Predict your customer’s payment date with AI-based Collections Software to ensure faster recovery

CFOs rightly refer to cash as the oxygen for the business. However, despite leveraging various working capital improvement initiatives, organizations continue to rely on working capital loans According to a survey report by Hackett, debt as a percentage of revenue has increased steadily over the last few years from 35% of revenue for the period 2008-2013 to 51% today, a 10-year high.

Where is this cash stuck? Mostly, in receivables as DSO increased by 4%. For the fourth year in a row, DSO degraded as organizations pushed payment term extensions on their supply base.

Finance leaders worldwide have to, therefore, pay more attention to collections and credit management process to define better credit policies and drive teams towards proactive collections to improve working capital.

This e-book has distilled insights from our study of credit and A/R transformation projects at 300+ organizations on how Fortune 1000 companies and SMBs reduced DSO by 15%-20% by implementing these eleven strategies.

Broadly, the strategies are categorized into the following buckets:

Customer onboarding is the first and one of the most important steps as wrongly estimated/arbitrary credit limits lead to bad-debt write-offs and high DSO. Most organizations ignore this step and take the word of sales representatives or customers to decide on credit limits.

According to a survey by NACM 33% organizations are pressed for time to perform due diligence on prospective customers. This is because companies typically assign credit limits based on credit agency data, financials, credit insurance, and bank guarantees. All of the manual processes, including paper-based credit applications, gathering data from third-party agencies such as D&B and Experian, and credit reviews, make it increasingly difficult for credit analysts to find time and onboard new customers.

Figure 1: Current Credit Application Process

The top bottlenecks for organizations in the credit application process are:

Figure 2: The Online Credit Application Process

Moving credit applications online, integrating them with credit agencies, and securing them with digital signature technology helps eliminate manual work and incomplete credit applications. An online application replaces a paper intensive credit management process with an electronic one to enable better credit portfolio and risk management and to quickly onboard new customers. Credit score and credit limits are calculated automatically while workflows are assigned to relevant credit managers to review and approve the assigned credit limits.

Figure 3: Credit Review and Customer Onboarding Process

Assigning the right credit limit to customers helps firms to collect payments on time, reducing DSO.

The adidas Group has about 10 different credit application formats which are filled by customers for requesting lines of credit from its various business divisions around the world. In what was a very manual paper-based process, the credit team at adidas took more than four days to process a single credit application. In essence, what this meant was that the credit team was mostly focused on tactical activities while trying to get a complete credit application rather than spending it strategically on the credit review process.

The Adidas group started deploying credit applications one by one at each of their business units. After deploying the HighRadius online credit application, the team was able to bring the new customer onboarding time to less than 2 days with more than 90% credit applications received with complete data on the first attempt. The end result was that the team was able to review more credit applications per given while using accurate data to reduce the credit risk exposure and alleviate the risk of high DSO due to wrongly estimated credit limits.

In the previous section, we discussed how inappropriate assignment of credit limits to new customers could lead to higher bad-debt and DSO. This section is about problems associated with the credit review process for existing customers.

Credit analysts are assigned hundreds to thousands of accounts for reviewing credit limits, onboarding new customers, and unblocking blocked orders. Since reducing credit risk exposure is the responsibility of the credit team, credit review processes need to be airtight. However, the sheer volume of accounts makes it impossible for credit teams to successfully cover all accounts which are due for periodic reviews. Constantly chasing the backlog of accounts means that credit analysts are often unable to focus on conducting a focused and accurate credit analysis.

Only after an objective analysis can a credit manager make an informed decision about extending credit or continuing the existing credit to the customer. While inconsistency in periodically reviewing existing customer credit lines is an issue, asynchronous events such as financial results, rating downgrades, and M& An activity could also be responsible for escalating credit risk. Figure 4 illustrates challenges related to both asynchronous events and internal SLA requirements that create a need for credit analysts to manually prioritize accounts for credit review.

Figure 4: Challenges with a Manual Credit Analyst Driven Process

This is where best-in-class companies leverage artificial intelligence to remove subjectivity from the process and help the analysts prioritize their worklist and simplify the review by suggesting credit scores based on several internal factors (including open A/R amount, aging details, ADD, dispute amount among others) and external factors (including dip in stock exchange, shift in credit rating, seasonal spikes, M&As among others)

Based on these factors, the system calculates a safe credit limit for the account and suggests it to the analyst along with all the documents used for research. Hence, empowering the analysts to make more informed decisions.

