Overcoming the Six Critical Challenges for Global Business Services to Thrive In a Turbulent Economy

- Strategic insights from leading GPOs to optimize the GBS model to achieve a best-in-class status

- The importance of technology to drive innovation and create working capital impact in the CFO’s office

- A three-step approach to executing a successful O2C digital transformation that delivers the desired ROI

Introduction

Disruptive events from the last couple of years brought a paradigm shift in the global business services (GBS) space. The crisis brought the importance of technology into the finance executive’s spotlight, and they were tasked with implementing digital transformation with limited resources in their ongoing processes.

This eBook highlights the top six challenges that global process owners (GPOs) have to deal with today. It also provides the best practices for GBS leaders to help their A/R teams become strategic value drivers by adopting an agile approach for the next quarter.

1. Inability To Meet Customer Expectations

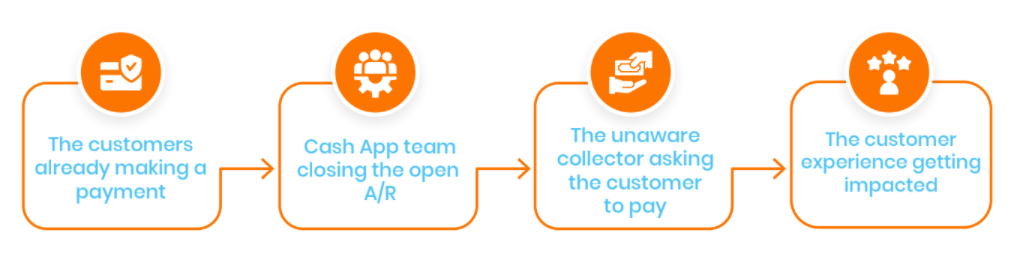

Most GBS organizations operate under a traditional shared service model which prioritizes cost reduction over customer satisfaction. GBS leaders are now trying to drive a more customer-centric approach across their A/R teams. But the factors that inhibit them from achieving customer satisfaction within order to cash is

To enhance the future role of GBS towards stronger value and customer focus, a more sophisticated and advanced service offering is key. 86% of all respondents rated this topic as highly relevant in the future, but only 21% feel confident about their offering and capabilities today

– Source SSON survey

- Lack of centralized systems causing silos across A/R teams:

A/R teams working with decentralized systems across different geographical locations cannot collaborate with other teams to evaluate the root cause, resulting in a poor customer experience in the long run.

2. Inability to Deliver on SLAs

A/R teams in most GBS models are involved in manual and transactional tasks, preventing them from taking up roles that require strategic decision-making skills. Hence, most GPOs were forced to rethink their service level agreements (SLA) because their A/R teams could not deliver on the desired objectives on time. Few even started collaborating with third-party service providers and investing in digital transformation initiatives to comply with the customer’s needs and improve revenue growth.

As per SSON, almost 43% of GBS professionals claimed inadequate infrastructure and limited hardware as their reason for failure to deliver during this volatile economy

3. Inability to Compete With the Best-In-Class in the Industry

Enterprise organizations today have a vision for global expansion – they’re venturing into new territories and even new industries and new business lines. And with growth, order to cash GPOs are faced with great opportunities and even more significant challenges.

The price of expansion is that they have to deal with competition in the market. Some O2C leaders believe that staying local will help them avoid competition, but they are continuously tasked with leveling up to be at par with their peers.

It is significantly more challenging to continue operating on a legacy platform when their peers have invested in advanced technology and automation capabilities.

According to a Gartner study, 79% of corporate strategists claim to be digitizing their businesses to create new revenue streams

4. Inability to Implement Disruptive A/R Operational Models

For every GBS model to thrive, leaders must deploy innovative operational models for their A/R processes that set them apart from their peers.

According to SAP insider, more than 60% of companies will be using cloud-based services by 2022. There is also a 3.8% expected increase in spending for cloud services in 2021

But it is often challenging for these leaders to implement such models. One of the primary reasons is that most finance executives are doubtful about the success of the operational model.

Hence, GPOs should create a compelling business case highlighting the cost, benefit, and execution pre-requisites of digital transformation initiatives to get the executive’s buy-in.

5. Lack of Operational Agility

Operational agility depends upon the rate at which the workforce adapts to change – the faster the workforce adapts, the sooner business objectives are met. The goal of improving operational agility has long been every GBS leader’s priority.

30%-50% improvement in operational performance in terms of speed, target achievement, and predictability with agile transformation

– McKinsey & Company

Achieving operational agility becomes difficult if there is resentment for a change in the team. This situation could arise if the A/R team is unaware of the technology’s functional aspect and considers automation a replacement instead of a value driver.

