For most CFOs, accounts payable has shifted from a cost center to a strategic control point in the business where it goes beyond mere operational efficiency. The right AP automation software not only safeguards liquidity but reduces supplier risks, ensures compliance, and reduces manual invoice entries. Implementing the best AP automation solutions can transform your financial operations and streamline your invoice lifecycle management.

However, most businesses end up implementing fragmented, legacy AP solutions that fail on so many levels. For starters, they don’t provide any comprehensive suppliers’ support, rely on human intervention to consolidate invoice data, fail compliance checks, and don't integrate fully across ERPs. To top it all, a research by Probolsky says, hardly 18% of accounts payable teams are end-to-end automated while the rest still struggles with siloed accounts payable processing software.

This is precisely why businesses must choose the best accounts payable automation software. It includes defining business outcomes, evaluating core invoice and transaction matching capabilities, checking for AI readiness and complying with regulatory standards. This blog will walk you through a step-by-step process of choosing the best accounts payable automation tools and some must-have features for AP automation.

Don’t let legacy AP processes block your next $1M in savings.

download the AP scalability playbook CFOs are using to outpace industry peers.

Download GuideAccounts payable automation tools are software solutions that digitize and streamline the AP cycle by eliminating manual invoice entry, approval routing, and payment processing. The best accounts payable automation software applies AI and ERP integration to reduce errors, accelerate approvals, and provide CFOs with real-time visibility into liabilities and cash flow.

These accounts payable applications serve as comprehensive spend management platforms, optimizing the entire invoice-to-pay process.

Today’s finance teams face mounting challenges that make manual accounts payable processes inefficient and risky:

The right accounts payable automation process address these challenges by leveraging AI, OCR, and ERP integration capabilities of automation tools to:

AP automation tools handle invoices from capture to payment, automating approvals, validation, and ERP reconciliation for faster, more accurate processing.

The best accounts payable automation tools drive efficiency, accuracy, and control, enabling finance teams to focus on strategic decisions while ensuring compliance and real-time visibility.

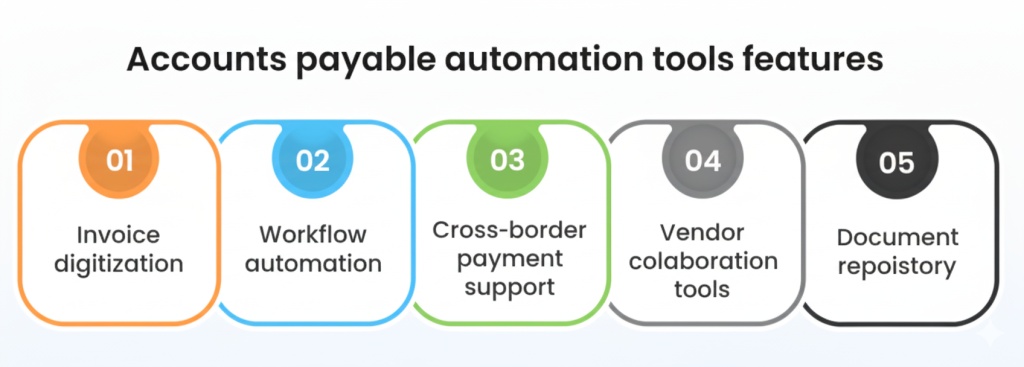

Modern AP automation processes go beyond basic invoice processing. They centralize data, enforce policy-driven approvals, and deliver actionable insights.

Converts paper and electronic invoices into digital formats using OCR, streamlining data entry processes.

Automates the approval and exception handling processes, reducing bottlenecks and enhancing efficiency.

Manages payments in multiple currencies, simplifying international transactions and reducing foreign exchange risks.

Provides platforms for vendors to interact with the AP department, improving communication and dispute resolution.

Establishes a secure, searchable archive for all AP-related documents, aiding in compliance and audit processes.

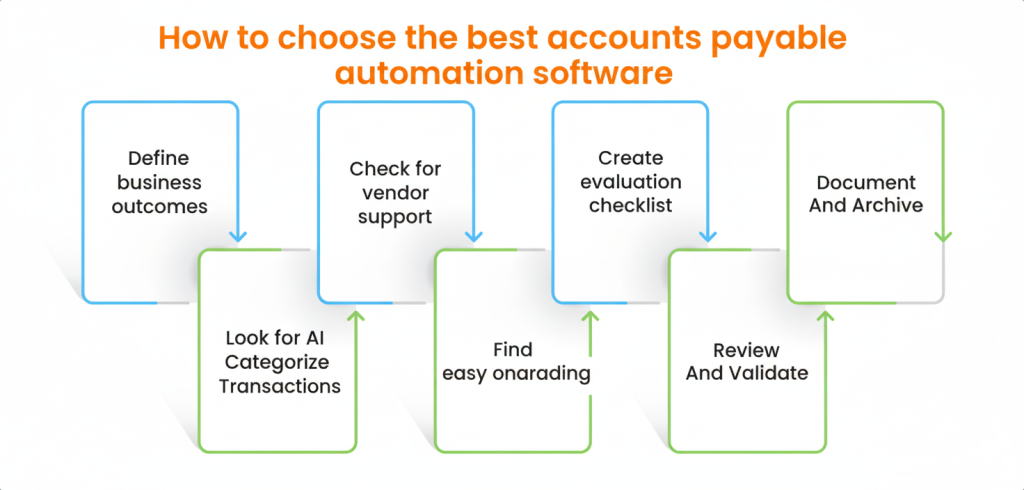

The best accounts payable software choice balances functionality, automation, and stakeholder alignment, enabling CFOs to optimize cash flow, strengthen compliance, and accelerate invoice-to-pay cycles. Here are a few tips to choose the best AP automation software and AP automation providers:

CFOs need clarity on whether the priority is faster invoice processing, reduced errors, stronger compliance, or improved supplier satisfaction. Without clearly defined outcomes, teams risk chasing features rather than measurable ROI.

