The market is crowded with accounts payable processing software that promises automation but delivers little beyond document scanning and OCR. For CFOs, this half-step digitization adds cost without unlocking real efficiency. To meet the evolving invoicing needs and suppliers’ expectations, businesses solutions that give more than just incremental improvements. This blog talks about critical questions businesses must ask before diving headfirst into buying an accounts payable processing software. They must ensure that the solution delivers autonomy, accuracy, and financial impact before you commit your next dollar of investment.

Every invoice left to manual entry burns $10–$15!

While AI-led payables slashes it by 40%.

Download AI guideAccounts payable processing software integrates every step of the invoice lifecycle, from capturing, validating, matching, approval and payment into one seamless, AI-driven flow. Machine learning and OCR extract and verify invoice data automatically, while intelligent workflows approve and pay without human intervention.

This end-to-end automation reduces errors, accelerates cycle times, and improves working capital visibility. In contrast, legacy tools only digitize paperwork, still requiring AP teams to manually review exceptions or approvals. True automation replaces manual oversight with predictive accuracy and continuous process optimization.

The right accounts payable software unifies every step of the payables lifecycle into one automated system. It involves invoice capture, matching, approvals, and payments.

Manual invoice touchpoints, delayed payments, and exception overload reveal the limits of legacy AP tools. Here’s how to identify AP tools capabilities that eliminate these gaps through AI-powered automation.

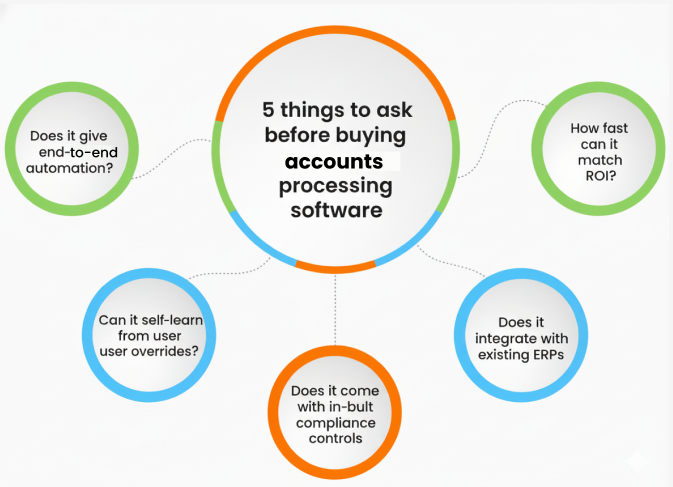

Ask if the software can automatically capture invoices, handle exceptions, route approvals, and trigger payments without human touchpoints. True AI-driven automation compresses invoice processing cycles by 70% or more, eliminating delays caused by manual validation.

Modern AP management software powered by machine learning continuously refine accuracy. Every time users override a match or correct an exception, the platform learns and adjusts its algorithms, increasing future precision. Over time, this self-learning capability means fewer exceptions, faster throughput, and near-autonomous processing, a sharp contrast to static rule-based tools that never improve.

CFOs can’t afford integration delays. The best payable software is built API-first, enabling real-time synchronization with major ERP systems through plug-and-play connectivity. It integrates directly with SAP, Oracle, and Microsoft Dynamics with minimal IT dependency, ensuring a unified source of truth for invoice and payment data.

Financial integrity depends on system controls. Advanced AP platforms include maker-checker workflows, automated policy enforcement, and real-time audit trails that detect duplicate invoices or policy violations before payments are released. These safeguards ensure governance while maintaining processing speed.

Speed matters. Leading accounts payable processing software solutions deploy in under eight weeks with guided onboarding, prebuilt ERP connectors, and rapid user adoption frameworks. Most CFOs see measurable ROI within the first quarter through lower invoice processing costs, early payment discounts, and reduced exceptions.

Before investing in any accounts payable processing software, pressure-test it for scale. Can it handle volume growth, global operations, and complex approval hierarchies without adding headcount? Here’s what you should look for.

Red flags that signal future friction:

Legacy accounts payable processing software traps finance teams in a reactive cycle. Manual touchpoints and fragmented data flows delay insights, inflate cycle times, and reduce your ability to leverage early payment discounts. As volumes grow, legacy systems simply can’t scale without adding headcount or risk.

HighRadius replaces fragmented workflows with a connected, AI-powered accounts payable processing software. With pre-built ERP integrations for SAP, Oracle, and NetSuite, it automates the full invoice lifecycle, from capture and validation to approval and payment. Finance, procurement, and treasury teams gain real-time visibility, automated compliance, and continuous process optimization. This enables businesses to unlock faster closes, stronger controls, and working capital that actually works.

Here are other key features of HighRadius Payable Software.

AI-Powered Invoice Scanning & Capture

Eliminates manual data entry by digitizing invoices across email, portals, and EDI with precision.

Intelligent Invoice Processing

Automates validation and ensures seamless exception handling for faster, error-free workflows.

Matches invoices against POs and receipts in real time to reduce disputes and duplicate payments.

Configurable Approval Workflows

Enables policy-driven, role-based routing that accelerates cycle times without compromising control.

Connects directly with leading ERP systems for a single source of truth across finance operations.

Gives CFOs live visibility into liabilities, cash outflows, and working capital positions.

Uses AI to flag anomalies and prevent costly errors before they escalate.

Accounts payable processing software automates invoice receipt, data capture, approval routing, and payments. It reduces manual work, eliminates duplicate entries, and accelerates the invoice-to-pay cycle while providing full visibility and audit trails for finance teams.

AI enhances AP processing by reading invoices using OCR, matching them to POs, and flagging exceptions automatically. Machine learning refines accuracy over time, cutting manual touchpoints, reducing errors, and ensuring invoices are processed faster and with higher compliance.

CFOs adopt AP processing software to gain real-time visibility into payables, optimize cash flow, and shorten approval cycles. By removing manual tasks and enabling faster, touchless invoice processing, it helps improve working capital efficiency and reduce processing costs.

True automation covers invoice ingestion, validation, exception handling, and approval workflows end-to-end. It integrates directly with ERP systems, enforces policy compliance, and delivers analytics for better spend control and decision-making across global finance operations.

HighRadius automates invoice capture, exception management, and approvals through AI and machine learning. It integrates seamlessly with ERPs, provides real-time dashboards for CFOs, and enables faster, error-free payments, transforming AP into a strategic, data-driven function.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center