Key Takeaways

- Credit risk analysis enables you to ascertain customer creditworthiness and mitigate your financial risk.

- Analyzing credit risk often improves cash flow and lowers bad debt. Key parts of this process include checking the borrower’s payment history, understanding their finances, and assessing industry stability.

- By leveraging automation B2B enterprises can navigate intricate credit evaluations quickly, enhancing risk assessment for confident and efficient credit decisions.

Introduction

It is no secret that achieving financial stability is a key factor in running a successful business, but do you know a mere miscalculation in credit risk analysis can trigger a domino effect, disrupting your financial stability.

In an environment where market conditions are susceptible to volatility, the task of accurately estimating credit limits for customers becomes even more crucial. Why? Because bad debts are increasing. A study by Gartner Finance, based on an analysis of 796 financial statements, unveils a stark reality: bad debts surged by an astonishing 26% in 2020.

The escalating challenge posed by mounting bad debts underscores the necessity for conducting comprehensive credit risk analysis for every customer seeking credit-based transactions.

So how do you estimate the correct credit limits for customers and avoid bad debts? This blog serves as a comprehensive guide tailored for credit analysts, unraveling the nuances of credit risk analysis and offering precise strategies for conducting accurate assessments—ultimately diminishing the looming threat of bad debts.

What Is Credit Risk Analysis?

Credit risk analysis is the assessment of a borrower’s creditworthiness and their ability to repay a loan or credit. It involves evaluating their financial history, credit score, income, and other relevant factors to determine the level of risk associated with lending to them.

Let’s explore further how credit risk analysis can benefit your business.

How Does Credit Risk Analysis Help to Improve Your Cash Flow?

Cash flow is the most crucial KPI for any business. Disruptions to cash flow can significantly affect both daily operations and investment opportunities. Credit risk assessment plays a vital role in safeguarding a positive cash flow by:

- Minimizing bad debts

Invoices might turn into bad debts if adequate measures are not taken to collect the payments. Credit risk analysis enables you to extend credit to reliable customers who are more likely to repay on time, helping you avoid the risk of bad debt.

- Reducing DSO

Whenever there is a trend of increasing DSO within your business, you must take additional steps, including spending more resources and time to collect the payments. Credit risk analysis helps reduce the hidden operational costs of late payments by lowering the DSO. It also contributes to maintaining a positive working capital that can fund the current operations and future growth initiatives of the company.

- Mitigating financial risks

Credit risk analysis provides greater visibility into accounts receivable forecasting. It helps your business identify high-risk customer accounts and plan strategically to tackle them. Reducing default risks can improve the financial health of your business.

- Improving customer experience

Customer satisfaction is vital for a company’s long-term growth. Credit risk analysis enables you to onboard low-risk customers quickly and improve their overall experience. Loyal customers who pay on time also help you utilize your resources to expand your services.

How to Do Credit Risk Analysis for Your Accounts Receivable?

Now that you know why credit risk analysis is essential for businesses, let’s explore how you can use it efficiently. There are multiple aspects to consider when conducting credit risk analysis. We’ve compiled a list of the key factors that impact your credit risk analysis based on industry best practices.

1. Assessment of unpaid invoices

The first step toward conducting an in-depth credit risk analysis is to review your customers’ past few years’ invoices. It is beneficial to understand the reasons for delayed payments. You can use the record of unpaid invoices to determine which customer is more prone to default risks or who requires additional payment guarantees.

After analyzing the invoices and identifying the default risks, you can categorize the late payment trends and group customers accordingly for dunning purposes.

2. Grouping of customers

The more segmented your customer base is, the easier it is to identify and analyze high-risk profiles and focus accordingly. Thus, it is essential to group your customers based on factors such as:

- Industry

- Geography

- Size of business

- Payment guarantees

- Percentage of your receivables the customer represents

Let’s take a scenario in which a few customers exhibit poor payment practices. After grouping customers based on their payment trends, you notice that most defaulters belong to the same industry. It makes you realize that this particular industry might be risky to do business with. You can accordingly reduce your exposure to clients from that industry or take additional precautions when dealing with them.

