Every number on a balance sheet tells a story, but when those numbers don’t add up, the story quickly turns into a crisis. Finance teams are under increasing pressure to close the books more rapidly while maintaining accuracy and ensuring audit readiness. Manual spreadsheets and disconnected processes are no longer sufficient, as they leave room for errors, delays, and missed insights. Today’s organizations need reconciliation software that not only matches transactions but also streamlines workflows, flags anomalies, and provides clear audit trails. According to a 2024 research, the global reconciliation software market was valued at USD 2.53 billion in 2024 and is projected to reach USD 7.54 billion by 2033, growing at a CAGR of 13.1% from 2025 to 2033. This growth is driven by increasing transaction volumes, the growing need for financial accuracy, and the rising demand for automation in accounting operations.

Automated balance sheet reconciliation software is designed to do more than just balance accounts. They integrate seamlessly with ERPs, automate repetitive tasks, and provide real-time visibility into discrepancies, allowing finance teams to focus on analysis and decision-making rather than manual data entry. In this blog, we will explore the nine best balance sheet reconciliation solutions of 2026, highlighting platforms that excel in automation, accuracy, and scalability, helping organizations close their books faster, maintain control, and operate with confidence.

Can You Reconcile Every Transaction Without a Miss?

Download the Reconciliation Template to spot mismatches instantly and simplify your reconciliation and month-end close.

Access the Free TemplateSelecting the right balance sheet reconciliation software is crucial for enhancing accuracy, streamlining month-end closings, and ensuring audit readiness. Below is a curated overview of leading tools, highlighting their key strengths and ideal use cases.

| Platform | Supports |

| HighRadius | Comprehensive AI-powered balance sheet reconciliation with automation of 95% of tasks, seamless ERP integration, real-time dashboards, audit-ready reporting, and scalable architecture for enterprise and mid-sized organizations. |

| BlackLine | Standardized reconciliation templates, workflow automation, and dashboards for general finance teams. |

| FloQast | Collaboration-focused month-end close and reconciliation tracking with ERP integration. |

| OneStream | Unified platform for consolidated financial reporting with standard reconciliation capabilities. |

| QuickBooks | Bank reconciliation and transaction matching suited for small businesses. |

| Sage Intacct | Multi-entity financial consolidation with standard reconciliation functionality. |

| SolveXia | Automation of routine reconciliation with matching and reporting, and dashboards. |

| Trintech | Dashboard and alerts to manage reconciliations with standard reporting features. |

| Xero | Side-by-side bank reconciliation and multi-currency support for small to mid-sized businesses. |

*List of leading balance sheet reconciliation tools, arranged in no particular order

Balance Sheet Reconciliation Software is a specialized tool designed to help finance teams verify that all balances in a company’s accounts are accurate, complete, and consistent with supporting documentation. It automates the process of matching transactions, identifying discrepancies, and ensuring that ledger accounts align with bank statements, sub-ledgers, and other financial records.

By replacing manual spreadsheets and disconnected workflows, this software reduces errors, accelerates month-end and year-end closes, provides audit-ready documentation, and improves overall financial control. Advanced solutions often include features such as AI-powered matching, ERP integration, real-time dashboards, and exception management, making reconciliations faster, more accurate, and easier to monitor.

Choosing the right balance sheet reconciliation software is crucial for enhancing accuracy, streamlining month-end closings, and ensuring that your financial records are audit-ready and compliant. The following list highlights nine of the best platforms for 2025, showcasing their key strengths and how they can help finance teams streamline reconciliations efficiently.

