Reforming Accounts Receivable Collections Strategy for CFO’s Office

What you’ll learn

- Balance customer experience with business expectations

- Avoid a “one size fits all” approach

- Optimize your collections strategy

- Conduct periodic reviews with a focus on AR

- Establish a strong credit policy

- Customer segmentation: Maximize collections, minimize effort

- Automation for improved collections and CX

- The RadiusOne Advantage

Customer Experience vs Collections KPI- It’s a tightrope!

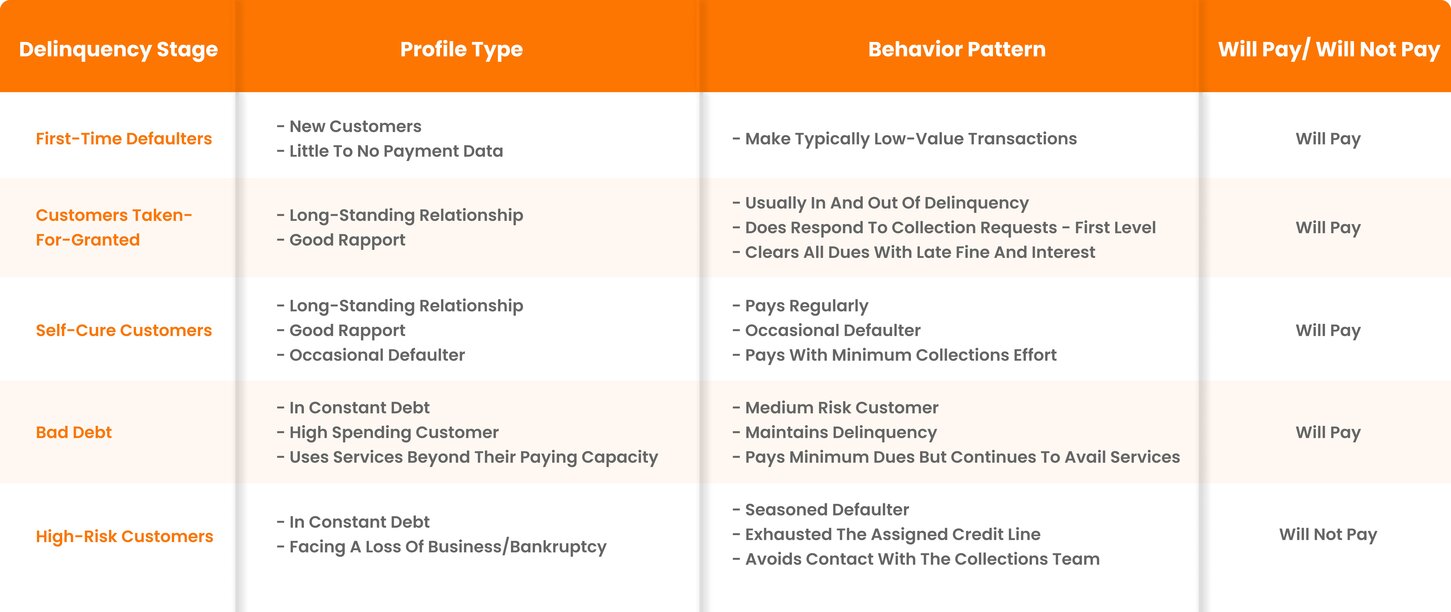

In the ebook above, you’ll find information on how segmenting customers based on previous payment behavior and profile type helps collection teams build proactive and customized collections strategies. In doing so, CFOs create an ecosystem of trust and a CX that encourages customer loyalty and maximizes customer lifetime value(LTV).

In the ebook above, you’ll find information on how segmenting customers based on previous payment behavior and profile type helps collection teams build proactive and customized collections strategies. In doing so, CFOs create an ecosystem of trust and a CX that encourages customer loyalty and maximizes customer lifetime value(LTV).

Why is it important to look beyond preconceptions in collections?

By applying a thought-through collections strategy and employing the best practices in collections, the CFO’s office can identify areas within the accounts receivable spectrum that are critical and require attention. Through real-time AR monitoring, the collections team can mitigate lost opportunities to collect cash, as well as plan their correspondence well in advance. This helps avoid bottlenecks caused by collectors’ focussing solely on making calls to customers. A planned approach can ensure businesses have adequate cash flows that can be used for other vital processes like inventory management and payroll.

2. Conduct periodic reviews apart from collections to optimize your day-to-day AR process

With the right collections strategy in place, the next step is to ensure regular monitoring of the AR processes. Assign a resource to review all the invoices and apprise the CFO’s office of any critical cases that require immediate attention.