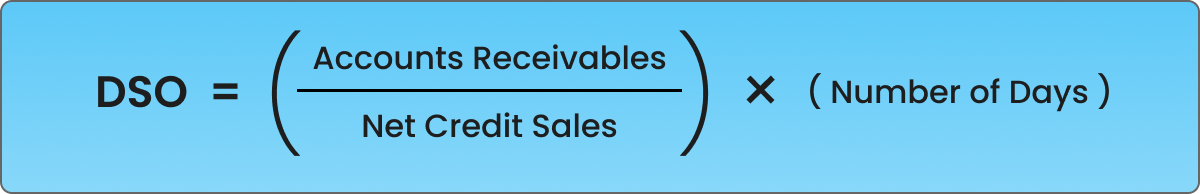

3. Calculation of DSO

Days sales outstanding measures the average number of days a company takes to collect payment for a sale.

You can segregate customers using this metric and analyze which segments make their payments on time and whose DSOs are higher and more prone to risks.

Calculating DSO in regular intervals helps you to:

- Keep a check on your cash flow

- Measure the effectiveness of your receivables

- Keep track of how the ratio has changed over time

- Compare the ratio with the industry average to determine whether your payment terms are more/less risky than your competitors

The formula for calculating DSO is:

For instance, consider the scenario of Company A. In January month, the company achieved a total of $500,000 in credit sales, resulting in accounts receivable amounting to $350,000. Given the month's duration of 31 days, the calculation for Days Sales Outstanding (DSO) for January unfolds as follows:

Accounts Receivable (AR) = $350,000 Credit Sales = $500,000 Number of Days = 31

DSO = ($350,000 / $500,000) * 31 = 0.7 * 31 = 21.7 days

Hence, the DSO for January equals 21.7 days.

Want to unlock insights into your business's financial health? Try our DSO Calculation Excel Template to gain a clearer understanding of your credit performance.

4. Review of receivables aging report

Accounts receivable aging report lists the unpaid invoices and their outstanding duration.

Let’s assume a company has $250,000 in its accounts receivable. $50,000 falls under the 0-30 days aging bucket, $150,000 in the 31-60 days aging bucket, and the remaining $50,000 in the 61-90 days bucket.

An aging report gives you a more detailed breakdown of the open invoices. It reflects how long your invoices remain open as well as gives an idea of how many customers delay their payments. It also helps determine whether the current credit limits are suitable or not. If your report shows any deviation from the standard payment patterns, there might be a need to investigate the issue.

5. Periodic credit review of your customer

Periodic credit reviews assist you in evaluating your customers' credit profiles at regular intervals. They contribute to refining credit scores and assessing customers' creditworthiness for determining appropriate credit limits.

A higher credit score serves as a positive indicator of creditworthiness. By updating credit scores through periodic reviews, you gain a more profound comprehension of your customers' financial health, especially within volatile market conditions.

6. Managing deteriorating payment trends

Your accounts receivable policy should include what actions you’ll likely initiate against customers who default or pay late. Your customer must be made aware of the implications of poor payment behavior; else, they might become accustomed to paying late.

Some of the potential steps you might consider to manage deteriorating payment trends are:

- Sending dunning emails regularly

- Employing escalation notices

- Conducting in-person visits

- Adjusting the credit facility as needed

- Applying penalties for late payments

- Exploring potential legal actions

7. Check your accounts receivable concentration ratio

The accounts receivable concentration ratio is a metric to determine the risks associated with your accounts receivable. It helps to evaluate:

- The number of customers who owe money

- The amount of money owed to your business

- Relative share of each customer in the total receivables and how that compares to an ideal situation

If the ratio of unpaid receivables to total receivables is high and closer to one, it indicates that even if one customer fails to pay, it will significantly impact your business, and there is a need to reduce it. Let’s look at how to calculate it.

Example: Consider a total accounts receivable balance of $250,000, broken down as follows:

- Company 1: $50,000

- Company 2: $150,000

- Company 3: $50,000

Step 1: Compute the percentage each customer contributes relative to the total accounts receivable balance:

- Company 1: $50,000 / $250,000 = 20%

- Company 2: $150,000 / $250,000 = 60%

- Company 3: $50,000 / $250,000 = 20%

Step 2: Square the obtained percentages and convert them into decimals:

- Company 1: 20% * 20% = 0.04

- Company 2: 60% * 60% = 0.36

- Company 3: 20% * 20% = 0.04

Step 3: Sum up the squared values to derive the accounts receivable concentration ratio:

- 0.04 + 0.36 + 0.04 = 0.44

Here, the accounts receivable concentration ratio is 0.44.

