Cashing In: 3 Ways Order-to-cash Teams Could Drive Balance Sheet Impact

An insightful summary on how to leverage credit and A/R data to lower operational costs, improve customer relationships, and gain a sharp competitive edge.

Executive Summary

According to a study by Finextra more than 75% of companies that are running at loss or struggling financially would be profitable and liquid with better working capital management.

However, most companies focus on financing through lending and overlook a large, hidden source of capital: the balance sheet. Regardless of how much revenues increase, if cash is tied up in A/R, it is going to impede business growth.

This eBook discusses 3 quick ways in which the finance leadership could leverage credit and A/R departments to improve working capital by:

- Identifying profitable market segments and upsell opportunities with strategic credit and sales collaboration

- Reducing churn with exemplary customer experience in order-to-cash

- Decreasing revenue leakage with proactive order-to-cash operations

Let us explore the potential of order-to-cash innovations to help finance executives hit their free cash targets and unlock the dollars trapped in your balance sheets.

Strategic Credit And Sales Collaboration

While sales teams operate with a single agenda to `win as much business as possible, credit personnel on the other hand, are focused more on the profitability of sales and therefore apply credit rules cautiously to minimize credit risk and bad-debt write-offs.

Consequently, credit and sales teams are always at loggerheads.

In truth, credit and sales departments share many important goals. Both want their company to increase its revenue and profits. Each brings to the table unique customer knowledge that could help businesses grow.

Hence, it is imperative to leverage collaboration between credit and sales teams to ensure that credit departments do not simply act as gatekeepers to prevent bad credit decisions but also support company efforts to expand sales and meet growth targets.

Following are some avenues where past credit data could help the sales teams:

- Pricing decisions for profitable customers

- Intelligent payment terms

- Faster customer onboarding

1.1 Pricing Decisions For Profitable Customers

In the credit department, you always come across customers who consistently pay early or on time.

This could be an opportunity to brainstorm incentives for these profitable customers.

Consider offering a discount on a new product, or a sneak peek at one that’s yet to be revealed in exchange of increased order size. You could even introduce a customer rewards plan for targeted segments with a bigger appetite.

Record the results of each strategy to see if they were successful and use these results to decide if each tactic should become company policy.

Collaboration between credit and sales departments could lead to actions that unlock growth opportunities. Don’t let all that knowledge go to waste.

1.2. Intelligent Payment Terms

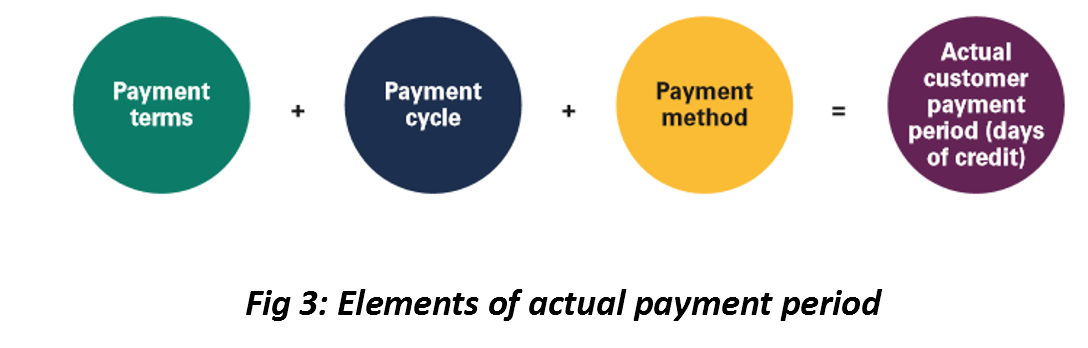

Payment terms have a big role to play in shortening the cash conversion cycle and improving customer relationships. Before companies can begin to harmonize their payment terms, they need to understand the three important components of terms and how they impact the actual customer payment period (Fig. 3).

– Payment terms: The payment term is what is typically defined within the contract, captured in the customer master data within the ERP system and then used as the basis of the calculation of the invoice due date. The payment term could be as simple as 30-days net, i.e., the due date is calculated as 30 days from the invoice date; however, there are many options related to payment terms that can affect and lengthen the actual customer payment period such as EOM terms, early payment terms, installments and so on.