At the same time, it also automates credit review for all the small customers while triggering a credit review for customers accounts with troubled financials or credit ratings.

Figure 5:Internal and External Factors Used by Artificially Intelligent System

Figure 5 illustrates what all factors are considered the dynamic credit review of a customer account.

Tech Data Corporation, currently ranked #108 in Fortune 500, is one of the world’s largest wholesale distributors of technology products. The credit team at Tech Data dealt with legacy systems and manual processes for credit reviews. With a large portfolio of customers worldwide, the team had to log in daily to multiple portals for each region to fetch data from credit agencies.

The team automated credit data aggregation and workflows to achieve a productivity boost of 120% in the credit review process and also saved $160,000 annually through improved efficiency.

Studies have shown that companies are able to reduce DSO by three to ten days with electronic invoicing. By adopting electronic invoicing, credit departments are able to reduce dependence on print and mail for timely delivery of invoices while also reducing costs.

The top challenges associated with the paper-based invoicing process are listed below:

The top challenges associated with accepting electronic payments are:

Creating a self-service portal for both invoicing and payments is the first step. This removes the waste in the collections process where roughly 20% of collector’s time is wasted re-sending invoices to customers. This is enabled with a centralized online repository of invoices that could be accessed anytime by customers.

Top features that organizations leverage in these portals are:

Reckitt Benckiser(RB), a leading consumer goods manufacturer, had an expensive paper-based process for invoicing as SMBs depended on paper-based invoices while large customers were already using EDI for invoicing. By moving to an EIPP portal, RB was able to provide SMBs with lower cost e-invoicing options including e-mail and portal-hosted invoices to reduce the electronic invoicing cost by 98%.

Yaskawa America, Inc., an American manufacturer of HVAC products, saved $12,000 on credit card payments with a PCI-DSS compliant credit card processing solution by leveraging Level III data in the ERP for maintenance and repair orders.

Buyers tend to pay faster if they are making those payments with their preferred payment methods. E-payments are a great way to recover the receivables from the A/P teams but considering the current economic climate, the buyers would prefer keeping more available cash in their hands rather than clearing all the payments upfront.

The customers will most likely make late payments rather than paying instantly. Even if the customers pay through e-payment formats such as ACH, wire, BACS, CHAPS, SEPA, credit cards, here are the key challenges that the suppliers will face processing these payments:

• Manual processing of remittances coming from sources such as emails, EDIs, web portal uploads

• Same day processing could turn out to be expensive. For example, CHAPS or SWIFT payments charge up to 25 pounds.

• Security becomes a constant concern due to payment frauds

Credit card payment is the most suitable payment format which can create a win-win situation for both buyers and suppliers. With credit card payments, the buyers get a 30-day payment float, on the other hand, the money gets deposited in the supplier’s account within the next 2-3days. Therefore, this payment format not only helps to reduce the DSO for A/R teams but it also helps the A/P teams to have a steady cash flow for their business.

Moreover, payment processing becomes easier for suppliers because of the following reasons:

I. Auto-extraction and processing of remittances from emails, EDIs, web portals

II. Credit card payments taking place in a highly secure environment with the PCI-DSS compliant payment portals

III. Reduction of credit card acceptance fees by leveraging level III data

Asking for Credit card payments is a great risk mitigation tactic especially during economic downturns where cash flow is a huge challenge for buyers as discussed previously. However, one of the reasons why Credit Managers think about accepting them is because of the interchange fee, which could get expensive.

Express Employment, a leading staffing services provider, leveraged Highradius’ PCI-DSS compliant e-payment gateway to save $200,000 in interchange fee by leveraging Level-III data for processing credit card

payments.

On any given day, collections analysts spend up to 30% deciding on who to contact. Studies state that 30% of collections analysts’ time is spent prioritizing and preparing for calls.

At the outset, the collectors relied on their intuition, skill, and experience to skim through the worklist in order to prioritize accounts and reach out to the customers. As collections management has developed into a reactive process,

the collectors use static parameters such as due-date, invoice value, and current customer segment to tweak their collections strategies. With the numerous factors involved in customer’s A/P functions, these factors are grossly insufficient to deal with dynamic changes.

