In the world of B2B finance, every dollar you save adds up, especially when applied to high-volume supplier payments. That’s where early payment discounts like 2/10 net 30 come into play. These terms give buyers the option to reduce invoice costs in exchange for quicker payment, offering a win-win for both the payer and the supplier.

Struggling to Capture 2/10 Net 30 Discounts?

See how HighRadius helps finance teams speed up approvals, avoid delays, and never miss early payment savings.

Book Your Personalized DemoBut to take advantage of these discounts consistently, finance and AP leaders need to understand not just the math but the strategy behind them. In this blog, we’ll break down the 2/10 net 30 meaning, how to calculate it, real-world examples, and when it’s smart to use — plus how automation helps capture these savings at scale.

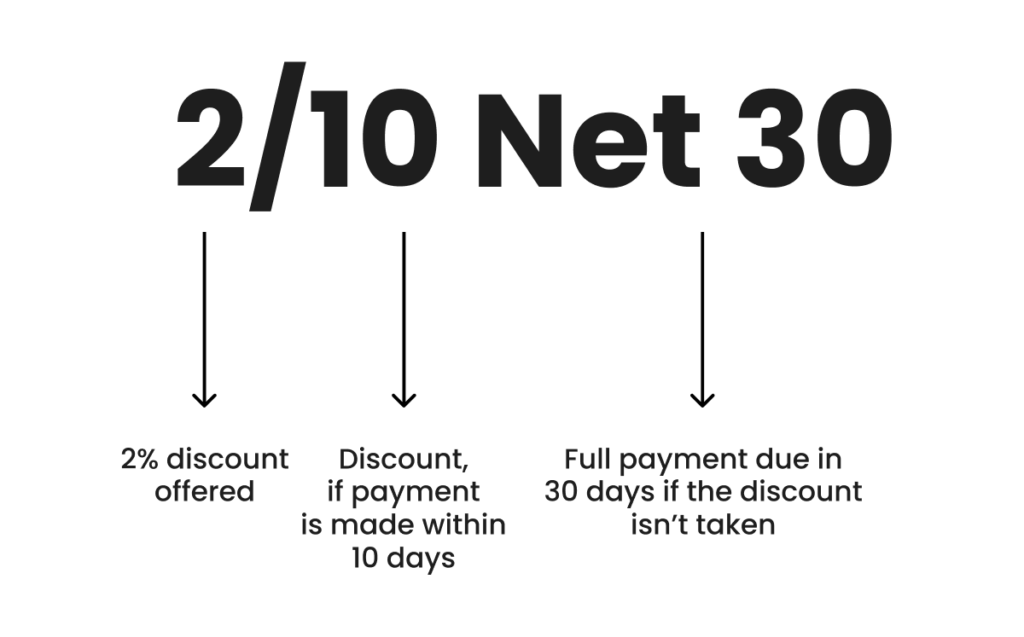

2/10 net 30 is a payment term that allows buyers to take a 2% discount on an invoice if payment is made within 10 days. If the buyer chooses not to take the discount, the full payment is due within 30 days from the invoice date. This term is commonly used in B2B & accounts payable transactions to encourage faster payments and support supplier cash flow.

It helps them identify opportunities to reduce costs, improve vendor relationships, and manage working capital more effectively.

2/10 net 30 is a type of early payment discount that gives the buyer two options: pay the invoice early and take a discount, or pay the full amount later. Suppliers commonly offer these terms to encourage faster payments and improve cash flow.

Here’s how it works:

For example, on a $10,000 invoice, paying within 10 days means you only pay $9,800. After day 10, the full $10,000 is due. These terms are beneficial when your AP process is efficient and cash flow allows for early payment.

Calculating a 2/10 net 30 discount helps determine whether it’s worth paying early. It’s a simple percentage calculation, but the return on early payment can be significant.

Let’s say you receive an invoice for $50,000.

To evaluate the financial benefit, calculate the annualized return:

Annualized Interest Return = (0.02 / (1 - 0.02)) × (360 / (30 - 10))

= (0.02 / 0.98) × (360 / 20)

= 0.02041 × 18

≈ 0.3673

≈ 36.73%

This means taking the discount is like earning a 36.73% return for paying 20 days early, making it a strong decision when cash is available.

While 2/10 net 30 offers clear financial incentives, it's important to weigh both the benefits and limitations before adopting or accepting these terms.

