A Strategic Look at Collections Correspondence

This ebook unveils the 11 most effective email templates that will help you collect your receivables faster. The ebook is a culmination of our work with credit and collection experts over more than 400 credit and A/R transformation projects across the world.

A Strategic Look at Collections Correspondence

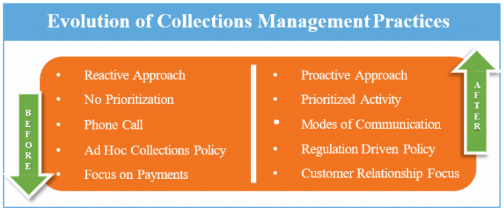

The Correspondence Approach ? Before vs. Today

Evolution of Collections†Management†Practices

Like most processes†in back-office finance, collections†have traditionally been viewed as a linear operation. The single-minded objective of getting customers to ?pay up? led to a single-dimensional approach to collections†management. Some of the trademarks of the collections†teams which continue to operate with a traditional approach are outlined below. A Reactive Approach Typically, collections†as a process were activated only when a customer†had defaulted, and in some cases, only for a large default value. Such an approach does not see prior follow-ups and intimations as a norm, even for large amounts pending with risky customers. The limited team sizes combined with the overly simplified priority of collecting from larger customers meant that the teams could never reach out to 100% of the open accounts within the valid payment terms. More Phone Calls Each Day Means Less Outstanding Amount Phone calls†were considered the best way of getting a customer?s attention about a late invoice payment. Phone calls did have a definite advantage with customer†connection because the conversation was 1-on-1 and more personal. The direct call resulted in a faster return of outstanding amounts. Therefore, connecting with the customer†via phone was considered the most effective way to get paid. However, phone calls also meant more time spent on collecting a single invoice. This coupled with the tendency to call customers only after payments†were due, meant that fewer customers could be reached on time. While high-touch customer†connection using phone calls made sense, effective utilization†continued to be a major challenge. Collection Policies†Created to Protect The Interest of Suppliers In the past, companies maintained a very outbound approach toward collections†management. The only objective was to get paid ?on time? and ?in full.? While the intentions were precise and objective, the means often came at a compromise of the customer†experience. Policymaking around collections†lacked any incorporation of the customers? needs and concerns. A Confrontational and Persistent Approach Towards Customers Irrespective of how some customers easily make a habit out of paying late, collection processes†and systems have never really been kind to the customers either. In the absence of proper customer†data and history, analysts and collection teams always saw rich dividends in applying a confrontational approach to the collection activity. If the dunning†was serious and strong enough, the chances of getting paid were higher. However, the long-term impact of such an approach was not foreseen. Sometimes customers†with good credit backgrounds and a history of on-time payments†faced harrowing experiences because of one-off late payments. Today, however, the tactics have changed to a more strategic prioritization and correspondence to customers focusing more on maintaining the customer relationship instead of ?just getting paid.? A Proactive Approach Today, collections†management†stresses on understanding customer†payment habits to create a win-win. In the proactive approach, collections†teams are increasingly analyzing past data to weed out strategies and tactics which are no longer delivering results, and modifying them to align with the goal of collecting more†and reducing the average collection period. This has been a major turnaround since collection teams no longer wait for invoices†to be due, but are able to determine the right time for reaching out to each customer. Prioritizing Customer†Follow-Ups to Maximize Returns As collections†management†continues to evolve into data science, the biggest impact is on how collection teams plan their follow-up in the modern world. While it is mostly the norm to start following up before the payment is actually due, collections†teams are spending a significant amount of time in figuring out which customer†requires an earlier follow-up compared to the others. Teams are looking at multiple factors including payment history, indicators of delinquency and credit risk†scores. Combined with easy access to enterprise-grade predictive analytics, teams turn data into well-informed decisions. This helps teams achieve better results from the collections†effort by controlling delinquency and bad-debt. Multiple Modes of Communication†in Use Phone calls†could be more effective at the level of an individual collection. However, with hundreds of thousands of invoices†requiring customer†contact, the tide has changed to favor other technological solutions. The idea that modern businesses have tested and adopted widely is the use of multiple channels for connecting with the customer†like emails. This is mainly because:

- Emailing the customers whose due dates are approaching; payment reminders often proves to be more effective.

- From a scalability point-of-view, emails take less time, which means that more customers could be reached in a shorter time.

- Emailsare less intrusive and usually very well-received in a business context as a polite way to remind customers who otherwise have a decent payment record.

- Emails are also a good way to share invoices, Proof of Deliveries (PODs), deal sheets and other required documents.

- Emails also make it easy to keep a track of all correspondence and communication†with the customer.

