Prologue: What is Digital Transformation?

Almost a third of financial services organizations are now realizing the benefits from their investment in modernising technology.

Source: CBI PwC Financial Services Survey – Q3 2021

The term Digital Transformation has become the go-to word for most GPOs, especially in the “new normal.” However, it has been a common misconception that Digital Transformation means automation. Let us set the context for further discussion on this chapter by saying that:

Digital Transformation ≠ Automation

Digital Transformation is more than just automating current processes. According to Forbes, some of the critical reasons which forced a rethinking of this concept are outlined below.

- The increased complexity of business processes is dependent on coordination between

multiple siloed departments. - The amount of unstructured data that flows into the business needs to be reconstructed

into a more meaningful and actionable format. - The customer demands a more multichannel experience that has to be more contextual.

If not just automation, then what is Digital Transformation?

Gartner defines digital business transformation as “the process of exploiting digital technologies and supporting capabilities to create a robust new digital business model.”

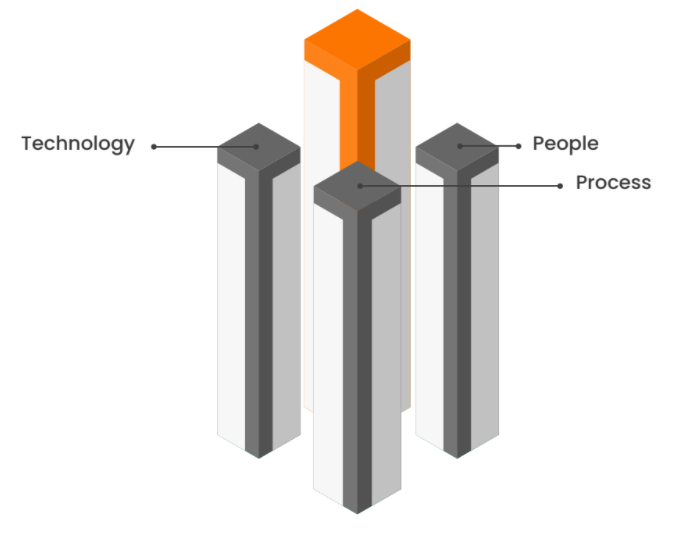

Digital Transformation is a crucial step in future-proofing your SSC business operations in the new normal, focusing on enhancing agility and efficacy using technology and data as the enablers. It marks a radical re-thinking of how an organization uses people, processes, and technology to fundamentally change business performance.

Digital transformation in A/R

Transforming accounts receivable (A/R) is the key to making business move faster in this slow economy.

- Digitizing your A/R process not only saves you money but also speeds up your collections, reduces late payments, and greatly reduces the volume of repetitive tasks taking up your team’s time.

- Customized enterprise resource planning (ERP) systems and manual, paper-based processes cost millions in-process waste. These broken processes hold your team back by limiting capital efficiency and liquidity and decreasing your time, revenue, and efficiency.

Related Resources

A Comprehensive Guide to Building a Future-Ready…

Read eBookPrescribing Success by Leveraging AI to Treat…

Take me to the blogFive Must-Have Automation Workflows for Fool-Proof Risk…

Take me to the blogPlease fill in the details below

Please fill in the details below