Global Recovery Monitor 10th Edition (May 27 – June 10): A summary of the survey on the impact of COVID19 on corporate treasury

What you’ll learn

- The outlook against accounts receivable for the duration of May 27 – June 10 shifted positively with 45% (vs 33%) of respondents favouring a positive outlook in the coming weeks against the metric

- Financial normalcy can be expected to be seen in 10 months from now, which is a one month positive shift from the earlier expectation of 11 months (from Global Recovery Monitor 9th Edition: May 13 – May 27)

- The outlook on organizational liquidity improved by 15% with 75% (vs 60% from Global Recovery Monitor 9th Edition: May 13 – May 27) respondents from the current survey period citing a positive outlook; further implying slow but alleviating financial conditions in the forthcoming months

About the Survey:

The Global Crisis Monitor is an ongoing survey, conducted by HighRadius in partnership with Strategic Treasurer. The intention behind the survey is to understand the sentiments of the treasury community at large, and also the current challenges Treasury departments and their organizations are facing.

In its 10th edition (Survey Period: May 27 – June 10), the survey witnessed a consistent number of respondents with 1000+ respondents being part of the survey.

Impact of COVID19 on Treasury: What Has Changed from May 27 – June 10

Of the 1000+ respondents who participated in the survey, ~75% cited having a positive outlook about organizational liquidity and ~25% cited having a negative outlook

Thus, shifting the overall outlook on organizational liquidity towards a net positive in the survey period, with implications of diminishing challenges surrounding organizational liquidity in the forthcoming weeks.

While this was a positive insight, respondents from the survey showed lessening concerns surrounding:

1. Accounts receivables, since the outlook in the current survey period, saw 45% of the total respondents having a positive outlook against this metric; hinting at reduced working capital pressures in the near future

2. Central Bank Liquidity, since a significant number of respondents, have cited having a positive outlook against the initiatives taken by the central bank, such as setting up Money Market Funds and more.

Access to Debt & Liquidity: The Perspective from May 27 – June 10

The outlook on survey metrics, such as access to short-term loans, money market funds and commercial paper issuances, remained positive, and have also shown a positive forward shift, in comparison to the period of (May 27 – June 10); implying easier access to short-term debts despite the Coronavirus Recession

However, the outlook on the US government’s fiscal activities showed a slight decline in the outlook in comparison to the survey period (May 27 – June 10), indicating a negative outlook on the remediation steps being taken by the US government.

The outlook on accounts receivable also has remained negative. But the respite for this metric is that 45% (vs 33% from the last survey period) of the total respondents cited having a positive outlook against it, implying a sluggish recovery of the metric in the coming times.