Most companies assign hundreds or thousands of accounts per collections analyst depending on the size of the company.

Figure 6 lists some of the most common attributes including dunning data, credit risk, and the number of promises to pay that effect whether a collections analyst should contact a customer on any given day. However, today companies want to strategically predict their customer behavior and hence take average days delinquent into account while prioritizing their worklist.

But, is it really the best way to go about it?

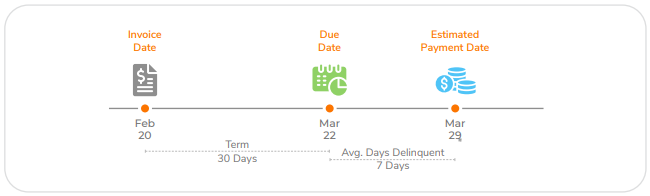

The subsequent figure illustrates payment date prediction using ADD as a metric for a small-to-medium

business (SMB) customer where the A/P team runs its cycle in the middle or end of the month and the payment terms are 30 days. This is just one potential pattern with one customer where the A/P cycle plays a vital factor in payment.

Figure 7: Customer Payment Behavior According to ADD

In the above scenario, the invoicing date is February 20th, and the due date is March 22nd according to the

30-days payment term. The ADD value of 7 indicates that on an average the customer delays the payment by

7 days after the due date. Based on this estimation, the predicted payment date is March 29th. However, the

A/P cycle schedule has not been considered in this assessment.

Figure 8: Predicted Delay vs. Actual Delay

The dynamics of the real-world overshadow this prediction. The A/P cycle of the customer runs on March 15th, i.e. mid-month when the payment terms are still valid and the payment is not due, and therefore, the A/P team skips initiating the A/P process for this invoice. The next A/P cycle runs on March 31st when the invoice is already past-due. This is when the A/P team begins the invoice approval and payment process, and the actual payment comes in on April 3rd. As a result, the actual delay is 12 days as compared to the 7 days prediction delay.

In another scenario, the invoicing date is February 12th, and the due date is March 14th, while the predicted payment date, based on ADD on 7 days, is March 21st.

Figure 9: Predicted Delay vs. Actual Delay

In this case, the A/P cycle runs on March 15th, one day after the due date, and approves the payment for the invoice. As a result, the actual payment is made on March 18th with a delay of 4 days, as compared to the predicted payment date of March 21st with a delay of 7 days.

The above scenarios clearly demonstrate that ADD as a metric is not sufficient to predict payment date and needs other customer-specific factors such as the A/P cycle schedule to predict the payment accurately.

Moreover, the above represents an instance of a single customer. With the gigantic number of customers with which the collectors deal, a nearly infinite number of factors come into play. It is not practically feasible for collections teams to identify each influencing factor and corresponding pattern for each customer to predict payment date and tweak collections strategies.

Machine learning-powered Artificial Intelligence is the hottest trend today, is incredibly powerful for predictions or calculated suggestions based on large amounts of data. In today’s aggressive economy, it is time for collections teams to recognize the necessity and worth of a proactive collections management process. This will only be achieved with collections strategies and correspondence game plans that resonate well with dynamic variables in the collections process. This chapter explains how AI/ML-enabled collections operate on dynamic factors.

Figure 10: A list of key factors considered by machine learning algorithms

The question is how does machine learning-powered AI works?

It takes training data or values of existing invoices to train the training model along with the actual results to compare the AI’s results against. So, for example in collections, AI can predict customer payment dates with up to 90+% accuracy. How does it reach that level of accuracy? It starts with training the models for the invoices that have already been paid for. It aggregates all the invoice attributes, accounts history among other things are part of the training data. The training models for the algorithm use this data to make predictions and ultimately, they are compared against the actual payment dates of the customer that has already happened. Based on the difference between the actual payment date and AI’s prediction date helps the model to self-learn and improve.

Proactive Collections Management not only helps analysts de-clutter their collections worklists by prioritizing the right accounts but also enables greater output with less cost by optimizing collections efforts.

ShurTech, the leading manufacturer of tapes under the “Duck” brand with manufacturing and distribution in 12 countries, leveraged Artificial Intelligence to devise a proactive collections strategy for their collectors. The team saw a 46% reduction in time taken to collect all past-due A/R.