Early payment terms like 2/10 net 30 can provide more than just savings on paper — they offer tangible financial and operational advantages when used strategically. Below are the key benefits, explained in detail:

By paying within the discount window, buyers can immediately reduce the amount they owe, typically by 2%. For example, on a $100,000 invoice, that’s a $2,000 savings just for paying early. Over the course of a year, these small discounts across multiple vendors can lead to substantial cost reductions, without changing purchase volumes or renegotiating contracts.

Timely or early payments are a strong signal of financial health and reliability. Vendors appreciate buyers who pay on time — or ahead of time — as it improves their cash flow and reduces their collection effort. This builds goodwill, positions your organization as a preferred customer, and can open the door to better service levels, favorable pricing, or flexible payment terms in the future.

From the supplier’s perspective, faster payments mean quicker access to working capital. This reduces their need to rely on financing options like lines of credit or factoring. Suppliers with healthier cash flow are more stable, which reduces supply chain risk and supports consistent delivery — an indirect benefit to your business.

When you calculate the effective annualized return of taking a 2% discount for paying 20 days early, it comes out to over 36%. That’s a return far greater than what most short-term investments or treasury instruments provide. For finance leaders managing idle or low-yielding cash, applying funds to capture early payment discounts becomes a high-value alternative.

While 2/10 net 30 can offer significant benefits, it’s not without drawbacks. These early payment terms require strong cash flow and efficient processes, and when those aren’t in place, the discount opportunity may turn into a burden.

Paying invoices within 10 days requires your organization to release cash faster than normal. If your revenue cycles don’t align or you’re dealing with tight liquidity, this can disrupt your broader cash flow planning. For many smaller or growing companies, it’s safer to hold onto cash rather than prioritize early payments — even if it means missing the discount.

The 10-day discount period passes quickly, especially if your AP process is manual or approval workflows are slow. If invoices sit in someone’s inbox or get delayed in review, your team may miss the window, resulting in full payment anyway, without the benefit. In this case, you’ve compressed your payment cycle without gaining any cost savings.

From the supplier’s perspective, offering a 2% discount on every invoice can add up to a sizable reduction in revenue, especially across large contracts or frequent orders. If the discount is expected every time, suppliers may factor this into their pricing, or become hesitant to offer it long-term unless it’s offset by faster, more reliable payments.

While 2/10 net 30 terms offer clear financial upside, they’re not always the right fit for every situation. To get the most value from this early payment discount, AP teams should evaluate both internal capabilities and vendor dynamics. These are the situations when it makes sense to use 2/10 net 30, and when it might be better to pass or renegotiate.

If your business consistently maintains healthy liquidity, using cash to capture early payment discounts can be a smart alternative to low-interest savings or idle cash reserves.

If your AP team can process, approve, and pay invoices within 10 days, you’re in a good position to consistently take advantage of discount terms. AP automation tools are particularly helpful here.

Early payments improve supplier cash flow and build trust. Using 2/10 net 30 can position your company as a preferred buyer, opening the door to better service and long-term pricing benefits.

If your team actively monitors KPIs like DPO, discount capture rate, and cost savings, 2/10 net 30 terms can help you move the needle, provided you have systems in place to execute consistently.

When it comes to accounting for early payment discounts like 2/10 net 30, companies generally use either the net method or the gross method to record transactions in their books. Both methods are accepted under accounting standards, but they differ in how the discount is recognized and when it’s applied. Understanding these methods is critical for AP managers, controllers, and finance teams to ensure accurate expense reporting, maintain audit readiness, and evaluate how efficiently discounts are being captured.

Under the net method, the organization assumes it will take the early payment discount and record the payable amount at the discounted value when the invoice is first entered. This means the accounts payable ledger reflects the reduced liability upfront.

If the company fails to make the payment within the discount window, the difference between the discounted and full amount is then recognized as an additional expense, often categorized as “purchase discounts lost” or similar.

This method encourages teams to prioritize discount capture, promotes discipline in invoice approval and payment cycles, and highlights the cost of missed opportunities in financial statements.

Example:

With the gross method, the company records the full invoice amount at the time of receipt, without assuming the discount will be taken. If the company ends up paying early and qualifies for the discount, the reduction is recorded when the payment is made, often reflected as a decrease in the cost of goods sold or an income account, depending on internal accounting policies.

This approach is more conservative and easier to manage if a business is not consistently taking advantage of early payment terms. However, it may underreport missed discount opportunities unless separately tracked.

