Cut Down Costs, Efforts and Time: 5 Ways to Automate Cash Application

Read on to find out how Artificial Intelligence and Cloud-Based Machine Learning can help you cut down costs, effort and time!

Introduction

Every account receivable manager has been given a simple directive – do more with less. Nowhere is this more pronounced than in the area of cash application where the amount of work and the resources required increase proportionately with sales. This dependence means that to accommodate growth, cash application teams need to either recruit and train new resources or take resources away from other activities such as managing credit and risk, reviewing and resolving deductions, or collecting on overdue accounts.

Over the years, accounts receivable managers have tried various methods to streamline and optimize their cash application process. Some have outsourced data entry to banks, others have off-shored all or part of their operations to business partners, and some have opted for technology solutions to help automate some of the work. While each of these solutions has helped to achieve a degree of success, there is still a huge opportunity for improvement.

In the course of our collaboration with many AR professionals and thought leaders, we identified a general lack of awareness and skepticism about the potential that technology presents for resolving core problems related to cash application. To help AR managers make better decisions regarding their businesses and teams, we decided to provide an overview of the latest technological advances powering cash application teams at some of the most innovative companies we have worked with.

This book will provide insights into the latest technologies in cash application and how they can solve common problems encountered by virtually all cash application teams we have worked with. Depending on your business, your customers, and your payment mix, you will be able to better plan and meet your resource allocation and automation objectives.

Artificial Intelligence to Capture Remittance Data from Check Stubs

One of the most time-consuming activities within cash application is the processing of paper remittance advice. Many companies, especially smaller players who have not switched to more recent systems, continue paying by paper check. A problematic side effect of this is that they continue to provide remittance as paper attachments to their checks. Reading and processing this information is a very time consuming, a low-value activity that occupies a significant chunk of time for cash application analysts.

As a result, many companies have outsourced this task to their banking partners, who usually charge per keystroke. Because of the cost per keystroke, only key information is entered – usually only payment header information. This means that there is still a lot of line-item detail that does not get processed. Invoices paid, amounts paid for each invoice, and deduction information are some of the details that usually get omitted and result in additional work being performed by cash analysts.

Early solutions aimed to fully process the information in the remittance by combining Optical Character Recognition (OCR) with pre-defined templates. A user, administrator or business user, would tell the system where to extract each piece of information (payment amounts, invoice numbers, etc.), usually done by drawing rectangles on the scanned remittance image. However, this led to a new set of complications as a set of exact rules had to be followed when drawing these regions or the accuracy of data extraction would be seriously reduced.

First-Generation Optical Character Recognition (OCR) Solutions faced a lot of issues. For example, the reading area rectangle had to be large enough to cover not just the payment amount on this check, but on checks with potentially larger amounts.

For instance, the reading area rectangle should not be big enough to overlap fields where it can get confused by characters unrelated to the amount. Tables, such as those in situations where multiple invoices were paid with the same check, posed a different problem since the rectangle had to cover the entire length of the table to accommodate a variable number of invoices. On the flip side, any text, such as description and notes that were interspersed between invoice lines, would cause issues. The limitations of template-based solutions constrained their practicality and made it expensive to increase automation by creating templates for new payers.

Recent technological advances have approached the problem from an entirely new direction. Artificial Intelligence and Machine Learning have addressed the problem regardless of whether the remittance is provided as paper, email, or in a customer portal. Such systems can be trained with historical remittance documents and the resulting extracted and parsed data. The systems then learn what keywords are used to identify key items. For example, the systems can learn over time that invoice, reference, and any other terminology encountered can be used to specify the invoices paid with the check. Another important piece of information that cash application analysts are very familiar with and apply instinctively is the location of information on the page. For example, the check number is most likely on top; the invoice numbers are towards the left side of the page, the amounts on the right, and the total amount at the bottom.

Machine Learning and Artificial Intelligence (AI) are particularly effective when deployed in cloud solutions. The nature of a cloud system where a single AI entity is handling the processing of data from multiple payers across customers makes it easy and quick to learn and apply lessons learned across accounts and companies.

The system is able to learn where to look for information and how to identify it. Once it identifies the information, validation rules can be run to ascertain accuracy. In a situation where the system has trouble extracting and identifying the critical fields, it will ask a user for guidance. The user will then teach the system in this peculiar situation and its learning will be applied next time a similar situation is encountered in remittance by this or other payers.

