Key Takeaways

- Which side of the accounting equation does Accounts Receivable belong to – the debit or the credit side?

- How can managing accounts receivable using best practices reduce bad debt and improve cash flow?

- How can Credit Risk Management Software help businesses mitigate risks and improve their cash flow?

Is Accounts Receivable Debit or Credit? Understanding the Role of A/R in Accounting

Accounts receivable is money owed to a company by customers for goods or services delivered but not yet paid for. It’s recorded as a debit entry in accounting as it increases assets. When a sale is made on credit, accounts receivable is debited and sales revenue is credited. One of the key functions of accounts receivable is to help companies manage their cash flow. By tracking the amount of money owed to the company, it allows companies to better manage their working capital and ensure that they have enough funds to operate their business.

In addition, accounts receivable can also be used to assess a company’s creditworthiness. In a survey of small business owners conducted by the Federal Reserve Bank of New York, 39% of respondents cited cash flow issues as a top challenge for their businesses. Lenders and investors may look at a company’s accounts receivable balance as an indicator of its ability to generate cash and manage its finances.

Overall, understanding the role of accounts receivable in accounting is crucial for any business owner or financial decision-maker. By properly tracking and managing accounts receivable balances, companies can improve their cash flow, maintain strong relationships with customers, and make better-informed financial decisions.

The Accounting Equation: Accounts Receivable on Balance Sheets

The accounting equation is the foundation of financial accounting that represents the relationship between a company’s assets, liabilities, and equity. Assets are things a company owns with value, liabilities are debts and obligations a company owes, and equity represents the ownership of the company.

Accounts Receivable as a Debit

Accounts receivable is recorded as an asset on a company’s balance sheet. It indicates money owed to the company, expected to be collected within a specific period, usually 30 to 90 days. Accounts receivable is listed as a current asset, meaning it is expected to be collected within the next year.

When recording accounts receivable journal entries, debits are always recorded under assets and placed on the left-hand side of the entry, while credits are recorded on the right. It’s important to ensure that your debits and credits always balance each other out.

For example, let’s say a company receives payment from a customer for goods or services they received. The bookkeeper would record the payment as a debit in the left-hand column under assets, while also recording a credit of the same amount in the right-hand column, assigned to revenue. This entry balances the books and reflects the increase in assets and revenue for the company.

|

Account |

Debit |

Credit |

|

Accounts Receivable – Molly Inc. |

$55,000 |

– |

|

Revenue |

– |

$55,000 |

Accounts Receivable as a Credit

While accounts receivable is typically recorded as a debit, there are times when credit balances can occur in the accounts receivable account. This happens when the amount of money owed to a company by its customers is less than the amount of money the company owes its customers.

A credit balance in accounts receivable can occur for several reasons, including:- Overpayment by a customer- Billing errors- Prepayments by a customer- Discounts applied- Returns and allowances after payment Although it’s normal to have credit balances in accounts receivable, frequent occurrences can indicate issues with billing and collection processes.

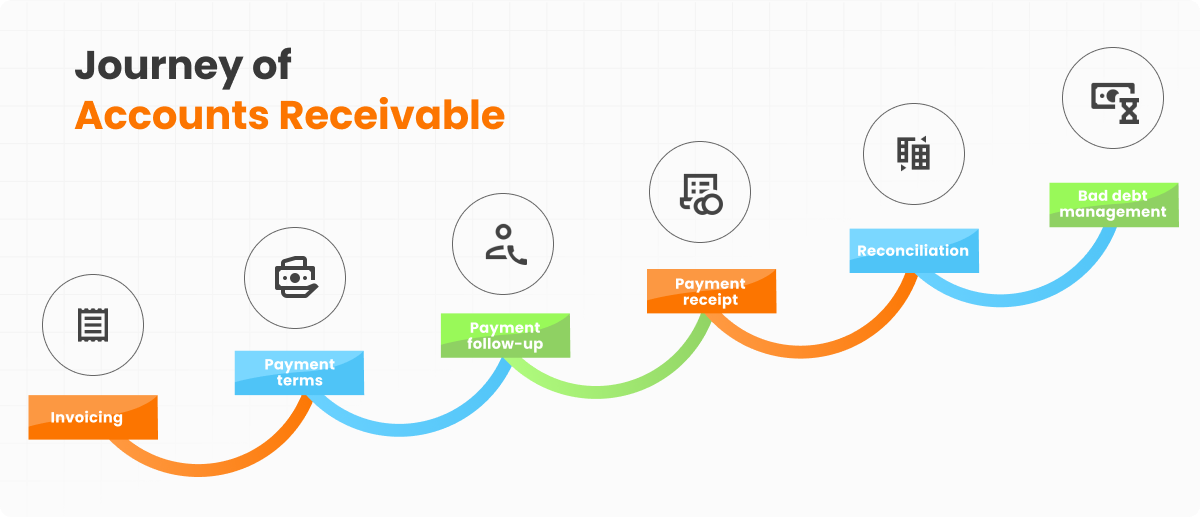

From Invoicing to Payment: The Journey of Accounts Receivable

The accounts receivable process cycle involves several steps that businesses must follow to ensure timely payments from their customers. These steps include:

-

Invoicing: The first step in the accounts receivable process is to create and send an invoice to the customer. This invoice should include the details of the goods or services provided, the amount owed, and the payment terms.

