Every finance leader knows the frustration of processes that slow decisions and drain resources. The cost of keeping manual systems becomes harder to justify as teams spend more time on routine tasks and less on analysis and strategy. Accounts payable is often at the heart of these inefficiencies, where delays, errors, and lack of visibility create ripple effects across the organization.

Using AP automation tools changes that. Routine tasks are handled automatically, errors are reduced, and teams gain real-time visibility into payments and cash flow. In fact, a KPMG study found that 92% of organizations report their AI initiatives in finance are meeting or exceeding ROI expectations, showing the tangible value automation can deliver.

But even with these benefits, getting approval for automation often stalls long before implementation. The missing piece is a well-structured business case that translates potential efficiency into tangible value.

In this article, we explore how to craft a compelling AP automation business case, highlighting measurable benefits, practical steps, and strategies to gain executive buy-in. First, however, let’s take a closer look at why AP automation is essential.

Manual accounts payable processes hide costs that finance leaders often miss while building their AP automation business case. These expenses are way beyond the reach and influence of visible processing costs. They create financial drains that affect the entire organization. Breaking down a few AP automation challenges below.

Managing invoices manually creates major operational bottlenecks. Finance teams waste hours looking for documents from different channels. They enter data by hand and route approvals through complicated pathways. Without AP automation, invoice approvals take 11 days or longer. This creates payment cycle delays. The team's constant chase for documents and information reconciliation stops them from working on projects that could help business growth.

Manual data entry leads to mistakes that get pricey and harm supplier relationships. Typing errors cause wrong payments that staff must fix. Duplicate payments are a serious concern. They happen when invoices arrive in different formats through multiple channels. These extra transactions affect cash flow directly. The recovery needs extensive reconciliation work. Companies without proper controls face these preventable losses. Error elimination becomes a vital part of any modern AP automation business case.

Traditional way of managing AP operations often miss chances to capture early payment discounts. This is one of their biggest hidden costs. Processing delays stop timely approvals. Companies miss valuable opportunities to cut costs through supplier discount programs. Traditional approval chains focus on compliance rather than speed. This pushes invoices past discount deadlines. As approval times grow longer from manual bottlenecks, these missed savings add up to big financial losses that could boost profitability.

Manual accounts payable workflows create security gaps that expose companies to financial and reputation damage. Systems without automation are open to internal and external fraud schemes. Manual systems make it hard to keep proper duty separation or create detailed audit trails. Companies also face compliance challenges. Manual processes struggle to maintain documentation standards needed for regulations and audits.

The human cost of manual AP processing is often overlooked in automation business cases. Finance professionals stuck in endless data entry, error fixes, and document chasing feel stressed out. Their job satisfaction drops. This heavy workload causes mental fatigue and lower productivity. It ended up increasing staff turnover. Organizations then face more costs through hiring, training, and lost knowledge. Beyond money, this burnout hurts team spirit and stops the finance department from being a strategic partner.

These hidden costs are the foundations of evaluating potential solutions and calculating true ROI when building an AP automation business case. The full impact of these inefficiencies shows why smart organizations prioritize accounts payable transformation.

Accounts Payable (AP) Automation is the use of technology to streamline and manage the process of paying a company’s invoices. Instead of manually handling paperwork, data entry, and approvals, AP automation leverages software to make the process faster, more accurate, and more transparent.

Cut Manual AP Work by 70% Without Replacing Your ERP

Learn how HighRadius integrates with your existing systems to automate invoice capture, matching, and payment.

Request a DemoOrganizations can build a strong business case by understanding fundamentals of implementing an automated payable software while pursuing efficiency and strategic advantage.

1. Digital AP

AP automation uses technology solutions to digitize and streamline accounts payable processes. These solutions replace manual, paper-based workflows with intelligent software systems. Digital systems handle invoice and payment tasks with minimal human intervention. The AP automation ecosystem creates a complete end-to-end solution that covers invoice capture, data extraction, approval routing, payment processing, and reconciliation.