A study by McKinsey found that 70% of collections calls go to customers who would have paid anyway. This is yet another place to optimize the process to increase the efficiency of customer contact and improve DSO.

Figure 11: The Biggest Challenge with the Collections Process – Too Many Assigned Accounts

The biggest challenge continues to be the account coverage and the limitation in the number of collections calls that could be made on any given day. Agents are assigned too many accounts at a time, and the preferred method of communication is a phone with very limited time spent on other mediums such as email or physical letters. Collections analysts focus on invoice value and aging data and make calls while ignoring a large number of assigned accounts; there are always accounts from the SMBs that makeup to 80% of the collections worklist but fall through the cracks since analysts tend to focus on high invoice value accounts. It is also impractical for collections analysts to call these customers for small amounts.

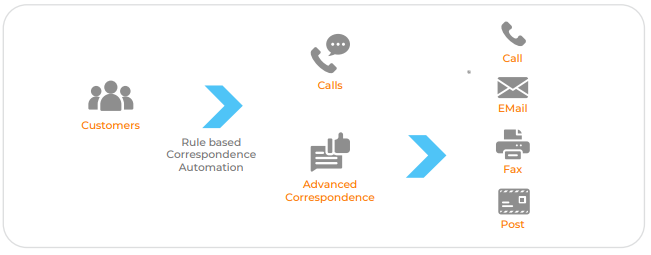

Figure 12: Automating Correspondence to Let Collectors Focus on Calling Only the Most Critical Accounts

As Figure 12 illustrates, systems have to be designed so that the collections analysts call only the most critical accounts. This automation is an extension of the previous section where we talked about how to let the system handle credit policies and score customers on the risk that they pose for the organization.

Based on each account score, the system will be able to tell the analyst what the next step should be. For example, if habitual late payers belong to a customer segment, the system should suggest that collections analyst to send out email correspondence 15 days before the invoice is past-due. The system should also have ready-made email templates so that the analyst is able to send mass correspondence to all customers in that segment with the click of a button. Taking correspondence automation further, the system should be able to automatically send proactive reminders for all accounts depending on the credit policies.

While email correspondence automation takes care of account coverage and brings the money to the bank through proactive reminders, collections analysts continue focusing on a high priority large accounts. This optimizes the collections process and reduces DSO.

Yaskawa America, the leading manufacturer of HVAC equipment, adopted automated prioritization of worklists and was able to contact more customers. The process improved overall to help Yaskawa in reducing DSO by 5.5 days and achieve a Collections Effectiveness Index of 90%.

Customers usually prefer making payments through self-service payment portals due to the ease of use and ease of tracking payments. However, can this experience be made more seamless? This is because a customer still needs to log into the payment portal every time, they are trying to make a payment.

Most of the customers are comfortable with using payment portals to make their payments. However, if you consider the time spent in this activity, the question arises whether someone will spend so much time to make a payment?

During this global crisis, they might simply avoid making the payment causing your DSO to rise subsequently. This is how payment portals make the payment experience slower:

• The A/P teams need to log in for every new payment

• Multiple payment formats are always not available on all supplier payment portals

• This process is tedious and time-consuming as the A/P teams will be making payments for multiple suppliers.

The collection teams will be able to collect the receivables faster with the payment links embedded in the dunning emails. This improves the payment experience as the customers do not need to log into the payment portals and make the payment. This is how customers will be able to pay instantly (in 3 steps) with these payment links:

I. The solution generates a unique payment link that is embedded within the payment reminder emails

II. Once the customer clicks on the payment link, they will be taken to a secure guest payment page with all the

necessary data such as invoice details, number of disputes, short payments, etc

III. The customer has to enter their bank account number or credit card details to complete the payment

Benefits of Email Payment Links for Dunning:

• Secure payment gateway

• Multiple payment formats supported: ACH, credit cards

• Customers will be able to download the payment receipt instantly

• The supplier will be able to view the payments made in the ‘Payments History Tab’ within the EIPP solution

• The remittance details will be automatically sent to the cash application teams

Cash application is one of the more resource-intensive processes in accounts receivable, and organizations are better off automating cash application and shifting resources to higher-value activities including collections and credit. The other disadvantage of a slow cash application process is that it is an upstream process that further slows down the deductions and collections processes. As an example, if a customer has already paid for an invoice but the status is not updated as closed in the ERP, collections analysts will waste time by calling a customer who has already paid.

