Skill #4 Process Improvement

An insightful summary of the essential skills required to steer your accounts receivable in the right direction while climbing your career ladder at the same time!

Skill #4 Process Improvement

Reporting and Analytics The Art of Transforming Data into Information into Insights

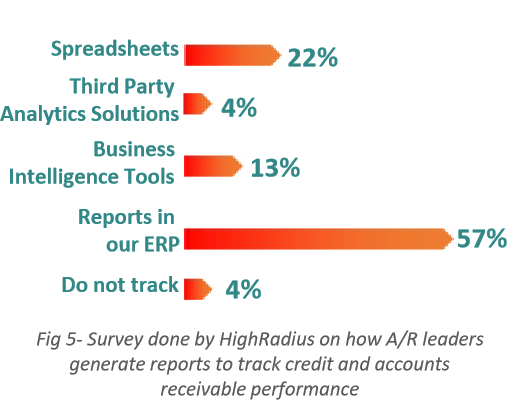

In today?s complex dynamics, managing accounts receivable without reporting and analytics is like driving a car without having the slightest idea how fast you?re going. Therefore, it is essential to have an accounts receivable dashboard that quickly translates the company?s objectives into measurable metrics. According to a survey by HighRadius, reportsare commonly made with these tools:

- Too much data to dig through

- Lack of real-time information

- Time-consuming to design drill-down that can be used by all users

The Solution

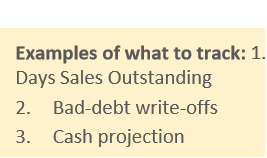

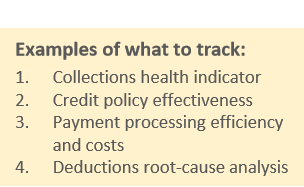

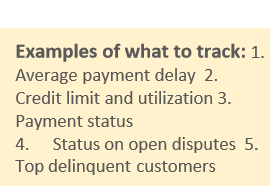

An ideal accounts receivable dashboard provides instant access to both basic and advanced data elements to help execs and process owners better understand the current state of their receivables to drive progress towards organizational goals. It should be able to provide the following critical information as required for each of these report consumers: – Finance Executive Overall A/R impact on finance strategy

- Cash flow trends

- Health of A/R and balance sheet impact

- Cost of A/R processes

- Support for long-term finance strategy† † † †

Functional Manager Process health

- Team/analyst productivity

- Process KPIs

- Performance improvement guidance† † † †

Process Analyst Individual performance and customer data

- Customer/account level insights

- Transaction level insights ? accuracy, speed

- Individual performance reports† † † †