most common recession strategy used by CFOs. In times of an economic boom, businesses may not keep a very stringent eye on their operational expenses. But a market downturn doesn’t allow you to lose due to inefficiencies and every dollar needs to be monitored for its return on investment (ROI). Estimate the likelihood that your business will experience a cash deficit, estimate the magnitude of that shortfall, and implement cost-cutting measures in line with those projections.

-

Assess your funding

The Federal Reserve is currently beginning a cycle of interest rate hikes that will probably continue through the rest of 2022 and possibly beyond. Therefore, obtaining the necessary cash as soon as possible is preferable. If you need a loan, secure one immediately at a fixed rate to guard against future rises.

-

Use predictive analytics

Use data to predict how your business might fare a month or quarter down the line. Are there cash flow troubles that you need to be prepared to tackle? Are some big customers likely to default on payments? What happens to your cash reserves in the likely scenario where suppliers hike prices? These are some questions to which analytics models can provide answers and prepare the business to face market challenges. Leverage treasury management software with analytics features to keep track of key metrics and predict possible future outcomes.

How cash management solution helps in treasury risk management

Automated cash management solution help companies automatically manage their finances, such as capital, assets, and investments. Cash management solutions help monitor risk positions, commodity price movements, and currency conversion rates to build hedge accounting solutions with a full audit record and limit exposure. It also helps treasury to:

- Automate data aggregation with granular cash visibility

Modern cash management solution uses Application Programming Interfaces (APIs), essential data gathering tools. It provides dashboards with drill-down functionality with a seamless, uniform data integration method by establishing a bridge between software and data sources that would not otherwise work together, APIs function. As a result, businesses can quickly and efficiently collect real-time data from several entities with various technological settings, such as ERPs, bank portals, FP&A systems, and TMS, and integrate it. This improves granular visibility into the cash flow categories across various regions, entities, and currencies, which assist companies in determining risk factors to enhance and enrich business processes and determine whether an organization’s investments concentrate on the most relevant areas.

- Detect earliest signs of probable threats:

CFOs must take a proactive strategy to identify and minimize potential risks since they operate in increasingly uncertain environments. Treasury management software assists CFOs in reducing efforts on lesser risk areas and allowing them to focus their resources on serious threats by prioritizing recent trends over old ones for understanding changes in stock prices, bank deposits, withdrawals, and identifying patterns or anomalies in transactions and customer behavior.

- Combat risk and compliance concerns

By identifying errors or fraud in transactions or payments and reducing various treasury risks, treasury risk management systems should assist companies in addressing risk and compliance challenges posed by frequent regulation changes.

- Make strategic liquidity decisions

Allocation of idle cash can be done effectively by using an automated cash management solution. This idle cash can be invested by purchasing new products, extending or restructuring the business, acquiring another company, or pursuing foreign markets. Therefore achieving competitive advantage alongside a plan for the future.

Get in touch with us to learn more about how our treasury management software can help your company prevent and mitigate risks.