2. Core Technologies

Modern AP automation solutions use several key technologies that work together. Optical Character Recognition (OCR) technology converts paper and electronic invoices into digital format and extracts critical data points. Artificial intelligence makes these capabilities better by processing invoice information intelligently, identifying patterns, and predicting discrepancies. Software "bots" handle repetitive, rule-based tasks throughout the AP workflow through Robotic Process Automation (RPA).

3. Automation Workflow

The complete accounts payable automation process follows a structured sequence. This sequence includes invoice capture, data extraction and validation, workflow automation, three-way matching, payment processing, reconciliation, and ERP integration. This approach will give a consistent, accurate, and efficient process at every stage.

AP automation is the life-blood of broader finance digital transformation initiatives. Organizations gain immediate operational benefits while building foundational capabilities for enterprise-wide transformation by digitizing a traditionally paper-heavy department.

The value of automation goes way beyond process efficiency. In fact, it creates a central platform where different departments can access and interact with invoice information live. This platform makes shared visibility possible between procurement, accounting, and operations teams. Teams make better strategic decisions with this cross-functional visibility.

CFOs and finance leaders gain strategic advantages critical to digital transformation goals through AP automation. Real-time dashboards and analytics provide unprecedented visibility into cash positions. Finance teams control cash flow planning and working capital optimization completely. These capabilities help organizations navigate economic uncertainty.

AP automation maintains consistent performance as businesses grow, regardless of transaction volumes. This adaptability helps AP processes accommodate growth without increasing headcount or operational costs proportionally.

Implementing automated accounts payable solutions serves as both a quick win and a long-term strategic investment in the digital transformation trip. It delivers immediate efficiency gains while building the data foundation needed for advanced finance initiatives.

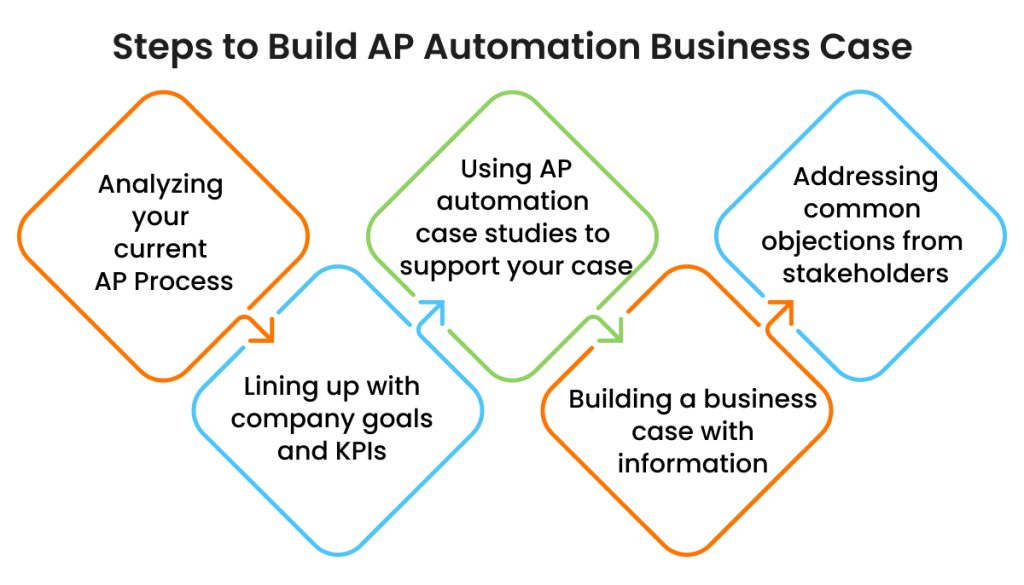

A well-planned and strategic approach helps finance leaders secure buy-in from decision-makers for AP automation. The business case must show a clear path that highlights both quick wins and strategic advantages over time.