Therefore, using a mix of emails and phone calls on an as-needed basis is the most effective way to approach customers. Collection Policies†Driven by Regulatory Compliance Collections†policies†have undergone tremendous change over the years. Business policy and reform have led to laws that restrict irregular and abusive procedures followed by collections†teams. For example, the Fair Debt Collections Practices Act strictly specifies prohibited conducts such as repeated calling, misrepresentation, seeking unjustified amounts, abusive language, among others, during a collections†process. More than ever before, companies are bound to consider their customers? expectations when designing internal policy, strategy and tactics around collections. Strategic Relationship with Customers With increasing competition, thousands of retailers and millions of products, end customers have more choices and the purchase decision-making has become an increasingly complex process. Retailers†selling directly to consumers are often able to win customer†loyalty simply with attractive pricing, affordable quality and a decent range of options. However, the business-to-business environment requires much more time and effort. Customers†value relationships that extend beyond product quality and price competitiveness. The simple thought that loyal customers are least likely to default is driving a sea of change in how finance†teams are approaching the collections†challenge.

Correspondence Automation

Since correspondence is the cornerstone of the collections process, it is imperative to have an automation solution that caters to this particular requirement. Ideally, a correspondence†automation†system should handle and maintain multiple correspondence†templates that are needed by the collection analysts. In addition, these systems should perform correspondence†activity across mediums including print and mail, email and fax, as well as keep track of all phone-based collection touchpoints. It should also be capable of completely automating manual work involved in creating correspondence, selecting accounts and contacts and sending out emails or dunning†notices. In short, correspondence†automation†should enable the collections†team to:

- Connect seamlessly with all the data-streams available to SAPCollections†Management

- Use the data from different data-streams to create letter templates as well as complete packages which send different documents as attachments with the correspondence

- Use the different variables available within SAPCollections†Management†as well as additional variables to define the rules for correspondence

- Create advanced strategies for correspondence by combining multiple rules

- Assign user-created packages for execution based on defined strategies and rules

Three Pillars of Customer Correspondence

While deciphering the best strategies to select the mode and style of correspondence that would suit a particular customer during the collections process, it is imperative to analyze the following three points to choose the most effective solution: Context Before sending an email/fax/mail or calling the customer, the collectors should ask themselves once why are they sending or what they are going to ask about on the call. It is necessary to understand the major objective of any correspondence activity. Is it about pro-actively reminding customers for upcoming payments or about solving any ad hoc queries of the customer, the collection analyst need to have a clear picture before initiating the correspondence activity? Based on this context, the analyst might need to change their tone/style of communication. Time Time is of extreme essence in collections domain. It is essential to note the time at which correspondence is happening. Is it before the due date or after the due date? The language and the content of the message will definitely change based on this constraint. For example, if the collection analyst is sending an email as gentle reminder for upcoming open invoices then, the tone of the conversation can be direct but light without pressurizing the customer to make a payment whereas if the collection analyst is sending an email for third-past due reminder then, the tone of the email should be strict and direct emphasizing on the impact of any further negligence on credit utilization or previous orders. Account Type With the change in the correspondence approach over the years from ?just-getting-paid-focused? to ?customer-relationship-focused?, the line of communication for different value accounts has also changed. For key accounts of large customers, the style of communication is quite polite and thankful. Also, a little lenient as compared to that for other accounts. For fast-paying customers, the language of emails is polite yet direct whereas, for slow-paying customers, it is demanding with stricter implications in case of failure to pay. Moreover, the frequency of emails also differs. Where for fast-paying customers it is about 7-15-20 days whereas for slow-paying customers, it is about 5-10-14 days. Based on these 3 pillars of customer correspondence, effective email templates can be created to deliver the best results i.e. adding dollars to the bottom-line faster without hampering the customer relationship in the long run.

While deciphering the best strategies to select the mode and style of correspondence that would suit a particular customer during the collections process, it is imperative to analyze the following three points to choose the most effective solution: Context Before sending an email/fax/mail or calling the customer, the collectors should ask themselves once why are they sending or what they are going to ask about on the call. It is necessary to understand the major objective of any correspondence activity. Is it about pro-actively reminding customers for upcoming payments or about solving any ad hoc queries of the customer, the collection analyst need to have a clear picture before initiating the correspondence activity? Based on this context, the analyst might need to change their tone/style of communication. Time Time is of extreme essence in collections domain. It is essential to note the time at which correspondence is happening. Is it before the due date or after the due date? The language and the content of the message will definitely change based on this constraint. For example, if the collection analyst is sending an email as gentle reminder for upcoming open invoices then, the tone of the conversation can be direct but light without pressurizing the customer to make a payment whereas if the collection analyst is sending an email for third-past due reminder then, the tone of the email should be strict and direct emphasizing on the impact of any further negligence on credit utilization or previous orders. Account Type With the change in the correspondence approach over the years from ?just-getting-paid-focused? to ?customer-relationship-focused?, the line of communication for different value accounts has also changed. For key accounts of large customers, the style of communication is quite polite and thankful. Also, a little lenient as compared to that for other accounts. For fast-paying customers, the language of emails is polite yet direct whereas, for slow-paying customers, it is demanding with stricter implications in case of failure to pay. Moreover, the frequency of emails also differs. Where for fast-paying customers it is about 7-15-20 days whereas for slow-paying customers, it is about 5-10-14 days. Based on these 3 pillars of customer correspondence, effective email templates can be created to deliver the best results i.e. adding dollars to the bottom-line faster without hampering the customer relationship in the long run.