-

Payment terms: The payment terms should be clearly stated on the invoice and include the due date, the payment method, and any early payment discounts or late payment penalties.

-

Payment follow-up: After sending the invoice, it’s important to follow up with the customer to ensure timely payment. This can be done through email, phone calls, or automated reminders.

-

Payment receipt: Once the payment is received, it should be recorded in the accounts receivable ledger and posted to the appropriate customer account.

-

Reconciliation: Reconciling accounts receivable involves comparing the amounts received to the amounts owed and identifying any discrepancies or overdue payments.

-

Bad debt management: In cases where customers are unable to pay their debts, businesses should have a bad debt management plan in place to minimize losses.

By following these steps, businesses can effectively manage their accounts receivable cycle and maintain a healthy cash flow. It’s important to have a clear understanding of your customers’ payment habits and establish a system for tracking and reconciling payments.

Keeping Your Cash Flowing: 4 Best Practices for Managing Your Accounts Receivable

Managing accounts receivable balances is crucial for maintaining a healthy cash flow and ensuring timely payments from customers. Here are some best practices for managing accounts receivable balances:

- Prioritize Customers Dynamically for Faster Collections:

To ensure timely payments, collectors need to prioritize customers based on various parameters such as aging analysis, payment behavior, credit risk class, and payment commitment analysis. By proactively monitoring these parameters and using an AI-based Collections Cloud, collectors can dynamically prioritize their worklist based on predicted payment dates and customize collection strategies with AI recommendations.

- Achieve Same-Day Cash Posting for Better Visibility:

Same-day cash posting is a crucial focus area for cash application teams. By deprioritizing manual tasks such as remittance gathering and deduction coding, and using an automated cash application process, analysts can auto-match open invoices to incoming payments and achieve same-day, accurate cash posting. Using an AI-based Cash Application Cloud can help resolve exceptions faster with intelligent recommendations.

- Enhance Customer Experience with Customized Invoice Delivery:

To improve customer experience, invoicing teams should cater to customers’ invoicing or billing preferences and customize invoices based on their brand guidelines or preferences. Automation can help generate customized invoices and automate invoice delivery via email, fax, or A/P portals and accounting systems. This not only improves customer satisfaction but also streamlines the invoicing process, leading to faster payments and a healthier cash flow.

- Mitigate Risks by Regularly Reviewing At-Risk Customers

Credit teams need to constantly monitor the credit risk of their customer portfolios to mitigate risks and reduce bad debt. By increasing the frequency of credit risk evaluation and using real-time credit risk monitoring, credit analysts can track changes in customers’ credit risk and payment behaviors, revise credit limits, and rescore customers to mitigate portfolio risks in real-time. This helps maintain a healthy cash flow and enables senior finance leaders to make informed decisions based on intuitive analytics and reporting dashboards.

Maximize Profitability with HighRadius' AI-Powered Credit Risk Management Software

Businesses need to have effective credit risk management strategies in place to maintain a healthy cash flow and ensure timely payments from customers. HighRadius’ Credit Risk Management Software leverages AI to provide real-time credit visibility and helps businesses manage their global portfolios through comprehensive workflows. It offers several features that enable businesses to mitigate risks and improve their cash flow:

-

Real-time Credit Risk Monitoring: With HighRadius, businesses can receive real-time alerts for any changes in their customers’ credit profile, enabling them to make data-driven credit decisions. The software integrates seamlessly with ERP systems, enabling businesses to start monitoring in just 30 days.

-

Configurable Scoring Models & Approval Workflows: HighRadius’ software allows businesses to customize credit scoring based on geography, customer segments, business units, and other factors. This feature enables businesses to fast-track credit approvals through complex corporate hierarchies.

-

Highly Configurable Online Credit Application: HighRadius’ software offers a highly configurable online credit application process that makes it easy for businesses to onboard new customers while minimizing risk. The software can automatically capture financials, personal guarantees, and check bank references, streamlining the onboarding process.

-

Automatically Extract Credit Data: HighRadius’ software can automatically capture credit ratings, financials, and credit insurance information from more than 40 global and local agencies. This feature reduces manual effort and improves data accuracy, enabling businesses to configure the auto-extracted data in their preferred currency.

-

AI-Based Blocked Order Management: HighRadius’ software leverages AI to predict blocked orders based on customers’ credit limit utilization and payment history. The software can recommend release or partial payment options for faster credit decisions, improving cash flow and reducing the risk of disputes.

-

Seamless Integration with Collections, Payments & Deductions: HighRadius’ software seamlessly integrates with other functions such as collections, payments, and deductions, providing businesses with a comprehensive view of their accounts receivable processes. This feature enables businesses to share credit scores and risk analysis with collectors, review collectible amounts to calculate adjusted credit exposure, and dynamically update credit exposure leveraging payment and dispute information.

If you’re interested in learning more about how HighRadius’ Credit Risk Management Software can help your business, request a demo call today. Our team will be happy to walk you through the software and answer any questions you may have.