Organizations today receive payments through cheques as well as electronic formats like credit cards. Reconciling cash for cheque and e-payments pose different challenges.

For cheques, A/R teams typically receive a bank lockbox file that contains the payment details, however, ERP systems need reconfiguration to be able to read the lockbox file and apply for payments. This is a recurring problem whenever organizations either add a new lockbox service or switch banks. Also, lockbox services tend to be quite expensive to maintain as banks also charge significant key-in fees for capturing remittance data. Nevertheless, this keyed-in data is usually insufficient for successfully posting the payments. More than 80% of the cash posting exceptions resolved by analysts are repetitive in nature. This is a result of customers repeatedly sending remittance information with the same inconsistencies or errors

The cash application analysts still have to resolve exceptions due to incomplete remittance data or code the deductions while identifying short payments. All these steps have been illustrated in figure 10.

Coming to electronic payments, while there is significant adoption of various formats, the cash application team is burdened with the cash reconciliation process as the remittance details are sent separately through email, EDI, or customer portals and websites.

Though the payment itself is electronic and fast, processing the payments is highly manual and time-consuming. The analysts collect remittance from different sources, associate them with incoming payments, link them to corresponding open invoices, check for short payments and discounts, and then post the cash in ERP which takes a

huge amount of time and effort. All of these steps have been illustrated in the above figure.

As the challenges have highlighted, cost and resource wastage are problems that have to be addressed on the cash application front.

By leveraging machine learning, the system is able to learn how different types of exceptions are being handled by analysts and identify the pattern of corrective actions for resolution. The engine is then able to replicate similar action using this intelligence, after undergoing thorough cheques and verification for the proposed correction.

Figure 12 talks about how each of the steps – aggregating remittance documents, coding deductions, and applying cash could be automated using an AI-based cash application system.

Danone North America had four FTEs for cash application, and, as with many North American businesses, they had both electronic and cheque payments that impacted their cash application process.

After leveraging an artificial intelligence-powered cash application automation solution, Danone was able to reduce the cash application team from four members to one and deployed the remaining members to other

A/R functions.

According to the study by Attain Consulting Group, about 90% of deductions are valid, and about 60-80% of the valid deductions are related to trade promotions. Whether the deductions are valid or invalid, analysts spend the same amount of time in resolving deductions.

Deduction Management teams and analysts process hundreds of thousands of deductions every year. However, even if a deduction is valid, it still requires a set of manual, time-consuming tasks to be executed before an analyst is able to determine its validity. With more than half of all deductions being valid, this means that credit and A/R teams lose productivity that could have been spent on resolving and collecting on invalid deductions.

Hence, there is value in weeding out invalid deductions and adding dollars back to the bottom-line.

Figure 18: The Deductions Paradox: Inability to prioritize deductions

As Figure 16 highlights that a high dollar value invalid deduction should be the highest priority for the deduction’s analyst whereas a low dollar value valid deduction should be at least priority. However, the analysts do not know which deduction is valid or invalid and hence, work on all the deductions. In other words, you do not really know whether a deduction is worth researching unless and until you have already worked on it.

As a result of this, the analysts end up:

Figure 19: Two Steps to Automate the Deductions Process

In order to reduce the time-crunch on deduction resolution, the AI enabled system predicts the validity of a deduction by analyzing several factors like payment history, customer account etc. and then compairing against the characteristics of the new deduction in question. With these predictions, 70% of the deductions worklist is automatically resolved.

For the remaining 30% deductions, the system provides recommendations. These recommendations are based on certain confidence categories. For example, it might predict for a certain deduction that it is 80% Invalid. This means that there is an 80% probability of this particular deduction being invalid. Similarly, it can predict 65% Invalid or 50% Invalid. On the basis of these recommendations, the deductions worklist gets re-prioritized to work on the highest probable invalid deductions first.

Keurig Dr. Pepper, the beverage manufacturer, had a high volume of deductions before leveraging automation. By leveraging automation to reduce the deductions workload and focus on root cause analysis, Keurig Dr. Pepper was able to recover an additional $1.4 Million in invalid deductions and also reduced the volume of deductions by 13%.