A full picture of current process kicks off successful AP automation business case. Start by documenting your existing workflows to spot bottlenecks and waste. Set clear goals for implementation, then calculate potential savings across labor, materials, and operations. Create a timeline with key milestones and pick team members to lead the initiative. Your presentation should start with the numbers that matter—yearly savings, payback period, and three-year ROI—before outlining how you'll make it happen.

Key Actions:

Your AP automation business case should connect directly to your organization's bigger picture. Look beyond department efficiency and show how automation helps company-wide goals like better cash flow, stronger vendor relationships, and quick responses to change. This approach positions AP automation as a strategic tool rather than just a department upgrade. The KPIs that appeal to executives include shorter invoice lifecycles, better discount capture rates, and stronger fraud prevention.

Key Actions:

Real-life examples make your accounts payable automation business case more convincing. Companies that use AP automation report big improvements, cutting invoice backlogs in half within three months and reducing processing time from eight days to three. These success stories show real results and help stakeholders see similar possibilities in their organization. Adding examples from your industry makes your case even stronger.

Key Actions:

Evidence-based arguments are the foundations of a compelling business case. Measure the actual cost of manual processes using your company's numbers instead of industry standards. Track processing delays, error rates, wasted labor, and compliance work. This practical approach turns abstract ideas into business effects that executives can easily review and approve.

Key Actions:

Get ready for pushback by tackling common concerns head-on. Budget worries? Focus on ROI and payback periods. Worried about complex implementation? Map out a step-by-step approach with clear goals. Handle change management by getting key stakeholders involved early and showing them user-friendly systems. Taking these concerns seriously and providing thoughtful answers helps build support for your AP automation project.

Key Actions:

Finance leaders need concrete data to build a strong business case for AP automation investments. A clear picture emerges by looking at key metrics that show potential savings and better operations.

The direct cost reduction per invoice makes the strongest case for AP automation. Research shows companies with manual processes spend USD 12.00 to USD 40.00 per invoice. Companies that use end-to-end automation cut this cost to USD 1.45-2.00. This means an 80% drop in processing costs. Let's look at real numbers. A company that processes 5,000 invoices each month could save USD 55,650 every year through automation. These savings come from cutting paper costs, reducing work hours, and fixing fewer mistakes.

AP automation does more than just cut direct costs - it makes teams more efficient. AP automation boosts team efficiency by streamlining workflows and reducing manual tasks. Teams can process many more invoices per person, which allows the organization to scale operations without adding additional headcount. Faster processing also accelerates approval cycles, ensuring that payments move quickly and accurately.

AP automation makes an organization's financial position stronger through better cash flow control. Additionally, in manual AP handling finance teams used to struggle with payment tracking. Now, detailed dashboards show the full payment cycle, which helps with forecasting and cash management . This clear view helps shape financial planning.

Early payment discounts are a great way to get extra savings. AP automation ensures that early payment opportunities are not missed. By accelerating invoice processing and payment approvals, companies can take full advantage of supplier discounts, resulting in additional savings that directly benefit the bottom line.

AP automation cuts audit and compliance costs in a big way. Automated AP systems maintain detailed audit trails and centralized document storage, simplifying audit preparation and reducing compliance risks. The automated tool creates detailed audit trails by connecting all documents and messages for each transaction. This makes audit prep easier and cuts down the time auditors need. On top of that, it adds security controls to protect against payment fraud.

The task of shifting to an automated AP process doesn't end at building a strong AP automation business case. You need to carefully evaluate several critical factors to choose the right AP automation solution. These factors will shape your implementation success and create long-term value for finance operations.

1. Key features to look for in AP software solutions: The best AP automation platforms should offer intelligent data capture, approval workflow customization, and reliable document management capabilities. Your system needs strong validation rules to automatically check for errors. Good accounts payable software includes complete analytics dashboards that give you applicable information to optimize processes continuously.

