Finance teams face rising invoice volumes and increasing compliance pressures, making invoice automation essential for modern accounts payable. Over 80% of APAC businesses now process invoices electronically, far exceeding the global average. Digital workflows highlight the need for greater speed, accuracy, and compliance in accounts payable.

Capturing invoices is just the beginning; matching them to purchase orders and goods receipts remains a time-consuming and error-prone process. Modern invoice matching software use AI, OCR, and rule-based validation to automate this process, eliminating mismatches, preventing overpayments, and enabling near-touchless processing.

This blog reviews leading invoice matching platforms for 2026, explaining how finance teams can verify, approve, and pay invoices with precision and control.

| Platform | Best Suited For | Key Features | Pricing |

| HighRadius | Mid-sized to large enterprises needing advanced invoice matching automation | Automated 2-way & 3-way matching, line-level validation, exception workflows, ERP-native integrations, real-time dashboards | Check Pricing |

| SAP Ariba | PO & receipt validation, workflow routing, centralised invoice tracking, compliance documentation | Companies want structured invoice validation and workflow controls | Contact for Pricing |

| Basware | Enterprises with multi-entity purchasing & AP processes | PO & GRN-based matching, exception handling, multi-entity reporting, e-invoice validation | Contact for Pricing |

| Coupa | Enterprises seeking unified procurement + AP workflows | PO matching, approval routing, invoice status dashboards, supplier collaboration | Contact for Pricing |

| Medius | PO matching, line-item checks, review workflows, and invoice tracking | Mid-sized businesses with standardised AP processes | Contact for Pricing |

| Tipalti | Teams prioritising collaborative AP review and approvals | PO matching, invoice lifecycle tracking, supplier validation, document management | Contact for Pricing |

| Stampli | PO matching, communication tools, approval routing, and audit logs | Mid-sized organisations needing straightforward matching workflows | Contact for Pricing |

| Yooz | Basic PO matching, data extraction, exception flagging, and approval workflows | PO & receipt matching, workflow automation, document capture, exception routing | Contact for Pricing |

| Nanonets | Small to mid-sized teams seeking lightweight matching functionality | PO validation, exception tracking, workflow approvals, and audit logs | Contact for Pricing |

| Invoiced | Businesses wanting simple invoice tracking with basic matching | PO validation, exception tracking, workflow approvals, audit logs | Contact for Pricing |

An invoice matching software is a digital tool that automatically reconciles invoices against related documents, such as purchase orders, goods receipts, and contracts, to verify accuracy before payment. Rather than relying on manual line-by-line checks, these systems use a mix of rules, OCR, and machine learning to normalise invoice data, perform matches, and surface any variances for review.

The result is faster approvals, fewer overpayments, and stronger controls in accounts payable. Modern invoice matching platforms also provide valuable insights to procurement and finance teams, enabling organisations to reduce exceptions and make more informed cash flow decisions.

While the definition covers what an invoice matching tool does, the real value appears when you see how these platforms streamline AP operations from start to finish. Modern tools do more than compare documents. They automate checks, validations, and approvals that usually slow invoice processing.

With AI, OCR, business rules, and ERP integrations, the invoice matching tool enables finance teams to reduce manual effort, identify discrepancies early, and maintain financial control. The features below demonstrate why these solutions are essential for organisations that want to scale AP without incurring additional workload.

2-way and 3-way invoice matching are core controls within accounts payable that help organisations verify whether an invoice should be paid. These matching methods compare invoices against supporting documents to prevent overpayments, duplicate payments, and fraud. They are essential for AP teams seeking to enhance accuracy, strengthen compliance, and minimise the manual workload associated with validating supplier invoices.

Still Resolving Invoice Discrepancies Manually?

See How HighRadius Automates 3-Way Invoice Matching to Eliminate Errors and Reduce Processing Time by 70%

Request a DemoHere’s a simple breakdown of how each process works and when businesses typically use them:

| Matching Type | What It Compares | When It’s Used |

| 2-way matching | Invoice & Purchase Order (PO) | When goods or services don’t require physical receipt tracking |

| 3-way matching | Invoice & Purchase Order & Goods Receipt Note | When physical goods must be received and verified |

AP teams verify whether the vendor’s invoice aligns with the approved purchase order. If the item price, quantity, and terms align, the invoice moves to approval. This is ideal for digital, intangible, or recurring purchases where receipt validation isn’t required.