There are numerous benefits of AI and Machine Learning and the intelligent cash application systems deployed on the cloud. At first, it helps reduce the cost to cash application teams and enables minimum delay in go-live.

“Automation rates achieved with AI solutions deployed on the cloud have been staggering … More than 95% of invoices are processed and closed without any human intervention.”

ONLINE WEBINAR

Companies today are challenged with processing payments from a l alarge number of customers. In the absence of automation, this is a manual, repetitive effort that requires a large team to spend time on low-value, frustrating tasks. Learn how J&J Sales and Logistics Company Secured 95% Invoice Hit-Rate for their Cash Application operations.

View Webinar

Secondly, the automation rates achieved with AI solutions deployed on the cloud have been staggering. Oftentimes, customers are able to achieve 95% or more on-invoice automation hit rate. This means that more than 95% of invoices are processed and closed without any human intervention. Over time, as these higher systems learn, the automation rates continue to improve until only rare exceptions require human intervention.

Without the need to define templates, the learning system can be up and running quickly and provide immediate results. This further provides value to the company as it minimizes the cost of expensive IT projects and the delays associated with procuring IT resources.

AI and Machine Learning provide a new opportunity to streamline the use of resources within the credit or A/R department. These cash application automation solutions minimize barriers to adoption as they limit dependency on internal resources. They enable a team to support growth without adding additional resources to handle low-value activities and by realigning the team and shifting resources to higher-value activities such as research of deductions, analysis of accounts and credit reviews, and collections activities.

Intelligent Parsing To Read Remittance Data from E-mails

The accelerating move to electronic payments and ACH has created some curious implications for cash application teams. While on the surface it seems that electronic payments should be easier and faster to process, the new ways of providing the corresponding remittance, including via e-mail, have had a potentially negative impact. Instead of leveraging their bank relationships, cash application teams have had to find new ways to process these remittances. Let us focus on remittance provided via e-mails and ways to automate its processing.

“The irony is that e-mail is one of the most convenient forms of remittance to automate.”

Without automation, e-mail remittance would require manually reading through the e-mails and attached files and processing the payments. In many instances, teams would attempt to use the low level of automation accomplished with OCR technology. This would mean that remittances would be printed first, then scanned and processed with OCR. This is not only manual and labor-intensive but also introduces the added cost of paper.

The irony is that e-mail is one of the most convenient forms of remittance to automate. The data is already provided in electronic form, removing a lot of the complexity and errors of OCR. The main hold up in automation here was that automation required customer-specific templates that needed to be developed by IT professionals. This required an IT project and would lead to delays and added costs.

Cash application system vendors have deployed several different types of solutions to address the problem. Template-based solutions automate e-mail remittance and make it easy to deploy a solution by eliminating the IT bottleneck. However, this still requires work to develop and test each template. This work was taken up by the vendors, speeding up the delivery of results and realization of value.

The latest technologies are also applying Artificial Intelligence (AI) and Machine Learning to automate e-mail remittance, similar to how it is applied in processing paper remittance as we learned in the previous chapter. The AI learns how to identify e-mails as containing remittance information by examining keywords and attachments. Similar to paper processing, the system can identify and extract the data fields relevant to cash application. It can do this in situations where the remittance is provided in the body of the e-mail as well as when it is in an attached file.

As far as e-mail remittance is concerned, the cloud model can again serve as a multiplier by helping quickly train and teach the AI. The lessons already learned can be carried across organizations to enable quick deployment and support of new payers. This helps reduce the cost to cash application teams and enables minimum delay in go-live.

ONLINE WEBINAR

Reckitt Benckiser (RB) is a consumer goods company with a vast and varied array of customers with global revenues in excess of $16 Billion. Cash Application was soon becoming a bottleneck in the ever expanding scale of operations. Learn how RB utilized the power of the Cloud and Artificial Intelligence to achieve a 98.5% on-invoice hit rate and reduce staffing costs by 65%.

E-mail remittance, like other electronic methods for providing remittance, presents a great opportunity to automate. Because errors due to scan quality and paper formatting are inherently avoided, the automation rates are able to reach 100%. In fact, during implementations, some of the fastest automation is realized on customers who submit remittance via e-mail. This means that your cash application team would not need to spend any time on customers providing e-mail remittance.