– Payment cycle: The customer’s payment cycle will be affected when a payment is processed and received. If, for example, a customer only executes one payment run a week and only includes invoices due at that point, a proportion of invoices will always be paid late (or potentially early).

– Payment method: Some forms of payment result in “cash in the bank” more quickly than others; e.g., payments via direct debit are typically received the same day, while payments received by check take several days to clear.

While a combination of these factors affects the actual customer payment period, businesses have limited influence on the payment method and even less on the customer payment cycle.

The only way they could reduce the payment period is through dynamic, customer-specific payment terms defined in collaboration with insights from the credit department.

If the credit team realizes the potential to make the customer pay faster by changing the payment terms based on their past behavior and preferences, such insights could be incorporated in the contracts with the objective of faster recovery of dues and shorter cash conversion cycle.

To illustrate this, customers who are habitual late payers could have shorter payment terms or even late payment fees imposed on them to reduce DSO.

1.3. Faster Customer Onboarding

Customer onboarding is invaluable in that it creates the first impression for the customer as far as the A/R practices are concerned.

If well-executed at every touchpoint from the first contact to purchase and thereafter, it can be the beginning of a long and fruitful relationship.

Delays can kill sales. People lose interest as more time passes between contact and close.

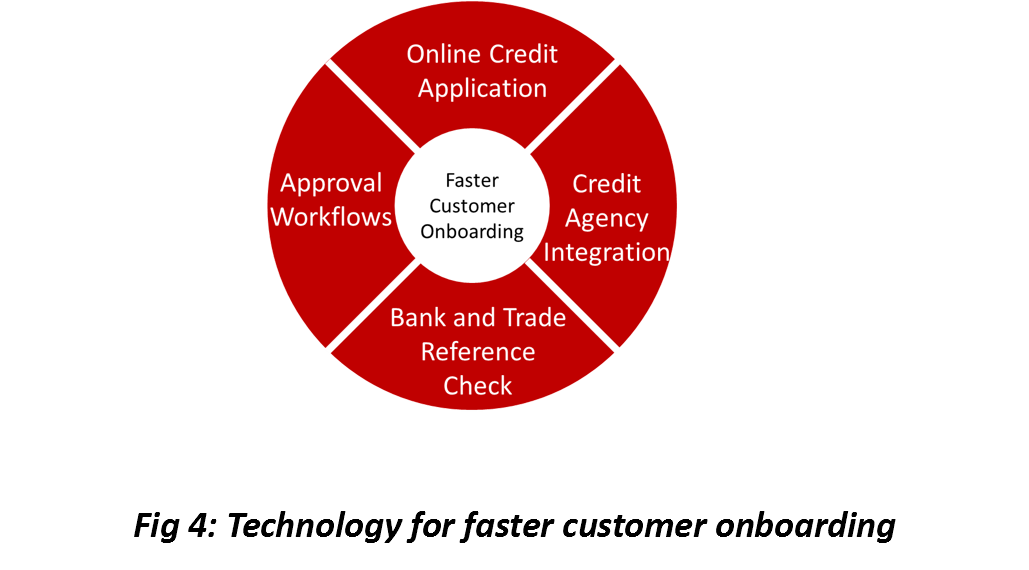

Faster customer onboarding is therefore critical for faster revenue realization.

Current processes for customer onboarding employed by many organizations involve collecting credit and financial documents and individually engaging credit reference agencies to verify customer creditworthiness against other independent data sources.

Internal team communication for approvals via emails, fax, calls, etc. further delays the process.

While credit departments are only doing their job by performing credit checks to reduce risk exposure, if the process is confusing, overwhelming, or puts up barriers to the first order, one could lose the customer to a competitor who has a smooth onboarding process.

Technology enables online credit application for capturing complete and valid information from your prospects while eliminating paper costs and processing delays. Automation supports real-time credit decision, which may translate into higher closing percentages; near-instantaneous approval via workflows helps deals happen regardless of geography and integration with external credit rating agencies and bureaus for financial statements and customer credit history helps credit teams process applications faster, with minimal effort and maximum accuracy (Fig. 4).

