Every delay in the accounts payable process has a direct impact on cash flow. Manual handling of invoices often leads to errors, late approvals, and missed payment windows. These inefficiencies translate into higher processing costs, strained vendor partnerships, and lost opportunities to benefit from discounts. For CFOs, the lack of speed and visibility in AP creates gaps in forecasting accuracy and limits the ability to deploy working capital effectively.

Basically accounts payable processes were never meant to be a back-office bottleneck. Yet when managed manually, it undermines a company’s ability to optimize working capital and capture opportunities for growth. Finance leaders who lack real-time insight into payables cannot act with confidence on investment or liquidity decisions.

Automation-driven software accounts payable addresses these challenges by streamlining every step of the process. From invoice capture to final payment, automated payable software delivers speed, accuracy, and control. CFOs gain real-time visibility into obligations, improve cash predictability, and elevate AP from a cost center into a driver of cash flow efficiency and strategic financial value.

Top AP Teams Capture Up to 85% of Supplier Discounts With The Right Payable Software?

Is Your Manual Process Missing Cash? Check With These Critical KPIs.

Download AP KPIsPayable software is a tool that digitizes the AP process, from invoice intake to approvals and payments. It centralizes vendor data, reduces manual effort, and gives finance leaders real-time visibility into obligations. Software accounts payable empowers CFOs to manage working capital with speed and accuracy.

The right software accounts payable does more than speed up invoice processing. It delivers measurable improvements across efficiency, accuracy, and liquidity management, turning accounts payable into a lever for stronger financial performance.

Leading software accounts payable help finance teams streamline invoice processing, improve cash flow management, and gain real-time visibility into payables.

Businesses face increasing pressure from growing invoice volumes, complex compliance requirements, and tighter working capital constraints. Manual accounts payable processes are slow and prone to error, creating operational friction that impacts cash flow and supplier trust. Without automated software accounts payable, finance teams struggle to maintain visibility, accuracy, and control over critical payment processes.

Software Accounts Payable automation transforms how finance functions operate. Automated invoice capture, approval routing, and payment execution reduce cycle times and errors while providing real-time insights into outstanding liabilities. Finance leaders gain transparency into cash obligations, enabling better working capital management and strategic decision-making.

In 2025, AP is no longer solely an operational function. Advanced, automated payable software allows CFOs to turn accounts payable into a strategic lever that enhances liquidity, improves forecasting, and supports enterprise growth. Companies adopting automated software accounts payable achieve faster payment cycles, stronger supplier relationships, and a measurable impact on financial performance.

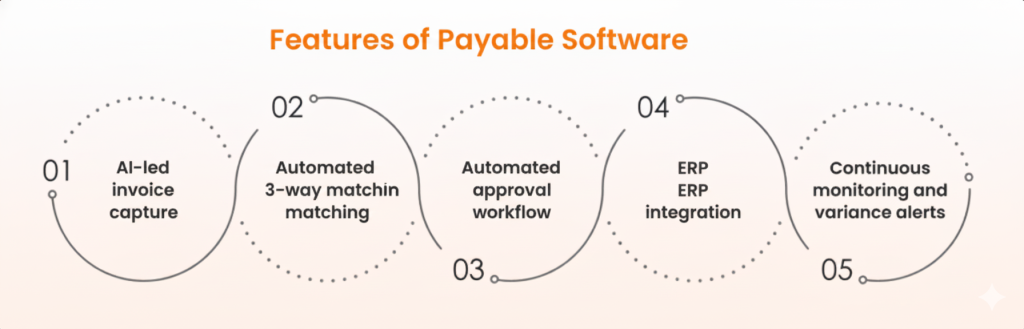

Modern Payable software is designed to turn AP from a transactional function into a strategic lever for cash flow and compliance. Key capabilities include:

Together, these capabilities streamline AP operations, reduce manual effort, and give finance leaders actionable intelligence. The right software accounts payable combines AI-driven automation, deep ERP integration, and advanced analytics to improve cash flow efficiency and strengthen supplier relationships.