Establish a correspondence mechanism that makes it easier for your team to send reminders to customers in a way that isn't curt or inconvenient. The collections team should also take notes on how customers react to the team’s correspondence methods so that they can amend their approaches accordingly.

3. Establish a strong credit policy for better control

It can often be difficult for mid-market CFOs to predict which of their customers will default on payments. The chances of even the most disciplined customers becoming delinquent are not unlikely, given the current, highly erratic economic climate.

On the other hand, businesses that pay a day or two late are often considered by collections teams to have gone under. The reality, though, might be that they are only taking a few days extra to sort their finances. To account for varied instances of this sort, the CFO’s office must have a strong credit policy in place that takes into account all the different factors including market conditions and clients’ promise to pay.

A well-defined credit policy enables customers to have some leeway while ensuring that all possible scenarios are accounted for in the credit policy. This vastly improves customer acquisition as well as the CX. Read this blog to get tips for designing a sustainable credit policy.

4. Know your customer

Customer segmentation allows collections teams to plan correspondence and customize it according to different customer profiles. It enables the team to maximize collections and simplify customer communications. For example, by segmenting customers, you can identify low-risk customers who needn’t be sent too many reminder emails. You’ll also know your high-risk customers, whom you’ll need to actively engage with dunning techniques.

5. Leverage automation to streamline collections and improve CX

Mid-market CFOs are realizing the efficacies of automation in their AR strategy, as it –

By applying a thought-through collections strategy and employing the best practices in collections, the CFO’s office can identify areas within the accounts receivable spectrum that are critical and require attention. Through real-time AR monitoring, the collections team can mitigate lost opportunities to collect cash, as well as plan their correspondence well in advance. This helps avoid bottlenecks caused by collectors’ focussing solely on making calls to customers. A planned approach can ensure businesses have adequate cash flows that can be used for other vital processes like inventory management and payroll.

2. Conduct periodic reviews apart from collections to optimize your day-to-day AR process

With the right collections strategy in place, the next step is to ensure regular monitoring of the AR processes. Assign a resource to review all the invoices and apprise the CFO’s office of any critical cases that require immediate attention.

Establish a correspondence mechanism that makes it easier for your team to send reminders to customers in a way that isn't curt or inconvenient. The collections team should also take notes on how customers react to the team’s correspondence methods so that they can amend their approaches accordingly.

3. Establish a strong credit policy for better control

It can often be difficult for mid-market CFOs to predict which of their customers will default on payments. The chances of even the most disciplined customers becoming delinquent are not unlikely, given the current, highly erratic economic climate.

On the other hand, businesses that pay a day or two late are often considered by collections teams to have gone under. The reality, though, might be that they are only taking a few days extra to sort their finances. To account for varied instances of this sort, the CFO’s office must have a strong credit policy in place that takes into account all the different factors including market conditions and clients’ promise to pay.

A well-defined credit policy enables customers to have some leeway while ensuring that all possible scenarios are accounted for in the credit policy. This vastly improves customer acquisition as well as the CX. Read this blog to get tips for designing a sustainable credit policy.

4. Know your customer

Customer segmentation allows collections teams to plan correspondence and customize it according to different customer profiles. It enables the team to maximize collections and simplify customer communications. For example, by segmenting customers, you can identify low-risk customers who needn’t be sent too many reminder emails. You’ll also know your high-risk customers, whom you’ll need to actively engage with dunning techniques.

5. Leverage automation to streamline collections and improve CX

Mid-market CFOs are realizing the efficacies of automation in their AR strategy, as it –

- Eliminates manual processes

- Simplifies AR complexities

- Eases customer onboarding

- Infuses artificial intelligence in collections

- Helps manage customer correspondence

- Drives cash flow

- Reduces the number of delinquency cases

- Delivers exceptional CX

Power up your collections process with RadiusOne

There's no time like the present

Get a Demo of Integrated Receivables Platform for Your Business

Request a Demo

HighRadius Integrated Receivables Software Platform is the world's only end-to-end accounts receivable software platform to lower DSO and bad-debt, automate cash posting, speed-up collections, and dispute resolution, and improve team productivity. It leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes and also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier accounts receivable process to the buyer accounts payable process. Integrated Receivables have been divided into 6 distinct applications: Credit Software, EIPP Software, Cash Application Software, Deductions Software, Collections Software, and ERP Payment Gateway - covering the entire gamut of credit-to-cash.