As businesses scale and payment volumes increase, managing accounts payable (AP) with manual processes or basic tools becomes time-consuming and error-prone. Many finance leaders now recognize that AP is no longer just a back-office function, it directly impacts cash flow, supplier relationships, and financial control. This shift has placed AP automation at the center of digital transformation strategies for 2025 and beyond.

Recent studies highlight the scale of this transformation. Forrester reports that AI-driven AP automation can reduce invoice processing time by up to 70% and cut costs by as much as 60%. These solutions also deliver real-time visibility into payables data, empowering finance teams to make faster, more informed decisions. By leveraging automation, companies can move beyond basic efficiency gains to achieve strategic benefits like better compliance, optimized working capital, and stronger supplier trust.

One of the most significant disruptors shaping AP automation today is advanced AI. Vendors are now experimenting with generative AI to create instant reports and analytics, while large language models (LLMs) are being deployed to accurately extract data from unstructured documents like invoices and contracts. This evolution is driving a new era where AP automation doesn’t just process transactions, it predicts risks, improves accuracy, and provides actionable insights for corporate finance leaders. In this blog, we’ll explore the top AP automation trends for 2025 and how organizations can leverage them to stay competitive.

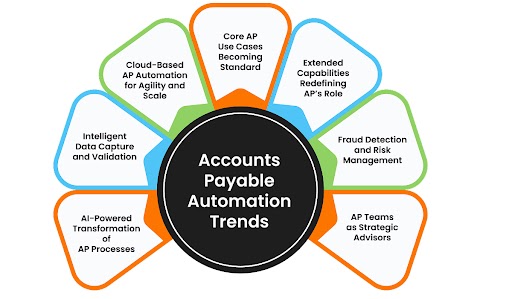

Accounts payable (AP) automation trends are emerging technologies and strategies that transform how finance teams manage invoices, payments, and supplier relationships. These trends focus on reducing manual work, increasing process accuracy, and improving financial visibility by adopting AI-driven and cloud-based solutions.

According to recent research, AI adoption in AP has quadrupled in the past year, showing a rapid shift from basic automation to intelligent, predictive systems. Businesses adopting modern payable software see faster invoice processing, better fraud detection, and lower operational costs.

Forrester-Backed Insights on AP Automation Trends

Discover focus areas and best practices shaping modern AP operations.

Download GuideAs teams face common AP automation challenges like rising invoice volumes, tighter compliance requirements, and growing pressure on cash flow, automation is becoming essential. These 7 key trends highlight how AI, cloud, and intelligent workflows are transforming AP from a back-office function into a strategic driver for finance.

Artificial intelligence (AI) has become the most significant disruptor in AP automation, moving beyond basic process automation to intelligent decision-making and predictive capabilities.

According to Forrester, organizations using AI in accounts payable automation solutions can reduce invoice processing times by up to 70% and cut costs by as much as 60%. AI tools now automate complex tasks such as invoice matching, fraud detection, and exception handling, freeing teams to focus on strategic initiatives.

AI also enables real-time insights into cash flow and spending patterns, helping finance leaders forecast more accurately and identify inefficiencies. With generative AI, AP systems can automatically generate reports, visualizations, and recommendations, positioning AP as a critical driver of business performance.

Manual invoice entry is one of the biggest bottlenecks in traditional AP workflows. Modern AP automation uses AI-driven optical character recognition (OCR) and large language models (LLMs) to extract and validate data from invoices automatically, even from unstructured or semi-structured formats like PDFs or scanned documents.

This trend reduces errors and accelerates invoice processing while improving data accuracy and compliance. Advanced systems can also cross-verify information against purchase orders and supplier records in real time, minimizing exceptions and manual intervention.

As businesses embrace remote and hybrid work, cloud-based AP automation platforms have become essential.

AP cloud solutions provide:

This trend is driving a shift from fragmented, on-premise tools to centralized, cloud-first platforms that improve collaboration across teams and geographies.

The most successful AP automation initiatives are built around core functionalities that every finance team needs to streamline processes.

Forrester identifies these core AP automation use cases:

Beyond core processes, AP automation platforms are expanding into strategic, value-adding functions. Examples include:

These extended features transform AP from a cost center into a strategic enabler that strengthens supplier relationships and optimizes financial operations.

With growing payment volumes and more complex supplier networks, AP fraud prevention is a top priority for finance leaders. AI-powered AP automation now analyzes patterns in historical data to detect anomalies and flag suspicious activities in real time.

These systems can identify issues such as duplicate payments, false vendors, and irregular transactions before they escalate into financial losses. This trend helps businesses enhance compliance and governance while protecting their reputation and bottom line.

As automation handles repetitive administrative tasks, AP teams are evolving into strategic advisors for the business. Instead of chasing paper invoices, AP professionals now analyze trends, predict risks, and advise leadership on cash management strategies.

This shift requires closer collaboration between AP, procurement, and finance teams, breaking down silos and enabling better working capital optimization and supplier negotiations.

As AP automation evolves rapidly, finance teams can start adopting these trends today to gain efficiency, reduce errors, and improve cash flow management. Here’s a step-by-step approach:

By implementing these steps, finance teams can move from manual AP processes to a fully automated, data-driven function that improves efficiency, reduces errors, and positions AP as a strategic contributor to business performance.