Here, AP compares three documents:

It is essential for enterprises handling physical goods, procurement-heavy operations, or industries with strict compliance requirements.

The choice between 2-way and 3-way matching often depends on the risk profile of the purchase:

In short:

2-way = speed and simplicity

3-way = accuracy and control

Invoice volumes and supplier networks are growing fast. Manual matching creates bottlenecks. AP teams spend hours checking invoices against POs and receipts, fixing discrepancies, and talking with procurement or warehouse teams.

This slows approvals, raises error risk, and weakens financial control, especially in enterprises that manage thousands of invoices monthly. Here’s how invoice matching automation strengthens enterprise AP processes.

Tired of Fixing the Same Matching Errors Every Month?

HighRadius eliminates 70% of invoice-PO mismatches automatically, saving your team hours each week

Request a DemoAutomatically validates invoice line items, quantities, unit prices, and PO details, dramatically reducing discrepancies and preventing costly mistakes.

Enables straight-through processing (STP) so invoices move faster through the system, helping AP teams meet payment terms and unlock early-payment discounts.

Flags duplicate invoices, mismatched SKUs, inflated quantities, and non-PO invoices before they reach the payment queue, reinforcing financial control.

Maintains detailed digital trails for every match, exception, and approval, making audits smoother and ensuring regulatory alignment.

Cuts the time spent on manual comparisons and data checks, allowing AP teams to focus on strategic tasks such as vendor analysis and process optimisation.

Provides a consistent automated matching framework that supports rising invoice volumes, multiple business units, and expanding supplier networks. Moreover, it enhances supplier relationships by expediting dispute resolution, ensuring predictable approval timelines, and minimising payment delays, ultimately fostering stronger supplier trust and collaboration.

Today’s leading invoice matching tools uses AI, machine learning, and rule-based workflows to validate invoices against POs and receipts without manual intervention. Whether you operate a lean AP function or manage high-volume global procure-to-pay operations, choosing the right automated invoice matching solution can dramatically reduce exceptions, improve visibility, and accelerate payment cycles.

Below is a curated selection of 10 top invoice matching tool options for 2026, detailing features, pros, cons, integrations, and pricing insights tailored for finance and accounts payable decision-makers.

HighRadius offers the best invoice matching automation platform built for enterprises and mid-market organisations that need accurate, high-speed, and exception-light AP operations. Finance teams use HighRadius to automate two-way, three-way matching at scale, eliminating manual efforts by 90%, which typically involves validating quantities, prices, receipts, and PO references. In mid-market PoCs, HighRadius consistently delivers 80–90% intelligent match rates, even on low-quality or non-standard invoice layouts.

Research shows that matching invoices against PO/GRN accounts for 22% of analyst effort and 21% of all AP workload across 21 tasks, making it one of the biggest time drains in the AP function. HighRadius addresses this directly with line-level matching, tolerance-based rules, and exception prediction that dramatically reduce manual touchpoints and accelerate approvals.

Organisations adopt HighRadius because it eliminates one of the most labour-intensive AP tasks, matching invoices to POs and receipts, with 90%+ accuracy and speed. By combining high-quality document capture, advanced matching logic, and intelligent exception management, HighRadius enables AP teams to handle large volumes without adding headcount & improve efficiency by 50%.

Enterprises benefit from faster cycle times, reduced manual workloads, better compliance, and a significant drop in matching-related exceptions. For global companies looking to modernise AP operations, HighRadius delivers the automation depth, scale, and reliability needed to transform invoice matching into a high-efficiency, low-touch process.

SAP Ariba includes invoice matching capabilities as part of its integrated procure-to-pay suite for large enterprises. It validates invoice details against purchase orders and goods receipts, helping maintain structured procurement workflows. Teams can track mismatches and route them through standardised review processes. Organisations rely on Ariba when they need end-to-end purchasing and AP oversight within a single ecosystem.