This ratio is significantly more than 0.1 (ideal result). Hence, the accounts receivable is more concentrated and therefore risky.

8. Understanding customer industry

It is necessary to understand your customer’s industry well to carry out thorough credit risk analysis. Some of the factors that you should consider are:

- Financial stability

- Competitiveness of the industry

- Government policies relating to the industry

- Future growth potential

- Current trends affecting the industry

- Potential factors that might affect the industry in future

Once you have a thorough grasp of your customer’s industry, you may tailor your services to fit their specific requirements. It also establishes a trustworthy relationship between the customer and the company.

9. Future planning

Predictive analytics tools help you accurately forecast future events and risks associated with your actions (e.g., credit sales). This helps you better prepare your business to mitigate credit risks. Identifying doubtful accounts would help you predict bad debts and help you put in extra payment collection measures when dealing with such clients. To get a sense of your customer’s future financial health, you should also analyze their growth strategies and upcoming projects.

10. Use of technology tools

Technology solutions help optimize processes and improve efficiency. Credit risk analysis can also be streamlined with the right technology. Automation solutions help standardize the process, enable real-time monitoring, and increase the efficiency of detecting potential risks.

Advantages over traditional process :

- Track changes in customers’ payment behavior with real-time credit risk monitoring

- Automate periodic credit reviews and stay updated

- Gain 360-degree process visibility with advanced reporting and analytics

- Save time and increase productivity of the credit department by reducing manual work with automation

How to Improve the Credit Risk Analysis Process?

Conducting a comprehensive credit risk analysis can enhance cash flow and mitigate the impact of bad debt. For optimal outcomes, prioritize periodic assessments over annual ones.

Moreover, you can elevate your credit processes through the prowess of automation. By implementing Credit Risk Management Software to automate the process, you can consistently monitor the health of your receivables and achieve unprecedented reduction in bad debts.

How Does Automation Help B2B Companies Make Better Credit Decisioning?

By seamlessly integrating automated processes, B2B enterprises can swiftly navigate complex credit evaluations. Automation empowers these companies to make informed decisions with greater speed, accuracy, and efficiency, enhancing risk assessment and enabling more confident credit choices.

HighRadius was recently invited to take part in a thought-provoking industry webinar hosted by the Finance, Credit, and International Business Association (FCIB) on the topic of ‘Automated Scoring Models’. With participation from HighRadius, Klöckner & Co – one of the largest producer-independent distributors of steel and metal products, and a panel of FCIB clients, this interactive session raised some interesting points on how best to leverage automation to make more effective credit decisions.

Here are some of the highlights:

Reducing credit risk with automation in a changing environment

In the face of an uncertain economic environment, lending money while staying safe is tricky. Lenders need good info to guess what might happen and decide quickly. Organizations need more predictable intelligence to be able to anticipate market changes and make decisions quickly.

A credit scorecard helps with this by providing a formula that uses data elements, or variables, to determine a threshold of risk tolerance. Some of these variables can include third-party credit scores, which use historical data and statistical analysis to predict future behavior. Credit risk professionals interpret this data to arrive at a logical decision on credit terms and limits. It’s a combination of smart data, sharp instincts, and time spent on due diligence.

However, like many other professions, the role of the credit manager has dramatically evolved. In today’s world, due diligence needs to be done in minutes or even seconds. Managing credit risk, reducing days sales outstanding (DSO), optimizing cash flow, and complying with regulations is more challenging than ever. Credit teams are under pressure to enhance the efficiency of their department, and this is where automation comes into play.

The importance of monitoring your credit risk score

A credit score can seem like a small part of the overall picture, but over the next year or so many organizations will be focusing on rebuilding their score to stabilize their business. Not only has the pandemic created immediate financial problems, but these challenges are likely to have a lasting impact on credit scores.

Your credit score can change for several reasons so it’s important to keep monitoring any changes with credit agencies. A high score demonstrates to suppliers that you’re creditworthy, which may make them more willing to negotiate with you on payment terms in volatile times.

One of the best ways to improve your credit score is to keep on top of your credit management process. Managing credit risk is key to a well-functioning business and a healthy cash flow. This is where automation and an end-to-end integrated receivables platform play a pivotal role in powering more efficient and effective credit decisions.