Intelligent Web Aggregation To Capture Remittance Data from Websites

As clients started to move from check payments to electronic payments, there was also a shift in how the remittance information was sent. Earlier, most of the electronic payments were accompanied by email. However, in recent years with advancement in account payable software, the big retailers now prefer to host the remittance information on their websites. The vendors are provided with credentials to login and download the remittance information.

With the absence of any automation, obtaining or pulling information from websites has become a highly manual task. Every day analysts log into retailer websites, search for remittance information, and download the data. The data is then manually fed into the ERP system or manually keyed into a file that goes into the auto-cash system. Overall, advances in accounts payable systems have resulted in manual work for vendors for their cash application process.

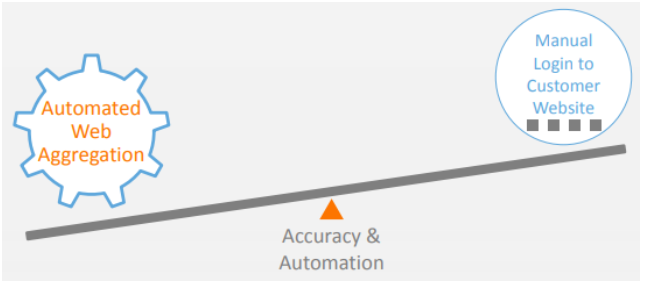

It may seem impossible to automate the remittance data that are hosted on websites, but technology solutions are now available to enable automation.

Over the last decade, web technology has advanced leap and bounds. Today, we have at our disposal what is referred to as web aggregation or web scraping. The Travel and Hotel industry heavily utilizes web aggregation technology. For example, let us consider a travel booking website such as kayak.com. kayak.com logs into all the travel websites and collects information on the cheapest available deals. This same web aggregation technology can solve the problem posed by major retailers hosting remittance information on their websites.

By using web aggregation technology, you can create agents that will regularly login to your retailers’ websites and look for remittance information. Once the information becomes available, the virtual agents will automatically capture the remittance data and provide it in a digital format.

“The entire process can be automated to such an extent that on a regular basis you get remittance and payment information without having to log in to any of your retailers’ websites.”

A set of rules can then be applied to further enhance the quality of data and bundle it with the payment information. The entire process can be automated to such an extent that on a regular basis you will get bundled remittance and payment information without having to log in to any of your retailers’ websites. Alerts can also be set up to track any errors such as the login/password expiring so that corrective actions can be taken.

If you have retailers or other customers who provide remittance data on their website, consider using web aggregation technology. Website automation provides you a good opportunity to achieve close to 100% accuracy and automation. Since the data is available on websites in digital format, we will not come across errors that we typically do with scanning technologies. You could achieve real automation wherein, your cash application team would not have to touch any remittances that are uploaded on your retailers’ websites.

EDI Encourage Customers To Use EDI For Remittance Data

One of the most successful automation attempts in payments has been the adoption of EDI, or Electronic Data Interchange, which can allow for full automation of cash applications from participating customers. EDI specifies the number of formats for everything from invoices to debit authorizations. Two financial formats related to payments and processing are EDI 820 and EDI 823. EDI 820 is for payment/remittance advice and is provided by paying companies, usually to accompany an electronic payment. EDI 823 is a lockbox file that usually comes from the bank. EDI 823 is not unlike other lockbox formats like BAI and BAI2, in that they have similar shortcomings – while they can usually be processed directly by ERP, they do not contain line item detail due to costs for adding these by the bank. For this reason, EDI 820 has emerged as a key enabler of auto-cash. The issue with EDI is that even with general standardization, the format is open to customization between various customer companies. In fact, there are two dominant standards for EDI –

ANSI X.12 and UN/EDIFACT. Because of the wide variation of data that can be included, the EDI formats vary between customers.

In the past, vendors looking to take advantage of EDI had to provide specific templates … this process is error-prone and limits flexibility…”

It is not uncommon to receive a manual of hundred-plus pages to describe the various segments and data fields in the file provided by a given company. This often meant that, in the past, vendors looking to take advantage of EDI had to provide specific templates to read and process each individual format of EDI. This process is not only IT-intensive to add new automation, but it is also error-prone and limits flexibility when payers make changes to their files.

Recent solutions have provided out-of-the-box, comprehensive support for the rich EDI 820 and 823 formats that allow onboarding new customers without additional resource expenditure and delays. By supporting the multiple variations allowed by the different formats, such systems can interpret the data correctly without the need for customization.

