One in every five major corporation treasurers reported losses due to spreadsheet errors, and such mistakes can be costly. While large corporations can endure such financial hardships, spreadsheet errors can cripple small to mid-sized businesses.

Every day, 2.5 quintillion bytes of data are produced on average. Organizations are now faced with the problem of gathering, managing, and extracting value from such data. One can see exponential growth in the data that businesses can access if they compare the data from the last few years with the available data. This data exceeds the amount that can be calculated, saved, and stored along with being kept. Managing this data presents a challenge.

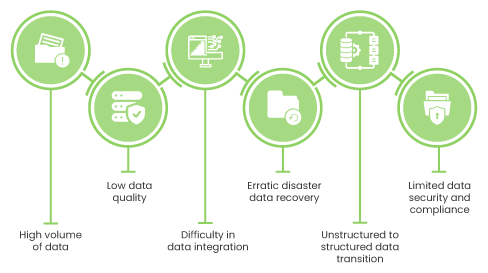

This takes us to the underlying difficulties with using spreadsheets for data management, such as:

The above challenges can be solved by implementing AI in workflows. According to Gartner, businesses are experiencing digital disruption due to the overwhelming amount of data they must manage. But with the help of AI, it’s feasible to integrate all that data into concrete results, from supply chains and sales and marketing to demand planning.

The potential impact of AI on the world economy is enormous. Data segmentation, validation, and processing are made easier by AI. Businesses and organizations can enhance their decision-making processes’ speed, accuracy, efficacy, and consistency by utilizing AI-powered datasets. AI can perform error-free analysis of large datasets in contrast to human analysis.

Making decisions today requires using technology to analyze tons of data. Due to its massive data processing and outcome prediction capacity, AI has established itself as a significant aspect of strategic decision-making.

With cash flow forecasting software, CFOs and treasurers can comprehensively view their current cash balances and the tools and knowledge required to foresee volatility, use advanced management analytics, and modify the company’s risk management strategy accordingly.

The features that help the executives to overcome the mentioned challenges are as follows:

As companies grow, forecasting cash flows becomes a top priority for making accurate decisions.

AI, as opposed to humans, can accurately and promptly evaluate massive datasets, allowing the staff to concentrate on other tasks. Businesses are also catching on; according to 66% of decision-makers, AI technologies are assisting them in boosting revenue and achieving their objectives.

Introducing AI into a business decision-making process helps in:

AI is excellent at navigating complexity, examining large data sets, and quickly identifying trends. On the other hand, humans excel in comprehending external aspects and making more creative decisions.

Below are the ways AI cash forecasting software improves decision-making:

For example, suppose a company is trying to choose which products to sell. In such a situation, AI can gather data on customer purchasing patterns and then harness data for recommending which products to sell.

To summarize, AI is constantly improving, making it more accessible and inexpensive to organizations of all sizes. By harnessing data with artificial intelligence, treasurers and CFOs can make better decisions, increase productivity, and promote creativity.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Talk to our experts