Calculating the cost per invoice in accounts payable (AP) gives finance teams a clear, data-driven view of the expenses involved in processing each supplier invoice. This metric includes direct costs, such as labor and technology, as well as variable costs like payment processing fees. By measuring this figure, organizations can identify inefficiencies, justify AP automation initiatives, and benchmark their performance against industry standards. Accurate cost-per-invoice tracking is essential for improving operational efficiency and supporting strategic decisions at the executive level.

In this guide, we’ll explore the importance of cost per invoice, how to calculate it, and how you can use this metric to improve AP performance. We’ll also provide actionable tips and a real-world example to help you manage invoice processing costs without compromising accuracy or compliance.

Cost per invoice refers to the average amount an organization spends to process a single supplier invoice. This figure includes:

Want to Slash Invoice Processing Costs?

Get a personalized demo and see how teams cut costs by 60% with AI-powered AP workflows.

Request a DemoBy tracking this metric, organizations can assess the overall efficiency of their AP operations and pinpoint areas where costs can be reduced, whether through process optimization or automation.

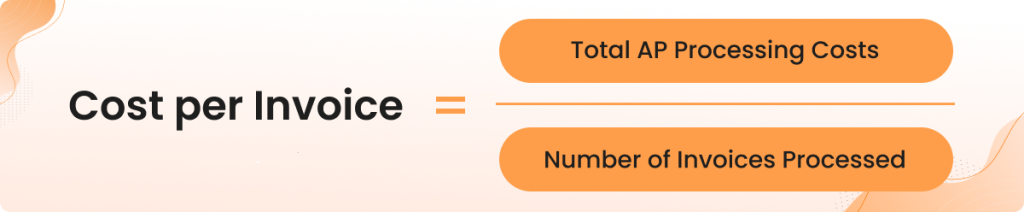

Calculating cost per invoice is a simple yet powerful exercise, as long as you track all relevant costs and invoice volume over a consistent period (usually monthly or quarterly). Here’s how to do it:

Add up all AP-related expenses for the chosen period. Be sure to include:

Count all valid supplier invoices processed during the same period, regardless of format (paper, PDF, email, EDI, XML, or API-based feeds).

Example:

If your total AP expenses for Q1 are $120,000 and you processed 4,000 invoices during that time, your cost per invoice is:

$120,000 ÷ 4,000 = $30 per invoice

To gain deeper insight into cost drivers, categorize your AP expenses. Separate them into labor, technology, payment, and overhead. If your cost per invoice increases over time, this breakdown helps you identify whether the spike is due to rising labor hours, increased system costs, or higher payment processing fees.

Let’s examine a real-world scenario to understand how cost per invoice is calculated and what insights it can reveal.

A mid-sized distribution company wants to evaluate its AP efficiency for Q1 of 2025. The finance team collects the following breakdown of its accounts payable processing costs:

The total AP processing cost for the quarter comes out to:

$90,000 + $18,000 + $7,200 = $115,200

During the same quarter, the company processed 4,800 supplier invoices.

To calculate the cost per invoice, use the standard formula:

Cost per Invoice = Total AP Processing Costs / Number of Invoices Processed

= $115,200 / 4,800

= $24.00 per invoice

The result shows that the company spends $24.00 to process each invoice.

Breaking this cost down further:

Not all invoices are created equal, nor are the costs to process them. A $20-per-invoice cost at one company might be $4 at another, simply because of how their accounts payable (AP) function is set up. To uncover where costs are coming from—and where you can reduce them—it helps to break down the key cost drivers:

People are often the largest cost component in invoice processing. This includes salaries, benefits, and overhead for staff handling data entry, approval routing, and supplier communication. Paper invoices require additional effort—scanning, sorting, and manual routing—whereas electronic invoices, paired with automation, can significantly reduce the hours involved per invoice.

The systems you use matter. Legacy tools might have low upfront costs, but demand high ongoing support and workarounds. Modern AP platforms, especially cloud-based ones, may require a subscription fee but offer streamlined automation, better integrations, and lower maintenance, driving down costs over time.

How you pay suppliers also affects your bottom line. Printing checks, buying envelopes, paying postage, and handling reconciliation all add up, sometimes costing $3–6 per transaction. Electronic payments like ACH or virtual cards are cheaper (often under $1) and easier to scale, though they may include flat fees or per-transaction costs.

