For CFOs, fragmented AP systems go beyond mere inefficiencies. Manual invoice entry, duplicate payments, and disconnected workflows still cost enterprises millions. Gartner reports that 60% of CFOs identify ERP integration as the key obstacle to scaling AP automation. Leading businesses are solving it with AP Management Software that embeds automation inside ERP systems, linking invoice capture, approvals, and payments in one digital thread.

By embedding AI-driven workflows directly within ERP environments like SAP, Oracle, and NetSuite, the AP automation ERP integration solutions eliminate duplicate entries and manual uploads, delivering seamless data flow and end-to-end automation. In 2026, AP automation ERP integration is the lever for agility, audit readiness, and cash flow precision.

This guide breaks down the 2025 best practices for ERP-integrated AP management software—what it is, why it matters, and how CFOs can benchmark their current systems.

AP teams that use automation can slash invoice cycle delays by 80%.

While you are stuck every quarter on slow approvals and manual coding?

Download AI GuideAP Automation ERP Integration unifies invoice processing, approvals, and payments inside the ERP to deliver end-to-end visibility and control. Instead of managing fragmented systems, CFOs gain a single automated platform that connects AP data with procurement, treasury, and accounting in real time.

The integration follows a structured path: evaluate workflows, clean master data, select ERP-compatible AP Management Software, pilot the setup, and scale in phases. Native ERP connectivity removes manual intervention, accelerates approvals, and strengthens governance. With accounts payable automation tools, businesses get shorter cycle times, lower exception rates, and optimized working capital. In 2025, it’s not just a technology upgrade—it’s the foundation of digital finance operations.

As automation becomes core to AP transformation, businesses must ensure that their AP management software delivers efficiency, accuracy, and visibility across the payables process.

Uses OCR and machine learning to extract, validate, and route invoices automatically—cutting manual data entry and errors.

Connects directly with ERP systems to synchronize invoice, payment, and supplier data for complete financial visibility.

Offers instant insights into invoice aging, approvals, and cash flow forecasts, helping CFOs make faster, data-driven decisions.

Provides secure approval workflows, audit trails, and policy enforcement to reduce risk and maintain governance integrity.

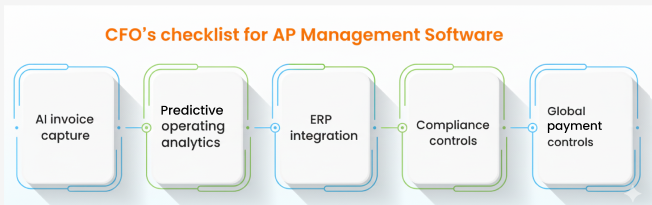

CFOs in 2026 need AP Management Software that does more than basic automation. It must transform payables into a strategic advantage. Here’s the checklist CFOs must consider.

Here’s a quick checklist for you to find out.

| Must-Have Feature | Why It Matters for CFOs | 2025 AP Management Software Standard | ERP-Integrated AP Automation Advantage |

| AI-Driven Invoice Capture | Eliminates manual data entry, reduces errors, speeds approvals | OCR reads and validates invoices automatically | Seamless posting into ERP without rekeying |

| Predictive Analytics Dashboards | Provides actionable spend insights and cash flow forecasts | Visual dashboards and KPI tracking | Real-time ERP data for accurate forecasts and decision-making |

| Deep ERP Integration | Ensures payables data is always synchronized | Native connectors with SAP, Oracle, NetSuite | Two-way sync enables instant invoice updates and approvals |

| Fraud Detection & Compliance Controls | Maintains audit readiness and regulatory compliance | Role-based access and automated approval workflows | ERP-linked controls enforce enterprise-wide governance |

| Global Payments Support | Handles multi-entity and multi-currency payments | Supports major currencies and multi-entity setups | Automates cross-border payments directly from ERP with minimal risk |

CFOs can’t afford fragmented AP systems. AP automation ERP integration is the core of modern payables automation, ensuring that AP Management Software works in lockstep with SAP, Oracle, or NetSuite. This eliminates data silos, enables instantaneous visibility across finance and procurement, and shortens the close cycle.

Automated invoice posting and approval workflows significantly reduce errors, while a single, unified audit trail guarantees compliance across all entities. For CFOs, ERP-integrated AP automation translates directly into measurable improvements in liquidity, risk reduction, and operational efficiency, turning AP into a strategic advantage rather than a bottleneck.

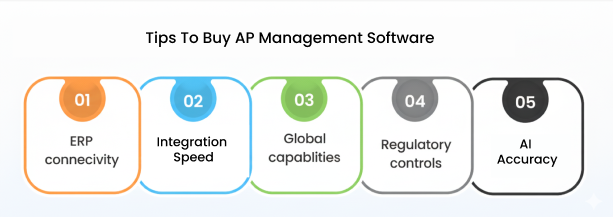

Before committing to AP Management Software, CFOs should ask vendors five critical questions to ensure strategic value:

Asking these questions positions CFOs as strategic evaluators, ensuring the AP solution delivers efficiency, compliance, and measurable ROI.

Many finance leaders recognize that traditional accounts payable processes are broken. Partial ERP integrations in legacy AP management software often leave critical data in silos, causing delayed invoice approvals, manual reconciliations, and error-prone workflows. Teams spend valuable hours firefighting exceptions instead of optimizing working capital. Choosing the wrong AP software amplifies these inefficiencies.

HighRadius AP software offers smarter AP automation ERP integration. Its solution seamlessly connects with SAP, Oracle, and NetSuite, providing end-to-end automation, from AI-powered invoice scanning and capture to intelligent processing, three-way matching, and configurable approval workflows.

Full integration ensures real-time synchronization across finance, procurement, and treasury, delivering complete visibility, higher compliance, and faster access to supplier discounts. Unlike partial solutions, HighRadius eliminates silos, accelerates the close cycle, and transforms AP into a strategic driver of enterprise efficiency.

Here are other key features of HighRadius Payable Software.

AI-Powered Invoice Scanning & Capture

Eliminates manual data entry by digitizing invoices across email, portals, and EDI with precision.

Intelligent Invoice Processing

Automates validation and ensures seamless exception handling for faster, error-free workflows.

Matches invoices against POs and receipts in real time to reduce disputes and duplicate payments.

Configurable Approval Workflows

Enables policy-driven, role-based routing that accelerates cycle times without compromising control.

Connects directly with leading ERP systems for a single source of truth across finance operations.

Gives CFOs live visibility into liabilities, cash outflows, and working capital positions.

Uses AI to flag anomalies and prevent costly errors before they escalate.

AP Automation ERP Integration connects accounts payable automation tools with enterprise resource planning systems to sync invoice data, approvals, and payments in real time. It eliminates manual entry and improves accuracy across financial workflows.

ERP integration ensures invoices, payments, and approvals automatically update across systems. It reduces duplicate data entry, speeds up reconciliations, and provides real-time financial visibility for CFOs.

Modern AP management software should include AI-driven invoice capture, deep ERP integration, compliance-ready workflows, analytics dashboards, and fraud prevention tools.

Most enterprise-grade AP automation platforms offer pre-built connectors for major ERPs like SAP, Oracle, NetSuite, and Microsoft Dynamics, enabling faster deployment and smoother data flow.

As finance moves toward real-time reporting, ERP-integrated AP automation allows CFOs to maintain data consistency, optimize cash flow, and enhance audit transparency across entities.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center