The benefits of EDI support are clear. Companies can automatically, and without error, get the information they need to immediately apply cash without any human intervention. The level of automation that EDI can provide? 100%!

This means that customers who provide EDI already or that you can convince to provide you with EDI remittance, will not take any of the cash application team’s time allowing for switching resources to higher-value activities or to support growth without growing team size.

Rules Achieve over 90% Automation Levels

Large organizations deal with thousands of customers. Each customer is unique – they run different ERPs, different accounts payable systems, and varying methods for providing remittance and payment. Many organizations consider such differences, especially when it comes to remittance, to make automating cash applications inherently difficult, time-consuming, and expensive.

… it is important to note that capturing the data is only the first step towards achieving real automation. ”

As discussed in earlier chapters, customers tend to send remittance information in various formats – checks in form of check stubs, via e-mail, hosted on web portals, or via EDI. The latest technologies can capture data from all of the above formats and convert them into electronic format to be processed further. However, it is important to note that capturing the data is only the first step towards achieving real automation. Once the data is extracted, it is necessary to cleanse it so that it is easily recognizable by your accounting system and all the invoices are automatically matched and cleared without the analyst having to perform any manual activities. The formatting and cleansing of data can be done using a sequence of rules which transform the extracted raw data into a format that matches open invoices and can be automatically processed by the ERP.

These rules would cover the full processing of the remittance and payment –from identifying the right invoices paid so that cash application does not require human intervention for coding deductions and short payments so that disputes can be processed faster.

A successful cash application automation system typically needs 100 to 500 configured rules to ensure a high degree of automation, depending on the number of payers and the format and information provided with the remittance. There are several different categories of rules that modern systems must support. Invoice identification rules help with matching a paid amount to an exact open invoice in cases where a different invoice number is provided or a PO number is provided instead of an invoice number. Deduction coding rules can help with the creation of dispute cases and providing reason code information to speed up a dispute resolution. Discount related rules can validate applicable discounts taken on a payment. Depending on the nature of the problem and the degree of automation required, different rules can be applied to quickly perform the manual tasks of translating the remittance information into formats that can be used to close invoices.

A common problem that automation rules are effective at solving is the presence of no-remittance payments, where customers pay without providing the supporting documentation. Automation rules enable a solution to this problem by applying cash to open invoices in a predictive, deterministic way, much like a human analyst would.

It is possible to configure rules to do different things, depending on the customer. Some examples seen are “oldest open invoice first,” “amount match,” etc. In general, these are rules that the cash application team already follows. It is simply a matter of allowing an analyst to configure the rules in the system, instead of them having to apply the rules manually each time. Automation rules are critical in removing the dependence on human intervention and achieving a high degree of automation. Rules not only enable matching of payment to invoices based on remittance processing and data cleansing, but also the processing of payments without remittance with a high degree of accuracy. This technology is fundamental to achieving a high automation rate.

Summary

Automating cash application is not only easier and faster to achieve, but also results in achieving high level of automation and significant resource savings. Armed with the information and resources within this book, you should be able to identify the right technology mix that will help you optimize your cash application process and meet your business objectives. Here is a brief summary of the important points we covered:

Use AI-Powered Optical Character Recognition

This will help you automate your check remittances. Not only will this enable cost savings but also help realize significant improvement in automation rates.

Focus on Automating E-Mail Remittances

This is a low-hanging fruit that can provide significant ROI and tremendous reduction in the cash-application effort.

Stop Manually Accessing Customer Websites for Data

Use Smart Web-Aggregation Technology to automatically capture all remittance related information from your customers’ portals.

Don’t Build EDI Templates for each of your Customers

Build a single, generic EDI Reader that can process various types of EDI remittance formats and file types.

Deploy Business Rules to Reduce Errors in Cash Application

Use Business Rules to cleanse data, ensuring invoices are closed in the system with minimal or no human intervention.

Additional Resources

Examples from the Real-World

Learn how Credit and Accounting Managers from different industries successfully implemented the latest cash application technologies in their organizations to achieve automation, cost-savings, improved productivity, and much more.

Benchmark Yourself

Assess your company’s accounts receivable performance relative to your industry peers and identify savings opportunities with high ROI.

Look Before you Leap

It is important for you to be fully aware of the potential cost-saving opportunity different cash application technologies can bring to your business. This tool and the accompanying report help you do just that!