Basware offers automated invoice matching within its AP automation platform, supporting large organisations with multi-entity purchasing structures. It validates invoices at the line-item level and highlights discrepancies that require attention. Teams benefit from a consolidated view of invoice progress across business units and regions. Basware is often adopted by enterprises needing high visibility and control across global AP operations.

Coupa provides invoice matching as part of its unified spend management platform. The system verifies supplier invoices against approved purchase orders and ensures mismatches follow predefined approval routes. It offers visibility into invoice ageing, pending reviews, and match status for both procurement and AP teams. Coupa is commonly adopted by enterprises looking for a tightly connected procurement and AP environment.

Medius includes invoice matching features that support line-level validation for PO and non-PO invoices. It identifies discrepancies early and routes exceptions to stakeholders for resolution. AP teams gain clearer visibility into invoice status as documents move through review and approval cycles. Medius is widely used by organisations aiming to reduce manual review time and improve match accuracy.

Tipalti provides invoice matching as part of its AP suite, designed for mid-sized businesses with structured purchasing processes. It verifies invoice details against purchase orders and flags mismatches for AP review. The platform consolidates invoice activity in one place, helping teams track progress and reduce delays. Tipalti is typically chosen by organisations seeking standard matching and payment workflows.

Stampli offers invoice matching within its collaborative AP automation platform. It validates invoices against purchase orders and enables teams to coordinate mismatches directly within the system using built-in communication tools. The platform makes it easier to track reviews and reduce approval delays. Stampli is a fit for teams that prioritise faster coordination between AP, procurement, and internal stakeholders.

Yooz provides invoice matching capabilities for mid-sized organisations handling growing AP volumes. The platform compares invoice data against purchase orders and receipts to reduce manual validation work. Its workflow features help streamline exceptions, approvals, and documentation. Yooz is often adopted by teams looking for a simple, centralised matching process.

Nanonets includes basic invoice matching features as part of its document processing workflows. It extracts invoice data and validates key fields against purchase orders where needed. The platform helps reduce data entry and provides visibility into matched and mismatched invoices. Nanonets is commonly used by teams seeking lightweight matching capabilities with simpler automation needs.

Invoiced provides invoice processing and limited matching features within its AR/AP workflow automation tools. It helps businesses validate supplier invoices against purchase order data and track mismatches through centralised dashboards. The platform improves visibility into approvals and invoice status across teams. Invoiced is used by organisations that want unified document tracking and simplified matching workflows.

Automated invoice matching tool helps enterprises eliminate the repetitive, error-prone steps that slow down accounts payable teams. Instead of validating invoices manually against POs and receipts, the system performs real-time checks, identifies discrepancies, and routes exceptions to the right people.

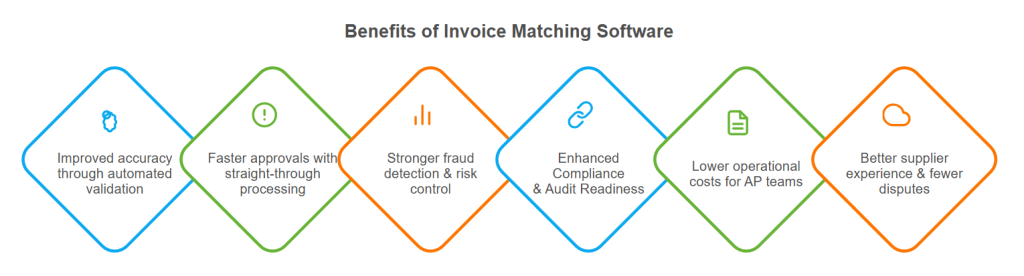

Here are the benefits of using automated invoice matching tool in your payable processes:

Automated invoice matching ensures every line item, quantity, and price is checked against purchase orders and goods receipt data. This reduces discrepancies, minimises exceptions, and helps teams maintain higher invoice accuracy at scale.