2. Integration with existing ERP systems : ERP integration quality stands out as the most crucial factor among AP solutions. The platforms you choose should support two-way data exchange between your AP automation software and ERP system. This integration enables up-to-the-minute validation, automated GL coding, and direct voucher posting into your ERP without manual work.

3. Scalability for large enterprises: The solution you pick must grow with your business without adding costs or complexity. Each vendor's platform should handle increasing transaction volumes while maintaining speed. Your system should adapt to new business processes and regulatory requirements easily.

4. Training and change management: User adoption drives AP automation success. Your team needs complete training to build essential skills. The core team should communicate goals and benefits clearly to create buy-in from all stakeholders.

5. AP automation best practices for rollout: A full picture of current AP processes sets the foundation. Clear goals and an implementation lead ensure accountability. The phased approach helps manage risk as you roll out the system. Addressing common objections from stakeholders

HighRadius accounts payable automation software empowers finance teams to streamline accounts payable, reduce errors, and gain complete visibility into the invoice lifecycle. Key capabilities and outcomes include:

HighRadius automates the capture of invoices from various sources—emails, portals, EDI, and cXML—utilizing Optical Character Recognition (OCR) and AI to extract key data points. This automation reduces manual data entry errors and accelerates invoice processing, achieving over 90% auto-matching of invoices.

The platform employs AI algorithms to perform three-way matching between invoices, purchase orders, and goods receipts. This intelligent matching process identifies discrepancies swiftly, ensuring accurate payments and minimizing delays. Exception handling is streamlined, allowing AP teams to resolve issues efficiently without manual intervention.

HighRadius integrates seamlessly with major ERP systems, automating master data imports, synchronizing purchase orders and goods receipts, and facilitating real-time invoice posting. This integration ensures consistent data flow across systems, enhancing financial visibility and reducing the risk of errors.

The platform enforces approval workflows and validation rules, ensuring compliance with company policies and regulatory requirements. Automated record-keeping and centralized document storage facilitate audit readiness, providing easy access to historical data and reducing the risk of non-compliance.

HighRadius' cloud-based solution is designed to scale with your business needs. Whether managing a growing volume of invoices or expanding to new geographies, the platform adapts to your requirements without the need for significant IT resources or infrastructure changes.

AP automation is the use of technology to digitize and streamline accounts payable processes. It's crucial in 2026 because it significantly reduces costs, improves efficiency, and provides better visibility into financial operations, helping businesses stay competitive in an increasingly digital landscape.

AP automation reduces manual data entry, errors, and approval delays while optimizing payments. It enables early payment discounts, lowers audit and compliance effort, and frees staff for strategic work. Savings vary, but most companies see measurable efficiency and cost gains quickly.

Hidden costs of manual AP processes include time lost in invoice processing, human errors leading to duplicate payments, missed early payment discounts, increased fraud risks, and employee burnout resulting in higher turnover rates.

AP automation significantly boosts productivity by allowing teams to process more than three times as many invoices per employee annually. Automated systems can handle 23,333 invoices per full-time employee compared to 6,082 for manual processors.

Start by identifying pain points in your current AP process, quantify potential savings in cost and time, highlight efficiency gains and risk reduction, and demonstrate ROI. Include real-world examples, projected outcomes, and executive-friendly metrics to gain buy-in.

When selecting AP automation software, companies should prioritize features like intelligent data capture, customizable approval workflows, robust document management, and strong integration capabilities with existing ERP systems. The solution should also be scalable to accommodate business growth.

Companies typically see measurable ROI within months, depending on invoice volumes, process complexity, and automation coverage. Benefits include lower processing costs, fewer errors, improved cash flow, and increased team productivity.

Ranked among the Top 15 Accounts Payable solutions in The Hackett Group’s 2025 report, HighRadius is recognized for excellence across implementation, scale, and AI-led intelligence, highlighting its ability to support complex, enterprise-scale AP operations

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center