The Importance of Centralization in Cash Forecasting

Learn the difference between decentralized and centralized cash forecasting. Understand how centralization enhances the efficacy of cash forecasts.

Importance of cash flow forecasting

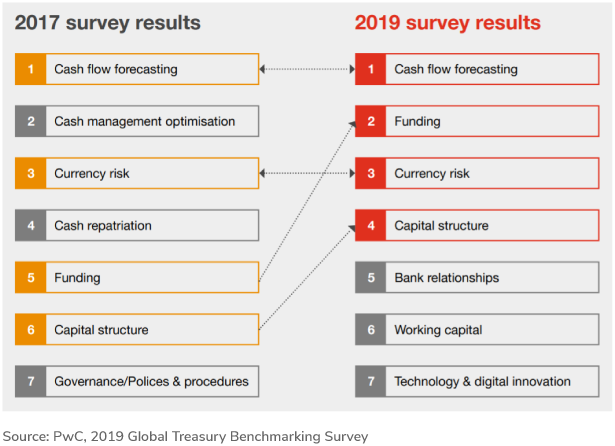

Treasury priorities over the years

Cash flow forecasting has always been a top priority for treasury, and its importance has been exacerbated during the pandemic. Treasurers are finding it difficult to manage liquidity due to challenges in forecasting cash, arising due to scattered landscape and spreadsheet-driven processes.

Decentralized vs. centralized forecasting

Decentralized cash forecasting

Centralized cash forecasting

Approach

Granularity

Impact

Characteristics of decentralized cash flow forecasting

In the decentralized approach, each entity generates its local forecast consisting of its own set of currencies, ERPs, and customers. Decentralized cash flow forecasting relies mostly on spreadsheets. Its characteristics are:

1. Visibility: Low visibility due to:

- Data scattered across disparate sources

- Inability to track A/R and A/P cash flows

- Inability to perform repatriation due to limited global visibility

2. Accuracy: Low accuracy due to:

- Manually aggregating data from different sources

- Difficulty to roll-up local forecasts to the central treasury

- Difficulty in identifying the cause of variance due to limited granularity

3. Frequency: High turnaround time due to manual activities and scattered landscape limits the cadence of forecasting.

Due to low visibility, accuracy, and frequency, the efficacy of the forecast takes a hit and leads to certain drawbacks.

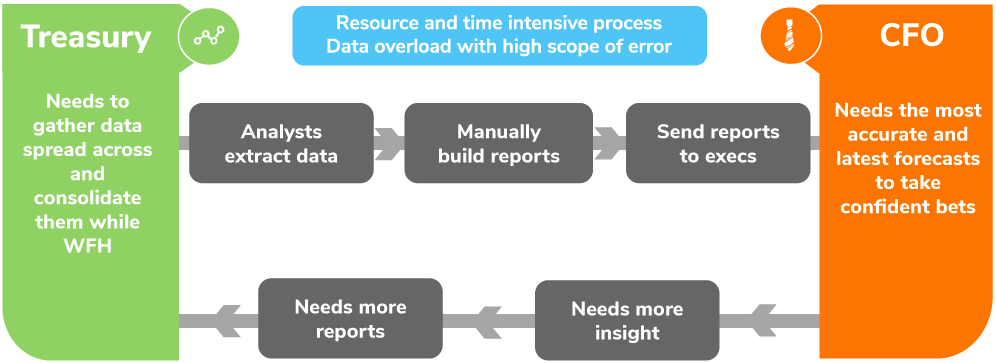

Drawbacks of the decentralized process

- Delayed reporting: It’s difficult and time-consuming to generate a central forecast. As a result, reports are dead on arrival, which affects decision-making.

- Poor decision-making: Siloed operations limit granular-level visibility. Low visibility hinders decisions about investments, business expansion, M&A, repatriation, etc.

The shortcomings of decentralized cash forecasting can be avoided by adopting centralized cash forecasting.

Characteristics of centralized cash flow forecasting

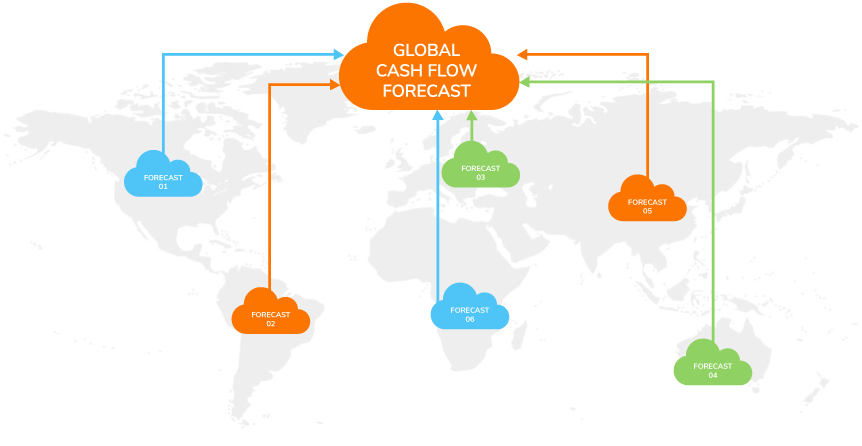

In centralized cash flow forecasting, local forecasts based on different regions, company codes, cash flow categories, and currencies are rolled up to generate a global forecast.

A centralized system enhances visibility into cash flows, boosts cash flow forecast accuracy, and supports forecasting due to the following reasons:

1. Visibility: Provides granular visibility across different cash flows categories, entities, ERPs, allowing drilling into individual lower-level forecasts. Moreover, centralization allows tracking specific customer accounts or transactions to determine variance sources for high variance categories such as A/R. It also provides the ability to track cash movements.

2. Accuracy: Centralized forecasting allows forecasting of individual cash flow categories of different entities rolling up to the central forecast, thereby significantly increasing baseline accuracy.

3. Frequency: Forecasts are easily replicated, and changes can be tweaked since the turnaround time is decreased. Hence the cadence is increased.

Reasons for adopting centralized forecasting

Centralized forecasting offers better control over the organization’s activities by ensuring consistency in operations and uniformity in decision-making. It also offers a better understanding of ‘what-if’ scenarios and their impacts on cash flows.

Impact of centralized cash forecasting

1. Continuous data visibility across all systems

It is easier to monitor cash categories like A/R, A/P, taxes, payroll across different geographies, horizons, company codes, etc., and access data at all times. Additionally, variance drivers are identified easily to understand the deviation between forecasts and actuals.

2. Ability to understand how transaction-level activities influence global forecasts

Centralized forecasting enables drilling down into cash flows with invoice-level granularity. Thus, treasury gains a better understanding of mitigating the potential risks and can redirect their decisions towards high-priority areas.

3. Improved scalability and standardization

The process doesn’t break when a new system is added. Moreover, the process can be replicated/ halted when a new company is acquired. Once the system is running, frequent human intervention is not required.

4. Improved strategic financing decisions

Real-time and accurate forecasts are created through centralization and are updated to provide real-time insights. As a result, CFOs can drive timely and confident decisions towards debts, investments, M&A, repatriation, etc.

With the changing business landscapes, companies and their treasuries emphasize the centralization of treasury functions. Companies have moved towards or are actively considering a centralized structure for better monitoring cash flows, especially in light of the macroeconomic fluctuations, by leveraging technologies such as AI to improve cash forecasting.