By validating invoices instantly and routing only exceptions for review, automated invoice matching shortens approval timelines and supports straight-through processing. This helps enterprises meet payment terms, prevent late fees, and take advantage of early-payment discounts.

The platform flags duplicate invoices, mismatched SKUs, unauthorised suppliers, or invoices without supporting documents before they are processed for payment. This reduces exposure to errors, fraud, and non-compliant transactions.

Each match, approval, and exception is logged automatically, creating a complete digital audit trail. This makes compliance reporting easier for finance, procurement, and audit teams, especially in regulated industries.

Automated matching eliminates the heavy manual workload involved in validating invoices, freeing teams from routine tasks. This reduces processing costs, allowing finance teams to focus on supplier relationships, cash flow planning, and cost control.

As vendors, business units, and invoice volumes grow, automated invoice matching provides a standardised framework that remains consistent across the organisation. This supports global operations without increasing team size.

When matching is automated, disputes are resolved more quickly, approvals are more predictable, and payments are made more efficiently. This builds trust with suppliers and strengthens long-term relationships.

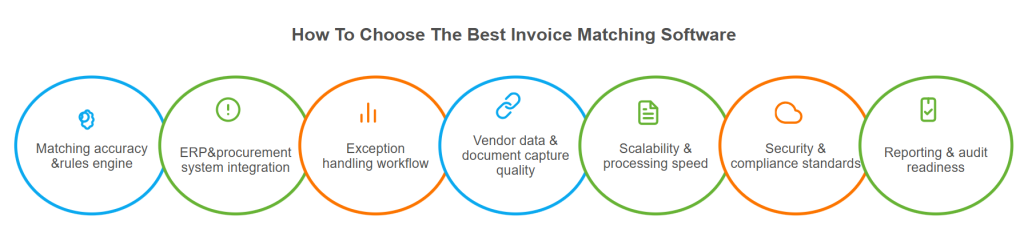

Choosing the right invoice matching automation platform comes down to understanding how well it aligns with your current AP workflows, the volume of invoices you process, and the complexity of your vendor ecosystem. The best invoice matching tool should not only automate rule-based matching but also intelligently flag exceptions, reduce manual interventions, and integrate seamlessly with your ERP. Here are the important things to note while choosing an invoice matching automation tool for your business:

Look for the platform that supports 2-way, 3-way, and n-way matching with customizable tolerance thresholds. Strong automation depends on an AI-driven rules engine that minimises false positives and reduces manual exception reviews.

Your invoice matching automation tool should integrate seamlessly with ERPs such as SAP, Oracle, NetSuite, or Microsoft Dynamics. Real-time data exchange enables accurate PO, GRN, and invoice alignment while eliminating reconciliation delays.

Choose the platform that automatically routes mismatches to the right stakeholder with full context, audit trails, and resolution suggestions. This is where automation delivers the biggest time savings and improves approval speed.

Ensure the platform includes OCR or AI-based document ingestion that extracts line-level data accurately from invoices, POs, and receipts, critical for powering frictionless and reliable matching.

Your system should be able to handle fluctuating invoice volumes without slowing down approvals or creating bottlenecks. Cloud-native platforms typically offer better elasticity and performance for enterprise AP requirements.

Opt for a platform with built-in analytics to track match rates, exception reasons, cycle times, and compliance metrics. Strong reporting ensures transparency and makes audits significantly easier and faster to conduct.

Look for SOC 2 and ISO-certified platforms with secure data handling, granular permissions, and robust access controls; especially important for organisations operating in multi-entity or global AP environments.

Invoice matching is a tool that automatically compares an invoice with supporting documents, such as purchase orders and receipts, to ensure accuracy before payment. It streamlines the invoice matching process by validating quantities, pricing, and terms without manual effort. Modern invoice matching automation enables AP teams to reduce discrepancies and expedite the approval process. It’s especially valuable for businesses dealing with high invoice volumes or complex procurement workflows.