A new era of credit risk decision making

Automation helps to streamline credit assessments and has many potential benefits that include cost savings; more consistent, faster decisions; and a better client experience.

It is only a matter of time before organizations gain a competitive advantage through the power of automation and benefits in the following areas:

- Delinquency Score – automation can decrease bad debt and lower days sales outstanding/days beyond terms by reducing exposure to high-risk accounts, as any red flags are quickly raised.

- Speed and Scale – automated processes ensure each customer is evaluated in seconds. Large quantities of information can be processed allowing the lender to be more productive and efficient.

- Consistency and Accuracy – human error is eliminated. Calculating new, routine credit decisions with the same formula becomes a repeatable process that ensures equal, objective treatment of each applicant by removing any subjectivity. Consistent decision-making also leads to fewer disputes and customer service issues.

- Targeted Sales – once automation is set up for new accounts, the formula can be re-evaluated and applied for subsequent invoices to increase approval rates. This can help boost sales by targeting those creditworthy accounts for future promotions and foster better collaboration with the sales team.

When you consider these benefits, leveraging an end-to-end integrated accounts receivable (A/R) platform also becomes more compelling. Managing credit risk alongside collections and deductions management provides global visibility of all A/R operations in one place. One consolidated view of data and a single version of the truth. And from this point onwards, the ability to tap into the power of Artificial Intelligence (AI).

Elevated control in the cloud

Automating your credit risk management process as part of an integrated receivables platform lowers the opportunity for bad debt, decreases blocked orders with AI-based predictions and significantly reduces customer onboarding time.

Tapping into real-time credit risk monitoring on the platform can lower bad debt by:

- Tracking changes in customer credit risk and payment behavior

- Accessing unlimited customer credit reports

- Utilizing the ability to revise credit limits and re-score customers based on real-time credit risk alerts

In a survey conducted by HighRadius of 200+ credit leaders globally across Fortune 1000 companies, respondents confirmed that since the pandemic there has been a 5x increase each month in blocked orders.

“We are changing our risk tolerance level from a conservative level to a higher risk level. We are asking the customer to provide more information that funds are available to pay for the order – in some cases getting letters of credit.” – Director of Credit at a US $970M electronics company

By leveraging AI to predict blocked orders based on past order volumes and payment patterns, organizations can make better credit decisions. Also, the process of releasing orders by leveraging information from cash and deductions modules drives AI-based order release recommendations, resulting in a much better client experience.

Organizations regularly cite challenges with the time it takes to onboard new clients, negatively impacting the client experience. HighRadius clients enjoy a 67% reduction in onboarding time through automation and a seamless credit application process. Integration with a client’s ERP and CRM tools ensures the onboarding process is efficient and rapid.

The Future of Credit Risk and Integrated Receivables

During this crisis, credit leaders realize the need for efficient credit risk management. Doing more credit reviews or pulling reports is a quick fix. To improve working capital, using automation in a full receivables system is key.

As more organizations move to this model, greater opportunities will arise to leverage data and AI. Manually intensive processes will disappear, and finance teams will impact more critical and strategic projects. Organizations that do not leverage these capabilities fully, will inevitably lose market share and struggle to build long-lasting relationships with their customers.

FAQs

1). What is credit risk exposure?

Credit risk exposure is like a part of credit risk. It’s the most a lender could lose if a borrower can’t pay back.

2). How to minimize credit risk in business?

Make sure to carefully evaluate customers creditworthiness before offering credit. When you evaluate credit risk properly, you can take steps to decrease the chances of something going wrong with the money you lend or credit you give. This helps keep your business safer and more stable.

3). What are the components of credit risk analysis?

The primary component of credit risk involves the chance of not repaying and the magnitude of loss if repayment doesn’t occur. In credit risk analysis, three aspects are crucial: evaluating the borrower’s payment history, assessing their financial situation, and gauging the stability of their industry.

4). What is an example of credit risk analysis?

Let’s say you want to lend money to a company. You’d start by checking how they’ve paid back loans before. If they’ve been responsible, that’s a good sign. Then, you’d look at their money situation to make sure they have enough to pay back. And you’d also see if their industry is doing well or not, because that can affect their ability to pay you back. All these things together help you decide if it’s safe to give them a loan.

![E-Invoicing and Payments Process: A Step-by-Step Guide [+ Free Templates]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2021/12/Untitled-design-20.png)