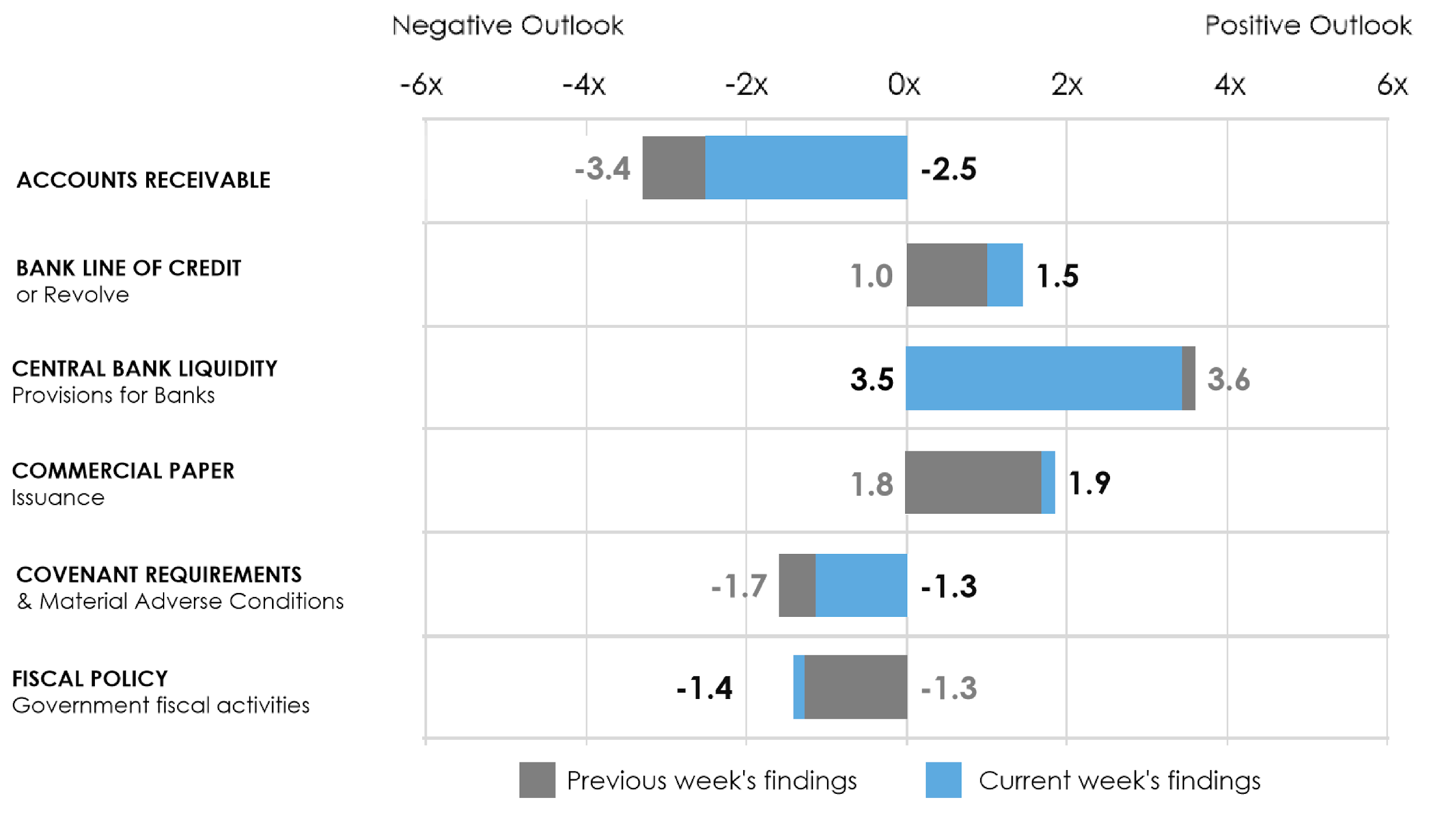

Here is a representation of the outlook that treasury departments currently have on various liquidity instruments available to them.

1. Outlook on accounts receivable changed from -3.5X (May 27 – June 10) to -2.5X, indicating a positive shift and a recovery of this metric.

2. Bank lines of credit which earlier had a positive outlook of +1.0X last week, shifted to +1.5X in the current survey period, showing a positive shift and indicating an easier accessibility to short-term loans provided by banks, that can be leveraged by organizations

3. Money market funds, which were set up by the central banks to induce liquidity into the system, had a positive outlook in the current survey period, with the metric shifting to +3.5X vs +3.6X from the last survey period (though the metric has positive outlook, the slight shift is indicative of possible negative outlook in the coming survey periods).

4. The outlook on commercial paper issuance in the current survey period saw a positive shift to +1.9X from +1.8X (from the period of May 27 – June 10), indicating an ease of access to short term debts by issuing commercial papers.

5. Covenant requirements & MACs had a negative outlook among the respondents since it stood at -1.7X vs +1.0X (in comparison to the period of May 27 – June 10). In the current survey period, however, the outlook shifted to -1.3X, hinting towards a positive outlook against the metric in the coming weeks.

6. The outlook for the US fiscal policy shifted slightly towards the negative side by standing at -1.4X (in the current survey period) in comparison to -1.3X from last week, indicating a slightly negative sentiment about the remediation initiatives being proposed by the US Senate.

The Lasting Effect of COVID19: When Treasury Can Expect a Change

In the last survey period (May 13 – May 27), respondents cited that COVID19 was expected to reach its inflection point in less than 1 month, while financial normalcy was expected to be restored within 8 months.

However, this week’s results pointed out that financial normalcy can be expected to be seen within 9 months from now; hinting at a slower than expected recovery from current economic pressures and financial conditions.

A Projected Timeline of Health & Financial Inflection

- The expected point where the impact of the virus begins to diminish can be seen in the next 2 – 3 months, which is a negative shift from the earlier expectation of 1 month from the survey period of May 13 – May 27

- The end of the COVID19 pandemic was expected to be seen within 10-12 months as cited by a majority of the respondents from the previous survey findings. The outlook against this metric in the current survey period shifted positively to 9 months implying a slower than expected recovery from the pandemic

- Financial normalcy was expected to be seen in 10-12 months in the last survey period. This survey period, however, the outlook shifted to 9 months indicating a slower than usual recovery of current economic pressures and financial conditions.

Conclusion: Accounts Receivables and Material Adverse Conditions remain the Top Concerns for Treasurers during (May 27 – June 10)

- Accounts receivablesremained a top concern for treasury departments this week since the metric showed marginal improvement in the outlook from -3.4X to -2.5X. However, considering the trends from the earlier survey the outlook against this metric is on the road to recovery and will eventually become positive in the forthcoming weeks.

- Covenant Requirements has also remained a top concern for treasurers in the current survey period since this metric had a negative outlook against it.

We’ll continue to monitor and report on how the changing dynamics of COVID19 has been impacting Treasury and Finance professionals, and on the way, we will empower readers with valuable insights that can help mitigate risks.

Insights: Key Survey Findings of Global Recovery Monitor 9th Edition May 13 – May 27

There’s no time like the present

Get a Demo of Cash Forecasting Cloud for Your Business

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.