Mistakes cost time, and time costs money. Each exception (duplicate invoice, wrong amount, missing PO, etc.) requires manual investigation, often delaying payments and straining supplier relationships. The more errors you have, the more expensive each invoice becomes. Improving data accuracy and automating validation steps is essential for reducing exception-handling costs.

The way your AP workflow is structured—manual vs. automated, fragmented vs. standardized—has a massive influence on costs. Even partial automation (like three-way matching or invoice OCR) can cut down cycle time and processing expenses. Clearly defined rules, streamlined approval chains, and integrated tools make the difference between high-cost and low-cost AP operations.

High-volume AP teams can spread their fixed costs (like software subscriptions and infrastructure) across thousands of invoices, lowering the average cost per transaction. Smaller organizations may face higher per-invoice costs, but right-sized tools with usage-based pricing models can help level the playing field.

Improving the cost per invoice is not just about cutting corners. It’s about building smarter systems, better habits, and long-term capabilities. Here’s how to do it strategically:

Adopting an AP automation platform delivers quick wins by reducing manual work and errors. Focus on capabilities like:

Even partial automation—like processing invoices via email or supplier portals—can cut costs by 50–80%, according to industry research.

Disparate AP practices across departments or regions drive up complexity and cost. Centralize invoice handling, define consistent approval workflows, and set clear invoice submission policies (like a central email or supplier portal).

Early-payment discounts (e.g., 2% for payment in 10 days) can lower your net invoice cost. With dynamic discounting tools, you can automatically decide when paying early delivers real financial value based on your cash position.

Exceptions are cost multipliers. Track root causes—mismatched POs, missing data, unclear approval chains—and solve them at the source. Integrating procurement and AP, or enforcing stricter PO compliance, can reduce exception rates dramatically.

Tools are only as good as the people using them. Offer ongoing training on AP platforms, fraud detection, compliance, and process optimization. Create a continuous improvement culture by tracking key KPIs and celebrating team wins.

Paper checks slow things down and cost more. Transition to ACH, virtual cards, or EFTs—balancing cost-efficiency with supplier preferences. Consider platforms that offer rebates or rewards on electronic payments to reduce total cost.

Strong controls are essential, but too many approval layers slow everything down. Audit your internal controls regularly. Use automation to flag high-risk invoices while simplifying low-risk workflows to speed up throughput.

Don’t wait for quarterly reports to find out something’s broken. Modern AP platforms show real-time performance—processing times, exception spikes, approval delays—so you can act fast and continuously improve.

Understanding the cost to process each invoice isn't just a number-crunching exercise—it’s a critical lever for improving AP performance and long-term financial health. Here’s why this metric should be on every AP leader’s radar:

When you know your cost per invoice, you can compare it against industry averages or peer organizations. If your processing cost is higher than the norm, it’s a red flag that your AP workflow might need attention.

A sudden increase in invoice processing costs could be a symptom of deeper issues, like slow approval cycles, frequent exceptions, or inefficient manual handling. Breaking down your total costs into categories (labor, tech, fees) helps pinpoint what’s dragging your team down.

By turning AP expenses into a per-invoice metric, you gain a powerful forecasting tool. Whether your invoice volume is rising or falling, you can adjust budgets more precisely and align staffing and tech needs accordingly.

Thinking about investing in AP automation? Use your current cost per invoice as a baseline. If automation could reduce that cost by 30–60%, you now have a concrete business case to present to leadership, grounded in data, not assumptions.

The real value of this metric comes from tracking it over time. When AP leaders measure their cost per invoice regularly, they gain insight into whether past changes are working and can quickly intervene when costs begin to creep up again..

At first glance, a lower cost per invoice is a win. But the real answer isn’t so black and white. Whether a high or low processing cost is better depends on the tradeoffs your AP team is willing—and able—to make.

Here’s how to evaluate your target cost per invoice in the right business context:

It’s tempting to chase the lowest possible number. But extreme cost-cutting can come at the expense of internal controls, staff bandwidth, or compliance. If you're skipping approval steps, underinvesting in training, or overloading employees, a “low” cost may hide bigger risks.

The ideal cost per invoice should reflect a balanced, well-managed process, not just lean operations, but secure and sustainable ones.

