Accounts Receivable Software for Faster Cash Flow

Get paid 3X faster with intelligent accounts receivable automation

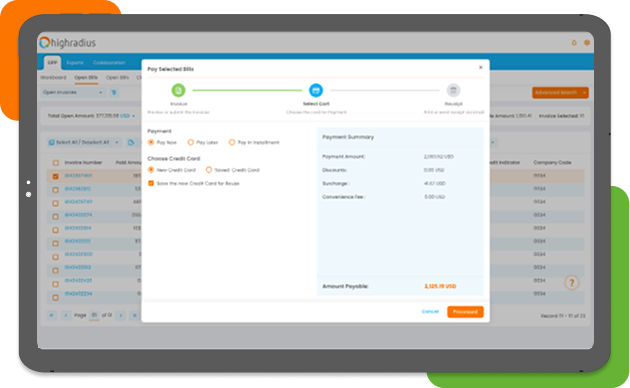

- Automate your AR process end-to-end, from invoicing and follow-up reminders to payment matching.

- Reduce DSO and bad debt while boosting collections and cash application efficiency with accounts receivable automation.

- Get a clear view of aging, cash flow, and DSO trends through AI-powered AR automation dashboards.

Top rated AR Software by 1100+ Global Businesses

See how AI helps reduce bad debt by 20%

Just complete the form below