Onboard more customers in less time through credit risk management software

As a credit professional, you are required to make accurate, on-the-spot decisions of high value and in huge volume, while your departments are consolidating and slimming down as well as under more scrutiny from auditors.

Under these conditions, how do you perform a detailed and consistent analysis needed to avoid unnecessary credit riski in your credit management process?

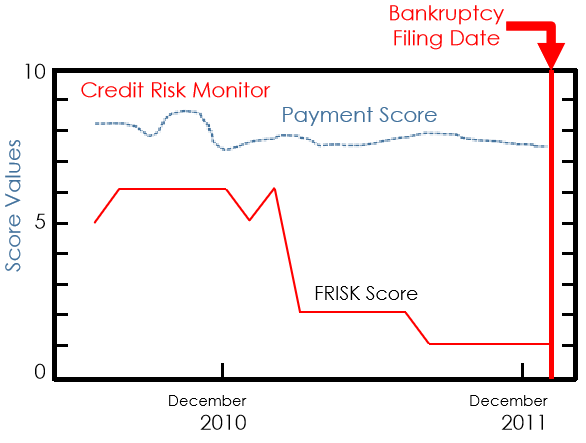

The “cloaking effect”: The credit scoring model is not able to predict bankruptcy, financial stress or delinquent behavior.

For example,

Eastman Kodak is a company whose payment behavior to its suppliers did not reflect its financial condition. But Kodak filed for bankruptcy on January 19, 2012.

The company was able to maintain a Payment Score around 8, which indicates no evidence of severely delinquent payment behavior until it went bankrupt. This is known as the cloaking effect.

Along with this, high bad-debt, undetermined losses, loss of business opportunities, an increase in delinquent behavior/delayed payments, and a prolonged credit approval process are signs that your current credit scoring model has become outdated.

Contrary to what those lousy internet popups would have you believe, no secret formula will improve your credit scoring model overnight.

A healthy credit scoring model is made up of three key elements:

robust information, sound financial management, and regular monitoring.

To make it easy for you, we’ve pulled together 15 must-have parameters to help you manage your score effectively.

Including these parameters in your model won’t guarantee you a perfect credit score, but they will certainly help you avoid any nasty surprises.

Credit Worthiness/Score should be calculated based on four kinds of information:

All credit bureaus typically use public data, information reported by vendors and lenders, as well as self-reported information to generate your business credit score.

The Credit Agency category will contain the third party ratings that you consider most important when making a credit decision.

Below are the four business credit bureaus and their most common credit score.

Dun & Bradstreet’s PAYDEX score (sometimes referred to as D&B PAYDEX) relies solely on the promptness of payments. This score examines your customer’s average time (in days) to pay off a debt, relative to the outlined terms.

Experian’s Intelliscore ranges from 0 (high risk) to 100 (low risk). Experian’s business credit score only considers whether payments are made on time or not. It also examines how a company has handled credit in the past, looking at things such as average credit utilization (how much of your available credit you use), as well as the frequency of any derogatory marks towards their account (payment delinquency, collections, liens, etc.).

Equifax assigns a company three different scores, inside of a single report.

A businesses’ FICO score can range from 0 to 300 and takes into account a huge amount of data – working in conjunction with companies like Equifax and Experian to come up with a comprehensive report on your business.

Financial statement analysis is a judgmental process. One of the primary objectives is the identification of significant changes in trends, and relationships and the investigation of the reasons underlying those

changes.

The Altman Z-score is the output of a credit-strength test that gauges a publicly traded manufacturing company’s likelihood of bankruptcy. The Altman Z-score is based on five financial ratios that one can calculate from data found on a company’s annual 10-K report.

This information can be found on a company’s website, Wikipedia, credit agency, social media, public financial reports.

Liquidity ratios measure a company’s ability to meet its current obligations. It includes Working Capital, Quick Ratio, Current Ratio, Cash Ratio.

Profitability ratios measure a company’s ability to control expenses and to earn a return on the resources committed to the business. It includes Net Profit Margin (Return on Sales), Return on Assets, Operating Income Margin, Return on Investment, Return on Equity, Du Pont Return on Assets, Gross Profit Margin.

Leverage ratios measure the degree of protection of suppliers of long-term funds and can also aid in judging a company’s ability to raise additional debt and its capacity to pay its liabilities on time. It includes Total Debts to Assets, Capitalization Ratio, Debt to Equity, Interest Coverage Ratio (Times Interest Earned), Long-term Debt to Net Working Capital.

Efficiency, activity or turnover ratios provide information about a company’s ability to control expenses and to earn a return on the resources committed to the business. It includes Cash Turnover, Sales to Working Capital (Net Working Capital Turnover), Total Asset Turnover, Fixed Asset Turnover, Days’ Sales in Receivables, Accounts Receivable Turnover, Days’ Payables Outstanding.

Bad-debt to Accounts Receivable ratio measures expected inability to collect on credit sales. An increase in bad debts is a negative sign since it indicates greater realization risk in accounts receivable and possible future write-offs.

Current-liability ratios indicate the degree to which current debt payments will be required within the year. Understanding a company’s liability is critical since if it is unable to meet the current debt, a liquidity crisis looms.

Banks rely heavily on business credit scores and FICO scores for establishing lines of credit. Banks implement internal credit ratings to evaluate the likelihood of a corporate customer defaulting on its

obligations.

Banks may not report negative payment histories to the national credit bureaus until borrowers are 30 or 60 days late. Some suppliers, especially smaller businesses, do not report client histories at all. This reality makes checking trade references a crucial element when companies decide to extend credit. A typical business credit application will ask for three trade references.

Although the Altman Z can predict bankruptcy to some extent, it is no match for the ‘cloaking effect.’ Only using real-time industry data ensures continuous updates to scoring attributes and weights.

Advantages: The scoring models self-adjust continuously without manual updates, pulling in more data types than traditional models, including micro and macroeconomic variables to target the prediction of outcomes that meet your company’s needs. The models adjust for a specific industry or business needs-based

on your unique data or information, defining your preferred outcome with high precision.

So how can you build such a model?

Answer. With strong>Artificial Intelligence.

It’s not that complex. Include the 15 essential parameters (as discussed in this eBook) in your current credit scoring model and apply artificial intelligence on it.

Adapt your existing credit scoring model today!

It’s critical to update your credit scoring model, so it reflects this market’s risk levels and growth goals.

By re-validating your models regularly, you can ensure that risk criteria aren’t too strict–or too loose. This way, the models don’t turn away prospects with good credit or offer it to those who present a real risk of delinquency or losses.

“A loose credit policy lost money. A tight credit policy lost business. Intelligence, judgment and useful information – These are what made the crucial difference.” – Lewis Tappan, Founder- Dun& Bradstreet

An artificial intelligence-enabled credit scoring model will provide you with real-time risk assessment and a credit decision, with an immediately available credit line.

With the use of the best-in-class credit scoring model, industry leaders like Klöckner, Mercury Marine, and Parker Hannifin have been able to:

Update your existing credit scoring model with artificial intelligence today!

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadius™ Integrated Receivables platform optimizes cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by Rivana™ Artificial Intelligence Engine and Freeda™ Virtual Assistant for Credit-to-Cash, HighRadius Integrated Receivables enables teams to leverage machine learning for accurate decision making and future outcomes. The RadiusOne™ B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months. To learn more, please visit www.highradius.com

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadiusTM Integrated Receivables platform stands out by enabling every credit and A/R an operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadiusTM Integrated Receivables leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.

HighRadius Credit Risk Management Software makes 360° visibility possible by giving access to unlimited customer credit reports

Get on a call with an expert