Reducing Churn With Exemplary Customer Experience

Customer satisfaction is often times the number one driver in competitive advantage and profitability, the post-sales customer experience is of growing importance to an organization.

Accounts receivable management could considerably improve customer satisfaction and retention. It is your last communication with the customer on a sale, and it could have a huge impact on whether or not they choose to do business with you again.

The easier you make the process for your customer, the happier they will be. Good accounts receivable management will make their lives much easier, help them remember to pay up for outstanding invoices and fetch you repeat business.

So, as an organization looking to improve all facets of customer experience, some ways in which credit and A/R could contribute to improving customer experience are:

1.Customer self-service for invoicing and payments

2.Customer portal to dispute invoices

3.Automated customer communication on invoices, past-due A/R, credit limits utilized, and deductions

2.1. Self-service Invoicing & Payments

Electronic billing reduces delivery time, paper costs, and manual hours dealing with cash allocation, disputes, and collections by automatically reconciling payments with your ERP system and reducing the scope of errors in invoicing and billing.

The upshot? Direct impact on the cash conversion cycle in the form of reduced ADD by as much as 50% for companies with a high invoice automation rate (Fig. 5).

2.2. Portal To Dispute Invoices

Invoice disputes raised through an email, fax, or traditional mail is a time-consuming, costly, and convoluted process that dents customer experience.

Simplifying the dispute resolution process will go a long way in ensuring customer loyalty.

Such documents are easily lost and difficult to keep track of. Traditional dispute documents are difficult to reproduce, keeping a record involves a large amount of file space, and finding a particular document may be time-consuming and difficult.

Moreover, reconciling them with transaction records in your ERP is a manually intensive and error-prone task that further delays downstream processes of cash allocation, deductions, and collections management.

To maximize simplicity and customer convenience, you could provide an online portal for customers to log in and dispute invoices that they do not agree to, need clarification on, or find incorrect.

Customers could provide all supporting documents and any additional comments for the analyst to work off a single platform, get rid of multiple backs and forth communication exchanges, and expedite payment. Not only does it improve the ease of doing business with you thereby reducing customer churn, but also streamlines processes, improves audibility with an online trail, and reduces manual hours dealing with cash allocation, disputes, and collections.

2.3. Automated Customer Communication

It is important to communicate with your customers throughout the purchase process. Excellent customer service is a great way of luring new customers and retaining existing ones. If your competition is matching you with regards to price and products, then exceptional customer service could help you pull away from the pack.

The order-to-cash department with customer touchpoints on order, invoicing, credit, deductions and collections could have a huge impact on whether or not they choose to do business with you again. Thus, it is imperative to maintain an open, productive communication channel between the A/R team and the customers at all stages, be it for payment reminders, collection correspondence, dispute resolution or customer support.

Manual correspondence is the biggest hurdle in providing visibility to customers on all things A/R.

Fortunately, there are technological solutions that could automate the correspondence process, making it easier for you to keep in close communication with customers with ease and convenience.

For example, you could automate payment reminders 15 days before the deadline, and send this reminder through various communication channels (e-mail, post, SMS). Most customers would appreciate a reminder that the date is approaching, not just receive a notice from you when the bill is past due.

2.3. Automated Customer Communication

Automated collection correspondence increases efficiency and yields better results. It allows teams to automatically send collection letters in multiple languages and currencies.

Automatic escalation allows the appropriate messages to be sent to your customers based on delinquency.

While the convenience, time-saving, and simplicity of automated correspondence is clear, it is by no means a substitute for human presence in your business. It is a way to shift focus away from low-value-added work and bureaucratic tasks and replace with those that result in stronger customer loyalty and lower overall costs.

“According to a recent credit and collections performance study conducted by the Hackett Group, 71% of dunning notices are automated in the top performing organizations as opposed to just 8% in the peer group”

Decreasing Revenue Leakage

While businesses have long been in the know about the impact of accounts receivable in improving cash flows and profitability, decision makers often push the process onto the back burner, assuming that leaving well enough alone is perfectly fine.

In general, accounts receivable in organizations is a pretty reactive department. Processes kick in and actions are taken AFTER due dates are crossed and the clock starts ticking.