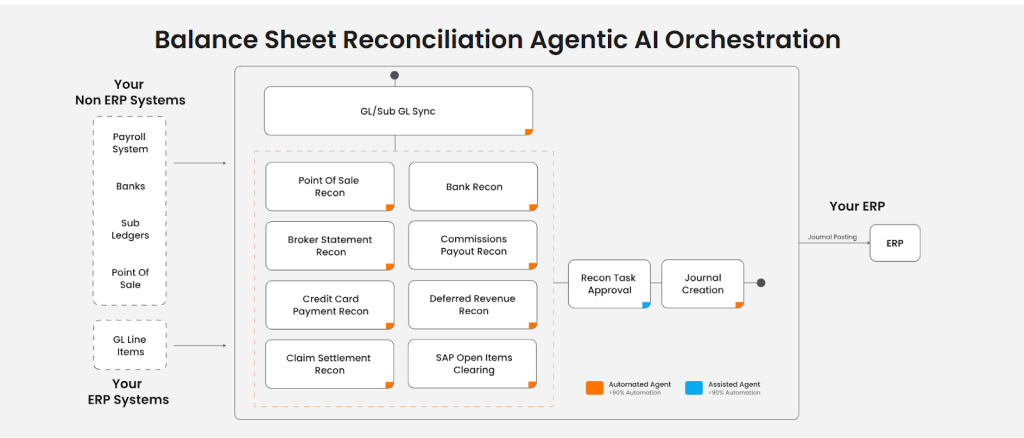

HighRadius Balance Sheet Reconciliation Software is an AI-powered solution designed to automate and simplify balance sheet substantiation, ensuring accuracy, compliance, and faster financial close cycles. It eliminates manual spreadsheet-driven reconciliations by leveraging 20+ AI agents that automate balance sheet reconciliations, flag exceptions, classify variances, and post journals, giving finance teams complete visibility and confidence in their close process. Companies can also upload 2,000+ R2R Excel to the LiveCube Agent Builder, enabling seamless automation within a familiar interface.

In addition to automation, HighRadius seamlessly integrates with leading ERP systems, including SAP, Oracle, and NetSuite, as well as BI tools for advanced reporting. These integrations enable real-time data synchronization, automated journal posting, and instant variance analysis across systems. Its unified dashboard provides complete visibility into reconciliation progress, exceptions, and outstanding tasks, ensuring finance teams close faster, with confidence and control.

Key Features:

BlackLine is a cloud-based platform for automating financial close, reconciliation, and journal entry management. It centralizes reconciliation templates, automates workflows, and provides visibility across the close process.

Key Features:

FloQast is a cloud-based platform that supports balance sheet reconciliation and close management. The platform includes automated reconciliations, centralized task management, and ERP integration, helping accounting teams manage workflows efficiently. It is commonly used by mid-sized organizations for structured financial close management.

Key Features:

OneStream offers a unified platform for financial consolidation, reporting, and reconciliations. It allows finance teams to trace reported balances back to their underlying accounts, helping improve transparency and maintain auditability across financial data.

Key Features:

QuickBooks is a cloud-based accounting solution commonly used by small to mid-sized businesses. It simplifies account reconciliations by providing an intuitive interface that enables users to match transactions, identify discrepancies, and maintain accurate records. The platform supports standard security features such as data encryption, multi-factor authentication, and audit trails, making it ideal for secure and compliant financial management.

Key Features:

Sage Intacct is a cloud-based financial management platform that supports organizations in automating reconciliations and managing financial operations. Its automation capabilities reduce manual work, minimize errors, and accelerate month-end close processes. The platform also includes features for multi-entity consolidations and financial reporting across subsidiaries.

Key Features:

SolveXia is an automation platform that supports finance teams in streamlining reconciliations and eliminating repetitive manual tasks. The platform automates data preparation, transaction matching, and reporting, enabling teams to process large volumes of transactions accurately.

Key Features:

Trintech is a financial software platform that automates reconciliation and streamlines the financial close process. The platform helps reduce manual errors, identify discrepancies, and provide visibility into account balances. It includes tools for compliance and audit-ready reporting and is compatible with Trintech products such as Cadency and Adra Balancer.

Key Features:

Xero is a cloud-based accounting solution designed to simplify and automate reconciliation processes for small businesses. The platform includes automated bank feeds, real-time transaction matching, and tools for maintaining accurate accounts. Xero also enables multiple users, such as accountants and team members, to access financial data simultaneously for improved collaboration and visibility.

Key Features:

Balance sheet reconciliation platform streamlines the process of verifying account balances, helping finance teams maintain accuracy and compliance while saving time. These tools go beyond simple number-matching by automating repetitive tasks, highlighting discrepancies, and providing actionable insights. Key features include:

Selecting the right balance sheet reconciliation tool is crucial for streamlining financial processes, enhancing accuracy, and ensuring compliance. To make an informed decision, consider the following factors:

Opt for software that automates transaction matching, exception identification, and journal entry postings to reduce manual effort and minimize errors.

Ensure the software seamlessly integrates with your ERP, accounting systems, and bank feeds to maintain data consistency and streamline workflows.

Select a solution that can scale with your organization's growth and adapt to evolving financial processes, accommodating multiple entities, various currencies, and complex reconciliation requirements.

A clean, intuitive interface enhances user adoption and reduces training time, leading to more efficient reconciliation processes.

Advanced tools that utilize AI can predict discrepancies, suggest corrections, and learn from past reconciliations to improve accuracy over time.

Look for software that provides detailed audit trails, compliance reporting, and supports regulatory requirements to facilitate internal and external audits.

Evaluate the total cost of ownership, including licensing, implementation, and maintenance, against the expected return on investment through time savings and error reduction.

