Invoices may seem simple and straightforward, but anyone who manages them manually knows how quickly they can become complex. In mid-sized companies, 50–70% of invoices still arrive as PDFs or emails, requiring manual validation, data entry, and approval routing. These repetitive tasks slow down processing, increase errors, and limit working capital.

For enterprises, the challenge is different but just as demanding. Many processes involve over 3 million invoices a year, across multiple ERPs and entities. In the absence of modern AP invoice processing software, decentralized operations, inconsistent approval chains, and regional compliance needs make it hard to maintain visibility and control.

Even with ERP-based automation, most mid-market AP teams still process about 70% of invoices manually. Large enterprises also face low automation rates and a heavy reliance on IT, leading to delayed payments, higher costs, and increased audit risks.

By 2026, AP invoice processing automation software will no longer be optional. Finance teams rely on it to scale efficiently, improve accuracy, and gain real-time visibility into spending. The right solution eliminates manual work, speeds up approvals, and gives AP leaders the control they need to manage payables strategically.

To help you find the right fit, we’ve evaluated the 10 best accounts payable invoice processing software for 2026. Each platform has been assessed for its strengths across various business sizes, invoice volumes, and AP complexities, allowing you to identify which one aligns best with your goals.

Finding the right invoice processing automation software can make a real difference in how efficiently your AP team handles invoices, approvals, and payments. Each platform offers unique strengths based on business size and workflow needs.

Here’s a quick overview of the best invoice processing automation software in 2026.

| Platform Name | Standout Features | Best Suited For |

| HighRadius | AI-powered, template-free data capture with automated exception handling, 3-way matching, and ERP-integrated workflows for faster and more accurate processing | Mid-to-large enterprises handling high invoice volumes and complex AP workflows |

| AvidXchange | Cloud-based invoice management with digital approval routing and payment scheduling | Mid-sized businesses looking to move away from manual invoice handling |

| Bill.com | Streamlined invoice capture and approval tracking through a simple online interface | Small and growing businesses |

| Basware | Procure-to-pay automation with e-invoicing and spend visibility across regions | Large and mid-sized organizations |

| Coupa | Spend management platform | Enterprises and mid-sized organizations |

| Medius | Automated PO matching and approval workflows | Mid-sized businesses seeking efficiency with minimal manual effort |

| Oracle NetSuite | ERP-native invoice automation for visibility into approvals and payments | Companies already using NetSuite ERP |

| SAP Concur | Centralized platform combining invoice, travel, and expense management | Enterprises managing both AP and employee spend |

| Stampli | Invoice capture solution with collaborative approval and communication tracking | Mid-market AP teams |

| Tipalti | Global payment automation with built-in tax and currency compliance features | International businesses managing cross-border supplier payments |

Invoice processing automation software is a digital solution that uses technology like AI, OCR, and machine learning to replace manual, repetitive invoice processing tasks with a faster digital workflow. It captures invoice data, checks it for accuracy, and routes it for approval without the constant back-and-forth that slows down AP teams.

More than just digitizing invoices, it helps finance teams stay accurate, compliant, and efficient at scale, whether they’re processing a few hundred or thousands of invoices each month.

Manual invoice processing may still get the job done, but it often comes at the cost of time, accuracy, and control. As businesses grow, these challenges only multiply. That’s where invoice processing automation software makes a real difference. It brings speed, visibility, and reliability to the accounts payable process while freeing finance teams from repetitive, error-prone tasks.

Here’s how automation can transform your AP operations:

Invoice automation speeds up processing from weeks to hours by removing manual data entry and delays in routing. It automatically captures and validates data, reducing errors and avoiding duplicate payments. Custom approval workflows ensure invoices reach the right people quickly, helping teams stay accurate, efficient, and on schedule.

Three-way matching is a key part of invoice processing that involves comparing three documents i.e, the purchase order (PO), the goods receipt, and the supplier invoice. This ensures that quantities, prices, and terms on the invoice match the corresponding PO and goods receipt. Accurate matching is critical to preventing AP fraud, and automation greatly improves both the speed and accuracy of this process.

With automated invoice processing, teams gain better control over payment timing. Faster approvals make it easier to schedule payments that align with cash flow goals or take advantage of early payment discounts. Companies can maintain healthy cash reserves while ensuring timely payments. Consistent, on-time payments also strengthen vendor relationships. Businesses that pay reliably often become preferred customers and may benefit from better terms or priority service during periods of high demand.