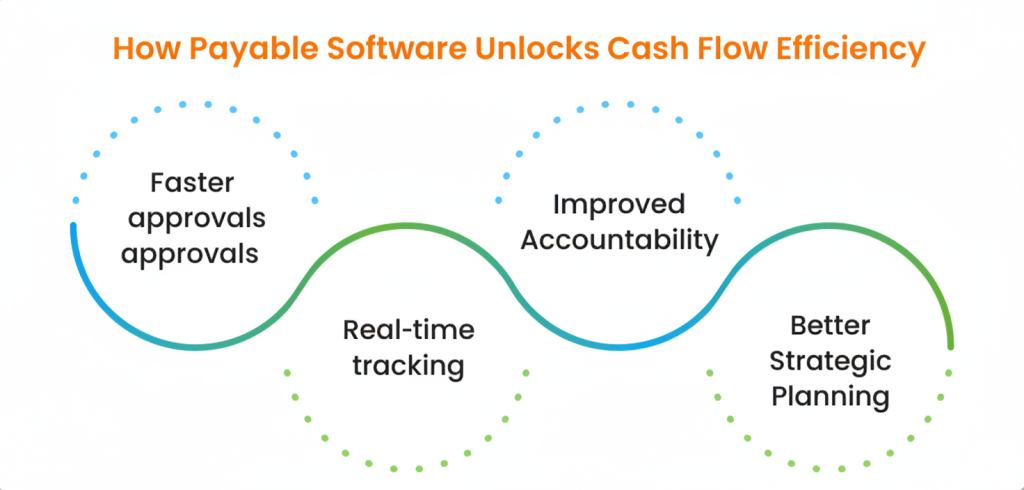

Unlocking cash flow efficiency requires turning accounts payable from a transactional process into a strategic lever that accelerates payments, improves working capital, and strengthens supplier relationships. Here’s how automated software accounts payable helps.

Automated workflows accelerate the approval process, allowing businesses to capitalize on early payment discounts, improving cash flow and supplier relations.

Continuous visibility into payables enables strategic payment scheduling, ensuring liquidity is maintained without compromising supplier relationships.

By reducing DPO, companies can enhance supplier trust, potentially negotiating better terms and discounts.

Advanced analytics offer CFOs accurate forecasts, aiding in better financial planning and decision-making.

The right software accounts software delivers AP automation that goes beyond operational efficiency. Its AI-first design enables autonomous finance processes, minimizing manual effort and error. Deep ERP integration ensures that all payable data syncs in real time, giving CFOs complete control over cash flow and working capital.

Additionally, the payable software must demonstrate measurable impact. An advanced, automated software accounts payable accelerates invoice cycle by 60–80%, unlocks early payment discounts, and strengthens supplier relationships. By combining intelligent automation, robust integration, and proven results, businesses will not only be able to transform accounts payable into a strategic function but also drive liquidity, compliance, and enterprise-wide financial performance.

The success of implementing software accounts payable depends on a structured approach that balances technology with people and processes. CFOs should focus on practical, measurable steps.

A disciplined approach to implementing payable software accelerates ROI, improves compliance, and positions accounts payable as a strategic function rather than a transactional process.

Many finance leaders recognize that the accounts payable process is broken with manual data entry, delayed invoice approvals, and error-prone workflows force teams to spend time firefighting instead of optimizing working capital. Choosing the wrong accounts payable automation tools only makes the problem worse. Businesses must ensure they choose the best payable software that closes integration gaps, scale globally, and offer AI-driven intelligence, give CFOs complete visibility, higher compliance, and more opportunities for supplier discounts.

HighRadius offers a smarter path forward. Its software accounts payable offers an end-to-end automation that combines AI-powered invoice scanning and capture with intelligent invoice processing, three-way invoice matching, and configurable approval workflows to remove friction from every step.

Here are the key features of HighRadius Payable Software.

AI-Powered Invoice Scanning & Capture

Eliminates manual data entry by digitizing invoices across email, portals, and EDI with precision.

Intelligent Invoice Processing

Automates validation and ensures seamless exception handling for faster, error-free workflows.

Matches invoices against POs and receipts in real time to reduce disputes and duplicate payments.

Configurable Approval Workflows

Enables policy-driven, role-based routing that accelerates cycle times without compromising control.

Connects directly with leading ERP systems for a single source of truth across finance operations.

Gives CFOs live visibility into liabilities, cash outflows, and working capital positions.

Uses AI to flag anomalies and prevent costly errors before they escalate.

The result? 50% reduced invoice processing costs, 100% policy adherence and 90% auto-detection of errors.

Payable software automates invoice capture, approvals, and payments while providing real-time reporting, reducing manual effort, errors, and ensuring timely vendor payments for better cash flow management.

Automated software accounts payable speeds invoice approvals, optimizes payment scheduling, and captures early payment discounts, reducing DPO and improving working capital visibility and liquidity for strategic decision-making.

When choosing software accounts payable, look for AI-powered invoice capture, automated matching, workflow approvals, ERP integration, real-time analytics, compliance tracking, and cash flow forecasting to optimize efficiency and reduce risk.

HighRadius payable software combines AI-driven automation, deep ERP integration, and autonomous finance capabilities, delivering faster processing, accurate forecasting, and measurable impact on cash flow and working capital.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center