What Differentiates World-Class

This Hackett Group research is an actionable summary that drills down on ?how? World-Class companies have leveraged digital transformation to excel over their peers

What Differentiates World-Class

What makes A/R Leaders Stand Out?

By analyzing different indicators, these are the areas where A/R leaders have harnessed technology and cracked the code for being World-Class.

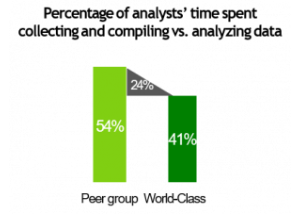

Analysts spend lesser time in clerical work

With the help of technology, such as robots and Artificial Intelligence, analysts in World-Class companies save 24% more time in low-value work such as:

With the help of technology, such as robots and Artificial Intelligence, analysts in World-Class companies save 24% more time in low-value work such as:

- collecting remittances/claims from emails, web-portals, faxes

- scanning and keying-in data into spreadsheets

- pulling credit details from public financials

- generating account worklists for dunning

Analysts instead focus on strategic tasks, such as researching invalid deductions, controlling credit-risk, reducing critically delinquent accounts.

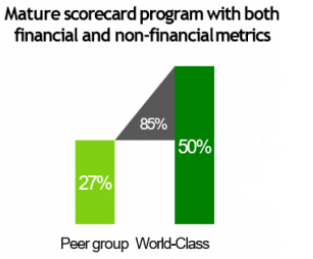

Advanced reporting and analytics provide better insight

50% of World-Class companies have advanced reporting and analytics capability providing† comprehensive process visibility and helping in decision-making by:

50% of World-Class companies have advanced reporting and analytics capability providing† comprehensive process visibility and helping in decision-making by:

- Drilling down on root cause

- Real time reporting

- Out of the box reporting

Technology positions executives to drive next-level process transformation versus policing metrics and process owners.

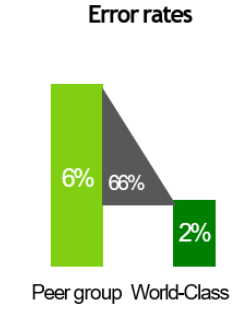

Teams are more effective

By automating business processes, A/R teams of World-Class companies are more effective and commit 66% lower errors associated with:

By automating business processes, A/R teams of World-Class companies are more effective and commit 66% lower errors associated with:

- Manual data entry

- Calculation errors

- Aggregating data from disparate sources

- Lack of complete information

Artificial Intelligence-enabled systems have self-learning capability that monitor analyst activity and improve over time, making lower mistakes.

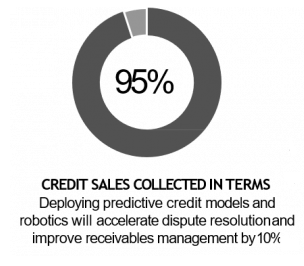

Teams do the right things to collect faster

Digital transformation enables A/R teams of World-Class companies to collect 95% credit sales within payment terms. This is achieved by using technology that allows:

Digital transformation enables A/R teams of World-Class companies to collect 95% credit sales within payment terms. This is achieved by using technology that allows:

- Proactive reminders and strategic dunning

- Prediction of payment date by analyzing customer payment trends

- Accelerated dispute resolution by predicting dispute validity

- Automated, proactive credit reviews for identifying high-risk customers