6. Lack of Sufficient Funds to Manage Non-Performing Business Units

GBS leaders are tasked with cutting down on additional operational costs of running business units to ensure an optimized working capital. But it becomes difficult for GPOs to continue managing business units that don’t deliver the desired business objectives.

More than 50% of GBS leaders are concerned about continued global business delivery operations, as per SSON.

Leaders are faced with the dilemma when making these critical decisions for

optimizing working capital:

- Should they continue to operate with traditional business units? Or are there a few units that cannot thrive in a period of turbulent business dynamics?

- What do they do with the operations of the business units they choose to terminate? Should they strategize on streamlining operations for better results, or should they consider outsourcing them to a third party at lower costs?

- If they choose to continue with all business units – should they let them operate as-is or instead invest in digital transformation initiatives to improve the long-term productivity of A/R teams working within them?

The Future of Global Business Services Is Digital

One of the most optimal solutions to tackle the pressures that GPOs are dealing with is digitally transforming the workplace. Investing in digital transformation initiatives in order-to-cash would enable GBS leaders to elevate their teams to create a working capital in the office of a CFO.

More than 37% of GPOs plan to accelerate their digital transformation

initiatives

– Source: SSON

According to Forbes, 84% of digital transformation projects fail due to a unidirectional approach to driving such projects and not focusing on all three levers of digital transformation.

The Three-Legged Stool Analogy

The three main drivers of digital transformation are people, process, and technology. This is similar to the legs of a three-legged stool. They’re codependent on each other, and if one only breaks, the stool will fall. Here are three ways how automation in A/R could impact the three main drivers of every business in the future:

1. People Management

GPOs should enable their A/R teams to shift their bandwidth to more high-impact tasks like performing credit reviews and making data-driven decisions. GBS leaders would need to digitally enable their teams to help them leverage technology to achieve such an agile operational model.

- Explaining automation to the team

Leaders should help the team understand how automation trims down the paper and labor-intensive A/R operations, enabling them to take up more strategic tasks.

- Preparing the team to make the transition easier

Leaders should upskill their teams by conducting workshops and training sessions. This will ensure their teams completely understand and adapt to how the A/R processes around them would transform.

This blog is based on insights from Gartner and shares the top five critical digital skills that leaders should equip their A/R teams with.

2. Process Management

The challenge for GPOs is to identify process gaps in A/R operations and find ways to improve them. Dedicating time to implement process improvement solutions could lead to an effective way to course-correct such gaps.

- Performing Fit-Gap Analysis

Focusing on leaks in the A/R process exposed due to changing business dynamics will help GPOs realize their expectations from a digital transformation initiative.

- Implementing Process Improvement Methodologies

Applying agile methodologies like lean six sigma and kaizen will help the team achieve the desired return on investment (ROI) and evaluate the new system compared to the legacy ones.

Lean six sigma is an integrated and balanced combination of process speed and variation reduction that helps an organization deliver services efficiently.

Kaizen is a process to boost revenue growth by creating a standard way of working, increasing efficiency.

3. Technology Investment

Technology investment is a crucial aspect of any business. Hence, GPOs need to ensure they invest in the right technology and get the stakeholder’s buy-in to achieve the finance executives’ goals of improving the cash flow. To do that, it is necessary to stay updated with evolving market trends. Below are a few common trends that GBS organizations are looking into

- Shifting to a AI-powered automation system

An AI-powered automated system can act as a single source of truth, centralizing customer master data in one location and promoting inter-team collaboration with real-time visibility. This enables teams to make data-backed decisions to mitigate credit risk and get paid faster.

- Installing self-service portals to enable customers digitally

This can act as a gateway allowing both customers and the A/R team to view invoices, make payments, and view outstanding disputes, etc. It would also reduce the number of touchpoints a user would have to go through to resolve an issue, improving customer experience.

According to Mordor Intelligence,, The customer self-service software market was valued at USD 7.20 billion in 2020. It is expected to register a compound annual growth rate(CAGR) of 20.94% during the forecast period from 2021 to 2026

- Investing in NLP-enabled digital assistants for A/R

Artificial intelligence-powered assistants help improve user experience by organizing an A/R analyst’s worklist and arranging action items based on priority levels. Mentioned below is how an NLP enabled digital assistant can help :

- Transcribing live customer calls, highlighting essential points.

- Enabling analysts to capture all the essential details from calls and act accordingly.

- Suggesting action items based on the intel from customer interactions and allowing analysts to make informed decisions.

Conclusion

Investing in digital transformation initiatives will play a major role for global business organizations to compete with the best-in-class in the industry. It is high time that GBS leaders work with their A/R teams to identify process gaps and start course-correcting them by leveraging technology.

Automation will help harmonize the operations globally and enable teams to re-allocate their bandwidth to make more informed decisions. This would eventually help leaders create a significant working capital impact in the CFO’s office.