Digital systems maintain detailed records of every step, from receipt of the invoice to final payment. During audits, documents can be retrieved quickly since all data is searchable and easily accessible. This enables finance teams to focus on strategic work instead of manual record-keeping. Built-in compliance checks help enforce company policies, reduce risks, and flag unusual patterns that could indicate fraud, offering stronger financial protection.

Automated invoice processing gives finance teams real-time visibility into approvals, spending, and invoice status through intuitive dashboards. This helps spot bottlenecks early, capture payment discounts, and manage cash flow more effectively. With accurate data and analytics, teams can identify cost-saving opportunities, improve workflows, and align financial operations with business goals.

With dozens of options in the market, choosing the right invoice automation software can be tough. To help you find the right fit, here’s a closer look at the ten best invoice processing automation software in 2026. This covers their key features, use cases, and what makes each one stand out.

HighRadius ranks among the top invoice processing automation platforms for enterprises looking to scale AP operations. With 24+ AI agents, Highradius AI-powered invoice automation software enables touchless invoice management, from capture and validation to matching and approval. Finance teams can reduce cycle times significantly and reduce manual effort.

Many organizations still process over 60% of their invoices manually, spending 10-12 days per invoice on routing and validation. HighRadius helps shorten cycle time by 50% through intelligent data capture and automated routing.

Key capabilities:

Enterprises often face decentralized AP processes, slow approvals, and multiple disconnected systems. HighRadius helps unify these operations through a single platform that streamlines invoice management across business units and regions.

The real challenge isn’t always visible. Exception handling accounts for just 14–16% of analyst time but appears in 34 points of the AP cycle, making it the most common manual task. Other smaller steps, though seemingly minor, can consume nearly 18% of total effort, adding to the hidden manual workload that slows teams down.

HighRadius minimizes these inefficiencies by automating exception handling, validations, and approvals, so finance teams can focus on higher-value work. It also supports companies modernizing their ERP landscape, helping connect legacy systems with modern digital workflows.

In short, HighRadius gives finance leaders the visibility, control, and scalability they need to manage complex invoice operations efficiently while cutting down on the manual effort hidden within everyday processes.

AvidXchange provides a cloud-based invoice processing automation software designed for mid-sized businesses. It automates invoice capture, data matching, and approval routing, helping AP teams reduce manual work and manage invoices from a single platform.

Key capabilities:

Bill.com is a popular choice among small and medium-sized businesses that want simple, end-to-end automation. It brings invoice creation, approval, and payments together in one platform.

Key capabilities:

Basware caters to large enterprises with complex, global AP operations. It offers e-invoicing, spend analytics, and procure-to-pay automation that improve visibility, compliance, and control.

Key capabilities:

Coupa combines procurement, expense, and invoice processing automation into a single platform. It helps businesses maintain accurate records through automated matching and makes approvals easier across teams.

Key capabilities:

Medius offers invoice processing automation software built to handle large invoice volumes efficiently. It utilizes AI to capture invoice data accurately and supports flexible approval workflows, simplifying validation and routing.

Key capabilities:

NetSuite offers built-in invoice automation within its ERP system, helping businesses manage invoice capture, routing, and approvals in one place. It’s a good fit for companies that already use NetSuite for their finance operations.

Key capabilities:

SAP Concur combines travel, expense, and invoice automation in a single platform. It offers mobile approvals and real-time compliance tracking, making it suitable for large, distributed organizations.

Key capabilities:

Stampli focuses on collaboration and visibility in AP workflows. Its AI assistant helps teams manage invoices faster while keeping communication and approvals centralized.

Key capabilities:

Tipalti works well for global businesses that manage multi-entity and cross-border payments. It automates invoice processing, payments, and tax compliance across different countries and currencies.

Key capabilities:

Modern automated invoice processing software comes with sophisticated features that reshape how finance departments handle accounts payable operations. These tools establish a continuous connection from the moment an invoice arrives until payment is made.

Intelligent data extraction capabilities form the core of effective invoice processing automation. Advanced optical character recognition (OCR) technology combined with artificial intelligence converts invoices of all formats into structured, usable data. These systems process invoices from email, PDFs, and scanned documents. They automatically extract critical information, such as vendor details, invoice numbers, due dates, and line items.

The intelligent document recognition system adapts to different invoice layouts without rigid templates. It learns from each processed document and improves its accuracy over time. This removes the need for manual data entry while maintaining high precision with invoices from vendors of all types.

