Intelligent Web Aggregation To Capture Remittance Data from Websites

Read on to find out how Artificial Intelligence and Cloud-Based Machine Learning can help you cut down costs, effort and time!

Intelligent Web Aggregation To Capture Remittance Data from Websites

As clients started to move from check payments to electronic payments, there was also a shift in how the remittance information was sent. Earlier, most of the electronic payments were accompanied by email. However, in recent years with advancement in account payable software, the big retailers now prefer to host the remittance information on their websites. The vendors are provided with credentials to login and download the remittance information. With the absence of any automation, obtaining or pulling information from websites has become a highly manual task. Every day analysts log into retailer websites, search for remittance information, and download the data. The data is then manually fed into the ERP system or manually keyed into a file that goes into the auto-cash system. Overall, advances in accounts payable systems have resulted in manual work for vendors for their cash application process. It may seem impossible to automate the remittance data that are hosted on websites, but technology solutions are now available to enable automation. Over the last decade, web technology has advanced leap and bounds. Today, we have at our disposal what is referred to as web aggregation or web scraping. The Travel and Hotel industry heavily utilizes web aggregation technology. For example, let us consider a travel booking website such as kayak.com. kayak.com logs into all the travel websites and collects information on the cheapest available deals. This same web aggregation technology can solve the problem posed by major retailers hosting remittance information on their websites. By using web aggregation technology, you can create agents that will regularly login to your retailers? websites and look for remittance information. Once the information becomes available, the virtual agents will automatically capture the remittance data and provide it in a digital format.

“The entire process can be automated to such an extent that on a regular basis you get remittance and payment information without having to log in to any of your retailers? websites.”

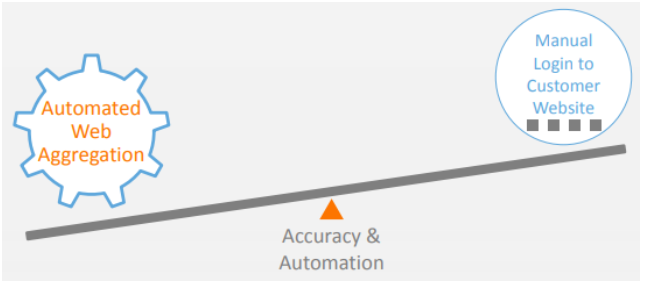

A set of rules can then be applied to further enhance the quality of data and bundle it with the payment information. The entire process can be automated to such an extent that on a regular basis you will get bundled remittance and payment information without having to log in to any of your retailers? websites. Alerts can also be set up to track any errors such as the login/password expiring so that corrective actions can be taken.  If you have retailers or other customers who provide remittance data on their website, consider using web aggregation technology. Website automation provides you a good opportunity to achieve close to 100% accuracy and automation. Since the data is available on websites in digital format, we will not come across errors that we typically do with scanning technologies. You could achieve real automation wherein, your cash application team would not have to touch any remittances that are uploaded on your retailers? websites.

If you have retailers or other customers who provide remittance data on their website, consider using web aggregation technology. Website automation provides you a good opportunity to achieve close to 100% accuracy and automation. Since the data is available on websites in digital format, we will not come across errors that we typically do with scanning technologies. You could achieve real automation wherein, your cash application team would not have to touch any remittances that are uploaded on your retailers? websites.