From extending credit to unqualified customers to failing to follow up with past-due accounts in a timely manner, reactive A/R practices suck time, money and productivity from a business.

They often produce a ripple effect that touches virtually every aspect of running a company.

A crucial part of optimise accounts receivable processes is to be persistent about starting the process early. A proactive culture helps identify problems early on and take corrective actions before things go out of hand, thereby leaving more scope for process improvements and less chances of problem recurrence.

1.Proactive Collections Management

i.Prediction of invoice payment date prior to the due date

ii.Data based customer segmentation and strategy definition

2.Data-driven dispute management

3.1. Proactive Collections Management

A typical B2B collections process is initiated only after the account turns delinquent. Once the payment becomes past due, a soft reminder is sent to the customer. It is then followed by multiple calls/email reminders depending on the aging of the invoice. It may or may not warrant a strict notice/legal reminder post which the customer relents to pay up (hopefully) but on their terms. Your A/R team has to unwillingly agree to their discounts and accept partial payments thinking that some money is better than no money.

Such reactive and largely ineffective approach to collecting past due payments will continue to be adopted unless businesses understand that collections is more than just applying fancy algorithms to the aging list of invoices to figure out which customers to contact today.

Such algorithms conjure up a list of some 300 accounts for dunning when the collector has time to reach out to not more than 50 today! In the face of such overwhelming ‘advice’, collectors have no option but to go back to the tried and tested ‘oldest-invoice-largest-account-first’ method, leaving a large chunk of the portfolio untouched.

On an average, your collections team is not able to cover more than 60-70% of accounts in any 30-day past-due cycle, with diminishing collectability of the rest with each passing day.

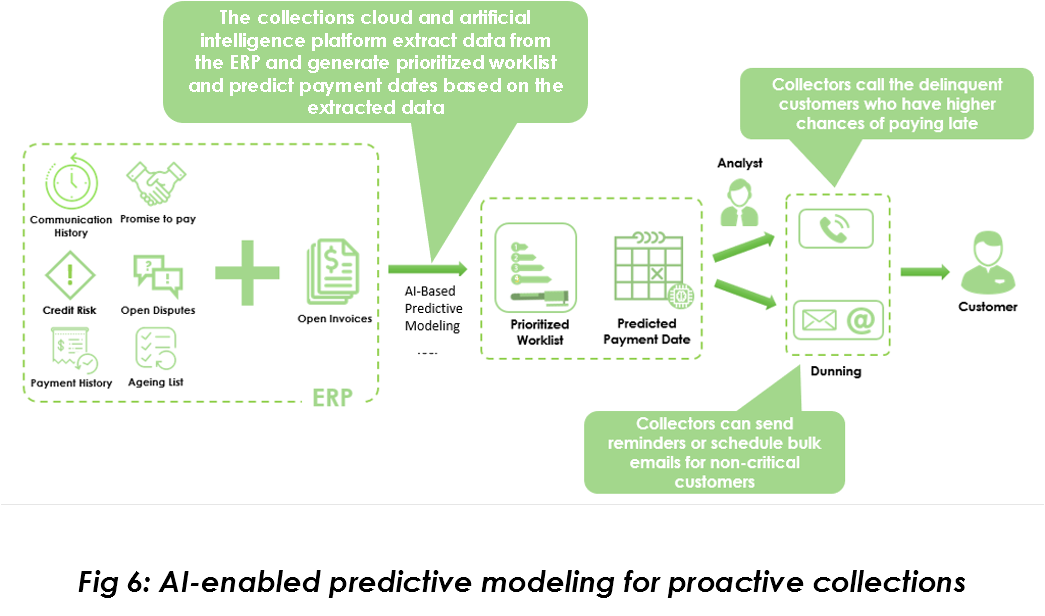

Statistical and data-based approaches to predict customers’ payment behavior have the potential to deliver unprecedented results for collections efforts.

Machine learning, natural language processing, and big-data analytics form the foundation of predictive data models that accurately forecast invoice payment date and manage customer credit risk in real time. This enables dynamic, multi-dimensional customer segmentation, strategy definition and portfolio management (Fig. 6).

Organizations experience benefits such as improved DSO and increased collections efficiency through:

Prediction of invoice payment date prior to due date.