Invoice processing software features configurable approval routing that adapts to an organization's structures and business rules. These workflows can be designed with:

Finance teams can modify these workflows as their organization’s needs change. The no-code configuration tools eliminate the need for IT department assistance.

Automated invoice processing systems provide complete visibility as a core advantage. Interactive dashboards show finance leaders instant updates on key metrics throughout the invoice lifecycle. These customizable displays highlight important information such as pending approvals, invoice aging, and processing times.

Advanced invoice processing automation software allows users to examine underlying data, apply filters to focus their analysis, and export findings in various formats. This visibility helps teams manage finances proactively. They can identify bottlenecks, optimize cash flow, and make decisions based on data.

These systems protect against financial risks as another vital feature. Advanced invoice automation systems include strong security measures that protect the entire process. These tools verify invoice data against purchase orders and receipt documentation. They flag unusual patterns that might indicate errors or fraud.

Built-in compliance features enforce policies consistently throughout the invoice lifecycle. Clear audit trails record every action, supporting internal controls and simplifying external audits.

Modern invoice processing automation software works beyond desktops. Mobile interfaces let team members approve and manage invoices from anywhere. This accessibility keeps business running smoothly regardless of location and prevents delays caused by travel or remote work.

Secure cloud deployment offers scalable processing without major on-site infrastructure investments. Cloud architecture also integrates smoothly with existing ERPs and accounting platforms, creating a unified financial ecosystem.

AP teams often struggle with inefficient processes, errors, and delayed approvals. Manual workflows and lack of automation make it difficult to manage high invoice volumes, maintain compliance, and gain visibility into invoice status. Accounts payable invoice processing software addresses these issues by streamlining workflows and reducing manual intervention.

Manual entry of invoice data increases errors and slows down AP operations. Accounts payable invoice processing software automates data capture, ensuring high accuracy and reducing the need for rework.

Large invoice volumes can overwhelm AP teams, causing delays and missed deadlines. Automation software enables faster processing and efficient handling of bulk invoices without adding headcount.

Duplicate or mismatched invoices often lead to overpayments and compliance risks. Accounts payable invoice processing software automatically flags duplicates and ensures accurate matching with purchase orders.

Without real-time insights, AP teams cannot prioritize urgent invoices or track pending approvals. Automated dashboards and reporting in accounts payable invoice processing software provide complete visibility across all invoice stages.

Manual AP processes make audits and regulatory compliance time-consuming. Accounts payable invoice processing software maintains an audit-ready trail, automatically logging approvals, matches, and exception resolutions.

Choosing the best AP invoice processing automation software isn’t just about picking a tool with the most features. It’s about finding a solution that fits your organization’s size, workflow complexity, and long-term goals. The ideal platform should simplify daily operations, integrate with your existing systems, and scale as your business expands.

Start by understanding where delays or manual work still exist so you can choose a platform that truly solves those challenges.

Start by reviewing your current accounts payable workflow to identify key challenges. Before selecting a solution, you need to understand your invoice volumes, approval chains, and workflow bottlenecks. A clear understanding of your needs helps you focus on features that address real problems. Consider invoice complexity as well. Companies that handle various document formats require systems with robust data capture capabilities. The solution should also manage exceptions and handle complex approval scenarios effectively.

Successful implementation depends on smooth connections with your existing systems. Your chosen invoice processing automation software must integrate well with your accounting software, ERP systems, and payment platforms. Look beyond basic compatibility and ensure the integration provides two-way data synchronization to eliminate duplicate entries. The software should offer open APIs that give you flexibility as your technology setup evolves.

A good invoice processing automation system should grow with your business without losing efficiency. The platform must handle higher invoice volumes during peak times while maintaining performance. Beyond scalability, evaluate vendor support options including setup assistance, training resources, and ongoing technical help. Access to clear documentation, webinars, and responsive support channels can make a significant difference in long-term success.

Features alone are not enough. Review each vendor’s track record carefully. Look for customer feedback from businesses similar in size and industry to yours. Study case studies that demonstrate successful implementations in comparable environments. The vendor’s financial stability and commitment to product improvement through regular updates are equally important. This research helps you assess reliability and service quality beyond marketing claims.

