What’s Driving the Change?

A look at what shaped the technological scenario of Treasury and how is new technology causing disruption in the field

What?s Driving the Change?

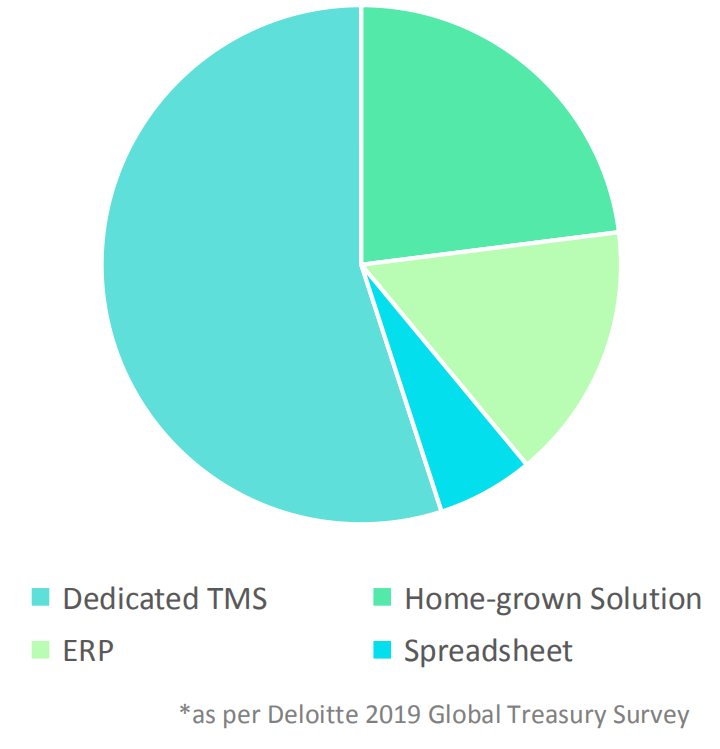

In the past decade, the use of spreadsheets has steadily declined to owe to the use of systems like TMS or ERP in Treasury functions. With an adoption percentage around 55% for TMS and 23% for ERPs, they have still not evolved entirely to meet the demands of treasurers. The low rate of adoption of these systems, especially in SMEs can be linked to a high cost of ownership, adoption and maintenance complexity, and a smaller demographic for business operations. Another reason may be their ability to run only simple functions, where they fail to accomplish complex tasks due to lack of specialization or updates from vendors, such as accurate cash forecasting or robust risk management.

Giant players in the market fail to understand the requirements of treasurers, and therefore many newer and smaller vendors and service providers are investing in new technology which could help fill the gap.

With these new groundbreaking technologies, treasurers will now be able to do more with less, add value to their role, and take a more strategic step towards their company’s growth. These new types of solutions aim at improving workflow, automating certain processes, and helping Treasury with better decision making on investments, borrowings, and optimizing cash conversion cycle.

There is still an inertia in the adoption of these technologies. Since they take up a few tasks of Treasury, it creates a sense of fear of job loss amongst Treasury teams. This creates a dilemma for them, as they must choose between increasing their chance of job loss or keeping up with tedious tasks and surmounting them. The lack of understanding among Treasury teams on the way these technologies operate also casts a shadow of doubt and creates a fear of the unknown. It becomes important to understand the sentiment of treasurers and highlight what is truly beneficial, and how more value can be derived not just from newly implemented solutions, but from themselves as well.