Balance sheet reconciliation tools provide finance teams with a more efficient and accurate way to verify general account balances. By automating routine tasks and identifying discrepancies, these tools enable organizations to reduce errors, save time, and maintain compliance. Here are some key benefits of using these solutions:

HighRadius helps accounting and finance teams simplify and accelerate the financial close and reporting process. Our cloud-based Record to Report Solution brings together close management, reconciliations, intercompany accounting, consolidation, and reporting, empowering businesses to close faster, improve accuracy, and gain deeper financial insights.

With intelligent AI-powered Account Reconciliation Software, HighRadius enables end-to-end automation of reconciliation activities, from transaction matching to variance analysis and journal posting. HighRadius’s AI agents automatically identify anomalies, classify variances, and generate supporting documentation, ensuring every account is substantiated and audit-ready. By integrating seamlessly with 50+ leading ERPs like SAP, Oracle, and NetSuite, it delivers real-time data synchronization and a unified view of reconciliation progress across entities.

Finance teams benefit from up to 95% automation in reconciliations and journal postings, a 90% transaction auto-match rate, and a 50% boost in productivity, resulting in faster, more accurate closes. Additionally, built-in dashboards and AI-driven insights enhance visibility, transparency, and control, helping organizations achieve 99% reconciliation accuracy and maintain 100% expense recognition compliance, ensuring every close is confident, compliant, and complete.

Our Financial Close and Anomaly Management solutions enable teams to coordinate, automate, and monitor close processes while proactively identifying, drilling down to the source of the discrepancy, and addressing potential discrepancies throughout the period, helping teams avoid last-minute surprises and reduce overall close times by 30%.

Our Intercompany Management solution simplifies multi-entity operations by streamlining transaction matching, eliminations, and reconciliation, ensuring cleaner closes and strengthening audit compliance across global businesses.

Through Financial Consolidation and Reporting, HighRadius enables organizations to produce accurate, compliant, consolidated financial statements 80% faster, drive meaningful analysis, and make more informed business decisions with a single source of economic truth.

HighRadius is a top choice for enterprises and mid-market businesses seeking an efficient solution for balance sheet reconciliation. The AI-powered platform automates up to 95% of journal postings and 80% of bank reconciliations, resulting in a 30% reduction in close times. It also offers seamless ERP integration across 50+ ERPs and systems for scalable, compliant operations.

For small businesses, HighRadius is a robust and reliable balance sheet reconciliation solution. Its AI-driven platform automates journal postings and bank reconciliations, minimizing errors, saving significant time, and providing seamless ERP integration, which enables teams to reconcile accounts faster and more accurately.

Companies that handle high transaction volumes, operate across multiple entities, or manage complex financial operations benefit the most from balance sheet reconciliation tools. Enterprises, mid-market firms, and growing small businesses can utilize these solutions to enhance accuracy, expedite the month-end close process, and streamline audits.

Yes, most balance sheet reconciliation tools can seamlessly integrate with ERPs, enabling automatic data syncing, real-time transaction matching, and streamlined reconciliation workflows. This integration not only reduces manual effort and errors but also provides finance teams with a unified, accurate view of accounts.

The system automatically matches transactions using AI and rule-based algorithms that compare key data points such as amounts, dates, and references. HighRadius enhances this process by using AI agents to identify patterns, auto-match up to 90% of transactions, and flag unmatched items for quick review.

Implementation time for an automated reconciliation solution typically ranges from a few weeks to a few months, depending on the organization's size, data complexity, and ERP integrations. With solutions like HighRadius, pre-built connectors, and AI automation enable faster deployment and quicker ROI.

Yes, HighRadius can manage multi-entity and multi-currency reconciliations. The platform consolidates data from multiple ERPs and subsidiaries, automatically matching transactions across entities and currencies, ensuring accurate, transparent, compliant, and real-time reconciliation at a global scale.

HighRadius stands out as a challenger by delivering practical, results-driven AI for Record-to-Report (R2R) processes. With 200+ LiveCube agents automating over 60% of close tasks and real-time anomaly detection powered by 15+ ML models, it delivers continuous close and guaranteed outcomes—cutting through the AI hype. On track for 90% automation by 2027, HighRadius is driving toward full finance autonomy.

HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions. With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. Backed by 2,700+ successful finance transformations and a robust partner ecosystem, HighRadius delivers rapid ROI and seamless ERP and R2R integration—powering the future of intelligent finance.

HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code scenario building. Its Cash Management module automates bank integration, global visibility, cash positioning, target balances, and reconciliation—streamlining end-to-end treasury operations.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center