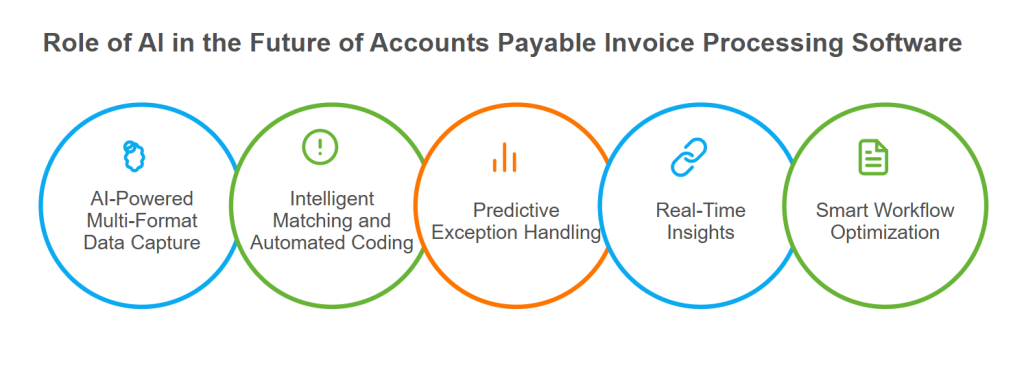

AI is transforming AP invoice processing software by taking automation beyond simple OCR and rule-based workflows. Future-ready systems use machine learning and AI to intelligently extract, classify, and validate invoice data, predict exceptions, and optimize workflows. Here's How :

AI engines can extract invoice data from PDFs, scanned documents, emails, EDI files, and vendor portals. Unlike traditional systems, AI adapts to new invoice layouts and formats without manual template setup, ensuring accuracy and reducing manual effort.

Machine learning enables the software to match invoices to POs, GRNs, contracts, or even non-PO invoices. AI can predict GL codes, cost centers, or expense categories based on historical patterns, improving speed and consistency while minimizing errors.

AI detects potential discrepancies — such as price, quantity, or policy violations — before they cause delays. By learning from past exceptions, the software can automatically resolve simple issues and escalate complex ones, reducing bottlenecks and backlog.

AI analyzes approval patterns, bottlenecks, and invoice priority to dynamically route invoices for faster processing. Once approved, the system seamlessly posts invoices to ERP or accounting systems, ensuring accurate general ledger synchronization.

AI-powered dashboards provide predictive analytics, visibility into exceptions, and cash-flow trends. AP teams gain actionable insights for vendor management, invoice prioritization, and smarter working capital decisions, turning AP into a strategic function.

Invoice processing automation software is a digital solution that uses AI, OCR, and rule-based workflows to capture, validate, and approve invoices automatically. It eliminates manual entry and reduces human errors by extracting key data from invoices and routing them for faster, accurate approvals.

Businesses using automated invoice processing software can cut invoice cycle times by 60–80%. By automating data entry, approval routing, and matching, the system reduces delays, eliminates repetitive tasks, and allows AP teams to process invoices in hours instead of days.

The factors you should consider when selecting invoice processing software, are ERP integration, accuracy of data extraction, approval workflow flexibility, reporting tools, and scalability. The right invoice processing automation system should boost visibility, compliance, and overall AP efficiency.

Invoice processing automation software helps enterprises streamline AP operations by reducing manual workload, improving accuracy, and ensuring compliance. It supports large invoice volumes, enhances visibility, and gives finance teams control over cash flow and costs.

To implement an invoice processing automation system, start by assessing current workflows, defining approval rules, and integrating with your ERP. Train teams, set up automation for data capture and routing, test performance, and monitor results to ensure smooth adoption.

This accounts payable invoice processing software uses OCR, AI, and rules-based automation to extract invoice data, perform PO or 3-way matching, and route invoices for approvals. Once validated, AP invoice processing software syncs the data to your ERP. It helps teams process invoices faster and more accurately.

Yes, most leading accounts payable invoice processing software integrates with ERP systems like SAP, Oracle, NetSuite, Microsoft Dynamics, and QuickBooks. These real-time integrations reduce manual posting, prevent errors, and keep Accounts Payable data synchronized across all financial systems.

It reduces processing time, minimizes data entry errors, and improves visibility into invoice status. Accounts payable invoice processing software helps AP teams manage higher invoice volumes without extra resources. It also strengthens compliance and supports timely vendor payments.

Yes. Small AP teams benefit from automation because accounts payable invoice processing software reduces routine manual work and speeds up approvals. It ensures accuracy, prevents bottlenecks, and allows teams to scale efficiently as invoice volumes grow.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center