The invoice matching process compares key fields between the invoice, purchase order, and goods receipt to verify that the items ordered match the items delivered and billed. Automated invoice matching tool pulls data from ERPs and applies rules to detect mismatches. If everything aligns, the invoice goes through straight-through processing (STP). If not, it’s flagged for review with clear exception reasons.

2-way matching in accounts payable compares the invoice against the purchase order to validate price and quantity. 3-way invoice matching adds another layer by including the goods receipt, ensuring items were actually received before payment. Most enterprises rely on 3-way matching for better control and fraud prevention. Automated tools make both types more accurate and faster.

4-way matching extends the validation process by adding an inspection or quality check to the PO, invoice, and receipt. It’s used in industries where goods must pass a compliance or quality check before approval, such as manufacturing, pharma, or aerospace. Invoice matching platform automates this by aligning inspection reports with the invoice data. This ensures that only approved goods are moved to payment.

Enterprises adopt invoice matching automation to eliminate the manual checking that slows down accounts payable operations. Automation reduces discrepancies, prevents overpayments, and helps finance teams maintain compliance. The software also accelerates approvals through straight-through processing (STP). As volumes increase, automated invoice matching becomes crucial for efficiently handling scale.

By automatically cross-checking values across documents, invoice matching tool removes human error from the process. It catches mismatches in pricing, quantities, tax amounts, and duplicate invoices before payments are made. The system uses predefined rules to ensure consistency and accuracy. This reduces exception rates and minimises rework for AP teams.

Invoice matching automation flags invoices with identical numbers, supplier IDs, dates, or amounts. It compares new invoices against existing records in the AP ledger to instantly detect duplicates. These checks help enterprises avoid accidental overpayments that often arise in manual processes. The system adds another layer of control before the invoice reaches the payment run.

Yes, most invoice matching solutions integrate seamlessly with ERPs, such as SAP, Oracle, NetSuite, Microsoft Dynamics, and Workday. The integration enables real-time syncing of POs, GRNs, and vendor data to power accurate matching. It also eliminates duplicate data entry and ensures that finance teams work from a single source of truth. Strong ERP integration is essential for reliable invoice matching automation.

Many modern platforms support non-PO invoices using workflow-based approvals instead of document matching. The system routes non-PO invoices to the correct budget owner for validation and approval. Although they don’t follow a traditional invoice matching process, automation still reduces manual handling of invoices. This helps companies maintain control over ad-hoc or service-based spending.

The core documents include the purchase order (PO), the supplier invoice, and the goods receipt note (GRN). Some businesses also include inspection reports for 4-way matching. Invoice matching tool extracts and aligns data from each document using predefined rules. This ensures every billed detail matches what was ordered and delivered.

Exceptions typically arise from discrepancies in quantity, price, tax, delivery dates, part numbers, or missing approvals. They can also occur due to vendor data inconsistencies or outdated POs. Automated invoice matching makes these exceptions visible instantly and categorises them for faster resolution. This reduces back-and-forth communication between AP, procurement, and vendors.

Yes, SMBs benefit significantly from automated invoice matching because it reduces the manual time required to validate invoices. Cloud-based tools offer scalable pricing and quick implementation for smaller teams. The automation helps SMBs maintain accuracy and avoid fraud without needing a large AP staff. It also supports faster month-end close and better cash-flow control.

Invoice matching automation is widely utilised in various industries, including manufacturing, retail, distribution, logistics, healthcare, construction, and consumer goods. These industries handle large order volumes, recurring purchases, and frequent goods receipts, making automated matching essential. Service-based industries also use it for PO-based contract billing. Any business with procurement-driven AP processes can benefit.

The platform automatically records every match, exception, approval, and user action. This creates a clean audit trail that auditors can easily trace without needing to pull physical documents. Automated invoice matching ensures data accuracy and standardises compliance checks. As a result, audits become faster, cheaper, and more predictable.

Common KPIs include first-pass match rate, exception rate, average resolution time, STP rate, and cost per invoice. Teams also monitor duplicate invoice detection and supplier-level mismatch trends. Invoice matching platform provides dashboards that automatically track these metrics. This helps AP leaders identify bottlenecks and improve process performance.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center