Example:

While 2/10 net 30 is one of the most widely used early payment terms, it’s not the only structure businesses encounter. Suppliers may offer a range of discount terms, depending on industry practices, cash flow needs, and negotiation dynamics. Here are a few frequently used alternatives to 2/10 net 30:

A 1% discount is available if payment is made within 10 days; otherwise, full payment is due within 30 days. This structure offers a smaller incentive but is often used in industries where margins are tighter or where buyers may not have the liquidity to consistently take larger discounts.

A 2% discount applies if payment is made within 15 days; otherwise, the full amount is due in 45 days. This gives buyers more time to assess and approve invoices while still rewarding faster payments. It’s common in sectors with longer delivery cycles or complex reconciliation needs.

A 3% discount is offered for payments made within 10 days, with a longer net period of 60 days.

This is typically seen in strategic supplier relationships where vendors are willing to offer more aggressive discounts in exchange for early cash inflows.

A high 5% discount for payment within 10 days, with a 30-day full payment term. This is less common but may be offered by cash-strapped vendors eager to accelerate payments or in negotiations where early liquidity is prioritized over margin.

While 2/10 net 30 terms can offer measurable financial and operational benefits, implementing them successfully across a finance organization isn’t always straightforward. Without the right processes, tools, and alignment in place, many companies find it difficult to capture the full value of early payment discounts.

Below are some of the most common roadblocks AP teams face when adopting or scaling 2/10 net 30 terms — and why solving them is key to realizing ROI.

The biggest barrier to capturing early payment discounts is simply time. If invoices aren’t processed, reviewed, and approved within 10 days, the discount window closes before your team can act. Manual routing, unclear approval chains, or disjointed workflows can all slow things down and result in missed opportunities.

Without real-time insights into invoice statuses and discount expiration dates, teams operate reactively. By the time an invoice is approved, the discount period may already be over. This happens frequently in organizations relying on email approvals, spreadsheets, or legacy systems.

Discount terms need to be clear, consistent, and documented — both in contracts and in AP systems. If vendor terms vary or aren't properly communicated to AP teams, it's easy to misinterpret or miss them entirely. The lack of centralized vendor master data only adds to the confusion.

Some systems lack the functionality to flag invoices with early payment terms or route them based on priority. If your platform doesn’t support real-time tracking or automated discount alerts, capturing 2/10 net 30 consistently becomes a manual — and error-prone — task.

Even if discounts are available and AP can process invoices quickly, the finance team may hesitate to release funds early due to uncertain liquidity. If cash flow planning is disconnected from AP execution, teams may pass on discounts that could have been captured without harming working capital.

Capturing early payment discounts like 2/10 net 30 consistently requires more than a financial strategy. Manual AP processes often can’t move fast enough to meet 10-day windows, leading to missed savings and strained supplier relationships.

HighRadius helps AP teams automate the full invoice-to-pay cycle, making it easy to capture early payment discounts without adding pressure to your finance operations. Here’s how we support smarter AP performance:

Our AI-powered system instantly extracts key invoice fields and applies smart GL coding, removing manual entry delays that often cause missed discount windows.

Invoices offering early payment discounts are automatically flagged and routed to the right approvers, ensuring they are reviewed and approved before discount deadlines expire.

Dynamic dashboards provide up-to-the-minute insights into pending discounts, payment timelines, and captured savings — empowering finance teams to optimize cash flow decisions.

HighRadius seamlessly integrates with leading ERP and financial platforms, enabling synchronized payment scheduling and real-time visibility without data silos or reconciliation delays.

If your organization wants to maximize savings, improve vendor relationships, and scale accounts payable operations without missing a beat, HighRadius can help. From automating approvals to optimizing discount capture, we make sure your AP team never leaves money on the table.

Ready to turn your AP process into a savings engine? Schedule a demo and see how HighRadius empowers smarter payment strategies.

The 2/10 net 30 annualized interest rate refers to the effective return a company earns by paying early and taking the 2% discount. Calculated over 20 days, the annualized return is approximately 36.5%, making early payment financially attractive if cash flow allows.

Companies use either the net method or the gross method to record 2/10 net 30 terms. In the net method, the invoice is recorded at the discounted amount, assuming the discount will be taken. In the gross method, the full invoice amount is recorded, and the discount is recognized separately if earned.

If you receive a $10,000 invoice with 2/10 net 30 terms, you can pay $9,800 within 10 days and save 2%. If you pay after 10 days but within 30 days, you owe the full $10,000. It incentivizes faster payments to benefit both buyer and supplier cash flow.

If you don’t pay within the 30-day net period, you may face late fees, interest charges, or strained vendor relationships. Some suppliers also impose penalties or suspend services until payment is received, impacting your company's credibility and supply chain continuity.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center