Deductions volumes have been growing over the years, making it more challenging for companies to handle the work with existing resources. A Credit Research Foundation survey observed that more than two-thirds of polled credit managers did not see any decline in the volume of deductions over the last 12 months.

Automating deductions identification, research and collaboration is yet another low hanging fruit to refocus resources from deductions operations to higher value operations including credit and collections.

Figure 16: Manual Steps in Resolving Deductions

Typically, a deduction proceeds through a set of stages for resolution handled manually by the analysts. Some of the major challenges they face while going through these manual steps include:

Deductions analysts spend a significant amount of time downloading and aggregating back up documents and collaborating with different stakeholders while research and resolution.

This is where the top companies leverage technology to auto-aggregate all claims and PODs while providing a structured workflow for the analysts to research, catalog, and amass all their collaboration at a single source of truth.

Figure 17: Two Steps to Automate the Deductions Process

Automating the deductions back up aggregation for claims and proof of delivery and attaching these to open deductions could significantly reduce the time take in backup retrieval and research. With this, the deductions become reasearch ready for analysts.

Going one step further and providing a structured workflow platform for analysts to take care of all internal and external collaboration enables smooth and fast resolution. Faster deductions resolutions, in turn, result in faster collections, thereby lowering DSO.

Land O’Lakes, one of America’s premier agribusiness and food companies, received more than 100,000 deductions per year with 50% being contributed by the top 12 large customers. Handling all these deductions manually required huge commitments from the analysts in terms of time and effort. With automation, Land O’Lakes was able to increase ~$2 Million in closed deductions (dollars) while reducing the Deduction Days Outstanding (DDO) by 23%.

As the previous sections show, there could be significant gains from optimizing each of the individual processes in the credit-to-cash cycle. However, credit and accounts receivable teams could unlock gains in multiples if they start breaking departmental silos and work as an engine.

Starting with the credit team, blocked orders directly affect the top-line of any company. Since the credit and collections teams work in silos, accounts that near credit utilization might be missed by collections and have new orders blocked. Sometimes, the problem is only that the customer is not aware of the existing credit limit.

Similarly, a lack of clarity on deductions means that collections team either call customers with open deductions and get nowhere or ignore resolved deductions which are low hanging fruit for collections.

Figure 20: Blocked Order Process

The figure above outlines all the different people who need to coordinate together to resolve a blocked order. The end result is that the blocked order process is always a reactive process and, along with delaying revenue realization, it is also responsible for compliance problems in credit policies.

Figure 21: A Streamlined Blocked Order Process Supported by Integrated Systems and Artificial Intelligence

Leading organizations are strengthening process collaboration by leveraging integrated technology. These systems are able to read patterns based on past sales orders and trigger a workflow for potential blocked orders to either send automated correspondence or for the credit analyst to notify the customer about delivery blocks. The customer is then able to directly view the invoice in a buyer-supplier collaboration portal and pay through the same. The credit limit is then automatically freed, and orders don’t get blocked.

One of the biggest challenges in the credit-to-cash cycle is supplier-buyer collaboration for processes across credit, billing, collections, payment processing, and dispute resolution. Since teams collaborate manually over email, it proves to be a huge challenge to maintain a system of record especially on past communication and patterns of problems.

A/R and A/P collaboration is very important right from the credit application process where the credit terms are set to the collections process where the A/P team pays invoices and reaches a settlement on deductions.

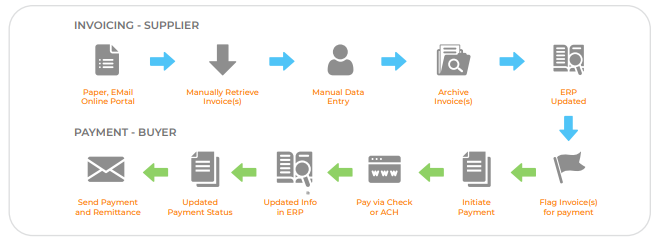

Figure 22: Manual Process in The Invoice to Cash Process

Figure 22 outlines the number of manual steps from the invoicing process to the payment process. An error in even one of the steps will result in a late payment and increase in DSO.