Legacy tools may handle current volumes but often lack adaptability and don't support supplier diversity. Next-gen accounts payable automation tools offer AI-driven anomaly detection, predictive insights, and intelligent exception management. Scalability ensures the tool supports growth and global operations without becoming obsolete in a few years.

Here are the few key features of accounts payable automation tools that businesses must look into:

Evaluate accounts payable automation tools on their ability to automatically extract data from invoices across formats, like emails, PDFs, and scanned documents. The best accounts payable automation software leverages AI and OCR for accurate extraction and validation, reducing manual effort and accelerating invoice processing.

Ensure accounts payable automation tools automate workflows for invoice approval process, reducing manual intervention. The best accounts payable automation software eliminates manual approval process according to company policies, ensuring smooth approval or rejection of invoices.

Businesses must look for accounts payable automation tools that perform multi-level invoice matching and handle exceptions efficiently. The best accounts payable software conducts multi-level invoice matching and stores vendor documents for easy verification, reducing the risk of overpayment or underpayment.

Choose accounts payable automation tools that integrate seamlessly with your existing ERP system. The best accounts payable automation software will seamlessly integrate with over 50 ERP systems, enabling real-time data synchronization and efficient financial management.

Businesses must choose accounts payable automation tools that offer customizable reports and dashboards for real-time insights. They should provide a 360° visibility with customized reports and dashboards, offering insights into AP performance.

Check vendor contract management thoroughly. Ensure the vendor offers comprehensive support and training resources. The best accounts payable automation software provides ongoing support with strong onboarding, training resources, and dedicated account managers who can resolve issues quickly and help teams adopt new features with ease.

Finance leaders should immediately evaluate:

CFOs must consider total AP automation cost, license cost, implementation speed, IT dependency, error reduction, and working capital impact. The best accounts payable automation software will enable businesses to unlock ROI through reduced days payable outstanding, fewer supplier disputes, and faster invoice-to-pay cycles. Moreover, by engaging procurement, treasury, and IT early, businesses seamlessly reduce resistance and accelerate adoption.

Many finance leaders recognize that the accounts payable process is broken with manual data entry, delayed invoice approvals, and error-prone workflows force teams to spend time firefighting instead of optimizing working capital. Choosing the wrong accounts payable automation tools only makes the problem worse. Businesses must ensure they choose the best AP automation software that closes integration gaps, scale globally, and offer AI-driven intelligence, give CFOs complete visibility, higher compliance, and more opportunities for supplier discounts.

HighRadius offers a smarter path forward. Its end-to-end AP automation platform combines AI-powered invoice scanning and capture with intelligent invoice processing, three-way invoice matching, and configurable approval workflows to remove friction from every step.

Here are the key features of HighRadius Accounts Payable Automation Tools.

AI-Powered Invoice Scanning & Capture

Eliminates manual data entry by digitizing invoices across email, portals, and EDI with precision.

Intelligent Invoice Processing

Automates validation and ensures seamless exception handling for faster, error-free workflows.

Matches invoices against POs and receipts in real time to reduce disputes and duplicate payments.

Configurable Approval Workflows

Enables policy-driven, role-based routing that accelerates cycle times without compromising control.

Connects directly with leading ERP systems for a single source of truth across finance operations.

Gives CFOs live visibility into liabilities, cash outflows, and working capital positions.

Uses AI to flag anomalies and prevent costly errors before they escalate.

The result? 50% reduced invoice processing costs, 100% policy adherence and 90% invoice auto-matching.

An accounts payable automation tool is software that digitizes invoice capture, approval routing, and payment processing. By replacing manual tasks with AI and ERP integration, it reduces errors, speeds up approvals, and gives CFOs visibility into liabilities and cash flow.

The best accounts payable automation software combines AI-driven invoice processing, three-way matching, and ERP-native integration. HighRadius, for example, enables faster invoice-to-pay cycles, predictive exception handling, and global scalability across entities and currencies.

AI-powered AP automation tools apply machine learning to invoice scanning, data extraction, and anomaly detection. This helps finance teams cut manual handling, detect fraud or duplicates, and maintain audit-ready records while freeing resources for strategic cash flow planning.

Companies automate AP processes by using accounts payable automation tools that digitizes invoices, applies OCR and AI for data capture, routes approvals automatically, and processes electronic payments. Integration with ERP systems ensures real-time visibility and accurate reconciliation across entities.

Popular accounts payable automation tools include HighRadius, Tipalti, Stampli, AvidXchange, and Bill.com. These platforms help finance teams reduce manual work, shorten invoice-to-pay cycles, improve compliance, and strengthen supplier relationships through timely, accurate payments.

Yes. An ap workflow software saves costs by reducing manual labor, errors, and delays, while unlocking early payment discounts and better supplier terms. For CFOs, it delivers real-time dashboards, compliance trails, and scalability that legacy AP tools simply can’t provide.

Yes. Top AP automation tools support multi-currency invoicing, cross-border payments, and global compliance, enabling finance teams to manage international suppliers efficiently and reduce foreign exchange risks.

Implementation time varies based on business size, invoice volume, ERP integration, and workflow complexity. Cloud-based solutions with prebuilt connectors typically allow faster deployment and quicker adoption across teams.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center