In 2025, AP automation is reshaping how medium and large U.S. businesses manage payables by cutting costs, boosting efficiency, and strengthening controls. By digitizing invoice processing and approvals, companies streamline workflows, reduce manual work, and process payments much faster. This shift allows finance teams to handle growing invoice volumes without increasing headcount while improving accuracy and capturing more early-payment discounts. Many organizations are also shortening their month-end close cycles and freeing up finance teams to focus on more strategic tasks rather than repetitive, manual work.

Fraud prevention is another critical benefit, with over two-thirds of U.S. firms facing payment fraud attempts. Automation enforces strict controls like three-way matching, AI-powered anomaly detection, and secure audit trails, reducing fraud exposure. In the near term, adoption is accelerating due to real-time payment growth and e-invoicing compliance mandates. Looking ahead, the AP automation market is expected to double by 2028, with emerging technologies such as generative AI, blockchain, and advanced fraud detection pushing AP toward a fully touchless, secure, and strategic function, empowering finance teams to focus on cash flow optimization and decision-making rather than manual processing.

HighRadius Accounts Payable Management Software helps finance teams simplify complex accounts payable processes by combining AI-driven intelligence with seamless integration. The solution focuses on eliminating manual work, reducing errors, and giving AP teams complete visibility into every step of the invoice lifecycle.

Manually entering invoice data is time-consuming and error-prone. HighRadius Invoice Processing Software automatically captures invoice data from multiple sources , including emails, portals, e-invoice networks, EDI, and cXML with over 90% invoice auto-matched, helping teams process invoices faster and with fewer mistakes.

Traditional matching often leads to delays when invoices don’t align perfectly with purchase orders or receipts. HighRadius Invoice Matching Software uses AI algorithms to automate matching and quickly identify discrepancies, ensuring accurate payments and faster reconciliations.

AP teams often spend hours resolving exceptions. With intelligent workflows, HighRadius AP Software flags only the issues that require human review, enabling teams to process exceptions in just 3 minutes without adding headcount.

Lack of real-time visibility makes it hard to plan payments and manage cash flow. HighRadius provides clear dashboards and reports, helping finance leaders track performance, forecast upcoming payables, and make informed decisions.

As payment volumes grow, so does the risk of fraudulent activity. HighRadius continuously scans transactions for unusual patterns, giving AP teams early alerts to prevent losses and strengthen compliance controls.

HighRadius provides seamless AP ERP integration making it easy to scale as invoice volumes grow without disrupting current processes or adding complex IT overhead.

The top trends for 2025 include AI automation for invoice processing, cloud-based ERP systems, mobile AP applications, hyper-automation, enhanced supplier portals, and real-time payments. These trends aim to streamline operations, reduce costs, and enhance the strategic role of accounts payable within organizations.

AI improves accounts payable by automating data extraction, invoice matching, and fraud detection, which reduces manual tasks, enhances accuracy, accelerates payment approvals, and improves cash flow management. Additionally, leveraging AI can provide valuable insights into spending patterns and vendor performance, allowing organizations to make data-driven financial decisions.

Cloud-based ERP systems are essential because they centralize AP data, improve accessibility, support remote work, and facilitate real-time collaboration while ensuring secure and compliant financial management. Furthermore, these systems enhance scalability, allowing businesses to adapt to growth and changing market conditions seamlessly.

Real-time payments speed up processing, reduce delays, improve supplier relationships, and give US businesses greater visibility into cash flow, enabling faster decision-making and stronger financial control.

AP automation ensures accurate records, supports e-invoicing mandates, and helps US companies meet local and federal regulations, reducing risk, improving audit readiness, and maintaining consistent compliance.

Mobile AP apps let finance teams approve invoices, track workflows, and manage payments on the go, increasing efficiency, responsiveness, and overall productivity for US finance departments.

Finance teams should adopt AI-powered solutions, move to cloud-based platforms, implement real-time payments, and continuously train staff to stay ahead of evolving AP automation trends.

Yes. Scalable AP automation solutions help small and mid-sized US businesses reduce manual effort, minimize errors, accelerate processing, and gain efficiency without large IT investments.

AP automation reduces manual work, speeds invoice approvals, improves cash flow management, and enhances visibility, allowing businesses to lower costs and achieve a measurable ROI.

Hyper automation significantly boosts accounts payable efficiency by fully automating invoice processing and payment approvals, minimizing manual intervention, and providing real-time financial insights. This level of automation allows organizations to reallocate resources towards more strategic activities, ultimately enhancing overall performance and profitability.

Crucial security measures include encryption, multi-factor authentication, and audit trails to protect sensitive financial data, prevent fraud, and ensure compliance with regulations like GDPR and CCPA. Implementing these measures not only safeguards against data breaches but also helps instill confidence among stakeholders regarding the integrity of financial processes.

Businesses can prepare by adopting AI tools, migrating to cloud-based platforms, strengthening data security, implementing supplier portals, and investing in employee training to enhance AP efficiency and compliance. By taking these proactive steps, organizations can position themselves to leverage new technologies effectively and stay ahead in a rapidly evolving financial landscape.

Some common AP automation challenges include integrating with existing ERP systems, handling diverse invoice formats, ensuring data accuracy, managing change within teams, and maintaining compliance. Overcoming these requires robust software, clear workflows, and ongoing monitoring to maximize efficiency and ROI.

Ranked among the Top 15 Accounts Payable solutions in The Hackett Group’s 2025 report, HighRadius is recognized for excellence across implementation, scale, and AI-led intelligence, highlighting its ability to support complex, enterprise-scale AP operations

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center