Accounts Receivable Automation Software

Reduce bad debt by 20% with intelligent accounts receivable software

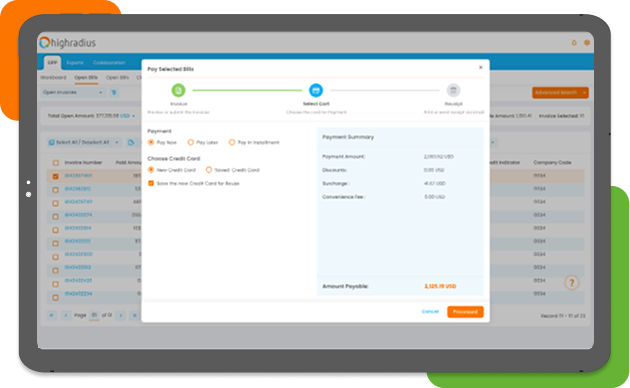

- Reduce DSO by 10% and enhance cash flow by facilitating payments seamlessly.

- Boost team productivity by 30% with our smart end-to-end accounts receivable automation workflows.

- Save over $100,000 in hard costs through accounts receivable automation and improved efficiency.

Top rated AR Software by 1100+ Global Businesses

The #1 Autonomous Finance Solution that Covers Its Cost in < 1 Year

Just complete the form below