Allow collections teams to anticipate which of the open invoices will be paid late or the payment date of a particular invoice to scientifically and accurately gauge AR risk and adopt proactive collections strategies that preclude late payment

Data-based customer segmentation and strategy definition.

Combine collectors’ experience and expertise with advanced analytics to support multi-faceted customer segments and dunning strategies. It enables informed decision making, collector performance-based portfolio allocation and frees up time to focus on accounts that need urgent attention while automating the collection process for the others

3.2. Data Driven Dispute Management

Short payments, overpayments, and invoice disputes endanger customer relationships and engender customer churn. The repercussions go beyond the explicit costs incurred.

Time and resources spent on resolving deductions could otherwise be spent on more value-added activities. The deductions analyst has to reach out to sales brokers, customer service, invoicing department, marketing, and trade promotion personnel to research and resolve disputes.

All the communication occurs manually over phone/email/fax leaving little scope for even holistic monitoring of all dispute case status and deduction reasons, let alone root-cause analysis and proactive corrective actions to address existing receivable issues.

Think about this: 60% of deductions go in favor of the customer. That means you essentially research 100% of the deductions to identify 40% invalid deductions. The culprit – a reactive outlook towards the resolution process that kicks in after the real transaction has already occurred. It is only after a customer makes a short payment that the A/R team:

- Checks if the customer received right invoice

- Checks if sales team has separate deal document

- Cross verifies remittance of the customer

- Contacts customer

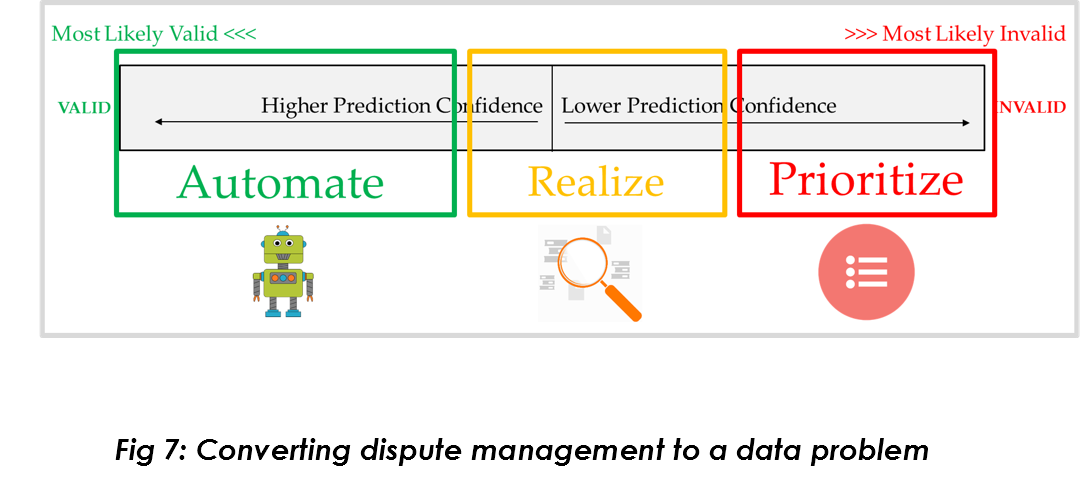

With the help of advanced analytics backed by artificial intelligence, it is possible to predict the validity of a deduction by analyzing several factors such as customer payment history, past deductions characteristics, root causes, resolution trends, and so on.

With these predictions, 60% of the deductions worklist is automatically resolved with recommendations to prioritize and resolve the remaining 40% (Fig. 7).

This translates into a 40% decrease in human touches, huge savings on valid disputes, high recovery rate, and reduced write-offs with more focus on collecting invalid deductions.

Summary

Many forces, including intensifying global competition, changing business operating models and lingering recessionary conditions, require finance organizations to continue to look for ways to wring improvements from every aspect of their operations, including their order-to-cash processes.

Whether broadly transformative or limited and incremental in nature, this eBook shares best-practices of organizations improving their working capital by optimise accounts receivable management and leveraging credit and A/R data to lower operational costs, improve customer relationships and gain a sharp competitive edge.