Figure 23: Enabling Digital Collaboration Between Buyers and Suppliers

As Figure 23 outlines, establishing a digital collaboration portal between buyers and suppliers is the first step that organizations have undertaken. The platform is able to link the supplier ERP with the buyer ERP so that with a single click the supplier is able to post invoices directly into the buyer’s ERP.

Figure 24: Condensing a 10 step process to a 2 step process by leveraging a buyer-supplier network

Figure 24 outlines what the new process will be. A billing analyst generates an invoice for a product/service and posts it on to the network which in turn posts it directly on to the ERP of the buyer. This results in faster invoice delivery, seamless payment from the accounting system and straight through cash posting as the payment happens through the portal.

Autonomous Receivables is a new way of thinking about order to cash software which reduces the amount of clerical work done by the user, and puts them in a position where they are applying their contextual decision making for course correction. This is similar to how you could have a self-driving car work perfectly well on a highway/freeway and the driver only needs to provide light inputs from time to time.

The depiction of machines as a threat to humans is a Hollywood construct. In reality, technology has driven the most revolutionary leaps for mankind. Think of what the printing press, electricity and the internal combustion engine did for the people of that time. What self-driving cars and drone delivery systems are doing today. The role machines play to improve the quality of human life is tremendous.

Combining A/R Analysts with AI and digital assistants could laser-focus teams on strategic work with higher corporate impact. While the AI digital assistant will perform the clerical tasks and provide deep analytical insights, the A/R analyst will evolve to combining this insight with their context-sensitive judgment to drive better outcomes.

Autonomous Receivables, the combination of the world-leading HighRadius AI-enabled Integrated Receivables platform and the Freeda Digital Assistant is set to fundamentally change how order to cash analysts get work done.

To summarize, all of these strategies fall into the following three buckets:

I. Fixing the Root Causes of High DSO: High DSO could either be because the customer in question is not creditworthy or simply because the customer was not contacted on time. Addressing the customer onboarding and credit review processes will take care of the former, and addressing the collections bottlenecks will take care of the latter.

II. Eliminating Waste in A/R Operations: Sometimes, even after all of the optimizations within collections, organizations don’t have enough resources for collections. Addressing waste in resource-intensive processes including cash application and deductions will give organizations enough leeway to increase FTEs working on collections while flatlining the A/R team headcount as a whole.

III. Breaking Silos in Operations and Facilitating Collaboration: Collections as a process involves communicating with internal and external stakeholders. Addressing how information flows within the A/R team, for example, from the cash application team to the collections team, and collaboration between buyers and suppliers will further unlock opportunities to reduce DSO and improve accounts receivable turnover.

As the success stories show, organizations of all sizes from Fortune 1000 companies including Dr. Pepper Snapple and Danone and SMBs including Zendesk and ShurTech brands have been able to deploy these twelve strategies and reduce DSO by 10-20%.

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company. The HighRadiusTM Integrated Receivables platform reduces cycle times in the order-to-cash process through automation of receivables and payments across credit, electronic billing and payment processing, cash application, deductions and collections.

Powered by the RivanaTM Artificial Intelligence Engine and FredaTM Virtual Assistant for order-to-cash teams, HighRadius enables organizations to leverage machine learning to predict future outcomes and automate routine labor-intensive tasks. The radiusOneTM B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

HighRadius solutions have a proven track record of optimizing cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

To learn more, please visit www.highradius.com

Integrated Receivables optimizes accounts receivable operations by combining all receivable and payment modules into a unified business process. The Integrated Receivables platform provides solutions for credit, collections, deductions, cash application, electronic billing, and payment processing – covering the entire gamut from credit-to-cash.

The HighRadiusTM Integrated Receivables platform stands out by enabling every credit and A/R operation to execute real-time from a unified platform with an end goal of lower DSO, reduced bad-debt, and faster dispute resolution while improving efficiency and accuracy for cash application, billing, and payment processing.

HighRadiusTM Integrated Receivables leverages RivanaTM Artificial Intelligence for Accounts Receivable to convert receivables faster and more effectively by using machine learning for accurate decision making across both credit and receivable processes. The Integrated Receivables platform also enables suppliers to digitally connect with buyers via the radiusOneTM network, closing the loop from the supplier Accounts Receivable process to the buyer Accounts Payable process.

Get real-time visibility into bad debt, DSO and CEI for effective collections strategies with AI-Powered Collections Management

Connect to an Expert