Typical AP processing costs vary widely:

So if your current cost per invoice is $25 and your peers average $15, that’s a signal you may be behind on automation or efficiency. But if you're already in the $8–$10 range, further cost reductions might yield diminishing returns, and your focus may shift to improving accuracy, approval time, or exception handling instead.

Automation pays off more when there’s volume. Larger enterprises can spread the cost of AP platforms and infrastructure over thousands of invoices, significantly lowering the average cost.

Smaller teams may not see the same ROI from large-scale tools, but they can still benefit from targeted automation like OCR-based invoice capture or digital payments to improve cost control without overinvesting.

Some sectors—like healthcare, utilities, or government—face strict compliance, audit, and documentation requirements. In these cases, a slightly higher cost per invoice may be strategically justified if it supports risk mitigation and audit readiness.

HighRadius AP Automation is designed to tackle the biggest challenges driving up your cost per invoice—primarily manual labor, slow approvals, payment fees, and errors—by leveraging advanced AI and automation technologies. Its AI-powered invoice capture eliminates time-consuming data entry by accurately extracting invoice details from multiple formats.

Automated three-way matching drastically reduces exceptions and manual interventions, cutting labor costs significantly. Smart, configurable approval workflows accelerate invoice processing, helping your team capture early-pay discounts and improve cash flow. The platform supports electronic payments through ACH and virtual cards, minimizing expensive check processing fees. Real-time dashboards and AI-driven exception management give you complete visibility and control, ensuring compliance without slowing down operations.

Plus, with seamless ERP integration and cloud scalability, HighRadius can effortlessly handle growing invoice volumes, enabling your AP function to stay agile and efficient. By adopting HighRadius, organizations can lower their cost per invoice by up to 80%, enhance supplier relationships, and transform AP into a strategic, cost-saving powerhouse.

By leveraging HighRadius AP Automation, finance leaders can dramatically cut invoice processing costs, reduce payment errors, and free up teams from time-consuming manual tasks. If you're ready to transform AP into a faster, smarter, and more cost-effective function, it’s time to see HighRadius in action.

The cost to process a single invoice varies widely based on organizational size, industry, and level of automation. Manual processing costs typically range from $12 to $40 per invoice, depending on complexity. Automated AP processes can reduce that expense to as low as $1 to $5 per invoice.

The cost per invoice ratio—or AP cost per invoice—represents the average amount your organization spends to process one invoice. It is calculated by dividing total AP processing costs (labor, technology, and payment fees) by the total number of invoices processed during the same period.

The formula for calculating the cost per invoice in accounts payable is:

Cost per Invoice = Total AP Processing Costs / Number of Invoices Processed

This formula helps AP teams measure efficiency, identify bottlenecks, and benchmark performance against industry standards.

Industry reports and research studies publish AP benchmarks. Generally, manual processing costs range between $12 and $40 per invoice, while organizations with end-to-end automation report costs as low as $1–$5 per invoice. Compare your calculated cost per invoice to these figures to gauge your performance.

To get a comprehensive view of AP performance, track metrics such as:

Monitoring these KPIs together with the cost per invoice provides a holistic view of AP efficiency and health.

Yes. Modern AP automation platforms leverage OCR, machine learning, and workflow automation to slash manual labor and errors. Organizations that implement end-to-end automation can see their cost per invoice fall into the $1–$5 range. Actual results vary based on the maturity of existing processes, invoice volume, and system integration.

Positioned highest for Ability to Execute and furthest for Completeness of Vision for the third year in a row. Gartner says, “Leaders execute well against their current vision and are well positioned for tomorrow”

Explore why HighRadius has been a Digital World Class Vendor for order-to-cash automation software – two years in a row.

HighRadius stands out as an IDC MarketScape Leader for AR Automation Software, serving both large and midsized businesses. The IDC report highlights HighRadius’ integration of machine learning across its AR products, enhancing payment matching, credit management, and cash forecasting capabilities.

Forrester acknowledges HighRadius’ significant contribution to the industry, particularly for large enterprises in North America and EMEA, reinforcing its position as the sole vendor that comprehensively meets the complex needs of this segment.

Customers globally

Implementations

Transactions annually

Patents/ Pending

Continents

Explore our products through self-guided interactive demos

Visit the Demo Center